104 long-only funds shows an average monthly gain of just 0.37 per cent, while long-short AIF category averaged 0.94 per cent

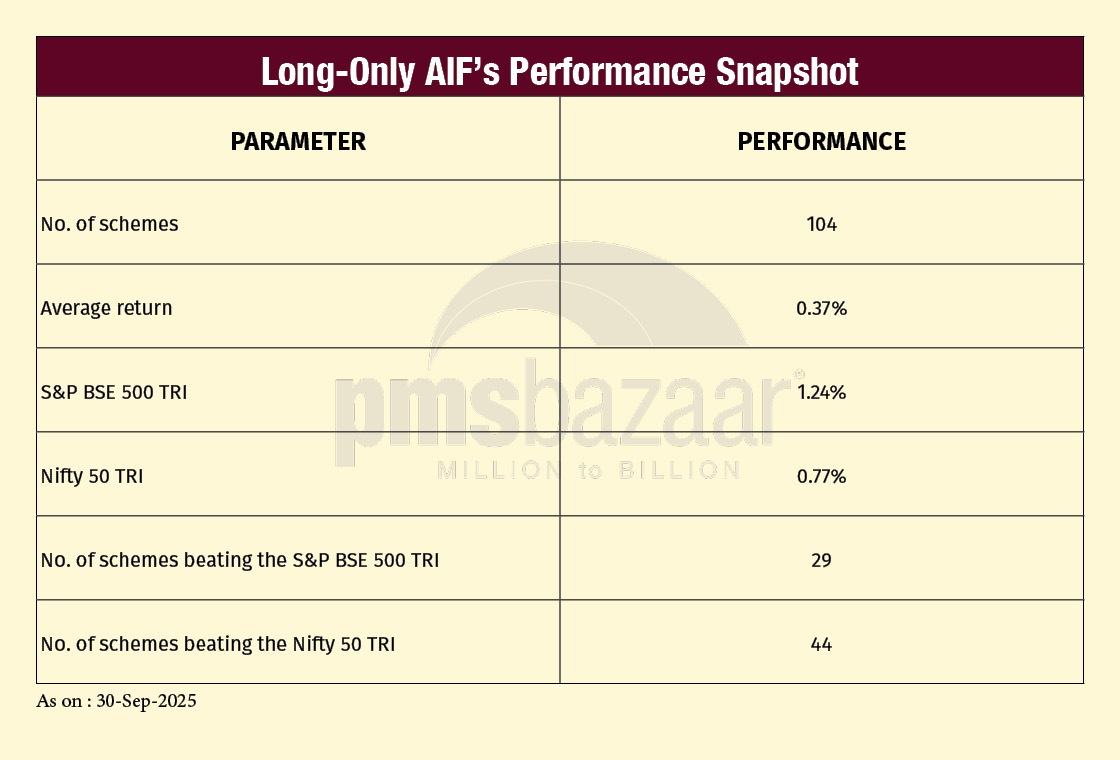

Alternative Investment Funds (AIFs) posted a mixed but improved performance in September 2025, as equity markets broke a two-month losing streak. After consecutive declines in July and August, the Nifty 50 TRI rose 0.77 percent, while the broader S&P BSE 500 TRI gained 1.24 percent. The upturn was supported by broad-based gains across most sectors. PSU Banks led the chart, followed by Metals, Automobiles, and Utilities even as Technology, Media, Consumer, and Healthcare slipped.

Within this backdrop, long-only AIFs lagged, while long-short strategies again offered better risk-adjusted results. Data from 104 long-only funds shows an average monthly gain of just 0.37 percent, trailing both the S&P BSE 500 TRI (1.24 percent) and Nifty 50 TRI (0.77 percent). Only 29 funds (about 28 percent) beat the broader index, and 44 (roughly 42 percent) outperformed the large-cap benchmark. The long-only segment’s median underperformance versus BSE 500 TRI of around 0.9 percentage point underscores the difficulty many managers faced in capturing the broader rebound.

