Over 63% of equity PMSes ended September in green; nearly two-thirds outperformed key benchmarks.

After two months of decline, broader equity indices finally closed higher in September 2025. The recovery came with a dose of volatility, yet the undertone was distinctly positive. Smaller companies regained momentum, with small- and mid-caps outperforming their large-cap peers.

All major sectors ended in green, signalling a broad-based revival. PSU Banks surged 11 percent, Metals climbed 10 percent, and Automobiles added 6 percent. Utilities and Capital Goods also advanced by 5 and 4 percent respectively. The only weak spots were Technology, Media, Consumer, and Healthcare, each slipping 2-4 percent month-on-month.

Against this backdrop, Portfolio Management Services staged a strong comeback. Of the 468 strategies analysed by PMS Bazaar, 428 were equity-oriented. A striking 272 of these delivered positive returns. Nearly 184 (68%) of them outperformed the Nifty 50 TRI, while 154 (57%) beat the BSE 500 TRI, showing broad participation across managers and styles.

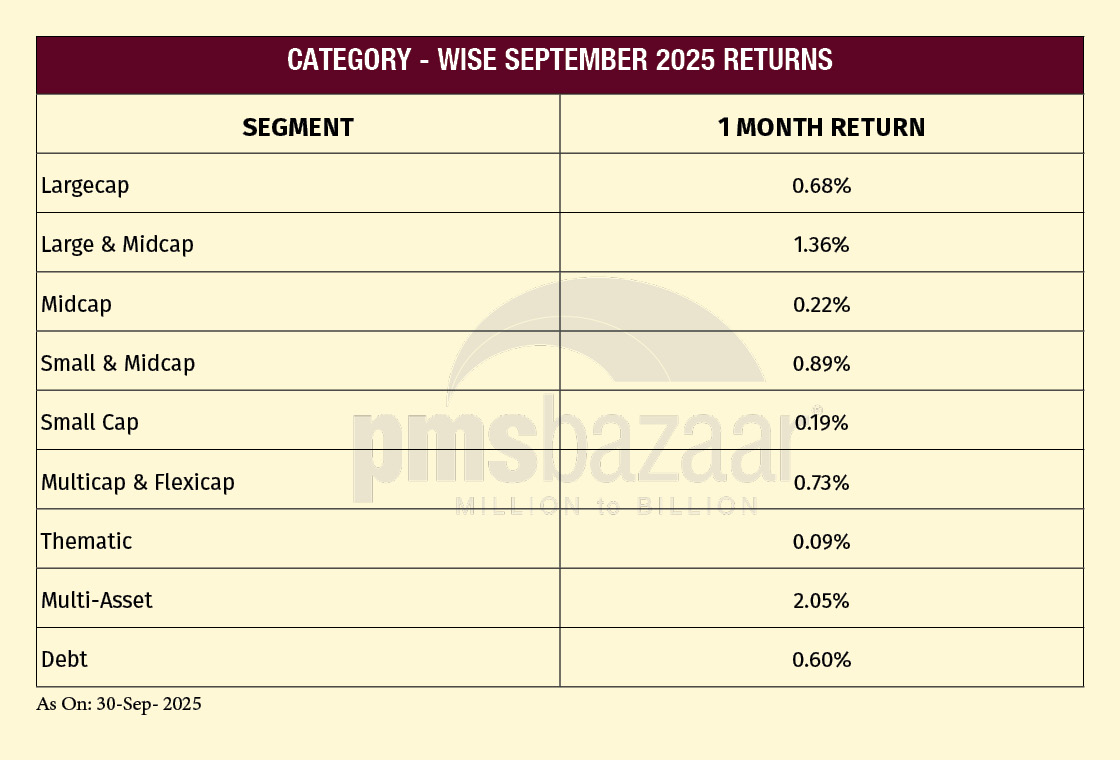

Benchmark indices reflected this improvement. The Nifty 50 TRI rose 0.77 percent, and the S&P BSE 500 TRI gained 1.24 percent. Multi-Asset PMSes stood out with a 2.05 percent average return, followed by Large & Midcap at 1.36 percent. Other categories too ended positive: Small & Midcap (0.89 percent), Multicap & Flexicap (0.73 percent), and Largecap (0.68 percent).

