Nifty 50 TRI gained 4.62%, BSE 500 TRI rose 4.27%; 415 of 427 equity PMSes ended positive

After a muted September, equity markets delivered a forceful rebound in October 2025, marking their strongest month-on-month gain in seven months. The Nifty touched the 26,000 mark, ending October with a 4.62 per cent rise. Broader indices kept pace, with the S&P BSE 500 TRI advancing 4.27 per cent. What defined the month, however, was the sharp breadth of the rally. The Nifty Midcap 100 and Nifty Smallcap 100 outperformed the large-cap benchmark, supported by the return of foreign institutional inflows after three consecutive months of selling pressure. Volatility remained elevated, but the underlying risk appetite clearly strengthened.

Sector leadership was unusually wide. Real Estate and PSU Banks surged 9 per cent each, Telecom gained 7 per cent, and Infrastructure and Technology rose 6 per cent apiece. Media was the sole laggard. This broad participation, combined with improving liquidity, set the stage for a near-uniform recovery across Portfolio Management Services (PMS) strategies tracked by PMSBazaar.

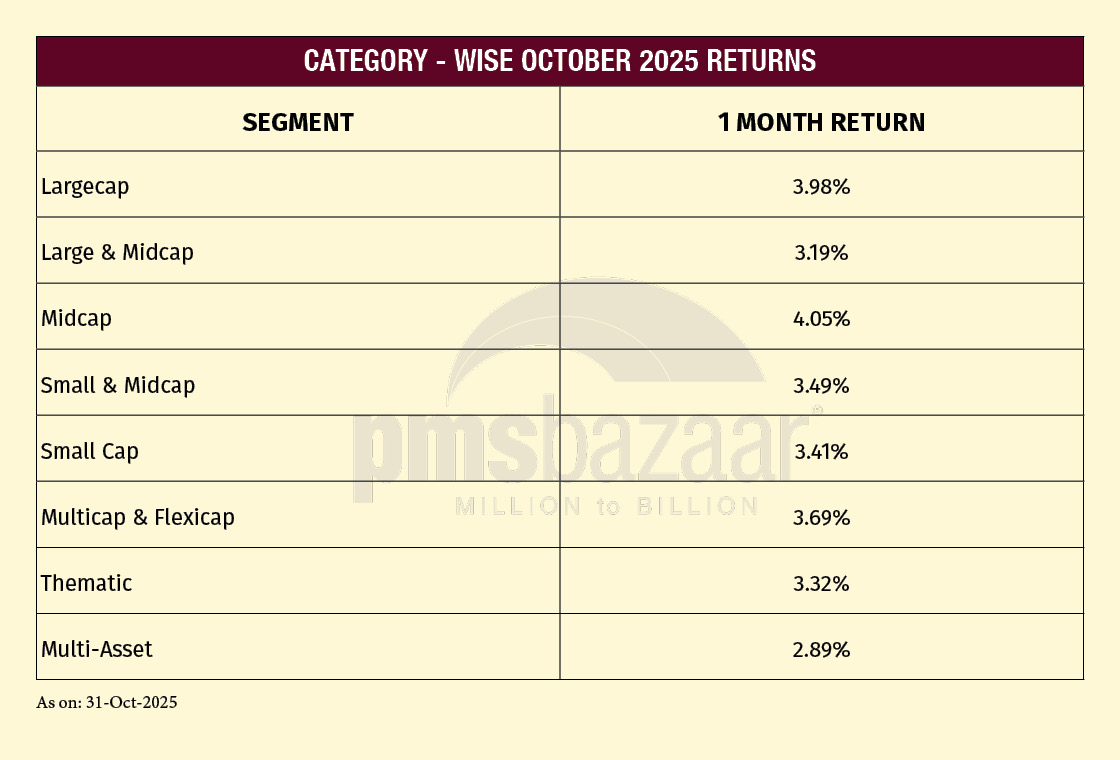

Of the 471 PMS strategies analysed, 458 ended the month in the green—an exceptional 97.2 per cent hit ratio. Among the 427 equity PMSes, 415 delivered positive returns. Outperformance against benchmarks was narrower: 1 out of 4 i.e. 26 per cent beat the Nifty 50 TRI and 1 out of 3 i.e. 33 per cent exceeded the S&P BSE 500 TRI. Category averages reflected the same broad-based upswing, led by Midcap PMSes at 4.05 per cent and Largecap PMSes at 3.98 per cent, with Multicap, Small & Midcap, Smallcap, Thematic, Large & Midcap, and Multi-Asset strategies returning between 2.89 and 3.69 per cent.

Stock-picking alpha reappeared at the top end. Sundaram Alternates’ Rising Stars gained 10.5 per cent, followed by Kotak’s Fintech strategy at 9.97 per cent, Right Horizons’ Super Value Aggressive at 9.47 per cent, and two InCred mandates (Focused Healthcare and Multicap) delivering over 9 per cent.

The broader set of signals suggests that while headline indices have been range-bound over the past year, market conditions are now more constructive than last year. Reasonable valuations, supportive policy momentum, and the potential for earnings acceleration together create a set-up conducive to mean reversion in Indian equities, even as external trade frictions remain an important swing factor.

