Long-only AIFs (2.19%) outperformed long-short peers (1.28%) with category average alpha of ~90 bps as macro tailwinds and index gains supported broad-based strategy resilience

Alternative Investment Funds (AIFs) extended their recovery in April 2025, as 110 out of 123 tracked AIF strategies by PMS Bazaar posted positive returns for the month. The top 10 performers across categories delivered strong single-digit gains in the range of 5-9%, underlining the growing dispersion and alpha opportunities. Long-only Category III AIFs emerged as the better-performing cohort, with 89 schemes averaging a 2.19% return. In contrast, long-short strategies delivered a more subdued average of 1.28%, highlighting their relative defensiveness in an uptrending market.

The broader equity market continued its upward trajectory, aided by improving liquidity and supportive policy signals. The Nifty 50 TRI rose by 3.48%, while the S&P BSE 500 TRI gained 3.18%. Midcap and smallcap indices also ended higher.

The rally was driven by multiple macro tailwinds. These included the India Meteorological Department’s above-normal monsoon forecast, the return of foreign portfolio investor flows, and continued support from domestic institutions. The Reserve Bank of India further bolstered sentiment with a 25-basis point repo rate cut to 6% and an accommodative stance, alongside relaxed lending norms aimed at reviving credit growth.

While the domestic markets experienced bouts of volatility early in April 2025, relief came later. Tensions flared after the US President announced a new round of reciprocal tariffs on April 2, triggering a wave of global uncertainty. However, the announcement of a 90-day pause on these tariffs helped restore investor confidence mid-month.

Here is a detailed AIF performance review.

Long-Only AIFs Outperformed with Focused Alpha Delivery

Long-Only AIFs invest primarily in equities with a buy-and-hold approach, aiming for capital appreciation without using short-selling or leverage strategies. Category III Long-Only AIFs delivered a solid performance in April 2025, with 89 tracked strategies posting an average return of 2.19%. Although this lagged the Nifty 50 TRI’s 3.48% and the S&P BSE 500 TRI’s 3.18%, a substantial number of funds stood out with strong alpha generation. Specifically, 24 strategies outperformed the BSE 500 TRI, and 21 beat the Nifty 50 TRI, showcasing the ability of skilled managers to generate excess returns through bottom-up stock selection and high-conviction bets.

Top-performing long-only funds clocked monthly gains ranging from 4.4% to 8.6%, significantly enhancing portfolio values. The dispersion in outcomes also highlighted the growing importance of fund selection, with a clear gap between outperformers and the broader peer group.

Below is a snapshot of category performance:

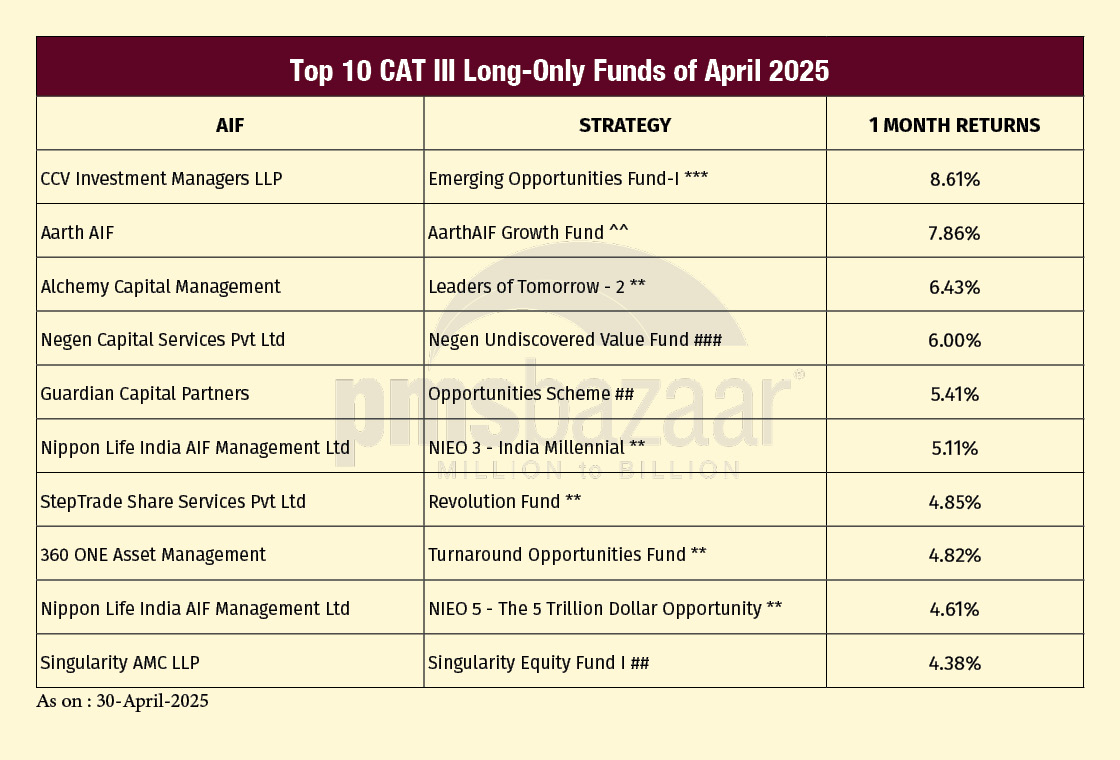

The top 10 long-only AIFs in April 2025 delivered strong alpha, posting monthly returns between 4.38% and 8.61%. CCV Investment Managers’ Emerging Opportunities Fund-I led the pack, followed by Aarth AIF’s Growth Fund and Alchemy’s Leaders of Tomorrow - 2. These funds capitalized on selective exposure to emerging or recovery-phase stocks. Value-oriented strategies like Negen’s Undiscovered Value Fund and Guardian’s Opportunities Scheme also featured prominently, suggesting investor interest in mispriced opportunities.