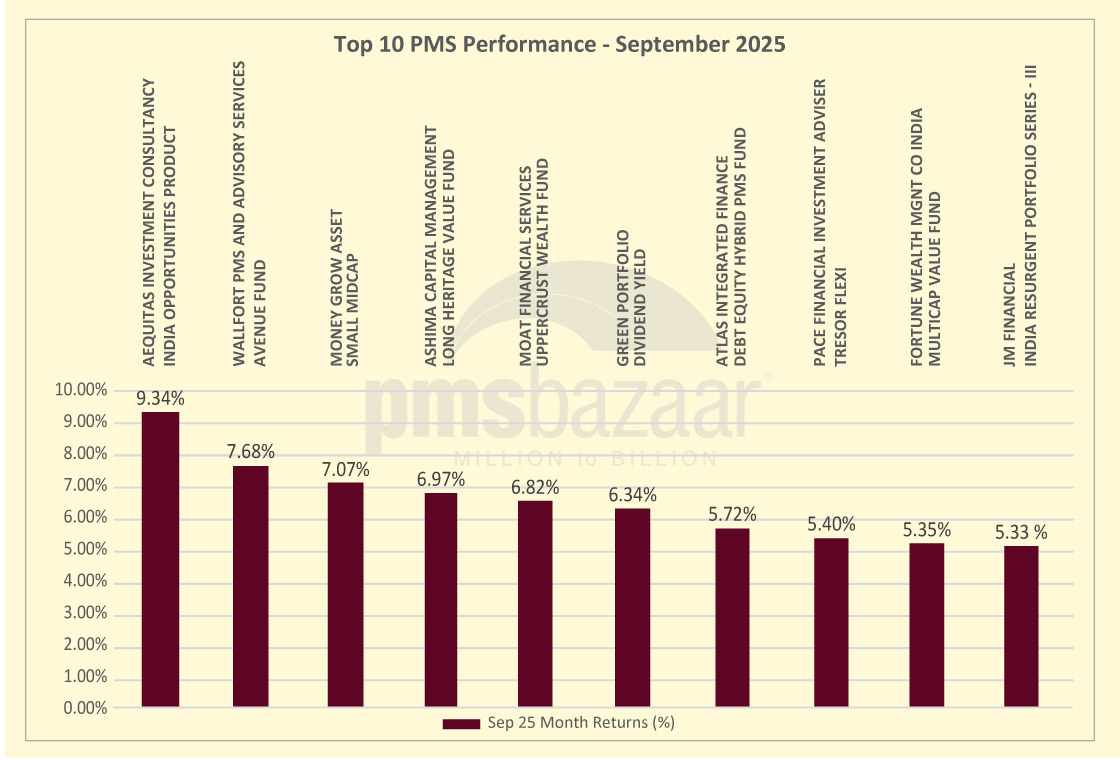

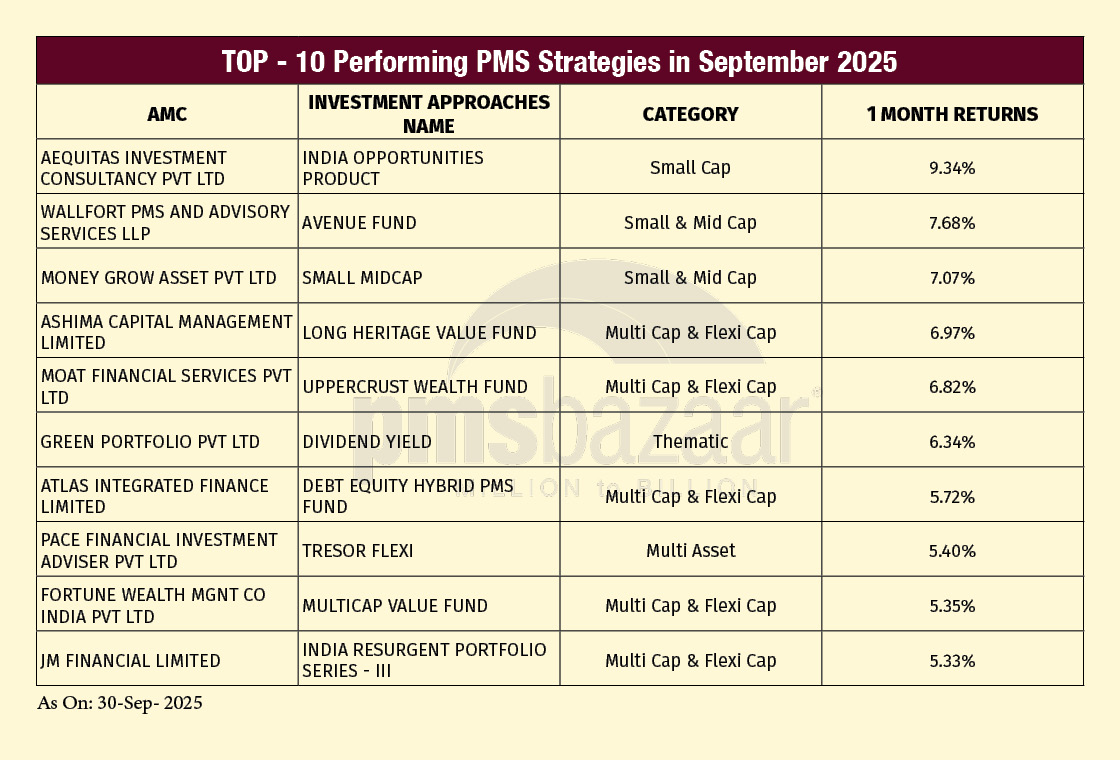

The rebound also brought back alpha generation. Aequitas’ India Opportunities topped the month with a 9.34 percent gain, followed by Wallfort’s Avenue Fund (7.68 percent) and Money Grow’s Small Midcap (7.07 percent). As optimism returns, September highlighted renewed market breadth, and the ability of active managers to capture it.

Top-10 Performers in Focus

September brought a broad recovery across PMS strategies, with strong gains concentrated in the equity space. The month’s leaders delivered high-single-digit returns, signalling renewed confidence after two volatile months.

Aequitas Investment Consultancy’s India Opportunities led the overall performance chart with an impressive 9.34 percent gain. The small-cap strategy was the clear outlier in a market where most peers posted mid-single-digit returns. Close behind, Wallfort PMS’s Avenue Fund advanced 7.68 percent, continuing its steady showing within the small- and mid-cap segment. Money Grow Asset’s Small Midcap strategy followed closely at 7.07 percent, rounding off a trio of strong performers in the broader mid-market universe.

Among diversified approaches, Ashima Capital’s Long Heritage Value Fund added 6.97 percent, while Moat Financial Services’ UpperCrust Wealth Fund delivered 6.82 percent, both drawing attention in the multi-cap and flexi-cap category. Together, these five accounted for the sharpest advances across PMS strategies in September, outpacing both the Nifty 50 TRI and the BSE 500 TRI by wide margins.

The rest of the top-10 also posted robust numbers, with Green Portfolio’s Dividend Yield gaining 6.34 percent, Atlas Integrated Finance’s Debt Equity Hybrid PMS Fund at 5.72 percent, and Pace Financial’s Tresor Flexi at 5.40 percent. Fortune Wealth’s Multicap Value Fund and JM Financial’s India Resurgent Portfolio Series III rounded out the list, each returning slightly above 5 percent.

Overall, September’s leaderboard showed healthy breadth. Top performers spread across small-cap, multi-cap, and multi-asset categories, reaffirming the market’s broad-based recovery.

Category snapshot: Multi-asset and broad-based strategies extend the lead

September 2025 turned out to be a month of recovery across almost every PMS segment, though the intensity varied. After two months of weakness, performance dispersion narrowed sharply, with all major categories ending in positive territory.

Multi-Asset strategies emerged as the strongest performers, delivering an average 2.05 percent return. Their balanced positioning between equities and fixed income allowed them to benefit from both the equity rebound and the stability of debt. Large & Midcap portfolios followed with 1.36 percent, aided by renewed interest in cyclical and industrial names that drove benchmark gains.

Small & Midcap PMS funds also made a notable comeback, posting 0.89 percent, signalling that investors were willing to re-enter broader market segments after August’s steep drawdowns. Multicap & Flexicap portfolios averaged 0.73 percent, while Large-Cap strategies added 0.68 percent, highlighting consistent yet moderate participation across equity tiers.

Midcap and Small-Cap segments lagged slightly at 0.22 percent and 0.19 percent, suggesting selective recovery within the broader rally. Thematic funds closed the month almost flat at 0.09 percent, reflecting uneven traction among concentrated themes that had underperformed in prior months.

For PMSes, September marked a decisive improvement from the broad losses seen earlier in the quarter. The return of positive averages across categories indicated improving sentiment and a stabilising market structure, with Multi-Asset and diversified equity mandates offering the smoothest path through volatility.