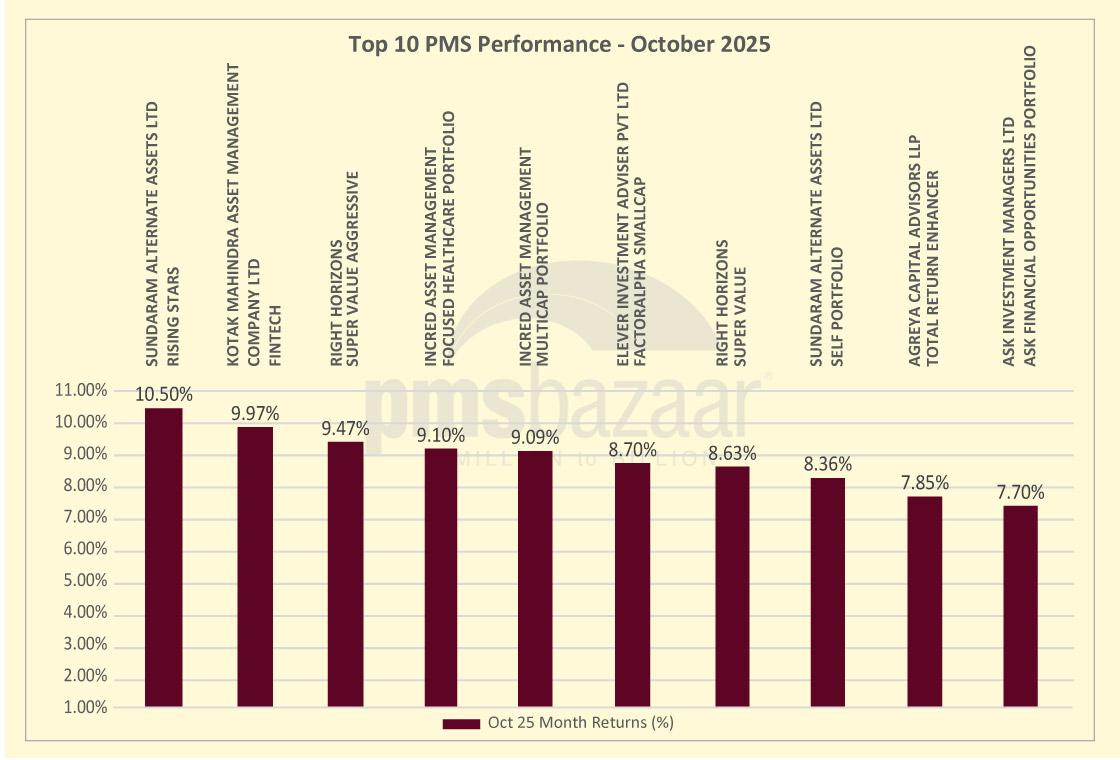

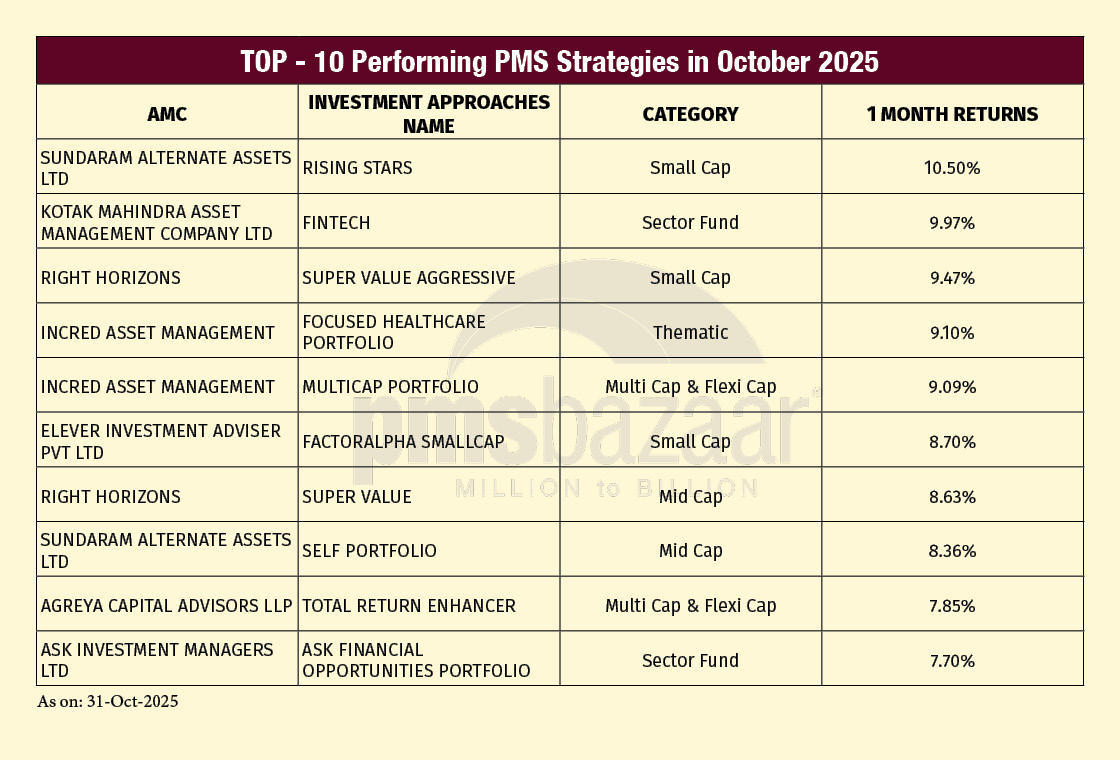

Top-10 Performers in Focus

October’s PMS leaderboard showed a clear step-up in dispersion, with the month’s top performers delivering mid- to high-single-digit gains and a few strategies breaking into double digits. Small-cap and thematic approaches dominated the upper end of the table, reflecting the broader risk-on tone seen in the market’s October rebound.

Sundaram Alternates’ Rising Stars led all strategies with a 10.50 per cent return, the only PMS in double digits. Kotak AMC’s Fintech sector-focussed mandate followed at 9.97 per cent, benefitting from the revival in technology names during the month. Right Horizons’ Super Value Aggressive strategy ranked third with a 9.47 per cent gain, reinforcing the strength visible across select small-cap portfolios.

Two InCred strategies also featured prominently: the Focused Healthcare Portfolio returned 9.10 per cent, while the Multicap Portfolio delivered 9.09 per cent, placing both comfortably within the top five. Elever’s Factoralpha Smallcap strategy added 8.70 per cent, followed by Right Horizons’ Super Value (8.63 per cent) and Sundaram Alternates’ SELF Portfolio (8.36 per cent), indicating consistent traction across mid- and small-cap-oriented managers.

Rounding out the top ten were Agreya Capital’s Total Return Enhancer at 7.85 per cent, and ASK Investment Managers’ Financial Opportunities Portfolio at 7.70 per cent.

The composition of October’s top performers remained broad, spanning small-cap, mid-cap, multicap, thematic and sector-focussed frameworks. This mirrored the wide market participation seen through the month.

Category snapshot: Midcap and Largecap PMSes lead the October uptrend

October 2025 delivered a stronger and more broad-based recovery across PMS categories compared with September, with every major segment ending the month in positive territory. The improvement in benchmarks, combined with sector-wide strength, pushed category averages meaningfully higher.