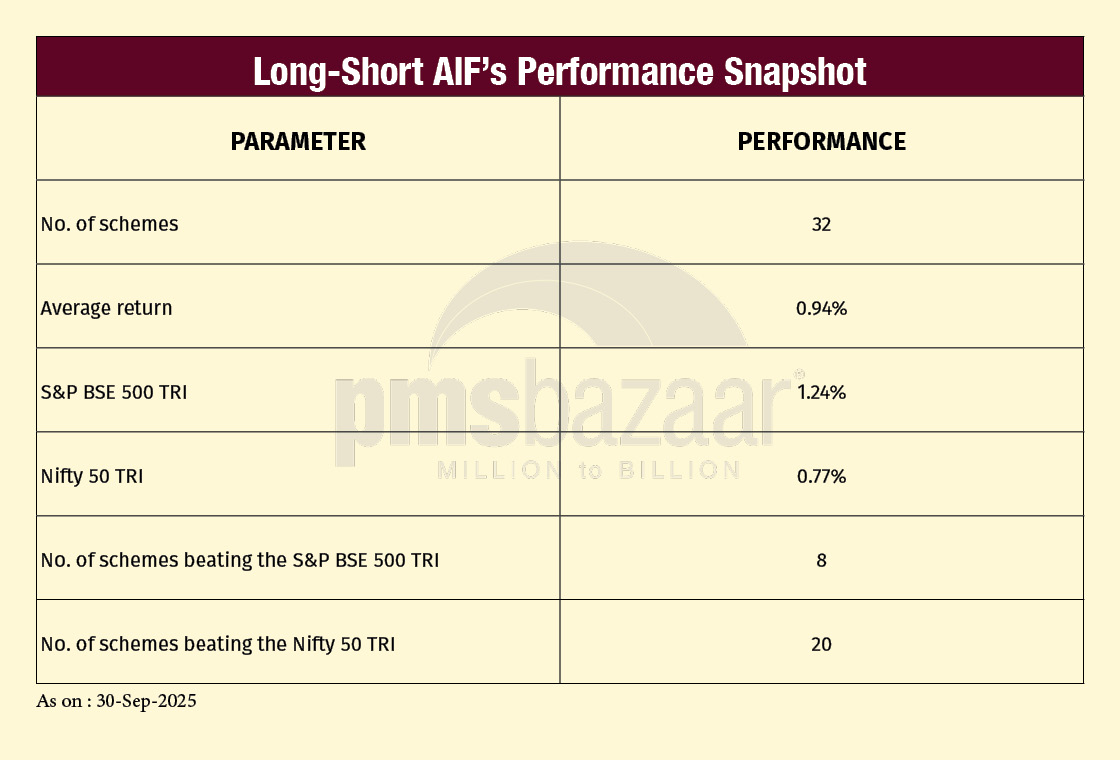

Long-short AIFs delivered a sharper comeback. Across 32 funds, the category averaged 0.94 percent, nearly 60 basis points above the long-only peer set and just 30 basis points short of the S&P BSE 500 TRI. Despite the modest absolute returns, relative performance was strong i.e. one in four funds (25 percent) beat the broad market, and over 60 percent outperformed the Nifty 50 TRI. The data suggest that tactical hedging and balanced exposures helped these strategies navigate volatility more efficiently.

September thus marked a month of healing for AIF investors, with benchmarks recovering moderately, and multi-strategy and hedged funds continuing to show their worth in preserving returns amid uneven market conditions.

Tactical Bets Lift Long-Short AIFs

Long-short AIFs are Category III Alternative Investment Funds that take both long positions (buying stocks expected to rise) and short positions (selling borrowed stocks expected to fall). This dual approach helps generate returns in rising or falling markets, aiming to reduce volatility and deliver superior risk-adjusted performance versus long-only equity strategies.