Multi-Asset PMSes extend lead as diversified portfolios shine

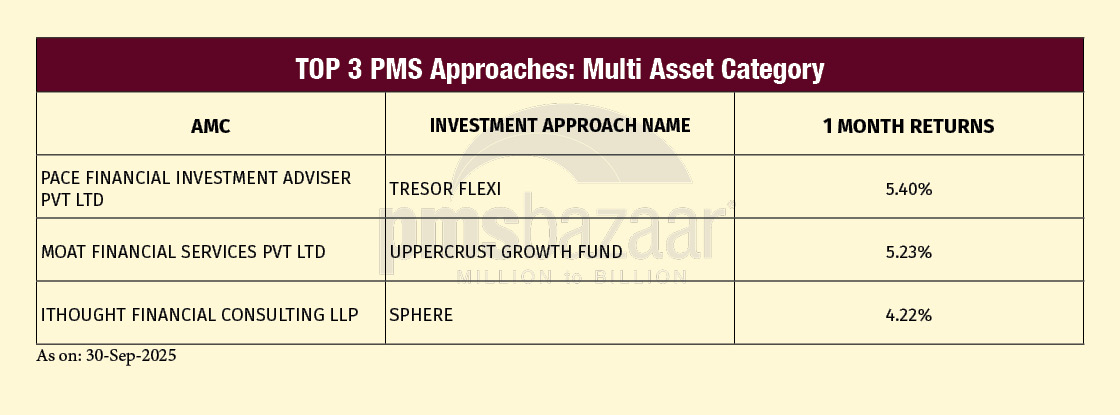

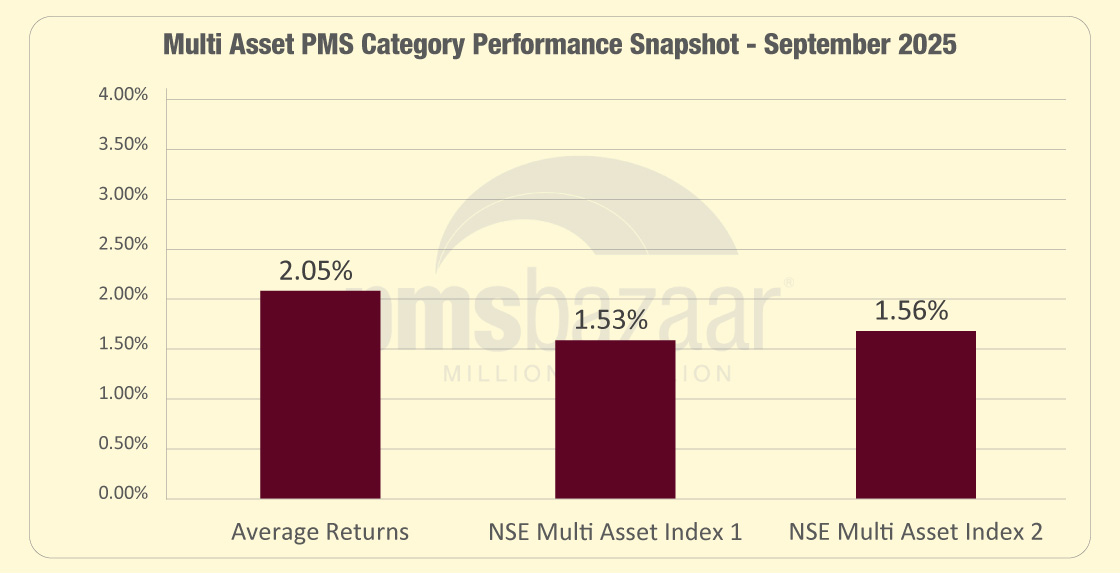

Multi-Asset PMS strategies continued their strong run in September 2025, emerging as the best-performing category for the month. Out of 23 schemes tracked, 14 outperformed the NSE Multi Asset Index 1 and 20 beat Index 2, highlighting the consistency of returns across managers. The category’s average return stood at 2.05 percent, well ahead of both benchmarks --- 1.53 percent and 1.56 percent respectively.

Leading the table was Pace Financial’s Tresor Flexi, which delivered 5.40 percent, setting the tone for the segment. Moat Financial Services’ UpperCrust Growth Fund followed closely at 5.23 percent, while ithought Financial Consulting’s SPHERE recorded 4.22 percent. These three strategies stood out for maintaining steady momentum through the broader market’s recovery phase.

The final picture of the month pointed to broad-based strength across asset mixes. With equities stabilising and debt returns holding steady, Multi-Asset PMS managers managed to capture upside while cushioning volatility. This reinforces the segment’s role as a stabilising force during market transitions.

Multi-Asset PMS Category Performance Snapshot:

The Multi Asset PMS category delivered a strong performance in September 2025, generating average returns of 2.05%, outperforming both benchmarks — NSE Multi Asset Index 1 (1.53%) and Index 2 (1.56%). This outperformance highlights the category’s effective asset allocation and balanced risk approach amid a dynamic market environment.

