106 long-only AIFs averaged 3.68% vs 32 long-short AIFs at 2.7%; only 24–31% of funds beat key indices

October 2025 marked the strongest monthly equity performance in seven months, and the Alternative Investment Fund (AIF) landscape reflected this shift with a clear tilt in favour of long-only strategies. The Nifty 50 TRI gained 4.62 per cent and the S&P BSE 500 TRI rose 4.27 per cent, supported by unusually broad sector participation. Midcap and Smallcap indices outperformed the Nifty, aided by the return of foreign institutional inflows after a three-month hiatus. Volatility stayed elevated, but risk appetite strengthened materially.

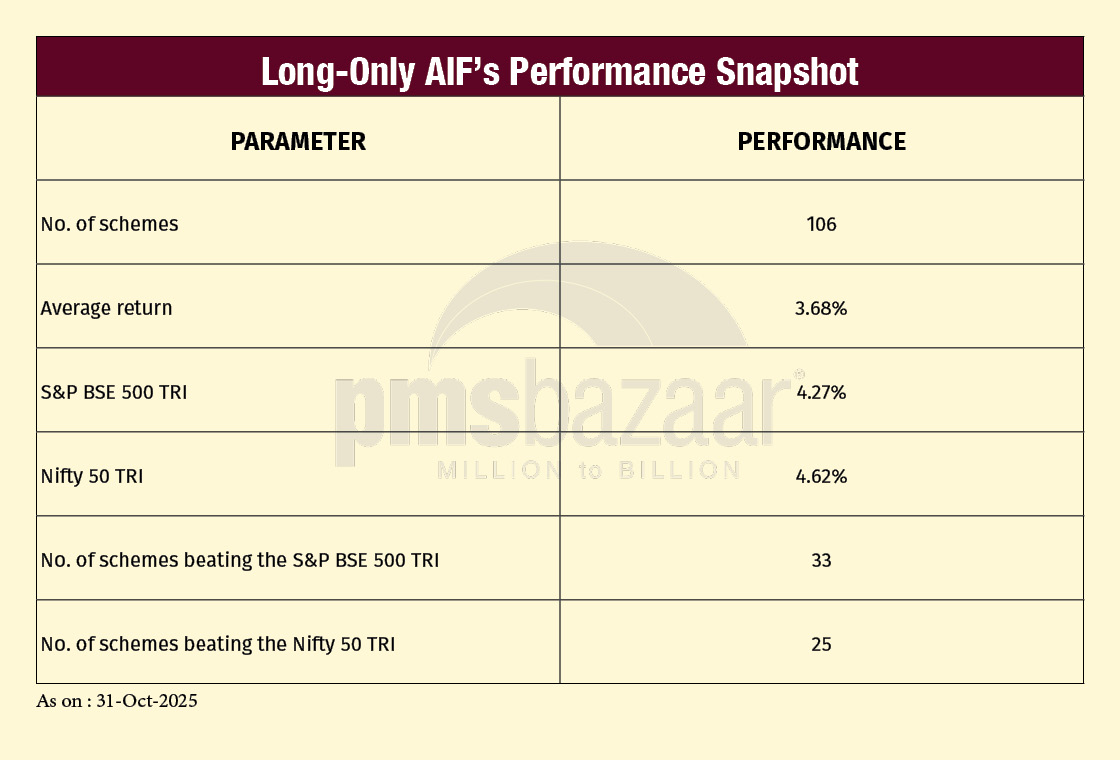

Against this backdrop, 106 long-only AIFs delivered an average return of 3.68 per cent, with a median of 3.41 per cent. Performance dispersion was wide: the top decile averaged 7.71 per cent, while the bottom decile delivered just 0.52 per cent. Benchmark beat-rates remained modest — 25 long-only funds (24 per cent) outperformed the Nifty 50 TRI, and 33 funds (31 per cent) beat the BSE 500 TRI. The segment, however, underperformed the broader market by 59 bps versus the BSE 500 TRI and 94 bps versus the Nifty 50 TRI, underscoring the difficulty of matching beta-driven gains during strong risk-on phases.

