Robust sectoral rotation and smart stock selection power one of the strongest alpha months for PMS managers

May 2025 turned out to be a stellar month for equity Portfolio Management Services (PMS), marking the third straight month of gains in sync with broader market momentum.

Out of 433 equity strategies tracked by PMS Bazaar, a staggering 409 ended in the green, with 388 beating the Nifty 50 TRI’s modest 1.92% return. That’s a 90% outperformance ratio and is among the highest seen in recent months. Even against the broader BSE 500 TRI’s 3.54% gain, 327 strategies (76%) managed to deliver alpha.

The surge in equities was driven by strong institutional flows with FIIs remaining net buyers for the third consecutive month while DII inflows hit $7.9 billion. Small cap and mid cap indices outperformed the Nifty50, with PMS strategies in those segments leading returns. Thematic and multi cap strategies also fared well, reflecting widespread market participation.

Meanwhile, all 20 multi-asset PMS strategies posted gains, and 70% beat their benchmark, the NSE Multi Asset Index 1.

Here is a deeper look at May-2025 PMS returns.

Top 10 performers in focus

May 2025 saw a standout list of equity PMS strategies delivering double-digit gains, with the top 10 all returning over 13.8%.

Topping the chart was Money Grow Asset’s Small Mid Cap strategy with a stellar 16.49% return, powered by the strong momentum in broader markets.

Close on its heels was NAFA Asset Managers’ Clean Tech Portfolio (16.01%) at overall 2nd rank, reflecting interest in mid cap oriented clean energy plays.

Securing 3rd rank was Negen Capital’s Special Situations and Technology Fund which clocked 15.35%, continuing its strong run within the flexi cap universe.

Small cap specialists also featured prominently—Nine Rivers’ Aurum Small Cap Opportunities (14.40%) and Ambit’s Emerging Giants (14.29%) capitalised on the segment’s revival.

Samvitti Capital’s PMS Aggressive Growth (14.39%) and Waya Financial’s Bin73 Sunrise Alpha (14.14%) rounded out the mid & small universe dominance.

Meanwhile, Anand Rathi Decennium Opportunity, Bonanza Portfolio Multicap, and Accelt Long Term Equity posted gains in the 13.8–13.9% range, reflecting consistent alpha across multi cap strategies.

The dispersion highlights how tactical positioning in mid and small caps paid off handsomely.

Here is a table of the top-10 PMS performers of May-2025.

PMS Categories in focus

Category performance in May 2025 was headlined by a sharp upturn in the broader markets, with Small Cap PMS strategies delivering an impressive average return of 8.58%—the best across segments.

Small & Mid Cap (8.46%) and Mid Cap (7.74%) strategies followed closely, reflecting strong participation from emerging and mid-tier stocks amid robust domestic flows and sectoral tailwinds.

Thematic strategies also fared well with a 6.73% average return, buoyed by interest in capital goods, real estate, and digital transformation themes.

Meanwhile, Multi Cap & Flexi Cap strategies posted 5.91%, marking a balanced capture of high-beta opportunities.

Large & Mid Cap (4.50%) and Large Cap (3.87%) strategies trailed as leadership remained concentrated in non-index names.

Multi-asset strategies delivered a stable 3.72%, underlining the diversified buffer they offer during rotational rallies.

All PMS category averages comfortably outperformed the Nifty 50 TRI’s 1.92% return in May 2025. Even the lowest-performing category, Multi-asset beat both Nifty 50 TRI and BSE 500 TRI, highlighting strong alpha across segments.

Overall, the return spread reinforced the outperformance of mid and small-cap focussed equity PMS portfolios and rewarded managers who leaned into broader market breadth.