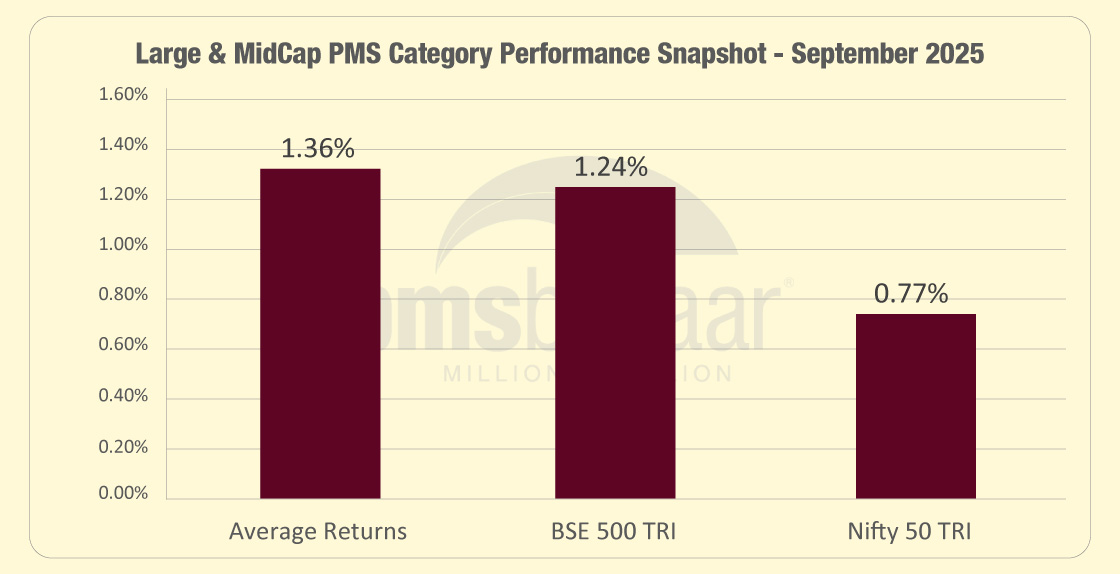

Large & Midcap PMSes maintain momentum with broad outperformance

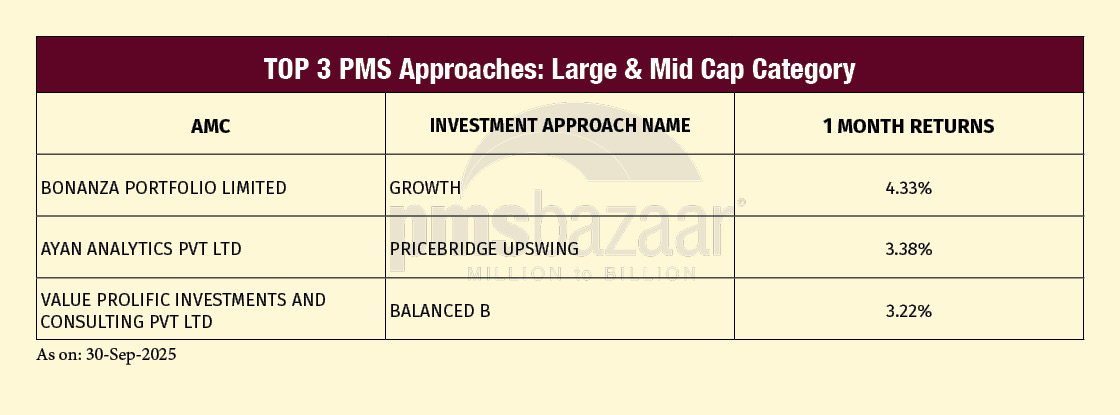

Large & Midcap PMS strategies delivered a solid month in September 2025, extending their relative strength seen through the quarter. The category posted an average return of 1.36 percent, comfortably ahead of both the BSE 500 TRI (1.24 percent) and the Nifty 50 TRI (0.77 percent). Out of 22 schemes tracked, 12 outperformed the BSE 500 TRI, while 15 beat the Nifty 50 TRI, reflecting broad participation across the segment.

Bonanza Portfolio’s Growth strategy led the category with a sharp 4.33 percent gain, well above peers. Ayan Analytics’ PriceBridge Upswing followed with 3.38 percent, and Value Prolific Investments and Consulting’s Balanced B came next at 3.22 percent. Together, these three strategies set the tone for the month, highlighting the resilience of diversified equity approaches.

As you can see, the Large & Midcap category continued to demonstrate stability and consistent alpha generation. September’s performance reaffirmed investor preference for balanced exposure, where combination of the growth potential of midcaps with the relative safety of largecaps brought investor delight.

Large & Midcap PMS Category Performance Snapshot:

The Large & Mid Cap PMS segment posted average returns of 1.36% in September 2025, outperforming both the BSE 500 TRI (1.24%) and Nifty 50 TRI (0.77%). This demonstrates the strategy’s ability to capture broader market gains while maintaining a diversified portfolio across large and mid-cap stocks.

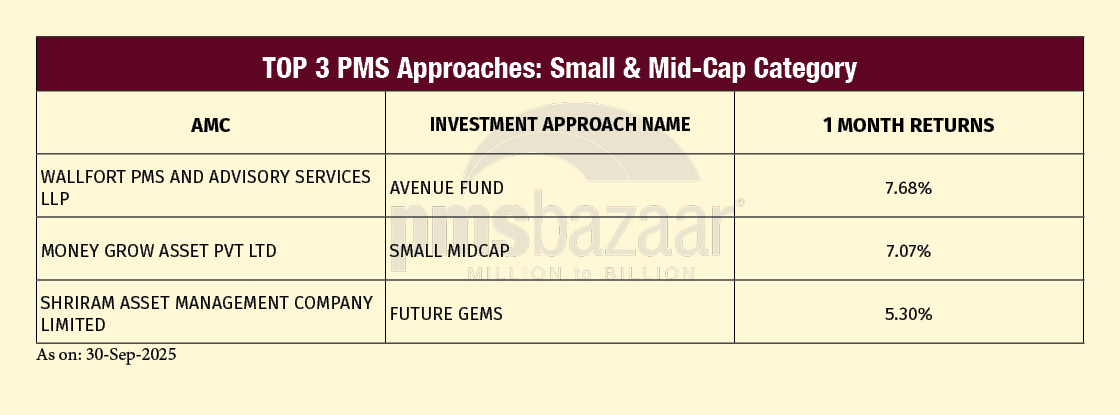

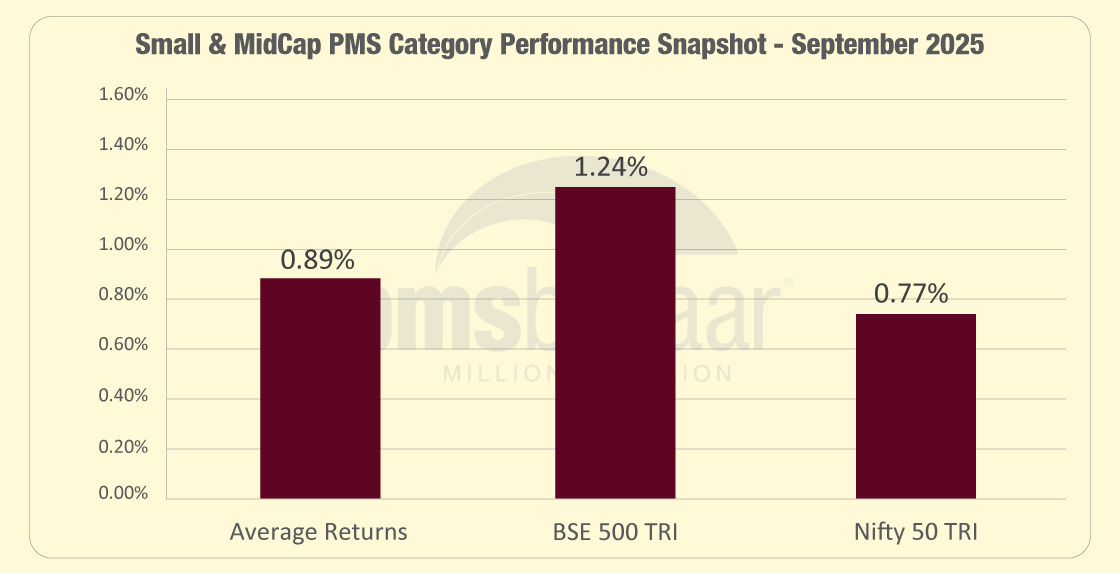

Small & Midcap PMSes rebound sharply, led by select high alpha strategies

After two months of weakness, Small & Midcap PMS strategies bounced back in September 2025 with a clear show of strength. The category posted an average return of 0.89 percent, slightly trailing the BSE 500 TRI (1.24 percent) but ahead of the Nifty 50 TRI (0.77 percent). Out of 54 schemes tracked, 23 outperformed the BSE 500 TRI, and 26 beat the Nifty 50 TRI, underscoring selective resilience in the broader mid-market space.

Wallfort PMS’s Avenue Fund led from the front with a stellar 7.68 percent gain, the highest within the category. Money Grow Asset’s Small Midcap followed closely at 7.07 percent, maintaining strong momentum through the month. While Shriram AMC’s Future GEMS posted 5.30 percent.

In a way, September marked a welcome turnaround for the Small & Midcap segment. Despite lingering volatility, the month showcased how focussed, bottom-up portfolios could generate meaningful alpha. This was partly possible as risk sentiment improved across the mid-market curve.

Small & Midcap PMS Category Performance Snapshot:

The Small & Midcap PMS segment delivered average returns of 0.89% in September 2025, slightly below the BSE 500 TRI (1.24%) but above the Nifty 50 TRI (0.77%). This reflects the segment’s exposure to higher-growth, higher-volatility stocks, highlighting the potential for long-term outperformance despite short-term fluctuations.