Midcap PMS strategies led with an average 4.05 per cent return, closely followed by Largecap portfolios at 3.98 per cent, both benefiting from the wider market rebound. Multicap and Flexicap strategies posted 3.69 per cent, reflecting consistent participation across diversified mandates. Small & Midcap and pure Smallcap PMSes delivered 3.49 per cent and 3.41 per cent respectively, aligning with the broader upmove seen across Real Estate (+9 per cent), PSU Banks (+9 per cent), Telecom (+7 per cent) and Technology (+6 per cent).

Thematic strategies recorded a 3.32 per cent gain, while Large & Midcap PMSes added 3.19 per cent, rounding out the mid-single-digit performance pack. Multi-Asset strategies lagged relatively but still posted a healthy 2.89 per cent, maintaining stability despite the equity-driven rally.

Overall, October marked a clear uplift for PMS categories. With 458 of 471 strategies ending in the green and benchmarks gaining 4.62 per cent (Nifty 50 TRI) and 4.27 per cent (BSE 500 TRI), the month reflected broad recovery rather than narrow leadership.

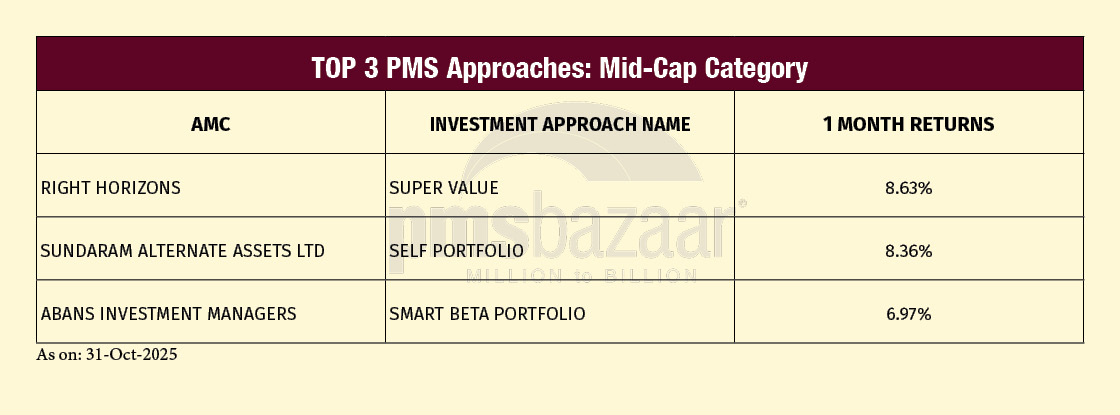

Midcap PMSes sustain strong momentum with broad gains across managers

Midcap PMS strategies posted a firm showing in October 2025, extending the strength seen across broader market segments. The category delivered an average 4.05 per cent return for the month, closely tracking the S&P BSE 500 TRI’s 4.27 per cent and the Nifty 50 TRI’s 4.62 per cent. Out of 21 schemes, eight outperformed the BSE 500 TRI, while seven beat the Nifty 50 TRI, indicating a reasonably competitive field despite benchmarks registering their strongest gains in several months.

At the upper quartile of performance table, Right Horizons’ Super Value led the pack with an 8.63 per cent return, followed by Sundaram Alternates’ SELF Portfolio, which posted 8.36 per cent. These two strategies were clear standouts, delivering nearly double the category average and Abans Investment Managers’ Smart Beta Portfolio secured the third position with a 6.97 per cent gain.

The overall distribution of returns showed that most Midcap PMSes participated meaningfully in October’s broad market rebound. While only a subset managed to beat the benchmarks, the category as a whole delivered tight clustering around mid-single-digit returns, reflecting steady execution in a month where beta remained a dominant driver.

Midcap PMS Category Performance Snapshot:

The MidCap PMS category delivered a solid 4.05% return in October 2025, showcasing steady performance in a supportive market. While it trailed the BSE 500 TRI (4.27%) and Nifty 50 TRI (4.62%), the category remained broadly aligned with benchmark momentum.