PMS Category Wise May 2025 Returns

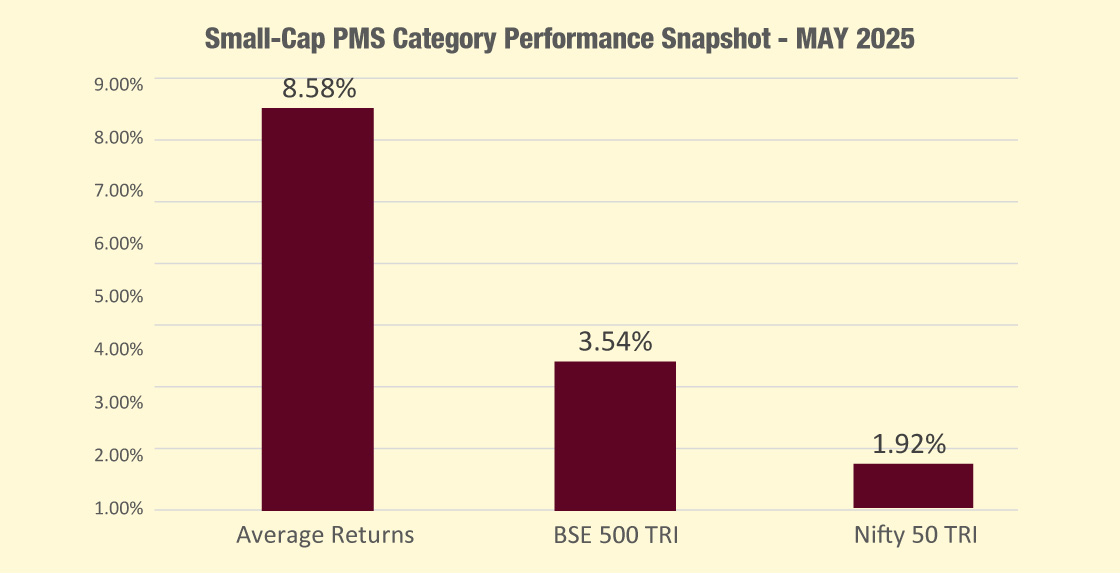

Small Cap: Small Cap PMS strategies delivered strong alpha in May 2025, with an average return of 8.58% which is well ahead of both the BSE 500 TRI (3.54%) and Nifty 50 TRI (1.92%). Of the 24 strategies in this segment, 23 outperformed both benchmarks, indicating widespread success in capitalising on the sharp rally in smaller stocks.

Among the top five performers, Nine Rivers Capital’s Aurum Small Cap Opportunities led the category with a 14.40% return. Close behind was Ambit’s Emerging Giants at 14.29%, both reflecting meaningful gains on the back of favourable market breadth and sectoral tailwinds. ithought Financial’s VRDDHI strategy posted 13.46%, further reinforcing the strong momentum among small-cap allocations.

The high hit rate of outperformance underscores the strength in the broader small-cap universe in May, where selective stock picking and active positioning yielded tangible results across the board.

Below is a table of the top-3 Small Cap PMS strategies for May 2025.

Small Cap PMS Category Performance Snapshot

Small-Cap PMS strategies outperformed in May 2025, delivering an impressive average return of 8.58%. This is more than double the BSE 500 TRI (3.54%) and far ahead of the Nifty 50 TRI (1.92%), underscoring strong stock-picking in the small-cap space.

Small & Mid Cap: Small & Mid Cap PMS strategies delivered a robust average return of 8.46% in May 2025, closely tracking the top-performing Small Cap segment. Of the 47 schemes in this category, 46 outperformed the BSE 500 TRI (3.54%) and all 47 beat the Nifty 50 TRI (1.92%), underlining the strength and breadth of participation in the mid & small cap space.

Money Grow Asset’s Small Midcap strategy led the category with a striking 16.49% return, the highest among all PMS strategies this month. Waya Financial’s Bin73 Sunrise Alpha followed with a strong 14.14%, while SVAN Investment Managers’ Velocity posted 12.76%, capitalising on favourable market sentiment and liquidity trends.

The segment’s near-universal outperformance reflects both favourable market dynamics and effective positioning by portfolio managers.