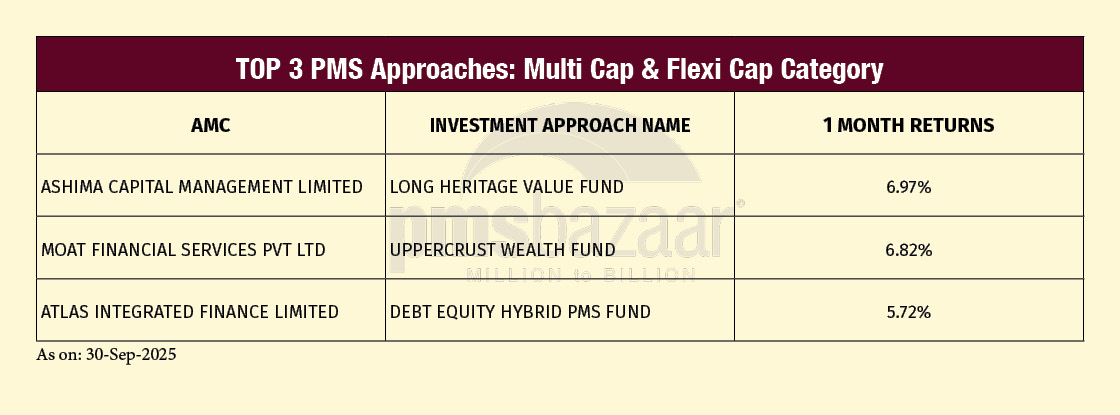

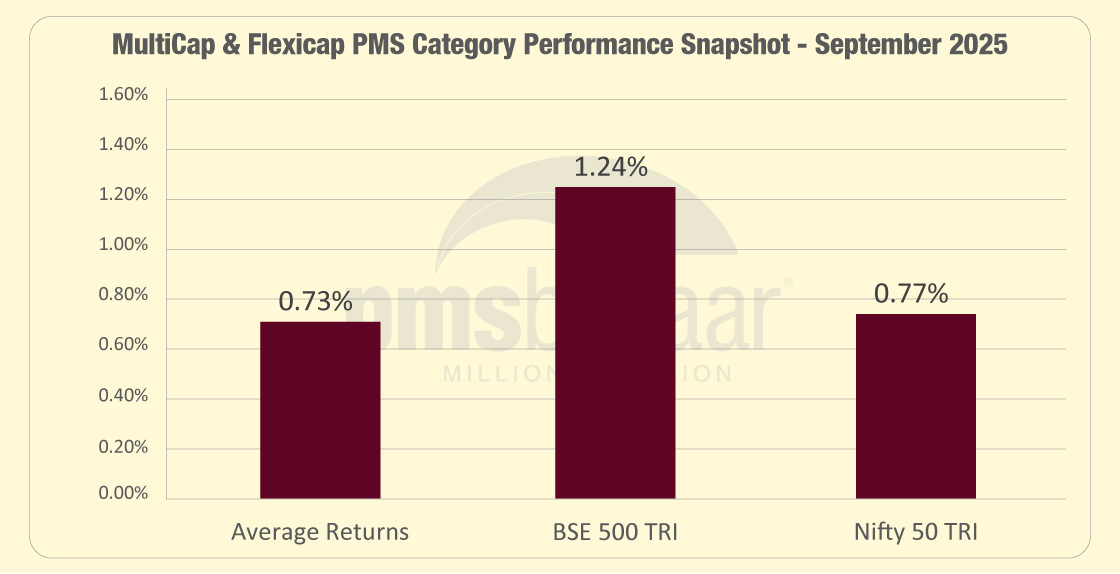

Multicap and Flexicap PMSes Record broad recovery with strong top-end gains

Multicap and Flexicap PMS strategies saw steady improvement in September 2025, reflecting renewed investor confidence in diversified equity mandates. The category recorded an average return of 0.73 percent, slightly behind the BSE 500 TRI’s 1.24 percent but above the Nifty 50 TRI’s 0.77 percent. Out of 249 schemes tracked, 93 outperformed the BSE 500 TRI and 110 beat the Nifty 50 TRI, signalling widespread recovery even amid moderation in benchmark returns.

Among the top performers, Ashima Capital Management’s Long Heritage Value Fund led the pack with an impressive 6.97 percent return, closely followed by Moat Financial Services’ UpperCrust Wealth Fund at 6.82 percent. While Atlas Integrated Finance’s Debt Equity Hybrid PMS Fund ranked third with 5.72 percent respectively.

Despite lagging the broader index on average, the large number of outperformers highlighted healthy breadth within the category. September reaffirmed the segment’s adaptability, with a mix of value, growth, and quantitative strategies contributing to positive outcomes across portfolios.

Multicap & Flexicap PMS Category Performance Snapshot:

The Multicap & Flexicap PMS segment recorded average returns of 0.73% in September 2025, slightly below the BSE 500 TRI (1.24%) and Nifty 50 TRI (0.77%). This performance reflects the diversified approach across market caps, balancing growth opportunities with risk management in a volatile market environment.

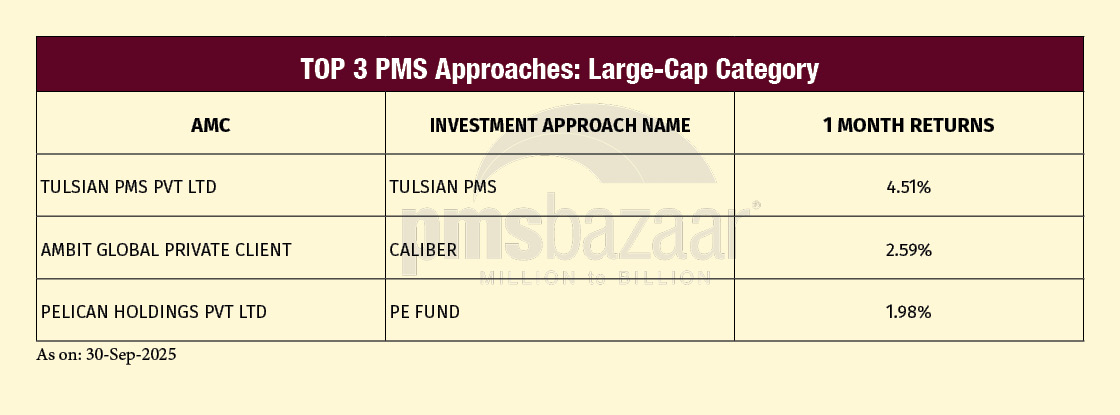

Large-Cap PMSes deliver modest gains; Some managers outperform benchmarks

Large-cap PMS strategies posted muted yet steady gains in September 2025. The category registered an average return of 0.68 per cent, trailing the BSE 500 TRI’s 1.24 percent and slightly below the Nifty 50 TRI’s 0.77 percent. Out of 28 schemes tracked, only seven outperformed the BSE 500 TRI, while nine beat the Nifty 50 TRI, showing that performance dispersion remained narrow within this relatively stable segment.