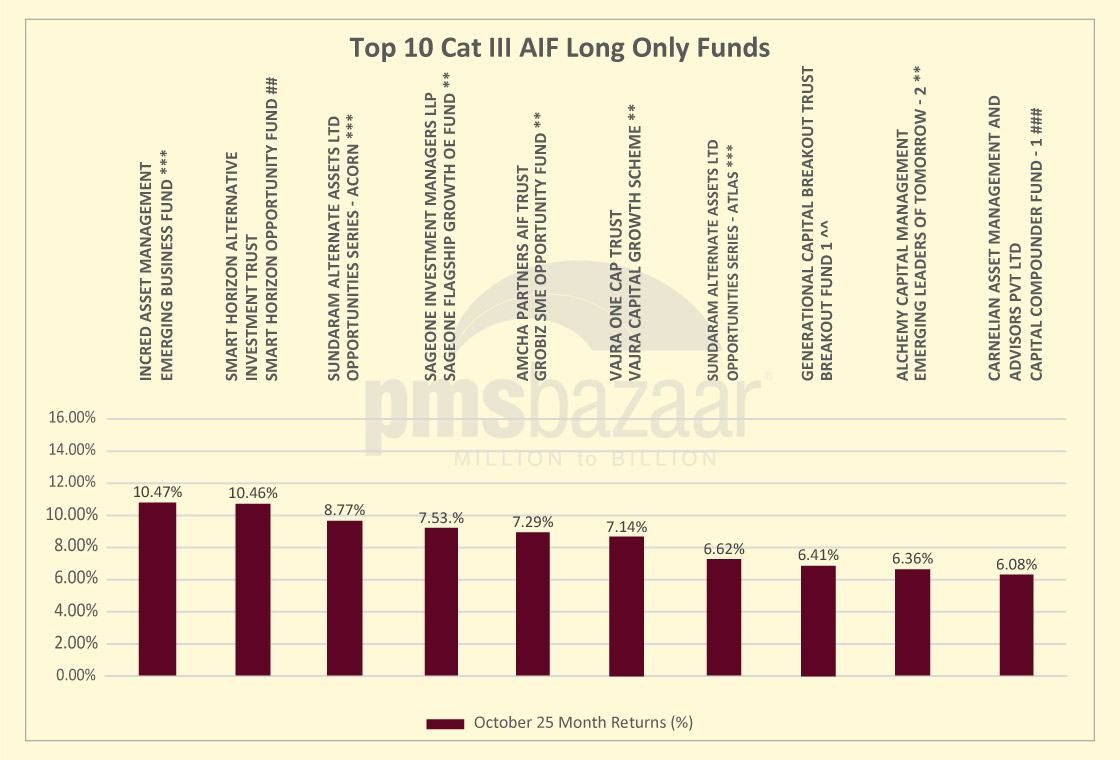

Notably, the category’s upper cohort delivered robust results: InCred’s Emerging Business Fund (10.47 per cent), Smart Horizon Opportunity Fund (10.46 per cent), Sundaram Alternates’ ACORN (8.77 per cent), SageOne Flagship Growth (7.53 per cent) and Grobiz SME Opportunity Fund (7.29 per cent) led the long-only universe.