Below is a table of the top-3 Small & Mid Cap PMS strategies for May 2025.

Small & Mid Cap PMS Category Performance Snapshot

Small & Mid-Cap PMS strategies delivered a stellar 8.46% return in May 2025, far exceeding the BSE 500 TRI (3.54%) and Nifty 50 TRI (1.92%). This sharp outperformance highlights the alpha potential in the mid and small-cap space during market upswings.

Mid Cap: Mid Cap PMS strategies posted a healthy average return of 7.74% in May 2025, well above the BSE 500 TRI’s 3.54% and the Nifty 50 TRI’s 1.92%. Of the 24 strategies in this segment, 21 beat the BSE 500 TRI and 22 outperformed the Nifty 50 TRI, showing strong stock selection across most portfolios.

NAFA Asset Managers’ Clean Tech Portfolio led the segment with an impressive 16.01% return, the highest in the category.

Master Portfolio Services India Growth Strategy followed with 13.31%, signalling well-timed allocations within the midcap universe.

NAFA’s Emerging Bluechip Portfolio also made the list with a strong 12.57% return.

The results reflect consistent midcap outperformance during the month, driven by strong earnings, improved liquidity, and favourable sector rotation.

Below is a table of the top-3 Mid Cap PMS strategies for May 2025.

Mid Cap PMS Category Performance Snapshot

Mid-Cap PMS strategies delivered a strong average return of 7.74% in May 2025. This performance significantly outpaced both the BSE 500 TRI (3.54%) and Nifty 50 TRI (1.92%), showcasing superior alpha generation in the mid-cap space.

Thematic: Thematic PMS strategies recorded an average return of 6.73% in May 2025, comfortably beating both the BSE 500 TRI (3.54%) and Nifty 50 TRI (1.92%).

Out of the 18 strategies tracked in this category, 16 outperformed the broader BSE 500 TRI index, while all 18 beat the Nifty 50 TRI, reflecting solid execution in theme-based portfolios.

Green Portfolio’s Super 30 Dynamic strategy topped the list with an 11.62% return, followed by the same PMS house’s MNC Advantage at 10.29%, both capitalising on targeted sectoral allocations.

Valcreate’s Lifesciences and Specialty Opportunities delivered 9.90%, riding on favourable momentum in pharma and innovation-linked segments.

The strong showing across themes indicates that focussed, high-conviction bets across capital goods, healthcare, and sustainability played out well during the month’s broad-based rally.

Below is a table of the top-3 Thematic PMS strategies for May 2025.

Thematic PMS Category Performance Snapshot

Thematic PMS strategies outshone broader benchmarks in May 2025 with a robust 6.73% return, nearly doubling the BSE 500 TRI (3.54%) and significantly outperforming the Nifty 50 TRI (1.92%). This reflects strong sector-specific plays and focused conviction-led investing.

Multi Cap & Flexi Cap: The Multi Cap & Flexi Cap category, the largest by number of schemes, delivered an average return of 5.91% in May 2025—beating both the BSE 500 TRI (3.54%) and Nifty 50 TRI (1.92%) with ease.

Of the 248 strategies tracked, 191 outperformed the BSE 500 TRI and a robust 230 beat the Nifty 50 TRI, showcasing widespread alpha generation across diversified portfolios.

Negen Capital’s Special Situations and Technology Fund led the pack with a strong 15.35% return, followed by Samvitti Capital’s PMS Aggressive Growth at 14.39%.

Anand Rathi Advisors’ Decennium Opportunity strategy posted 13.91%, reflecting consistent multicap allocation performance.

The results highlight that flexible allocation across market caps and sectors paid off handsomely in May’s broad-based rally, with several managers capturing upside from both large and mid-small opportunities.

Below is a table of the top-3 Multi Cap & Flexi Cap PMS strategies for May 2025.