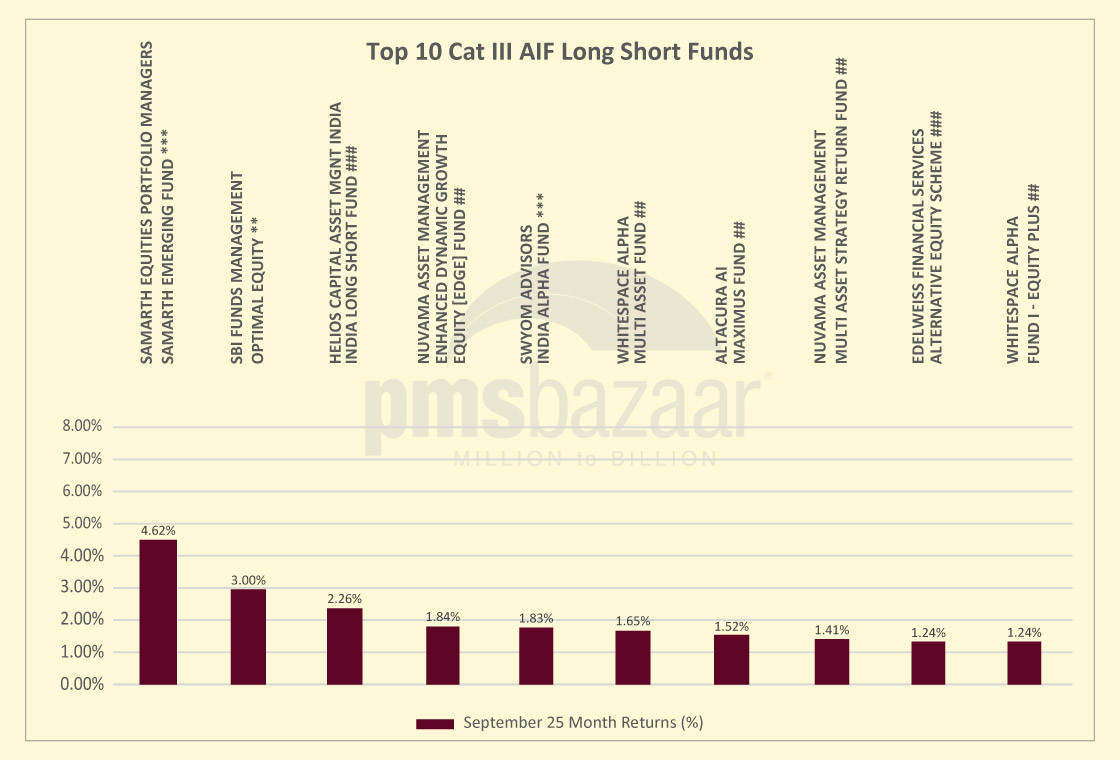

Long-short Alternative Investment Funds (AIFs) built on their relative strength in September 2025, outperforming long-only peers even as markets staged a moderate rebound. The 32 funds in this category posted an average return of 0.94 per cent, compared with 1.24 percent for the S&P BSE 500 TRI and 0.77 percent for the Nifty 50 TRI. While only eight funds (25 percent) beat the broad market index, 20 funds (about 63 percent) outperformed the large-cap benchmark. The results reinforce the value of hedged strategies in maintaining consistent returns during uneven market recoveries.