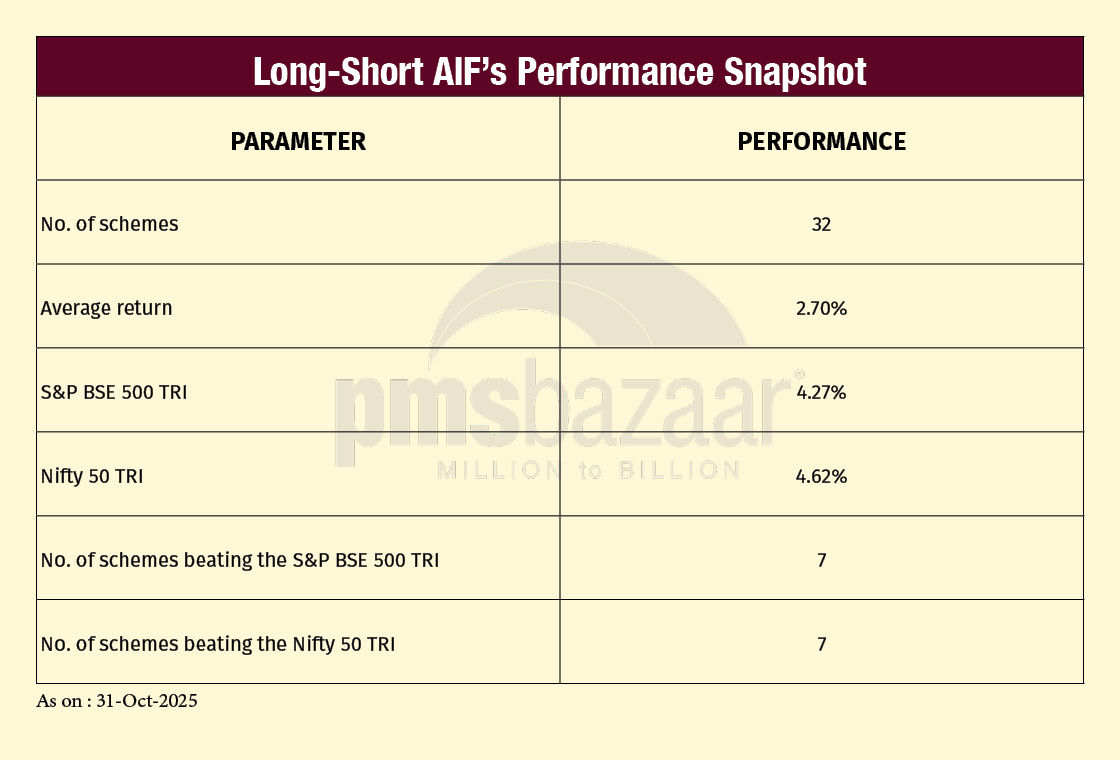

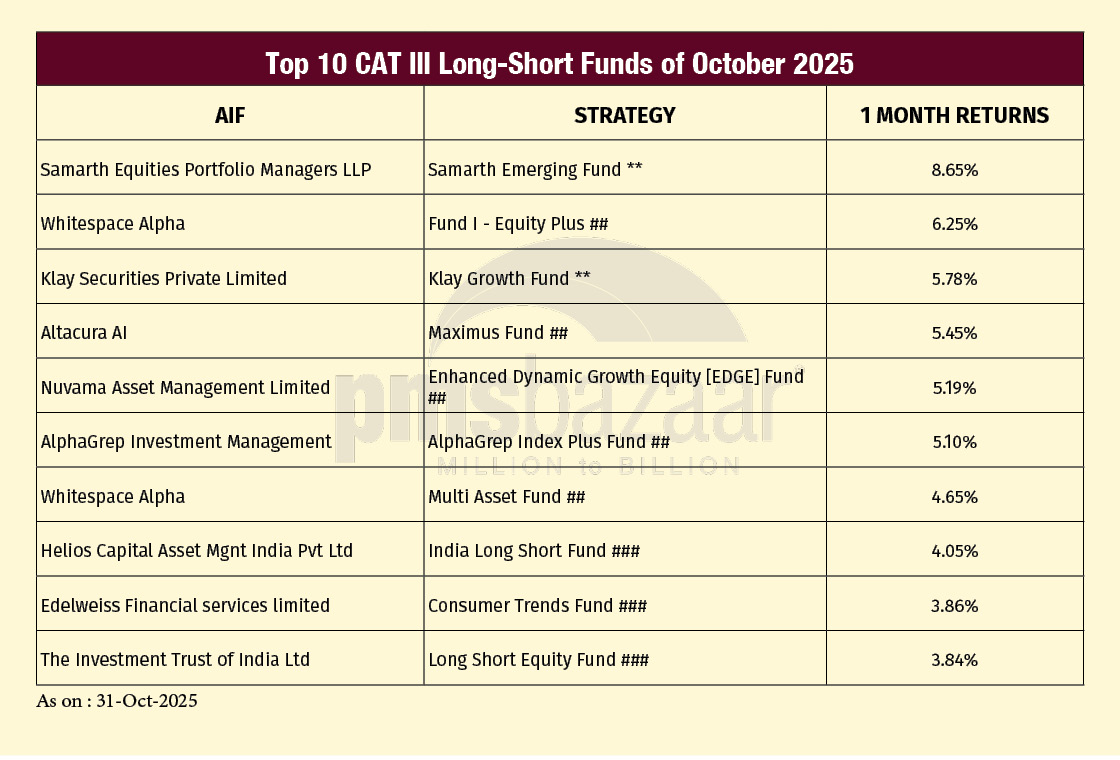

In contrast, 32 long-short AIFs posted an average return of 2.7 per cent, well below both benchmarks and lagging long-only peers by 98 bps. The median return at 2.97 per cent obscured a similar dispersion pattern: the top decile averaged 5.28 per cent, while the bottom decile managed only 0.90 per cent. Just 7 long-short funds (22 per cent) outperformed the Nifty 50 TRI and