Equity markets continued their bull run for the third consecutive month in June, and PMS strategies continued to have a good run during the period. Inflation’s downward trajectory and a pause in interest rate action from Central Banks ensured that the markets extended their rally. The Nifty delivered 3.7% during the month, while the broader market BSE 500 did better and recorded a 4.28% return. FIIs remained bullish and bought (net purchase) Rs 27,250 crore in the cash market in June. DIIs also made net purchases during the month, pushing the market higher.

The June month saw 246 of the 325 (or more than 3 in 4) PMS Investment Approaches deliver higher returns than the Nifty TRI. As many as 218 PMSes (more than two in three) outperformed the BSE 500 TRI in June. On average, PMSes gave 5.18% returns in June, much higher than the Nifty and BSE 500. Many styles displayed solid performances during the month.

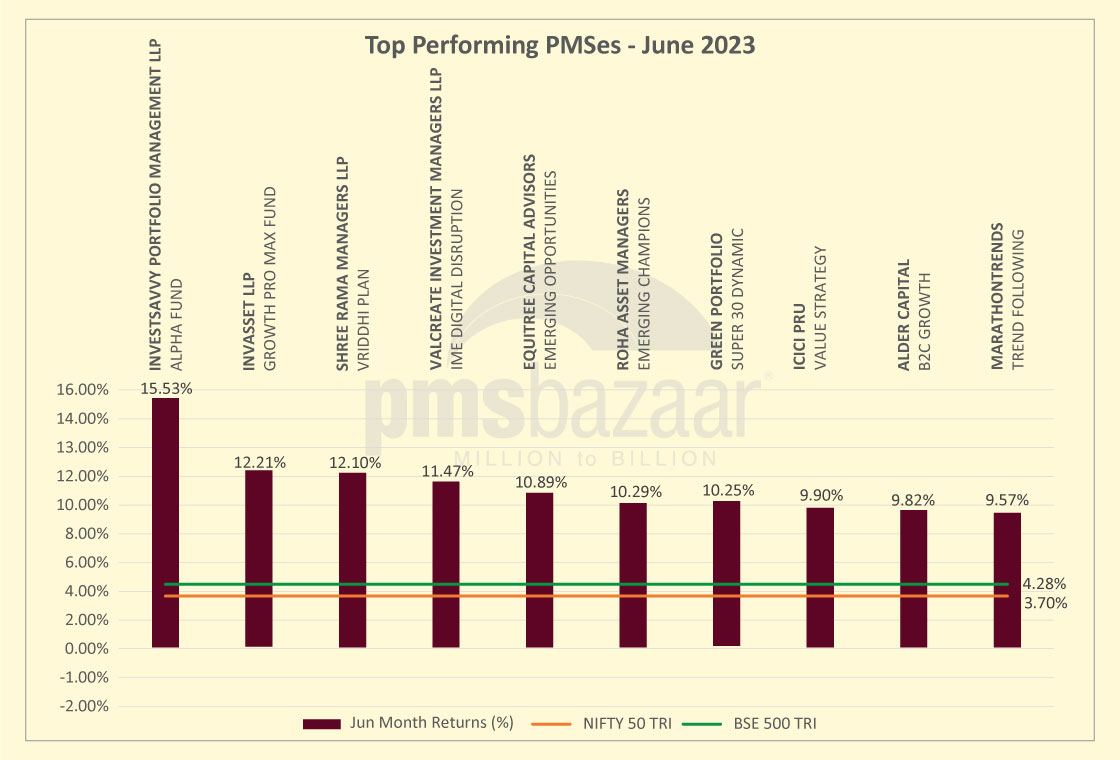

Top 10 PMS Strategies of June 2023

Most of the PMS Investment Approaches in the top 10 delivered double-digit returns, making for a spectacular month. The Multi Cap style dominated the list, though a few other categories also delivered well during June.

The top 10 funds delivered 2x to 3x the returns of the Nifty 50 TRI and BSE 500 TRI.

Investsavvy Portfolio Management’s Alpha Fund, a small cap investment approach, came on top of the pack with a 15.53% return in the month.