Multi Cap & Flexi Cap PMS Category Performance Snapshot

Multi-Cap & Flexi-Cap PMS strategies delivered strong returns of 5.91% in May 2025, clearly outperforming the BSE 500 TRI (3.54%) and Nifty 50 TRI (1.92%). This underscores the advantage of flexible allocation across market capitalizations.

Large & Mid Cap: Large & Mid Cap PMS strategies posted an average return of 4.50% in May 2025. This was comfortably ahead of both the BSE 500 TRI (3.54%) and Nifty 50 TRI (1.92%). Out of 21 strategies in this category, 14 outperformed the BSE 500 TRI, while 20 managed to beat the Nifty 50 TRI, indicating broad-based effectiveness despite a relatively narrow segment.

Alchemy Capital’s Smart Alpha 250 emerged as the category leader with a strong 9.30% gain, closely followed by Samvitti Capital’s PMS Long Term Growth at 9.07% Whereas Dynamic Equities Bluechip strategy returned 6.32%. These strategies set the pace for the category, reflecting well-timed allocation between large and midcap names.

Despite the smaller number of schemes, the segment showed steady and dependable outperformance, especially among managers who tactically allocated across market caps with a disciplined, growth-focussed lens.

Below is a table of the top-3 Large & Mid Cap PMS strategies for May 2025.

Large & Mid Cap PMS Category Performance Snapshot

Large & Midcap PMS strategies generated an average return of 4.50% in May 2025, outperforming the BSE 500 TRI (3.54%) and Nifty 50 TRI (1.92%). This reflects balanced alpha generation across broader and large-cap indices.

Large Cap: Large Cap PMS strategies delivered an average return of 3.87% in May 2025, exceeding both the Nifty 50 TRI (1.92%) and BSE 500 TRI (3.54%).

Out of 26 schemes, 22 outperformed the Nifty 50 TRI, while 11 surpassed the broader BSE 500 TRI. This signals a moderate but stable month for this benchmark-sensitive category.

Tulsian PMS led the segment decisively with a 13.19% return, significantly ahead of peers.

Asit C Mehta’s ACE – 15 strategy followed with 6.26%, and Standard Chartered’s Long Term Value Compounder posted 5.52%. These top performers clearly demonstrated effective stock selection within the large-cap space.

While the category didn’t match the exuberance of mid- and small-cap peers, large cap PMS strategies continued to provide consistency and downside protection, with a few standout managers delivering sharp alpha.

Below is a table of the top-3 Large Cap PMS strategies for May 2025.

Large Cap PMS Category Performance Snapshot

Large Cap PMS strategies delivered an average return of 3.87% in May 2025, marginally outperforming the BSE 500 TRI (3.54%) and significantly beating the Nifty 50 TRI (1.92%). This indicates steady alpha generation even within the large-cap segment.

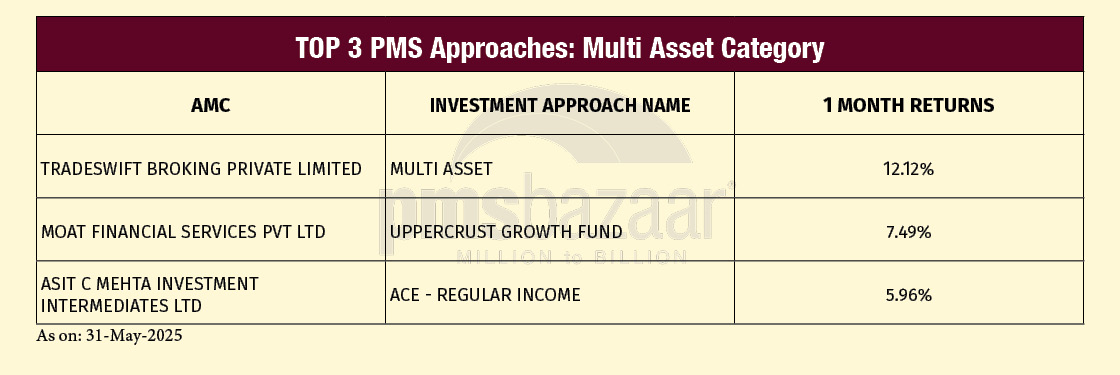

Multi-asset: Multi Asset PMS strategies posted an average return of 3.72% in May 2025, outperforming both NSE Multi Asset Index 1 (2.41%) and NSE Multi Asset Index 2 (2.57%).