an identical share beat the BSE 500 TRI, reflecting the inherent trade-off of hedged exposure in a month dominated by directional equity strength.

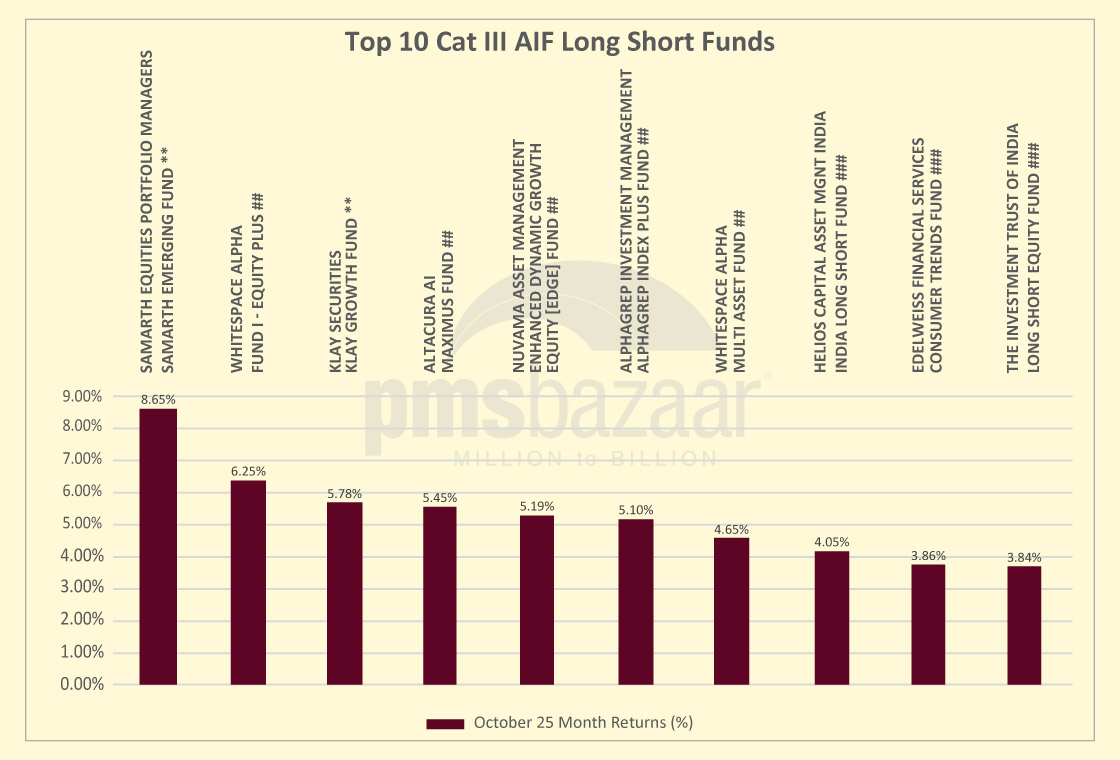

Still, select managers delivered meaningful alpha: Samarth Emerging Fund (8.65 per cent), Whitespace Alpha Equity Plus (6.25 per cent), Klay Growth Fund (5.78 per cent), Altacura AI’s Maximus Fund (5.45 per cent) and Nuvama EDGE (5.19 per cent) outperformed decisively.