Second on the list was the Growth Pro Max Fund of INVASSET LLP. This multi cap investment approach gave a 12.21% return during June. Over two-thirds of the fund’s portfolio is invested in small caps, as they could become potential multi-baggers.

Shree Rama Managers’ Vriddhi Plan was third on the list with- 12.1% returns during the month. The fund invests in a portfolio of 8-12 mid to large-cap stocks.

Get in-depth insights about the remaining entries on the Top-Performing PMSes List of June 2023, and other PMS Investment Approaches you want to explore by subscribing to PMS Bazaar: Subscribe NOW

The performance of the top 10 strategies and their comparison with Nifty and BSE 500 for the month are given below.

Small caps

Continuing their robust run over the previous couple of months, small cap PMS strategies delivered a healthy 6.81% returns during June. Of the 19 Investment Approaches, 16 PMSes delivered more than the BSE 500 TRI. Also, 17 funds beat the Nifty 50 TRI.

The Alpha Fund from Investsavvy Portfolio Management was the chart-topper with 15.53% returns.

Equitree Capital Advisors’ Emerging Opportunities came a distant second with 10.89% returns during the month. This fund invests in under-researched and under-invested small and micro cap stocks and also takes contrarian calls at times.

The Growth Investment Approach from Molecule Ventures was third in the chart, with 8.88% returns in June.

The performance of the category in June with respect to the BSE 500 TRI and Nifty 50 TRI is depicted in the graph below.

Small & Midcaps

The small and midcaps segment had a reasonably sound month with 6.19% returns on average in June.

Roha Asset Managers’ Emerging Champions was the topper in the category, with a strong 10.29% return during the month. The fund invests in mid and small cap companies that are set to benefit from India’s multi-year structural growth theme.

ICICI Pru’s PIPE Strategy, which invests in companies enjoying some economic moat or undergoing special situations, came second with 9.55% returns in the month.

Motilal Oswal’s IPO V2 was third, with 9.41% returns during June.

Midcap

Midcap strategies continued their reasonable showing in June as well, with the category delivering 5.29% on an average during the month. As many as 22 of the 23 strategies beat the Nifty 50 TRI, while 19 outperformed the BSE 500 TRI.

The Focused Midcap Investment Approach of Motilal Oswal was the chart topper, with 9.34% returns during the month. This Investment Approach invests in a concentrated portfolio of 15-20 stocks.

The Smart Beta Portfolio of Abans Inv. Managers came second with 7.82% returns. This Investment Approach uses a combination of fundamental and technical parameters for stock selection, driven by algos.

Third on the list was ACE Midcap Investment Approach from Asit C Mehta Investment Intermediaries, with 7.07% returns in June. This fund invests in 20-25 equal-weighted stocks.

The chart below shows how the midcap PMSes fared against the Nifty 50 TRI and BSE 500 TRI in June.

Large and Midcap

The 14 large and midcap funds delivered 5.06% on average in June.

The large and midcap Investment Approach of Care Portfolio Managers was the best in the category, with 8.34% returns in June. This fund invests in 18-20 stocks from the top 250 companies by market capitalization.

The Alpha fund of Green Lantern Capital was second with7.18% return during June.

Large cap

The Large cap category delivered 4.16% on average in the month of June. But the performance of the funds, on the whole, was not superior. Of the 24 strategies tracked, only 14 beat the Nifty TRI, and just 11 did better than the BSE 500 TRI.

Global Consistent Compounders from Marcellus was the chart topper with 7.95% returns during the month.

Nippon India’s Absolute Freedom came in second with 6.01% returns in June. The fund predominantly invests in large cap stocks and selectively in the quality mid cap, small cap, and micro-cap stocks.

Reliance Wealth Management’s Alpha Large Cap was the third on the list, with 5.77% returns during the month.

In the chart below, the performance of the large-cap category average against the returns of the Nifty 50 TRI and BSE 500 TRI in June is depicted.