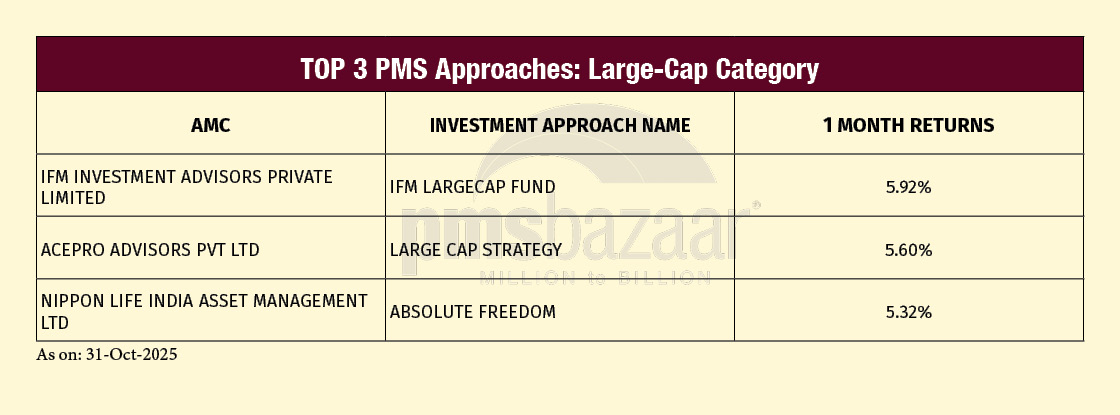

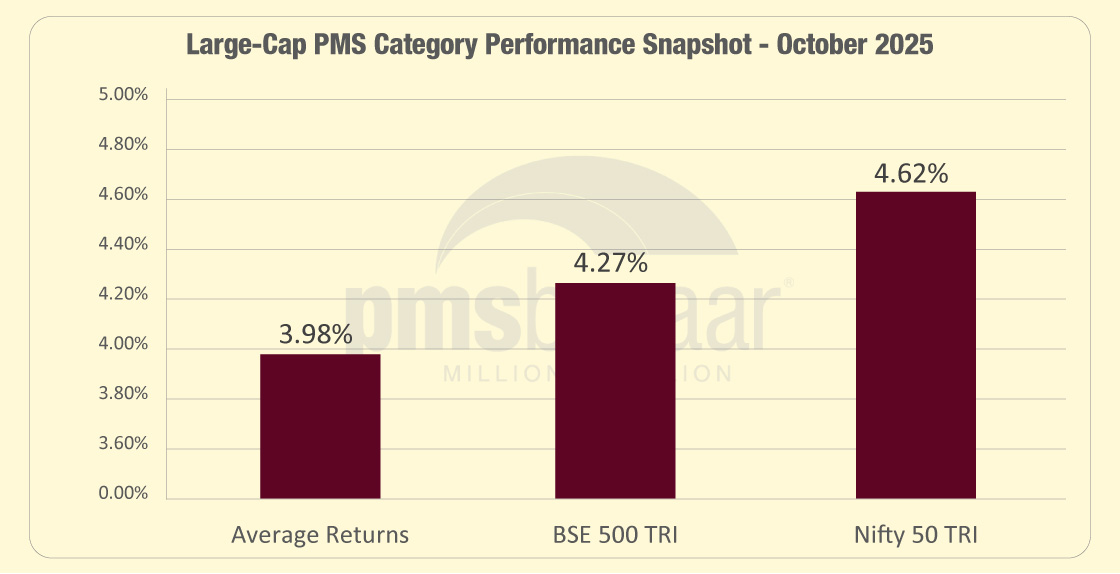

Largecap PMSes deliver steady gains, with nearly half beating benchmarks

Large Cap PMS strategies posted a stable performance in October 2025, supported by the broad-based upturn in frontline equity indices. The category delivered an average return of 3.98 per cent, marginally below the S&P BSE 500 TRI’s 4.27 per cent and the Nifty 50 TRI’s 4.62 per cent for the month. Out of 29 schemes, 14 outperformed the BSE 500 TRI, while 13 exceeded the Nifty 50 TRI, indicating a competitive but balanced distribution of outcomes within the segment.

At the top end, IFM Investment Advisors’ IFM Largecap Fund led with a 5.92 per cent return, followed by Acepro Advisors’ Large Cap Strategy at 5.60 per cent. Nippon Life’s Absolute Freedom Portfolio, benchmarked to the BSE 500 TRI, delivered 5.32 per cent, rounding out the top three performers. These strategies exceeded both category and benchmark averages by a meaningful margin.

Overall, October’s numbers show that Large Cap PMSes captured the market-wide momentum reasonably well. While category averages trailed the benchmarks slightly, the breadth of schemes beating indices suggests delivery was steady across managers rather than driven by isolated outliers.

Largecap PMS Category Performance Snapshot:

The Large-Cap PMS category delivered 3.98% returns in October 2025, maintaining steady performance in a stable market environment. While it trailed the BSE 500 TRI (4.27%) and Nifty 50 TRI (4.62%), the category remained broadly aligned with broader index trends.

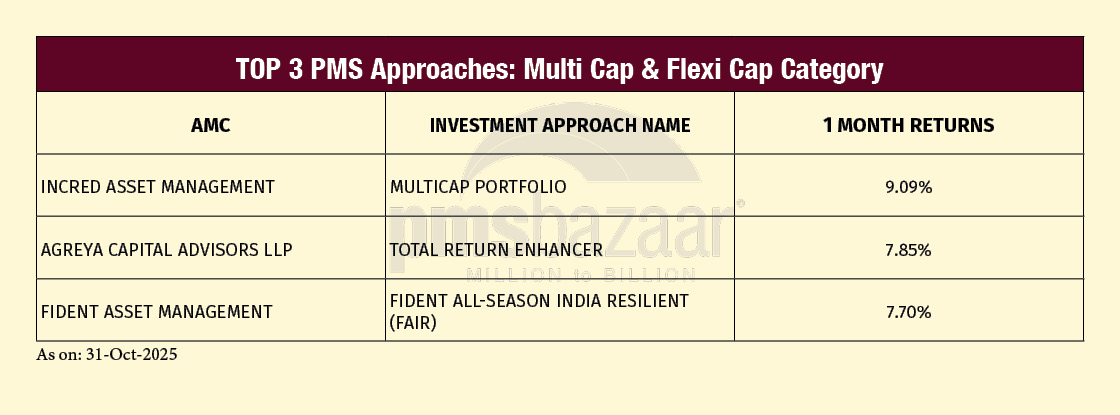

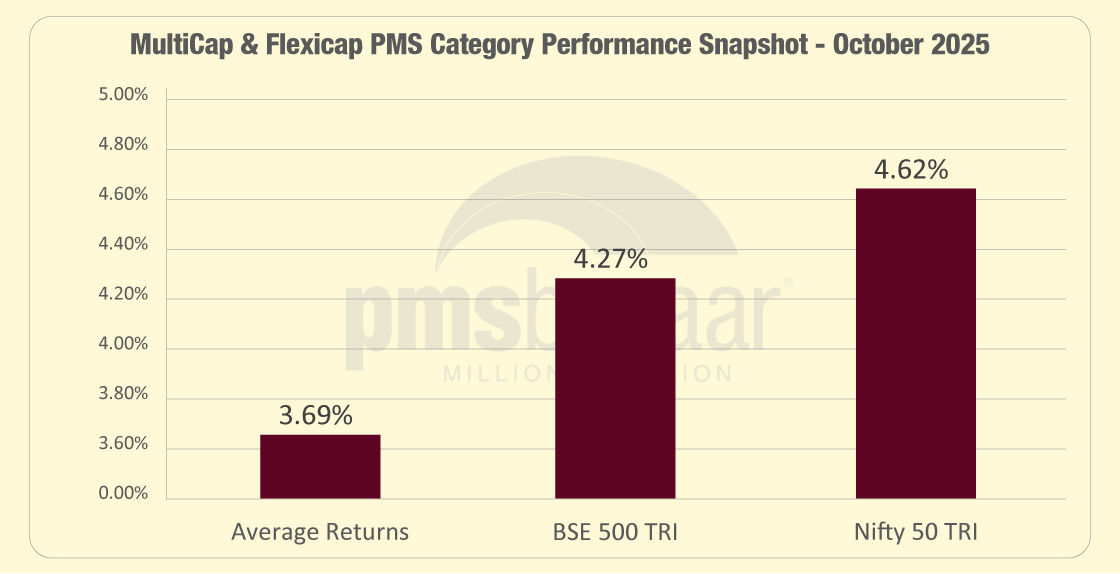

Multicap & Flexicap PMSes record broad gains, though benchmark outperformance remains selective

The most popular, Multicap and Flexicap PMS strategies delivered a steady performance in October 2025, reflecting the wider uptrend across market segments. The category posted an average return of 3.69 per cent, trailing both the S&P BSE 500 TRI’s 4.27 per cent and the Nifty 50 TRI’s 4.62 per cent for the month. Out of a large universe of 255 schemes, 84 beat the BSE 500 TRI, while 65 outperformed the Nifty 50 TRI, indicating that while returns were broadly positive, benchmark-beating delivery was more selective.