October underscored a clear rotation: when markets deliver strong, broad-based upmoves, long-only AIFs tend to capture the upside more fully, while long-short strategies prioritise drawdown control over beta participation.

Long-only Alternative Investment Funds (AIFs) delivered a markedly stronger showing in October 2025, lifted by the sharpest equity-market rebound in seven months. Yet the segment continued to trail the broader benchmarks. Across 106 schemes, long-only AIFs posted an average return of 3.68 per cent, below the S&P BSE 500 TRI’s 4.27 per cent and the Nifty 50 TRI’s 4.62 per cent. The median return of 3.41 per cent underscores a consistent but benchmark-lagging outcome for the category as a whole.

Benchmark outperformance remained selective. Only 25 funds (24 per cent) beat the Nifty 50 TRI, while 33 funds (31 per cent) outpaced the broader BSE 500 TRI. On average, long-only AIFs underperformed the Nifty 50 by 94 basis points and the BSE 500 TRI by 59 basis points, signalling that even in a broad-based up month—where mid-cap and small-cap indices outperformed—most managers struggled to capture the full beta of the rally.

Dispersion across the universe was wide. The top-decile average return of 7.71 per cent contrasted sharply with the bottom-decile average of 0.52 per cent, reflecting the outsized impact of stock selection and portfolio concentration. Strategies with higher exposure to small- and mid-cap segments, and those with thematic or high-conviction frameworks, dominated the performance charts.

At the top end, InCred Asset Management’s Emerging Business Fund delivered the strongest long-only performance, returning 10.47 per cent. The strategy’s tilt toward emerging mid-cap compounders and scalable business models aligned well with October’s market environment, where mid-cap indices outpaced large caps. Close behind was Smart Horizon Opportunity Fund at 10.46 per cent.

Sundaram Alternates’ Opportunities Series – ACORN followed with an 8.77 per cent gain. Its multi-cap flexibility and focus on earnings momentum aided its ability to participate meaningfully in the month’s broad market advance. SageOne Flagship Growth, a small- and mid-cap strategy known for its high-growth bias, posted a strong 7.53 per cent. Amcha Partners’ Grobiz SME Opportunity Fund delivered 7.29 per cent, reinforcing the advantage enjoyed by niche small-cap and SME-oriented portfolios during the October rebound.

The mid-tier of outperformers included Vajra Capital Growth Scheme (7.14 per cent) and Sundaram Alternates’ Opportunities Series – Atlas (6.62 per cent), both benefitting from diversified exposure across mid- and large-cap leaders. Rounding off the top ten were Generational Capital’s Breakout Fund 1 (6.41 per cent), Alchemy Capital’s Emerging Leaders of Tomorrow – 2 (6.36 per cent), and Carnelian Capital Compounder Fund – 1 (6.08 per cent)—a group that reflects a mix of growth, quality-compounder, and momentum-driven frameworks.

Note: *** Post Exp & Tax, ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax, ^^ Post Exp & Tax and Pre Perf.Fees, # Below 1 Year returns are Simple Annualized. All Performance above is as on 31st October 2025.

In effect, October proved far more constructive for long-only AIF investors compared with the previous two months. However, despite improved absolute returns, benchmark-relative performance remained soft.

The divergence between high-conviction, mid- and small-cap biased managers and the rest of the category highlights the continuing importance of style alignment in a market where sector breadth widened but stock-level dispersion remained high. Long-only AIFs may therefore require sustained relative strength through the November–January quarter to decisively close the performance gap with listed benchmarks.

Category III long-short Alternative Investment Funds delivered a steady but somewhat moderated performance in October 2025, navigating a sharply rebounding equity market characterised by elevated volatility and renewed foreign inflows. The category’s average return of 2.7 per cent lagged the headline benchmarks—4.62 per cent for the Nifty 50 TRI and 4.27 per cent for the S&P BSE 500 TRI—but continued to demonstrate the segment’s ability to produce more controlled drawdown profiles and smoother return arcs across turbulent periods.