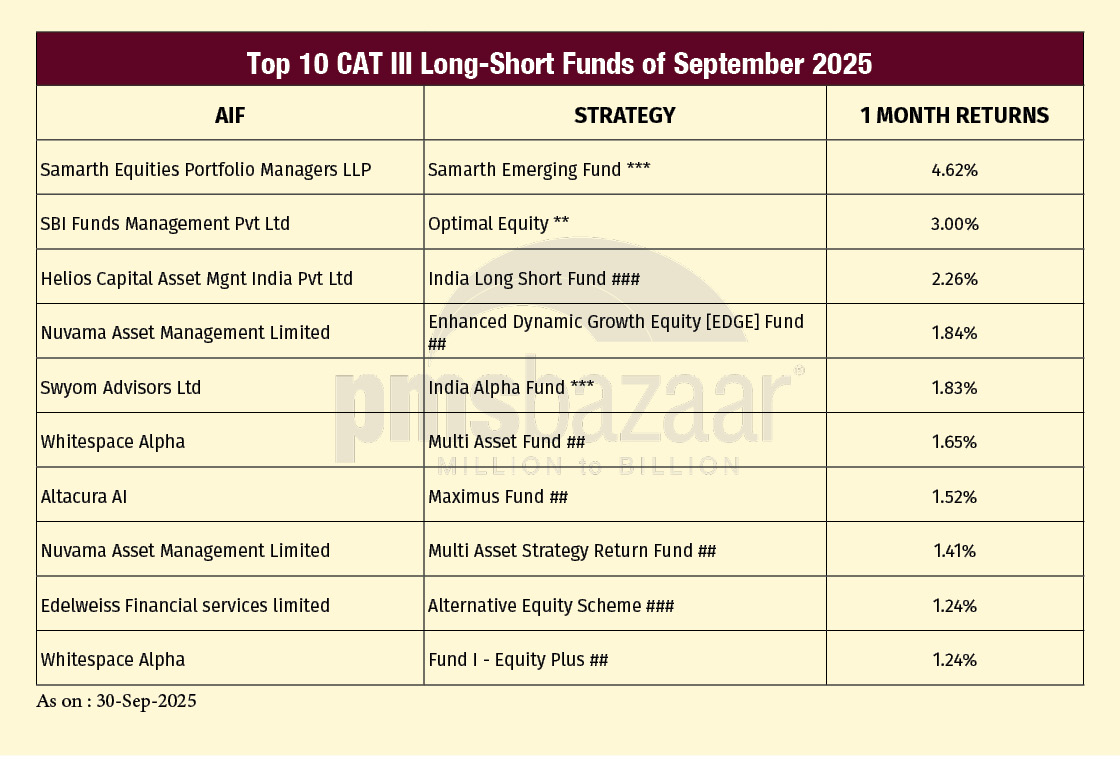

The top performers stood out for their strong positive alpha. Samarth Equities Portfolio Managers’ Samarth Emerging Fund led the pack with a 4.62 percent gain, far ahead of benchmarks and peers. It blends fundamental investing with tactical trading. Its style centres on high-conviction compounders on the long side and event-based short positions to enhance alpha. The fund typically maintains 8–18 long holdings and 5–15 short exposures, with a net exposure range of –15% to 100%. Positioned as an open-ended, actively managed strategy, it leverages proprietary models, sector concentration, and disciplined hedging to deliver steady, risk-adjusted returns over a three-year horizon

SBI Funds Management’s Optimal Equity Fund followed with 3.00 percent, while Helios Capital’s India Long Short Fund added 2.26 percent. These funds benefited from tactical positioning in mid- and large-cap segments and selective sector exposures that captured upside while managing risk. SBI Optimal Equity Fund’s portfolio net allocation to equities is determined by an asset allocation framework, with the long only strategy of the equity being a concentrated portfolio investing in high conviction ideas. Its derivatives strategy is used to manage fund with lower volatility. Portfolio is thus a combination of Cash Equities and Equity derivatives in a way that the net equity exposure is equal to the asset allocation determined by the framework.

Other notable gainers included Nuvama’s Enhanced Dynamic Growth Equity [EDGE] Fund (1.84 percent), Swyom Advisors’ India Alpha Fund (1.83 percent), and Whitespace Alpha’s Multi Asset Fund (1.65 percent).

Systematic and AI-driven strategies such as Altacura AI’s Maximus Fund (1.52 percent) and Nuvama’s Multi Asset Strategy Return Fund (1.41 percent) also contributed. Rounding off the top 10 were Edelweiss Financial Services’ Alternative Equity Scheme and Whitespace Alpha’s Fund I – Equity Plus, both returning 1.24 percent.

Note: *** Post Exp & Tax, ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax, ^^ Post Exp & Tax and Pre Perf.Fees, # Below 1 Year returns are Simple Annualized. All Performance above are as on 30th September 2025.