Tulsian PMS led the pack with an emphatic 4.51 percent gain, well ahead of peers and benchmarks alike. Ambit Global Private Client’s Caliber strategy followed with 2.59 percent, and Pelican Holdings’ PE Fund delivered 1.98 percent, rounding off the top three. These managers demonstrated the benefit of disciplined, high-conviction exposure in an otherwise subdued market.

Overall, September underscored the steady nature of large-cap mandates. Returns were contained, yet several managers managed to add incremental alpha through stock selection and exposure timing, helping sustain investor confidence in this core equity category.

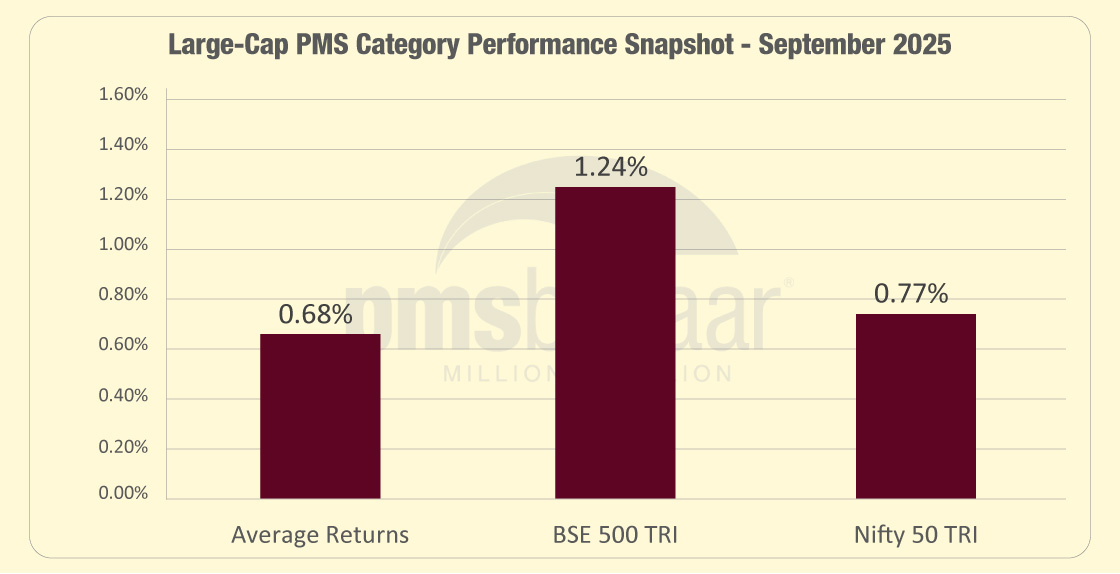

Largecap PMS Category Performance Snapshot:

The Large Cap PMS segment delivered average returns of 0.68% in September 2025, underperforming both the BSE 500 TRI (1.24%) and Nifty 50 TRI (0.77%). This reflects a conservative positioning within large-cap stocks, prioritizing stability and risk management amid market fluctuations.

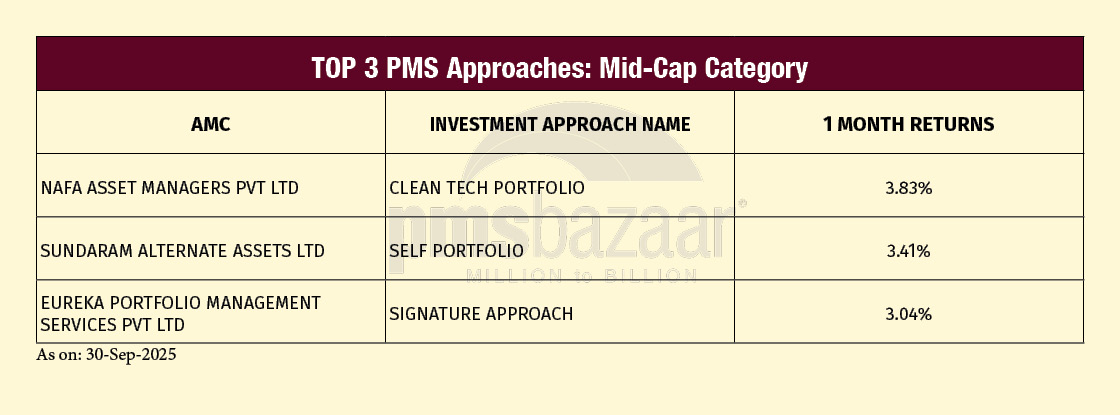

Midcap PMS strategies deliver mixed results amid narrow market gains

Midcap PMS strategies had a subdued showing in September 2025, reflecting the uneven recovery within the broader market. The category reported an average return of just 0.22 percent, lagging both the BSE 500 TRI’s 1.24 percent and the Nifty 50 TRI’s 0.77 percent. Out of 22 schemes tracked, only four outperformed the BSE 500 TRI, and five beat the Nifty 50 TRI, underlining selective performance in this volatile segment.

NAFA Asset Managers’ Clean Tech Portfolio led the group with a solid 3.83 percent return, emerging as the standout in an otherwise muted category. Sundaram Alternate Assets’ SELF Portfolio followed with 3.41 percent, while Eureka PMS’s Signature Approach added 3.04 percent, rounding off the top three. These strategies managed to generate alpha even as broader midcap indices struggled for direction.

Midcap managers faced a month of consolidation. Despite sporadic outperformance by a few focussed strategies, the broader category continued to grapple with narrow breadth and intermittent volatility. This suggests that sustained gains may require a broader pickup in mid-tier corporate earnings.

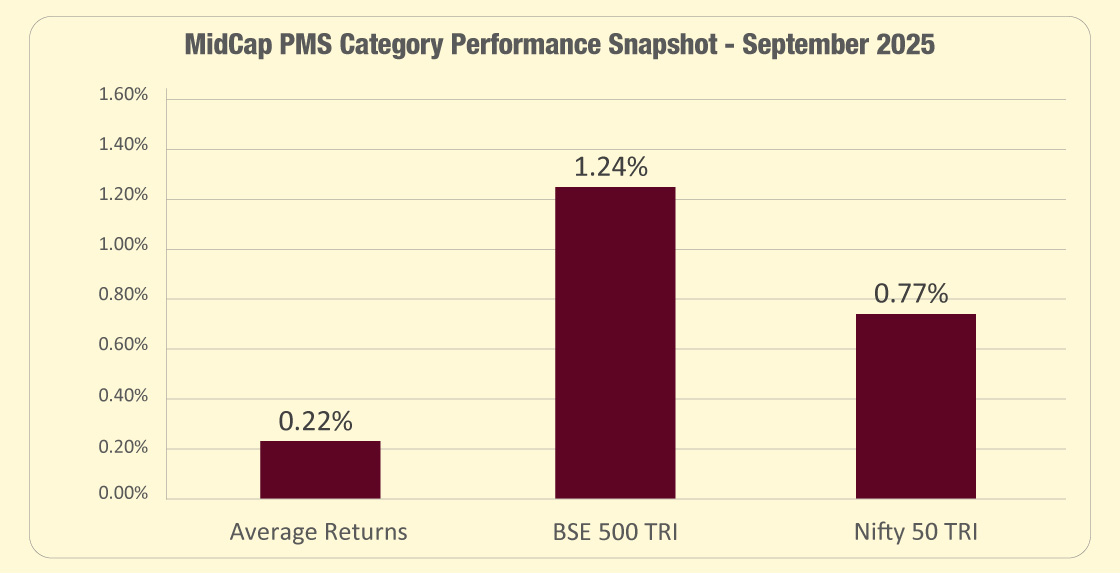

Midcap PMS Category Performance Snapshot:

The MidCap PMS segment posted average returns of 0.22% in September 2025, significantly below the BSE 500 TRI (1.24%) and Nifty 50 TRI (0.77%).This underperformance reflects the higher volatility and sensitivity of mid-cap stocks in a fluctuating market environment.