The month’s backdrop was especially challenging for hedged strategies. A strong, breadth-driven rally saw the Nifty Midcap 100 and Nifty Smallcap 100 decisively outperform large caps, propelled by Real Estate (+9 per cent), PSU Banks (+9 per cent), Telecom (+7 per cent) and Infrastructure and Technology (+6 per cent). With equities posting their best month-on-month returns in seven months, short positions became a drag across several portfolios, while net-exposure caps limited upside capture. These dynamics are reflected in the benchmark-relative outcomes: only 7 of 32 funds (22 per cent) managed to beat either the Nifty 50 TRI or the BSE 500 TRI.

Yet the headline averages mask meaningful dispersion. The median long-short return of 2.97 per cent was slightly above the mean, while the spread between the top and bottom deciles remained wide. The top 10 funds averaged 5.28 per cent, supported by tactical allocation, disciplined gross exposure management and selective participation in mid- and small-cap trends. By contrast, the bottom decile averaged just 0.90 per cent, reflecting the amplified drag short books experience during strong upside phases.

At the top of the leaderboard, Samarth Equities’ Samarth Emerging Fund delivered an impressive 8.65 per cent, the highest among all long-short AIFs. The fund has historically blended concentrated long positions in earnings-compounders with opportunistic shorting frameworks. Such approaches allow protection of capital in volatile periods while participating meaningfully in broad recoveries.

Whitespace Alpha’s Fund I – Equity Plus, a more conservative long-short strategy, recorded a strong 6.25 per cent. Such offerings demonstrate that even lower-beta hedged frameworks can perform well when long books are aligned with cyclical leadership. Klay Securities’ Growth Fund followed with 5.78 per cent. Some AIFs were supported by exposure to domestic cyclicals and high-beta segments that outperformed during the month.

Systematic and alternative-signal approaches also featured prominently. Altacura AI’s Maximus Fund delivered 5.45 per cent, while Nuvama’s EDGE Fund posted 5.19 per cent, highlighting the increasing relevance of quant-driven models in navigating high-volatility, trend-reversal environments. AlphaGrep’s Index Plus Fund (5.10 per cent) and Whitespace Alpha’s Multi Asset Fund (4.65 per cent) rounded off a strong top cluster.

Further down the list, strategies such as Helios Capital’s India Long Short Fund (4.05 per cent), Edelweiss’ Consumer Trends Fund (3.86 per cent) and ITI’s Long Short Equity Fund (3.84 per cent) posted healthy, outcomes. This reflects the category’s ability to absorb market swings even when long-only portfolios outperform more visibly.

Note: *** Post Exp & Tax, ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax, ^^ Post Exp & Tax and Pre Perf.Fees, # Below 1 Year returns are Simple Annualized. All Performance above is as on 31st October 2025.

On a relative basis, long-short AIFs underperformed long-only AIFs by 98 basis points in October, which is a reversal of September’s dynamic. However, this underperformance aligns with expectations for hedged strategies in months dominated by strong beta and sectoral breadth. Despite this, long-short funds continue to provide valuable risk-adjusted stability: lower drawdowns, reduced volatility and more consistent return pathways across cycles.

As a matter of fact, October reaffirmed a familiar pattern: in sharp up-months, long-short AIFs sacrifice some upside, but their disciplined exposure frameworks, tactical hedging and ability to reduce tail risks keep them central to diversified, high-ticket portfolios.

Outlook for November 2025

The investment landscape heading into November continues to strengthen, supported by a macro environment that is gradually aligning in favour of long-term allocators. Policy continuity remains a steady anchor, and the government’s emphasis on execution—rather than just announcement—across taxation reform, infrastructure build-out, and digital public infrastructure is beginning to feed through to sectoral earnings expectations. Early signals from GST rationalisation discussions and the ongoing acceleration in capital expenditure underscore a growth cycle that retains momentum.

For AIF investors, this phase argues for staying invested rather than trading the news cycle. Market breadth has improved meaningfully over the past two months, mid- and small-cap earnings revisions are turning incrementally positive, and domestic liquidity remains supportive. Together, these trends are creating a more stable backdrop for active strategies, especially those with differentiated stock selection and disciplined risk frameworks.