Long-Only AIFs Lag Broader Market

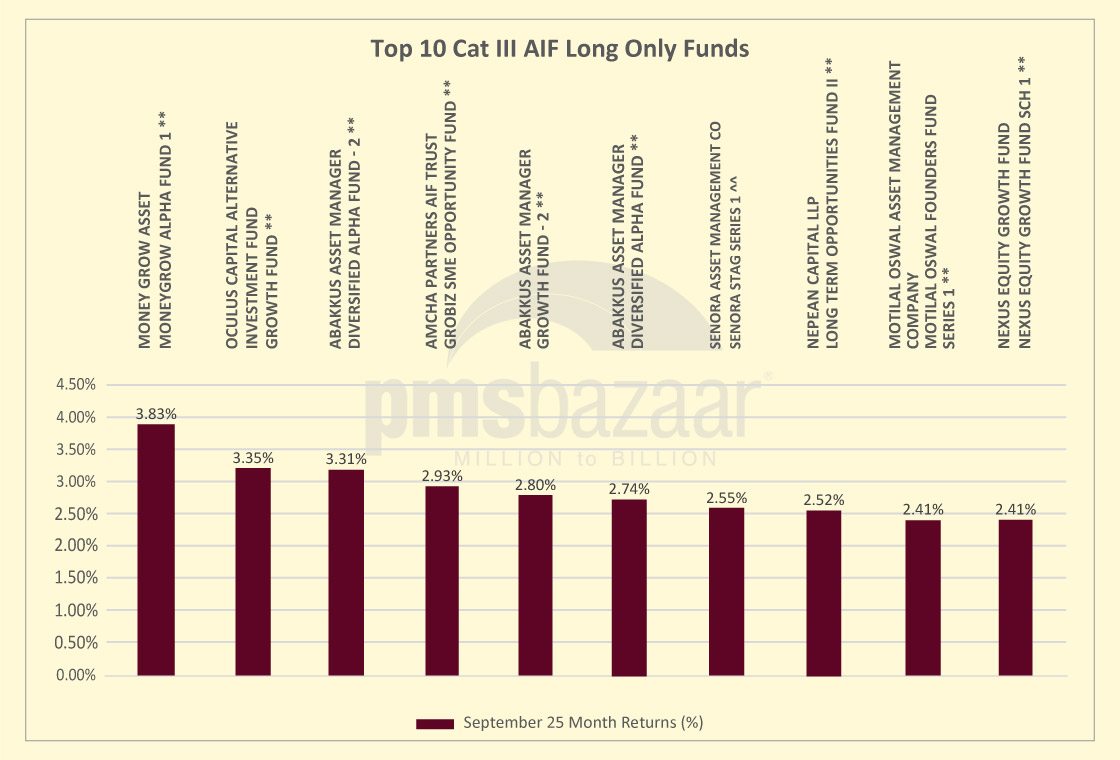

Long-only Alternative Investment Funds (AIFs) underperformed the broader equity indices in September 2025, extending their recent streak of muted returns. Across 104 schemes, the segment delivered an average monthly gain of 0.37 percent, falling short of both the S&P BSE 500 TRI (1.24 percent) and the Nifty 50 TRI (0.77 percent).

Only 29 long-only funds (28 percent) managed to beat the broader market index, and 44 funds (42 percent) outperformed the large-cap benchmark.

The data shows that while a handful of managers benefited from sharp rallies in select mid- and small-cap pockets, the majority struggled to match benchmark momentum. Stock-specific dispersion remained high, favouring concentrated and thematic portfolios over diversified, large-cap-heavy approaches.