InCred Asset Management’s Multicap Portfolio delivered the strongest showing at 9.09 per cent, setting a wide lead over peers. Agreya Capital Advisors’ Total Return Enhancer followed with 7.85 per cent, while Fident Asset Management’s FAIR strategy ranked third with 7.70 per cent. All three comfortably exceeded both category and benchmark averages.

Overall, October’s results underline broad participation across Multicap and Flexicap PMSes. While the category’s average trailed headline indices, the dispersion at the top end shows that a meaningful subset of managers captured the month’s market-wide strength effectively.

Multicap & Flexicap PMS Category Performance Snapshot:

The MultiCap & FlexiCap PMS category reported 3.69% returns in October 2025, reflecting a moderate performance amid mixed market conditions. Although it lagged the BSE 500 TRI (4.27%) and Nifty 50 TRI (4.62%), the category-maintained resilience across diversified market segments.

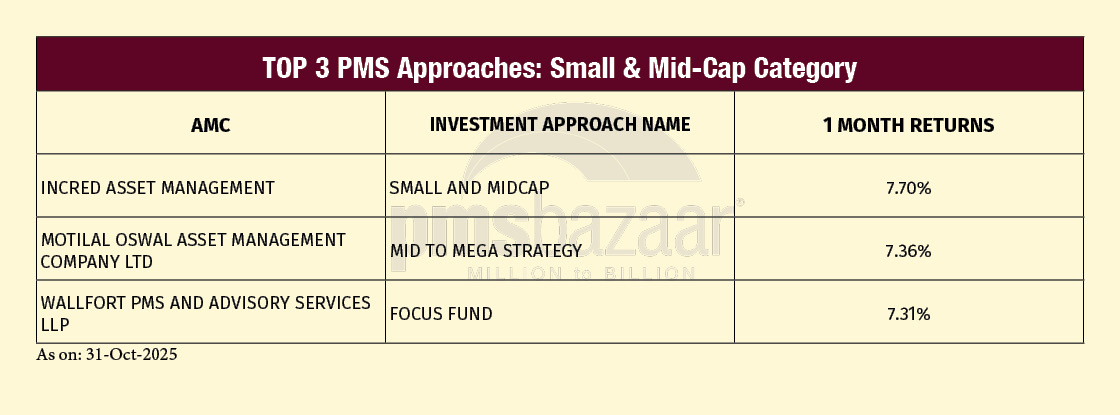

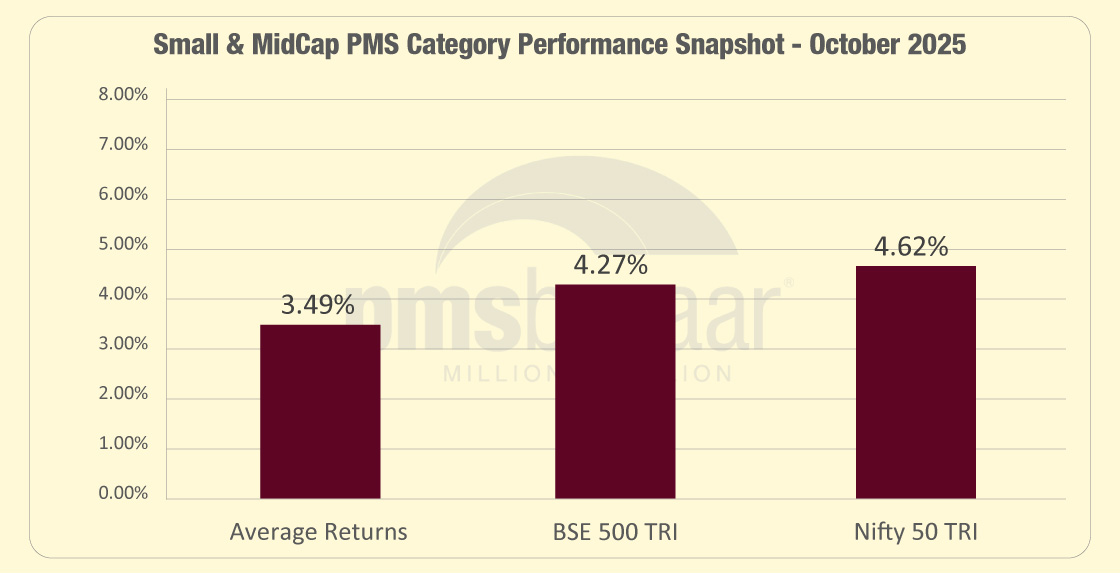

Small & Midcap PMSes deliver steady gains, with a subset outperforming benchmarks

Small & Midcap PMS strategies posted a stable performance in October 2025, participating in the broader market’s recovery but trailing the benchmark indices. The category registered an average return of 3.49 per cent, compared with 4.27 per cent for the S&P BSE 500 TRI and 4.62 per cent for the Nifty 50 TRI. Out of 53 schemes, 20 outperformed the BSE 500 TRI, while 14 exceeded the Nifty 50 TRI, indicating a moderate but meaningful pocket of outperformance within the segment.

At the upper end of the pecking order, InCred Asset Management’s Small and Midcap strategy led with a 7.70 per cent return, setting a clear gap over the rest of the category. Motilal Oswal AMC’s Mid to Mega Strategy followed with 7.36 per cent, closely tracked by Wallfort PMS’s Focus Fund, which delivered 7.31 per cent. These three strategies comfortably surpassed the broader Small & Midcap cohort.

Overall, the category’s October performance shows broad participation, with several strategies meaningfully outperforming despite the category average lagging the benchmarks.

Small & Midcap PMS Category Performance Snapshot:

The Small & MidCap PMS strategies delivered 3.49% returns in October 2025, trailing the broader market indices. Both the BSE 500 TRI (4.27%) and Nifty 50 TRI (4.62%) outperformed the category during the month.