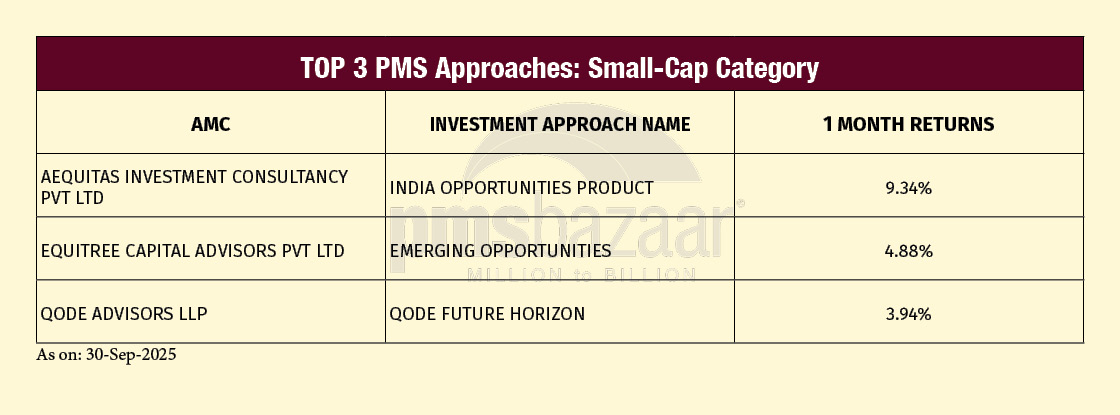

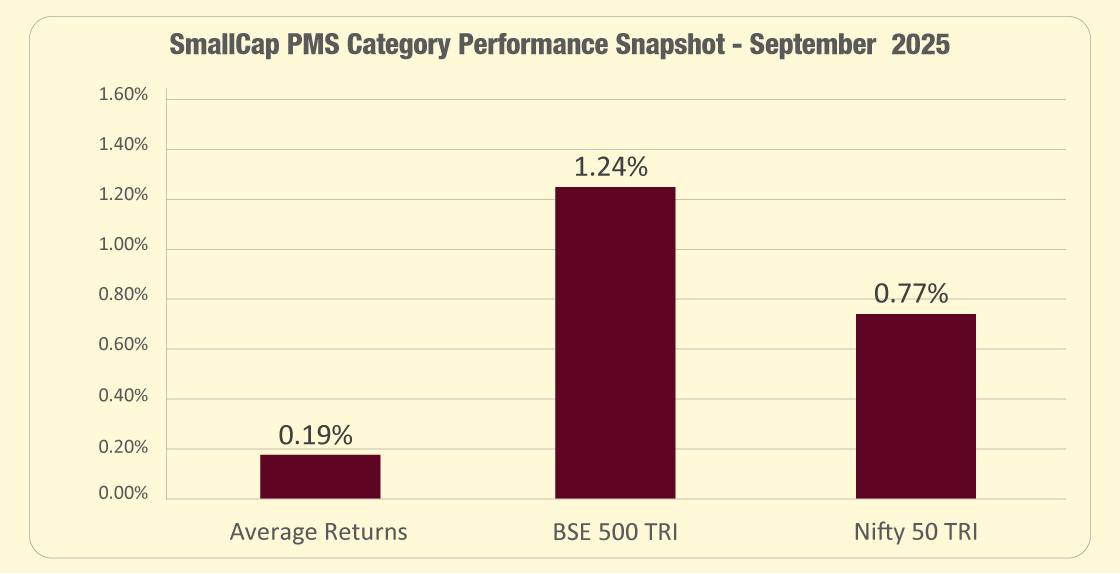

Small-Cap PMSes clock alpha generation despite category-level softness

Small-cap PMS strategies posted a mixed performance in September 2025, though a few standout performers lifted overall sentiment. The category recorded an average return of 0.19 percent, trailing both the BSE 500 TRI’s 1.24 percent and the Nifty 50 TRI’s 0.77 percent. Out of 28 schemes tracked, five outperformed the BSE 500 TRI and seven beat the Nifty 50 TRI, signalling that select, high-conviction portfolios drove most of the gains.

At the forefront, Aequitas Investment Consultancy’s India Opportunities Product delivered a remarkable 9.34 percent, the highest across the entire PMS universe for the month. Equitree Capital Advisors’ Emerging Opportunities followed with 4.88 percent, while Qode Advisors’ Future Horizon generated 3.94 percent.

Despite subdued category averages, September reinforced small-caps’ reputation as a source of concentrated alpha. While broader volatility kept most funds restrained, the top performers demonstrated how focused stock-picking and patience in smaller-company exposure could yield outsized results even in a cautious market phase.

Smallcap PMS Category Performance Snapshot:

The Small Cap PMS segment delivered average returns of 0.19% in September 2025, trailing both the BSE 500 TRI (1.24%) and Nifty 50 TRI (0.77%).This highlights the high volatility inherent in small-cap stocks, emphasizing the potential for long-term gains despite short-term underperformance.