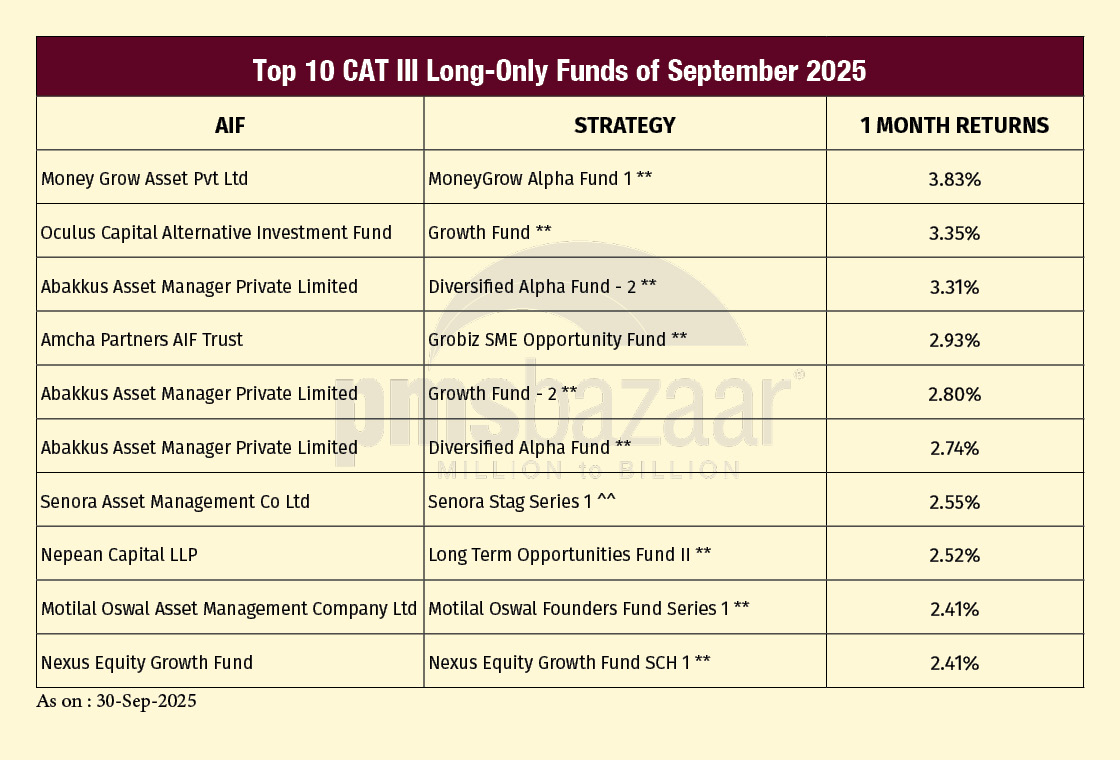

Among top performers, MoneyGrow Asset’s Alpha Fund 1 led the category with a robust 3.83 percent return. It follows a long-only equity strategy aimed at long-term capital appreciation through dynamic allocation across large-, mid-, and small-cap stocks. The fund combines stability from large caps, growth from mid-caps, and alpha from emerging small caps, occasionally allocating to REITs and commodity-linked firms for diversification. Using a bottom-up approach, it targets businesses with strong governance, attractive valuations, and high EPS growth, while tactically shifting sector weights to capture special situations and emerging themes for sustained alpha generation.

It is followed by Oculus Capital’s Growth Fund (3.35 percent) and Abakkus Asset Manager’s Diversified Alpha Fund – 2 (3.31 percent). Oculus’ strategy is grounded in disciplined screening, evaluation, and risk management. Guided by the principles of Chanakyaniti, it blends top-down and bottom-up analysis to identify quality businesses with strong governance, high ROE/ROCE, and sustainable growth potential. The fund dynamically allocates capital across sectors and market caps, focussing on risk-adjusted returns and capital preservation through business cycles.

On the other hand, Abakkus Diversified Alpha Fund – 2 adopts a strategy of stringent stock selection process using unique 40:30:20:10 approach to portfolio construction to capture opportunities across market capitalization. The Fund shall track key sectors that continue to grow at a consistent pace and demonstrate long term return potential. The Fund shall be focused through a collection of core equity holdings and shall seek diversification across various sectors. The Fund endeavours to generate alpha via exposure to mid, small and micro caps and lower the volatility through large cap and larger mid cap exposure. The Fund maintains risk discipline and liquidity management by way of position sizing as smaller capitalization companies have incrementally smaller weights.