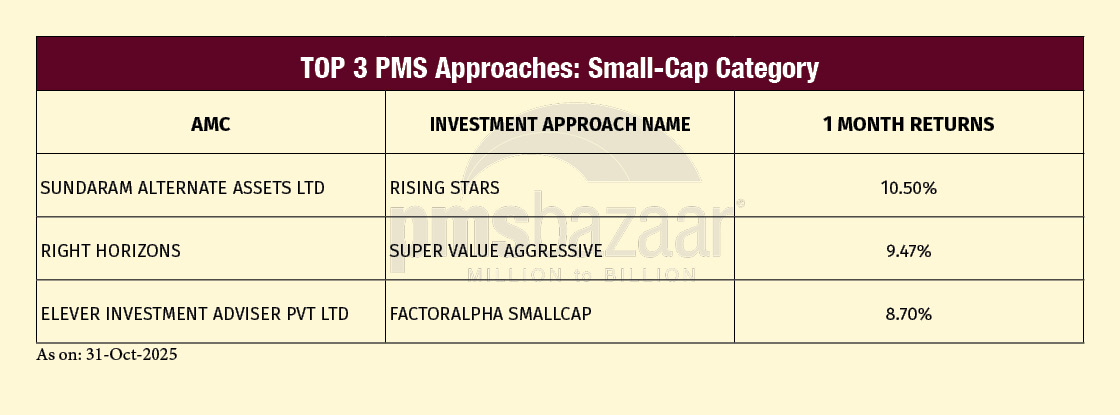

Smallcap PMSes see wide dispersion; only a handful beat benchmarks despite strong top-end returns

Small Cap PMS strategies delivered positive returns in October 2025 but lagged the broader benchmarks. The category posted an average gain of 3.41 per cent, compared with 4.27 per cent for the S&P BSE 500 TRI and 4.62 per cent for the Nifty 50 TRI. Out of 28 schemes, only five outperformed the BSE 500 TRI, and an identical five beat the Nifty 50 TRI, indicating a narrow band of outperformance despite some standout individual results.

The top of the table showed strong gains. Sundaram Alternates’ Rising Stars led decisively with a 10.50 per cent return — the highest among all listed Small Cap PMSes for the month. Right Horizons’ Super Value Aggressive followed with 9.47 per cent, while Elever’s Factoralpha Smallcap came in third at 8.70 per cent. These three strategies substantially outpaced the category average and the benchmarks.

Overall, while a few managers generated meaningful alpha in October, the wider Small Cap PMS segment showed tight clustering below benchmark levels, underscoring a month where leadership was restricted to the category’s upper tier.

Smallcap PMS Category Performance Snapshot:

SmallCap PMS strategies delivered 3.41% returns in October 2025, lagging behind broader market benchmarks. Both the BSE 500 TRI (4.27%) and Nifty 50 TRI (4.62%) outperformed the category during the month.

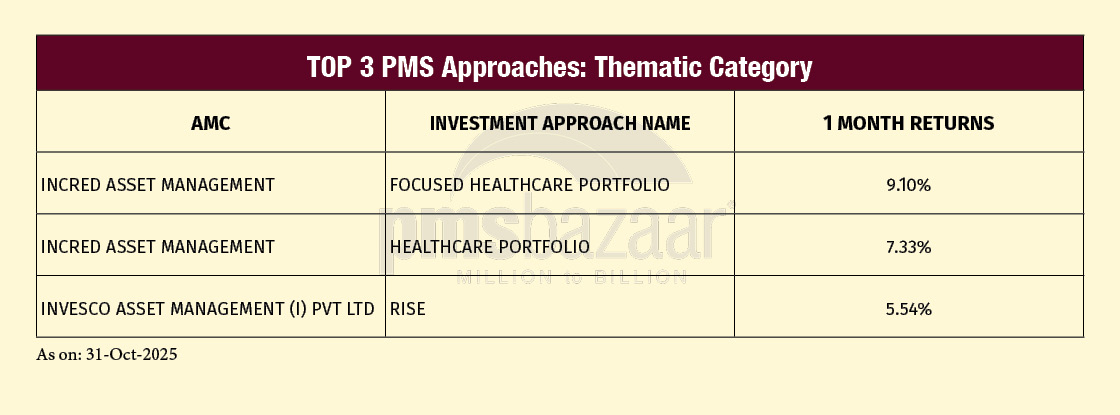

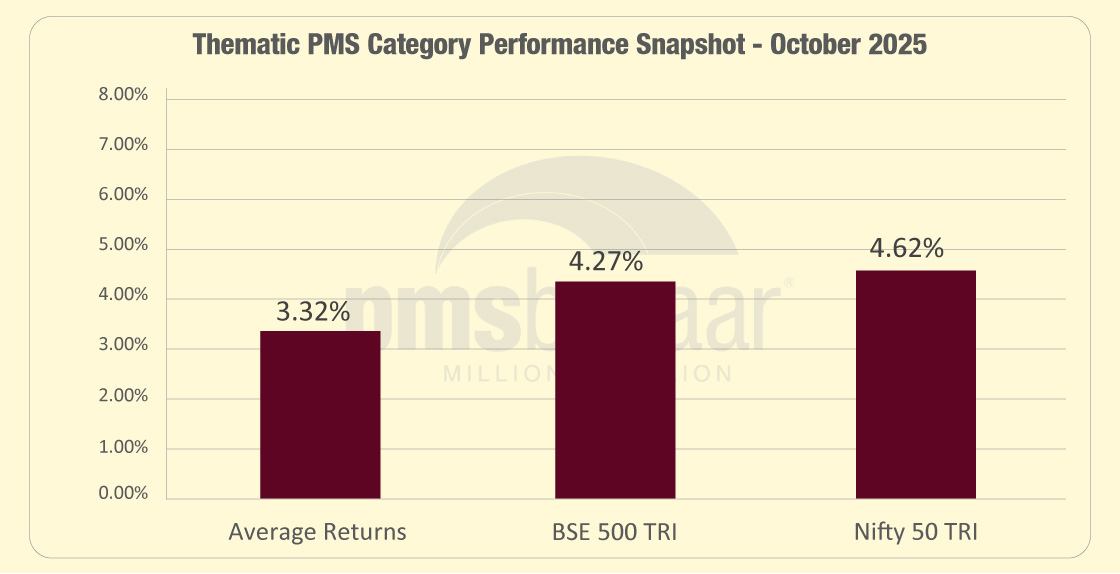

Thematic PMSes deliver moderate gains; a few strong performers lift otherwise subdued averages

Thematic PMS strategies recorded a moderate performance in October 2025, participating in the broader market recovery but trailing the headline benchmarks. The category delivered an average return of 3.32 per cent, lower than both the S&P BSE 500 TRI’s 4.27 per cent and the Nifty 50 TRI’s 4.62 per cent. Out of 17 schemes, only five outperformed the BSE 500 TRI, and four beat the Nifty 50 TRI, indicating that outperformance remained selective and concentrated at the top end.