Of the 20 strategies tracked, 14 outperformed Index 1 and 12 beat Index 2, indicating broad-based success in navigating equity-debt-gold allocations during a bullish month.

Tradeswift Broking’s Multi Asset strategy led the category with a robust 12.12% return, far ahead of its benchmark.

Moat Financial Services’ UpperCrust Growth Fund followed with 7.49%, while Asit C Mehta’s ACE – Regular Income posted a steady 5.96%.

The segment benefitted from favourable equity market conditions and flexible asset allocation. While more conservative than pure equity strategies, multi-asset PMSes showed they could still capture meaningful upside with lower volatility.

Below is a table of the top-3 Multi-asset PMS strategies for May 2025.

Multi Asset PMS Category Performance Snapshot

The Multi Asset PMS category delivered an impressive 3.72% return in May 2025, outperforming both the BSE 500 TRI (2.41%) and Nifty 50 TRI (2.57%). This highlights the category’s resilience and effective diversification in a dynamic market environment.

Outlook for June 2025

After reversing early-year losses, the market closed May on a strong footing with PMS strategies capturing this upswing well.

While FY25 earnings saw only modest 1% Nifty EPS growth, they still beat expectations.

Near-term earnings downgrades and global headwinds may fuel volatility, but long-term structural strength remains unshaken.

Broader markets are trading near its long-period average, signalling balanced valuations.

For PMS investors, this is a time to stay invested with quality-focused portfolio managers.

With India’s medium-term growth intact, disciplined stock-picking and thematic positioning will continue to create consistent alpha across cycles.

Recent Blogs

5 Key Considerations Before Investing in AIFs in India

Alternative Investment Funds (AIFs) have emerged as a compelling option for sophisticated investors seeking diversification and potentially superior returns. But venturing into AIFs requires a clear understanding of their unique characteristics that go beyond simply knowing what they are and their categories.

How AIF can help in diversification?

Traditionally, Indian investors have relied on a mix of stocks and bonds to build their wealth. While this approach offers diversification, it can still leave your portfolio vulnerable to market fluctuations. Enter Alternative Investment Funds (AIFs), a dynamic asset class gaining traction for its ability to unlock diversification beyond the realm of conventional options.

Long-Short AIFs Outperform Again Even as Markets Rebound in September

104 long-only funds shows an average monthly gain of just 0.37 per cent, while long-short AIF category averaged 0.94 per cent

Resilience returns as markets rebound in September; Multi-asset PMSes lead pack

Over 63% of equity PMSes ended September in green; nearly two-thirds outperformed key benchmarks.

Stories Fade, Numbers Last: Trends vs Fundamentals

This article is authored by CA Rishi Agarwal, Co-founder & Fund Manager, Aarth Growth Fund

Auto-Adaptive Strategies for a Rapidly Changing Market

PMS Bazaar recently organized a webinar titled “Auto-Adaptive Strategies for a Rapidly Changing Market,” which featured Mr. Alok Agarwal, Head - Quant and Fund Manager, Alchemy Capital Management.

How to overcome FOMO (Fear of Missing out) in Investing and Why Timing Matters?

PMS Bazaar recently organized a webinar titled “How to overcome FOMO (Fear of Missing out) in Investing and Why Timing Matters?” which featured Mr. Mahesh Gowande, Director and CIO, PriceBridge (Ayan Analytics Pvt. Ltd).

Reigniting India’s Consumption Engine

This article is authored by Ashish Chaturmohta, Managing Director, APEX PMS, JM Financial Ltd.