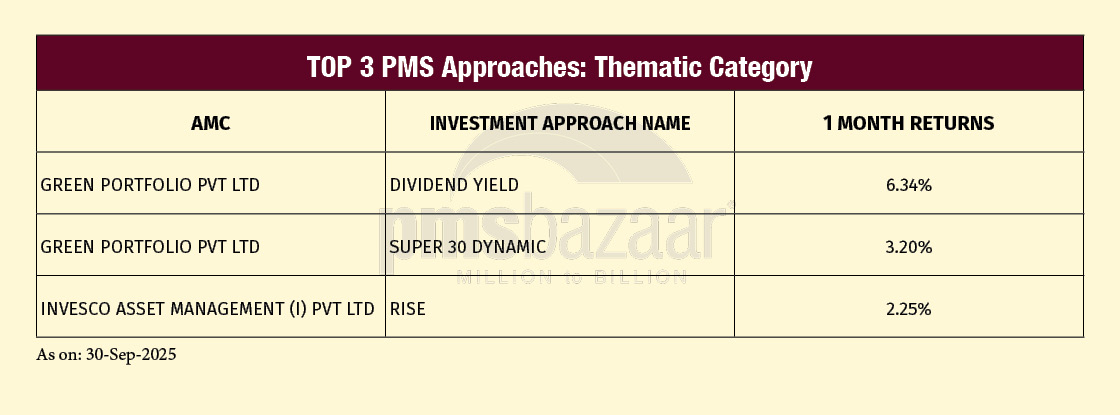

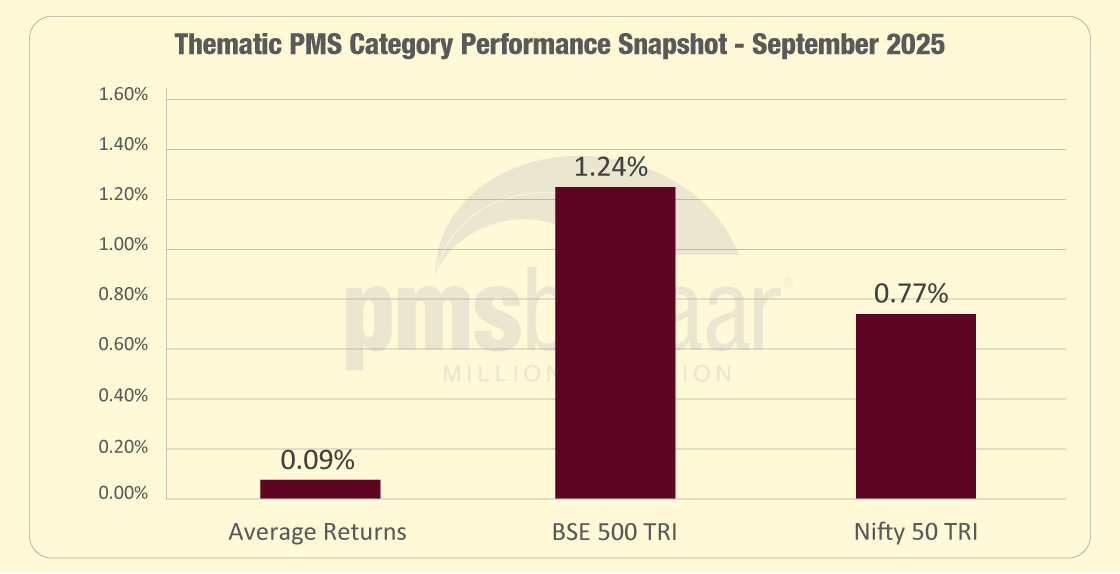

Thematic PMSes witness uneven performance with select bright spots

Thematic PMS strategies registered muted overall performance in September 2025, though a few standout portfolios managed to post strong gains. The category’s average return stood at 0.09 percent, lagging both the BSE 500 TRI’s 1.24 percent and the Nifty 50 TRI’s 0.77 percent. Out of 18 strategies tracked, four outperformed the BSE 500 TRI, while five beat the Nifty 50 TRI, indicating narrow leadership concentrated in a handful of themes.

Green Portfolio’s Dividend Yield strategy led the segment with an impressive 6.34 percent gain, far ahead of the category average. Its sister product, Super 30 Dynamic, followed with 3.20 percent, underscoring the firm’s consistent strength across differentiated equity themes. Invesco Asset Management’s RISE strategy secured the third spot at 2.25 percent.

Notwithstanding the uninspiring category average, select thematic strategies proved that well-defined focus areas such as dividend yield, manufacturing, or policy-linked opportunities continued to create alpha even in a consolidating market. In a way, this reaffirmed that conviction-driven themes can outperform, but breadth across the category remains limited.

Thematic PMS Category Performance Snapshot:

The Thematic PMS segment posted average returns of 0.09% in September 2025, underperforming both the BSE 500 TRI (1.24%) and Nifty 50 TRI (0.77%). This reflects the concentrated nature of thematic strategies, which can experience short-term volatility while targeting specific high-growth themes for long-term potential.

Outlook for October-2025

The domestic setup looks increasingly encouraging for long-term investors. Policy continuity, a focus on structural reforms, and supportive liquidity measures have begun to restore confidence across sectors. The recent push toward GST rationalisation and infrastructure acceleration could further strengthen the growth cycle in the coming quarters.

For PMS investors, this phase offers an opportunity to stay invested and aligned with managers who balance growth participation with risk discipline. Broader market breadth, improving earnings visibility, and steady macro indicators are slowly translating into a more constructive environment for equities.

While global uncertainty remains a constant backdrop, India’s relative resilience stands out. The combination of reform momentum and prudent monetary support is creating conditions for sustainable wealth creation.

PMS investors who remain patient and goal-focussed are likely to benefit as the recovery broadens and active strategies begin to realise their potential.

Happy Investing!

Recent Blogs

January Rout, Extreme Dispersion: PMS Returns Swing From Losses to Gains

Benchmark falls deepened losses, but multi-asset and debt cushioned portfolios meaningfully

Investment Frameworks : A Practitioner’s Guide

PMS Bazaar recently organized a webinar titled “Investment Frameworks: A Practitioner’s Guide,” which featured Mr. Sumit Agrawal, Senior Vice President, Nuvama Asset Management Limited. This blog covers the important points shared in this insightful webinar.

Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability

PMS Bazaar recently organized a webinar titled “Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability,” which featured Mr. Sandeep Daga, MD& CIO, Nine Rivers Capital and Mr. Kunal Sabnis, Portfolio Manager, Nine Rivers Capital. This blog covers the important points shared in this insightful webinar.

Flat Markets, Wide Outcomes: How 484 PMS Strategies Performed in Dec 2025

December 2025 was a month where market returns stayed close to flat, with the Nifty 50 TRI at -0.28% and the BSE 500 TRI at -0.24%.

Equity Markets 2026: Outlook, Risks and Strategy

PMS Bazaar recently organized a webinar titled “Equity Markets 2026: Outlook, Risks and Strategy,” which featured Mr. Ashish Chaturmohta, MD & Fund Manager – APEX PMS, JM Financial Limited. This blog covers the important points shared in this insightful webinar.

MICRO CAPS: The Dark Horses of the Indian Equity Market

PMS Bazaar recently organized a webinar titled “MICRO CAPS: The Dark Horses of the Indian Equity Market,” which featured Mr. Rishi Agarwal and Mr. Adheesh Kabra, both Co-Founders and Fund Managers, Aarth AIF. This blog covers the important points shared in this insightful webinar.

Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy

PMS Bazaar recently organized a webinar titled “Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy,” which featured Mr.Anunaya Kumar, President – Sales and Distribution ASK Investment Managers Limited. This blog covers the important points shared in this insightful webinar.

.jpg)

Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS

PMS Bazaar recently organized a webinar titled “Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS,” which featured Mr. Karan Bhatia, Co-Founder and Co-Fund Manager , Pricebridge Honeycomb ETF PMs. This blog covers the important points shared in this insightful webinar.