The strongest gains came from healthcare-focussed offerings. InCred Asset Management’s Focused Healthcare Portfolio led the category with a 9.10 per cent return, followed by its Healthcare Portfolio, which posted 7.33 per cent. These two strategies created a wide gap over the rest of the thematic universe. The next tier of performers showed mid-single-digit gains where Invesco’s RISE delivered 5.54 per cent.

Overall, October’s thematic performance reflects a consistent but more subdued showing relative to other equity PMS segments. Gains were broadly positive across strategies, but benchmark outperformance was limited to a small subset of concentrated thematic approaches.

Thematic PMS Category Performance Snapshot:

Thematic PMS strategies delivered 3.32% returns in October 2025, falling short of broader market gains. Both the BSE 500 TRI (4.27%) and Nifty 50 TRI (4.62%) outperformed the category during the month.

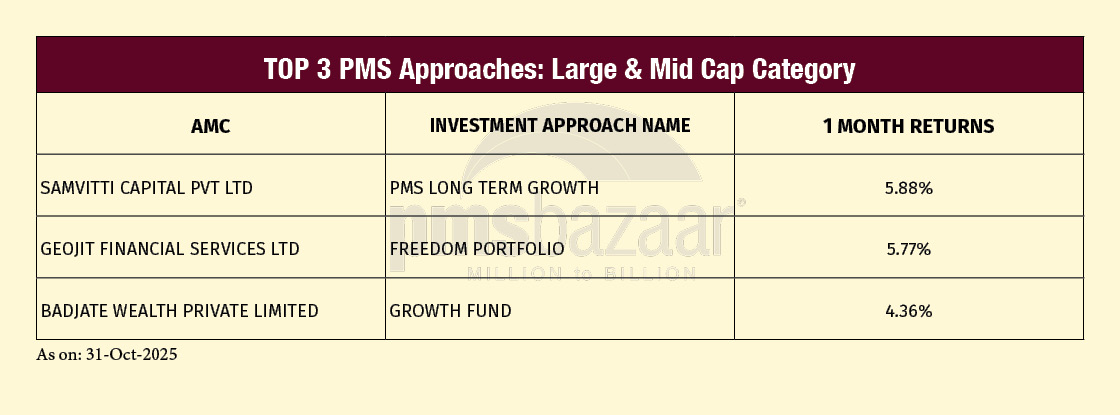

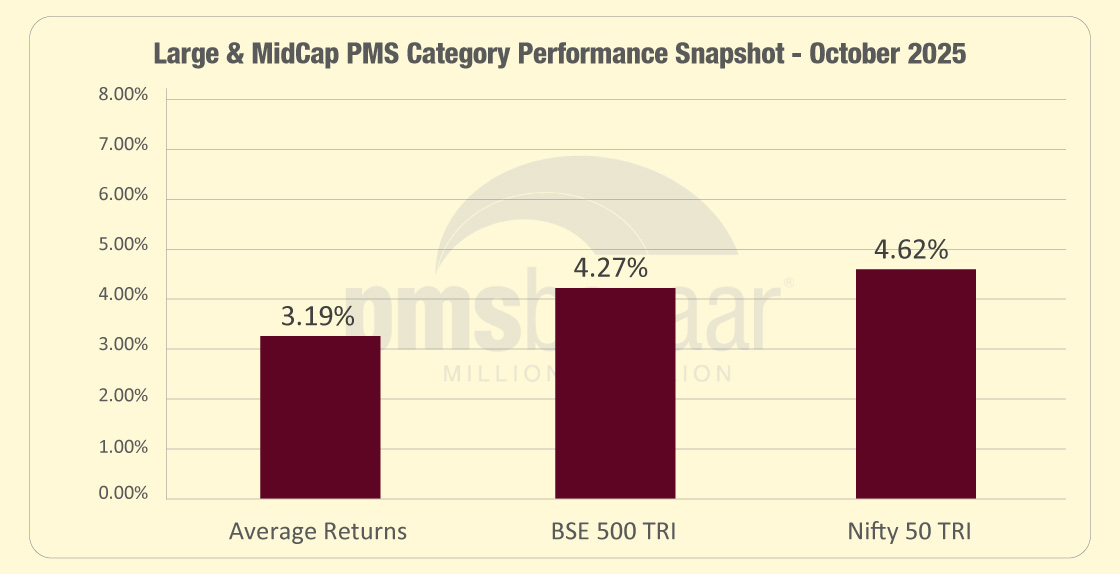

Large & Midcap PMSes post modest gains; only a few outperform benchmarks

Large & Midcap PMS strategies delivered modest results in October 2025, participating in the broader uptrend but lagging headline indices. The category recorded an average return of 3.19 per cent, below the S&P BSE 500 TRI’s 4.27 per cent and the Nifty 50 TRI’s 4.62 per cent. Out of 21 schemes, only three outperformed the BSE 500 TRI, while two exceeded the Nifty 50 TRI, reflecting limited benchmark-beating performance across the segment.

Leading the category, Samvitti Capital’s PMS Long Term Growth with a 5.88 per cent return emerged as the clear outperformer. Close behind, Geojit Financial Services’ Freedom Portfolio, benchmarked to the Nifty 50 TRI, posted 5.77 per cent. These two strategies were the only ones to deliver returns meaningfully higher than both the category average and the broader benchmarks. In third place, Badjate Wealth’s Growth Fund delivered 4.36 per cent.

Overall, October’s results show that while Large & Midcap PMSes posted uniformly positive returns, outperformance relative to indices was limited, and leadership remained concentrated among a small subset of strategies.

Large & Midcap PMS Category Performance Snapshot:

The Large & Mid Cap PMS category delivered 3.19% returns in October 2025, marking a modest performance compared to broader market indices. While it trailed the BSE 500 TRI (4.27%) and Nifty 50 TRI (4.62%), the category remained stable amid shifting market dynamics.