Multi-caps

Multi-cap PMSes had a relatively average month, delivering 5.25% on average during June. As many as 111 of the 154 strategies (more than 7 in 10) outperformed the BSE 500 TRI’s return of 4.28% in June. When the Nifty TRI is taken as a benchmark, 123 (nearly 8 in 10) outperformed the bluechip index.

INVASSET’s Growth Pro Max Fund was the category topper with 12.21% returns during the month.

Next on the list was the Vriddhi Plan of Shree Rama Managers with 12.1% returns in June.

ICICI Pru’s Value Strategy came third with 9.9% returns over the course of the month.

Thematic

The thematic category witnessed one of its best months in recent times and delivered 6.79% on average during June.

Valcreate Investment Managers’ IME Digital Disruption Investment Approach came on top with 11.47% returns during the month. This fund invests in a concentrated portfolio of listed digitally-native platform businesses.

Green Portfolio’s Super 30 Dynamic, which invests in companies amidst special situations, came second with 10.25% returns during the month.

The Impact ESG Fund from Green Portfolio came in third with 9.41% returns in June.

The markets have run up for three months in succession. Softening inflation and healthy economic and high-frequency data points indicate that the India growth story is getting firmly on track. Falling crude oil and commodity prices have also aided the market's rally.

As the earnings season unfolds, the next trigger would come from the financial performance of companies in the June quarter. Many large firms in the IT pack have reported their numbers, and there are expectations that the sector may be bottoming out. As companies in other sectors start reporting their financials, a clearer picture would emerge of the sustainability of the market rally. As of now, though, the sentiments seem quite bullish, with very few negative triggers.

Get access to the widest coverage of PMS & AIF Data and make informed investment decisions by subscribing to PMS Bazaar!: Subscribe NOW

Recent Blogs

Sectors to watch and Sectors to Dodge – Alternates Universe Webinar Series

PMS Bazaar recently organized a webinar titled “Sectors to watch and Sectors to Dodge” which featured Mr. Darshan Engineer, Fund Manager at Sundaram Alternate Assets and Mr. Sandeep Tulsiyan, also a Fund Manager at Sundaram Alternate Assets, who had a discussion with Mrs. Reshmi Chakraborthy from Sundaram Alternate Assets. This blog covers the important points shared in this insightful webinar.

Mid and Small Caps: Driving India’s $5 Trillion Pathway

PMS Bazaar recently organized a webinar titled “Mid and Small Caps: Driving India’s $5 Trillion Pathway,” which featured Mr. Achin Goel, Fund Manager at Bonanza.

Equity PMS strategies shine in May; 9 in 10 Beat Nifty 50 TRI as small cap surge lifts all boats

Robust sectoral rotation and smart stock selection power one of the strongest alpha months for PMS managers

128 of 133 AIFs posted gains in May 2025; Long-only strategies beat long-short peers by 400 bps

Long-only AIFs averaged 5.69% returns in May 2025 sharply above long-short peers (1.68%) as broader market strength, FII flows, and sector momentum powered alpha generation

Who Will the Race for Alpha – Fund Managers vs AI

PMS Bazaar recently organized an exciting webinar titled “Who Will the Race for Alpha – Fund Managers vs AI,” which featured Mr. Sankarsh Chanda, Founder & CEO, Savart.

Trust Tech and Transformation – The Future of Private Banking in India

PMS Bazaar conducted another episode of the Alternates Universe Webinar Series -Season 2- Episode 11 - Trust Tech and Transformation – The Future of Private Banking in India.

Access Innovative Global Themes via Gift City Route

PMS Bazaar recently organized a webinar titled “Access Innovative Global Themes via Gift City Route,” which featured Mr. Vaibhav Shah, Associate Director – Head- Business Strategy, Products & International Business, Mirae Asset Investment Managers and Mr. Scott Helfstein, Head of Investment Strategy, Global X ETFs.

110 of 123 AIFs Deliver Gains in April; Top Performers Log 5–9% Returns

Long-only AIFs (2.19%) outperformed long-short peers (1.28%) with category average alpha of ~90 bps as macro tailwinds and index gains supported broad-based strategy resilience