While global variables—from commodity swings to policy divergences among major central banks—continue to inject short-term volatility, India’s relative insulation stands out. Tax collections remain buoyant, credit growth is steady, and corporate balance sheets are entering FY26 with healthier leverage and improved cash flows. These elements provide a counterweight to external uncertainty and help sustain investor confidence.

The coming months will likely be characterised by moderate but broadening recovery rather than sharp, index-led moves. For investors, the priorities remain unchanged: patience, participation, and alignment with managers capable of navigating dispersion. Bottom-up research, sector rotation discipline, and a willingness to hold through temporary dislocations may offer disproportionate benefits as the year-end earnings season approaches.

In this environment, long-term investors are better served by consistency than by tactical shifts. The foundations of the next phase of wealth creation—stronger earnings visibility, improving policy execution, and deepening domestic participation—are steadily falling into place. November may therefore act less as a turning point and more as a continuation of a market that is rebuilding conviction one layer at a time.

Disclaimer: This Blog is made for informational purposes only and does not constitute an offer, solicitation, or an invitation to the public in general to invest in any of the Funds mentioned. All the Returns mentioned in this blog are provided by the respective asset management companies and may vary based on their reporting structure (Pre-tax, Post-tax, Post-expenses, etc.). PMS Bazaar has taken due care and caution in the compilation of data and information. However, PMS Bazaar doesn’t guarantee the accuracy, adequacy, or completeness of any information. Investors must read the detailed Private Placement Memorandum (PPM), including the risk factors, and consult your Financial Advisor before making any investment decision/contribution to AIF. This Blog has been prepared for general guidance, and no person should act upon any information contained in the document. PMS Bazaar, its affiliates, and their office, directors, and employees shall not be responsible or liable for any investment action initiated. This Blog is intended only for the personal use to which it is addressed and not for distribution.

Recent Blogs

January Rout, Extreme Dispersion: PMS Returns Swing From Losses to Gains

Benchmark falls deepened losses, but multi-asset and debt cushioned portfolios meaningfully

Investment Frameworks : A Practitioner’s Guide

PMS Bazaar recently organized a webinar titled “Investment Frameworks: A Practitioner’s Guide,” which featured Mr. Sumit Agrawal, Senior Vice President, Nuvama Asset Management Limited. This blog covers the important points shared in this insightful webinar.

Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability

PMS Bazaar recently organized a webinar titled “Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability,” which featured Mr. Sandeep Daga, MD& CIO, Nine Rivers Capital and Mr. Kunal Sabnis, Portfolio Manager, Nine Rivers Capital. This blog covers the important points shared in this insightful webinar.

Flat Markets, Wide Outcomes: How 484 PMS Strategies Performed in Dec 2025

December 2025 was a month where market returns stayed close to flat, with the Nifty 50 TRI at -0.28% and the BSE 500 TRI at -0.24%.

Equity Markets 2026: Outlook, Risks and Strategy

PMS Bazaar recently organized a webinar titled “Equity Markets 2026: Outlook, Risks and Strategy,” which featured Mr. Ashish Chaturmohta, MD & Fund Manager – APEX PMS, JM Financial Limited. This blog covers the important points shared in this insightful webinar.

MICRO CAPS: The Dark Horses of the Indian Equity Market

PMS Bazaar recently organized a webinar titled “MICRO CAPS: The Dark Horses of the Indian Equity Market,” which featured Mr. Rishi Agarwal and Mr. Adheesh Kabra, both Co-Founders and Fund Managers, Aarth AIF. This blog covers the important points shared in this insightful webinar.

Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy

PMS Bazaar recently organized a webinar titled “Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy,” which featured Mr.Anunaya Kumar, President – Sales and Distribution ASK Investment Managers Limited. This blog covers the important points shared in this insightful webinar.

.jpg)

Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS

PMS Bazaar recently organized a webinar titled “Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS,” which featured Mr. Karan Bhatia, Co-Founder and Co-Fund Manager , Pricebridge Honeycomb ETF PMs. This blog covers the important points shared in this insightful webinar.