Amcha Partners’ Grobiz SME Opportunity Fund and Abakkus Growth Fund – 2 also featured prominently, posting 2.93 percent and 2.80 percent gains respectively. Other notable outperformers included Abakkus Diversified Alpha Fund (2.74 percent), Senora Stag Series 1 (2.55 percent), Nepean Long Term Opportunities Fund II (2.52 percent), and Motilal Oswal Founders Fund Series 1 (2.41 percent). Nexus Equity Growth Fund – Scheme 1 rounded off the top 10 with 2.41 percent.

Note: *** Post Exp & Tax, ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax, ^^ Post Exp & Tax and Pre Perf.Fees, # Below 1 Year returns are Simple Annualized. All Performance above are as on 30th September 2025.

Outlook for October 2025

India’s macro setting appears increasingly favourable for investors willing to look beyond short-term noise. The continuation of reform-oriented policies, an emphasis on capital expenditure, and ample domestic liquidity are creating fertile conditions for sustained growth. With GST simplification, infrastructure momentum, and manufacturing incentives gathering pace, the economic recovery is broadening beyond a few sectors.

For portfolio managers and investors alike, this phase rewards conviction and discipline. The interplay of improving earnings visibility, better market breadth, and steady domestic demand points to a healthier investment climate. Active managers who combine bottom-up research with prudent portfolio construction are positioned to capture the evolving opportunity set.

Despite global uncertainties, ranging from rate volatility to geopolitical risks, India’s underlying fundamentals remain resilient. Fiscal prudence and central bank stability continue to anchor confidence, offering a rare blend of growth and stability in the emerging-market universe. For long-term investors, patience may prove to be the most valuable differentiator. Those who stay invested through the current consolidation stand to benefit as corporate balance sheets strengthen, private capex revives, and consumption trends normalise.

As confidence rebuilds, the argument for staying invested in quality managers becomes stronger. This is not a market that rewards haste; it rewards persistence, selectivity, and a willingness to participate through cycles. The groundwork for the next leg of wealth creation appears to be quietly taking shape beneath the surface, making this a time to observe less—and endure more.

Recent Blogs

January Rout, Extreme Dispersion: PMS Returns Swing From Losses to Gains

Benchmark falls deepened losses, but multi-asset and debt cushioned portfolios meaningfully

Investment Frameworks : A Practitioner’s Guide

PMS Bazaar recently organized a webinar titled “Investment Frameworks: A Practitioner’s Guide,” which featured Mr. Sumit Agrawal, Senior Vice President, Nuvama Asset Management Limited. This blog covers the important points shared in this insightful webinar.

Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability

PMS Bazaar recently organized a webinar titled “Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability,” which featured Mr. Sandeep Daga, MD& CIO, Nine Rivers Capital and Mr. Kunal Sabnis, Portfolio Manager, Nine Rivers Capital. This blog covers the important points shared in this insightful webinar.

Flat Markets, Wide Outcomes: How 484 PMS Strategies Performed in Dec 2025

December 2025 was a month where market returns stayed close to flat, with the Nifty 50 TRI at -0.28% and the BSE 500 TRI at -0.24%.

Equity Markets 2026: Outlook, Risks and Strategy

PMS Bazaar recently organized a webinar titled “Equity Markets 2026: Outlook, Risks and Strategy,” which featured Mr. Ashish Chaturmohta, MD & Fund Manager – APEX PMS, JM Financial Limited. This blog covers the important points shared in this insightful webinar.

MICRO CAPS: The Dark Horses of the Indian Equity Market

PMS Bazaar recently organized a webinar titled “MICRO CAPS: The Dark Horses of the Indian Equity Market,” which featured Mr. Rishi Agarwal and Mr. Adheesh Kabra, both Co-Founders and Fund Managers, Aarth AIF. This blog covers the important points shared in this insightful webinar.

Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy

PMS Bazaar recently organized a webinar titled “Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy,” which featured Mr.Anunaya Kumar, President – Sales and Distribution ASK Investment Managers Limited. This blog covers the important points shared in this insightful webinar.

.jpg)

Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS

PMS Bazaar recently organized a webinar titled “Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS,” which featured Mr. Karan Bhatia, Co-Founder and Co-Fund Manager , Pricebridge Honeycomb ETF PMs. This blog covers the important points shared in this insightful webinar.