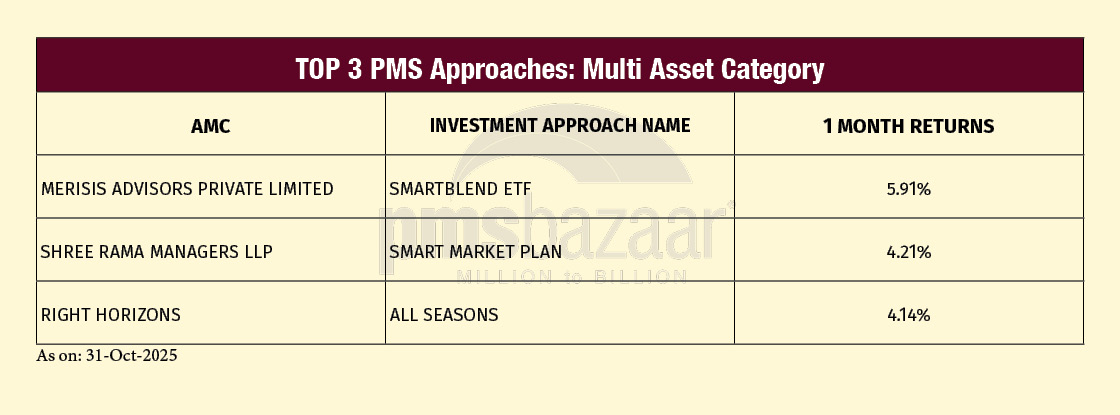

Multi-Asset PMSes deliver stable gains; majority outperform benchmarks

Multi-Asset PMS strategies posted a steady performance in October 2025, benefitting from the broad-based positive month across asset classes. The category recorded an average return of 2.89 per cent, comfortably above the NSE Multi Asset Index 1 (2.55 per cent) and Index 2 (2.58 per cent). Out of 24 schemes, 15 outperformed Index 1 and 14 outperformed Index 2, indicating stronger benchmark-beating consistency compared with several equity-focussed PMS categories.

At the top of the chart, Merisis Advisors’ Smartblend ETF led with a 5.91 per cent return, setting a wide margin over peers. Shree Rama Managers’ Smart Market Plan, benchmarked to the Nifty 50 TRI, followed with 4.21 per cent, while Right Horizons’ All Seasons delivered 4.14 per cent, ranking third for the month.

Overall, Multi-Asset PMSes maintained a balanced performance profile in October. Despite moderate average returns, the segment showed broad participation and a healthy share of benchmark outperformance. This underscores its role as a diversified, low-volatility complement to pure equity PMS categories.

Multi-Asset PMS Category Performance Snapshot:

The Multi Asset PMS category delivered 2.89% returns in October 2025, outperforming both key benchmarks. With NSE Multi Asset Index 1 at 2.55% and Index 2 at 2.58%, the category showcased superior diversified asset allocation performance.

Outlook for November-2025

The domestic backdrop heading into November appears progressively favourable for long-term investors. Policy continuity remains a defining anchor, and the government’s push on structural reforms, particularly in taxation, digital governance, and infrastructure, continues to filter through to sectoral confidence. The renewed conversation around GST rationalisation and the visible acceleration in capital expenditure both point to a growth cycle that still has room to run.

For PMS investors, this environment favours staying disciplined rather than tactical. Broader market breadth, improving earnings clarity for FY26, and reasonably steady macro indicators are helping rebuild conviction across equity segments. Managers who combine participation in the ongoing recovery with a clear risk framework remain well placed, especially as dispersion across styles and market caps is likely to persist.

Global variables such as geopolitics, commodity swings, and central-bank signalling, remain a consistent source of noise, but India’s relative resilience continues to stand out. Stable domestic liquidity, healthy tax collections, and a still-supportive credit cycle offer a counterweight to external uncertainty.

As the breadth of the recovery gradually widens, PMS investors who remain patient, goal-aligned, and diversified are likely to benefit. The combination of reform momentum, improving earnings visibility, and active portfolio construction sets the stage for a more constructive medium-term equity environment through the November–January quarter.

Happy Investing!

Recent Blogs

January Rout, Extreme Dispersion: PMS Returns Swing From Losses to Gains

Benchmark falls deepened losses, but multi-asset and debt cushioned portfolios meaningfully

Investment Frameworks : A Practitioner’s Guide

PMS Bazaar recently organized a webinar titled “Investment Frameworks: A Practitioner’s Guide,” which featured Mr. Sumit Agrawal, Senior Vice President, Nuvama Asset Management Limited. This blog covers the important points shared in this insightful webinar.

Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability

PMS Bazaar recently organized a webinar titled “Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability,” which featured Mr. Sandeep Daga, MD& CIO, Nine Rivers Capital and Mr. Kunal Sabnis, Portfolio Manager, Nine Rivers Capital. This blog covers the important points shared in this insightful webinar.

Flat Markets, Wide Outcomes: How 484 PMS Strategies Performed in Dec 2025

December 2025 was a month where market returns stayed close to flat, with the Nifty 50 TRI at -0.28% and the BSE 500 TRI at -0.24%.

Equity Markets 2026: Outlook, Risks and Strategy

PMS Bazaar recently organized a webinar titled “Equity Markets 2026: Outlook, Risks and Strategy,” which featured Mr. Ashish Chaturmohta, MD & Fund Manager – APEX PMS, JM Financial Limited. This blog covers the important points shared in this insightful webinar.

MICRO CAPS: The Dark Horses of the Indian Equity Market

PMS Bazaar recently organized a webinar titled “MICRO CAPS: The Dark Horses of the Indian Equity Market,” which featured Mr. Rishi Agarwal and Mr. Adheesh Kabra, both Co-Founders and Fund Managers, Aarth AIF. This blog covers the important points shared in this insightful webinar.

Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy

PMS Bazaar recently organized a webinar titled “Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy,” which featured Mr.Anunaya Kumar, President – Sales and Distribution ASK Investment Managers Limited. This blog covers the important points shared in this insightful webinar.

.jpg)

Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS

PMS Bazaar recently organized a webinar titled “Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS,” which featured Mr. Karan Bhatia, Co-Founder and Co-Fund Manager , Pricebridge Honeycomb ETF PMs. This blog covers the important points shared in this insightful webinar.