Nippon Life’s NIEO series and 360 ONE’s Turnaround Opportunities Fund continued their momentum with consistent returns. StepTrade and Singularity AMC rounded out the list with focused mid-cap and thematic exposures. The dispersion reflects diverse positioning, with top performers benefiting from tactical agility and high-conviction calls amid an improving market backdrop.

Top 10 Category III Long-Only AIFs – April 2025

*** Post Exp & Tax , ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax ,^^ Post Exp & Tax and Pre Perf.Fees , All Performance above are as on 30 April 2025

Long-Short AIFs Trail as Uptrend Limits Hedged Strategy Gains

Long-Short AIFs use both long and short equity positions to generate absolute returns, managing risk through hedging and tactical exposure shifts. Category III Long-Short AIFs posted relatively muted performance in April 2025, with 34 tracked strategies delivering an average return of 1.28%. This fell short of the broader market gains, with only 4 funds outperforming the S&P BSE 500 TRI (3.18%) and just 2 beating the Nifty 50 TRI (3.48%). The hedged nature of these strategies, which typically excel in volatile or sideways markets, limited upside capture during the equity rally.

Below is a snapshot of category performance:

Despite the subdued average, select strategies continued to stand out. Finideas’ Growth Fund Scheme-1 led with a strong 7.36% return, benefitting from agile positioning. Edelweiss’ Consumer Trends Fund followed with 4.65%, while InCred, Nuvama, and AlphaGrep delivered gains around the 3% mark. The performance dispersion suggests that strategy design and short exposure calibration played a key role in monthly outcomes.

Top 10 Category III Long-Short AIFs – April 2025

*** Post Exp & Tax , ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax ,^^ Post Exp & Tax and Pre Perf.Fees , All Performance above are as on 30 April 2025

May 2025 outlook

After a sharp rebound from March lows, markets enter May on firmer ground, but not without caution. The recovery has been broad but uneven. For AIF investors, especially those in long-only and long-short strategies, this reinforces the importance of active stock selection and tactical flexibility over passive alignment.

Valuations have seen some moderation. Large caps now hover closer to their long-term averages, but mid and small caps still look stretched relative to historical norms. With earnings growth likely to slow, this backdrop calls for measured optimism.

This is a time to back high-conviction managers who combine valuation discipline with sharp sectoral insight. Cycles are shifting, and so are the opportunities.

Long-Only AIFs may benefit from selective exposure to resilient sectors like private banks and consumption. With mid and small caps still richly valued, fund managers with valuation discipline and bottom-up conviction are well-positioned. Stock dispersion is likely to persist, rewarding strategies focused on fundamentals over broad market momentum.

On the other hand, Long-Short AIFs may regain relative edge as markets navigate potential consolidation. Hedged strategies could offer downside protection if earnings disappoint or volatility resurfaces. Managers who calibrate long-short exposures dynamically and lean into asymmetric setups may outperform. As dispersion widens, flexibility and risk control will remain critical differentiators.

Recent Blogs

Mid and Small Caps: Driving India’s $5 Trillion Pathway

PMS Bazaar recently organized a webinar titled “Mid and Small Caps: Driving India’s $5 Trillion Pathway,” which featured Mr. Achin Goel, Fund Manager at Bonanza.

Equity PMS strategies shine in May; 9 in 10 Beat Nifty 50 TRI as small cap surge lifts all boats

Robust sectoral rotation and smart stock selection power one of the strongest alpha months for PMS managers

128 of 133 AIFs posted gains in May 2025; Long-only strategies beat long-short peers by 400 bps

Long-only AIFs averaged 5.69% returns in May 2025 sharply above long-short peers (1.68%) as broader market strength, FII flows, and sector momentum powered alpha generation

Who Will the Race for Alpha – Fund Managers vs AI

PMS Bazaar recently organized an exciting webinar titled “Who Will the Race for Alpha – Fund Managers vs AI,” which featured Mr. Sankarsh Chanda, Founder & CEO, Savart.

Trust Tech and Transformation – The Future of Private Banking in India

PMS Bazaar conducted another episode of the Alternates Universe Webinar Series -Season 2- Episode 11 - Trust Tech and Transformation – The Future of Private Banking in India.

Access Innovative Global Themes via Gift City Route

PMS Bazaar recently organized a webinar titled “Access Innovative Global Themes via Gift City Route,” which featured Mr. Vaibhav Shah, Associate Director – Head- Business Strategy, Products & International Business, Mirae Asset Investment Managers and Mr. Scott Helfstein, Head of Investment Strategy, Global X ETFs.

Gateway to Global Investing: Strategic Access through GIFT City

PMS Bazaar recently organized a webinar titled “Gateway to Global Investing: Strategic Access through GIFT City,” which featured Mr. Alok Kumar, Head – Alternate Products & Special Mandates, Aditya Birla Sun Life AMC Limited and Mr. Rudy Gopalakrishnan, Fund Manager, Lyptus Capital Global Fund.

April Delivers Gains for PMS; One in Four Strategies Beat Benchmarks

Large caps led this month’s PMS strategy gains (3.06%), while Smallcaps lagged at 0.88%; most categories delivered 1–2.5% returns