Best schemes log 10-19% gains, but the overall extent of outperformance vs. benchmarks was lower compared to May

June 2025 extended the winning streak for equity Portfolio Management Services (PMS), with markets rising for the fourth month in a row. Out of 427 equity strategies tracked by PMS Bazaar, a robust 423 (99%) ended the month in the green. The best schemes clocked 10-19% returns in this month, showing the power of alpha creation.

However, only 245 outpaced the Nifty 50 TRI’s 3.37% return, and 216 beat the broader BSE 500 TRI’s 3.68% gain—reflecting a lower outperformance ratio compared to May, as the rally broadened and turned more benchmark-driven.

Institutional flows remained supportive. FIIs were net buyers for the fourth consecutive month, adding USD 2.4 billion in June, while DIIs pumped in USD 8.5 billion. Sectoral breadth was strong with Telecom, Infrastructure, Technology, Real Estate, and Metals stocks logging solid gains. The only drag was the Consumer pack, down month-on-month.

In the multi-asset PMS space, 21 strategies were tracked, with about half beating the NSE Multi Asset Index 1 benchmark. They were helped in part by the positive equity bias in June.

Here is a deeper look at June-2025 PMS returns.

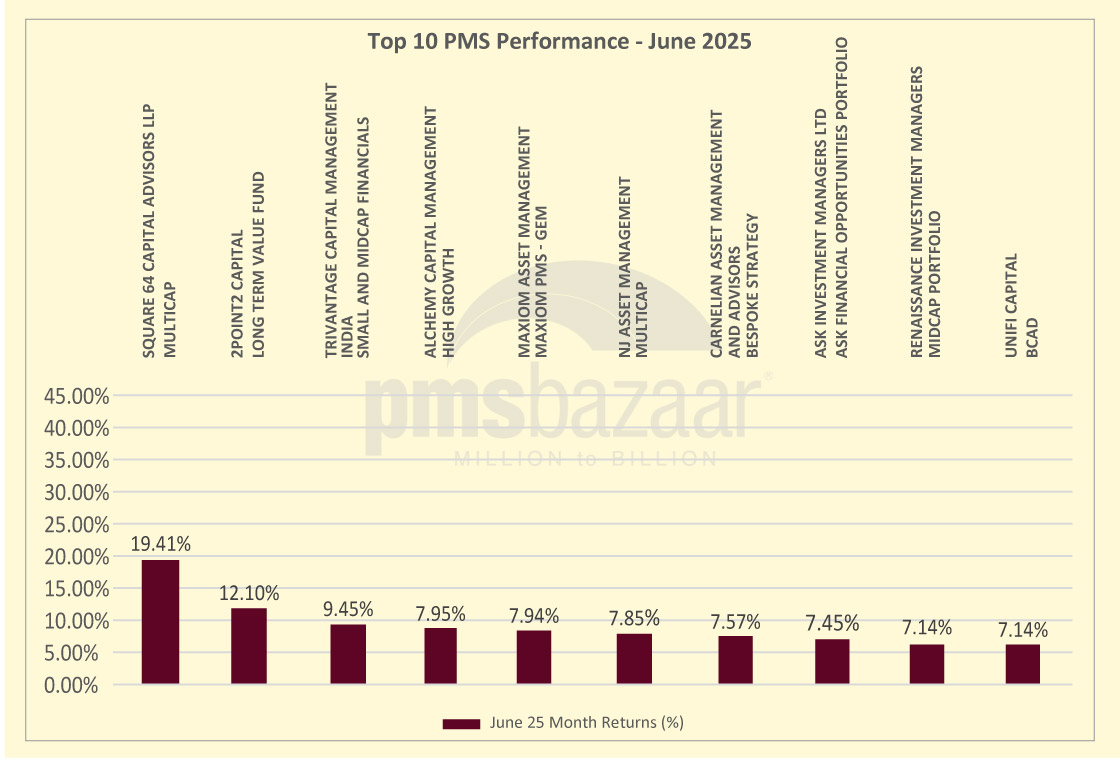

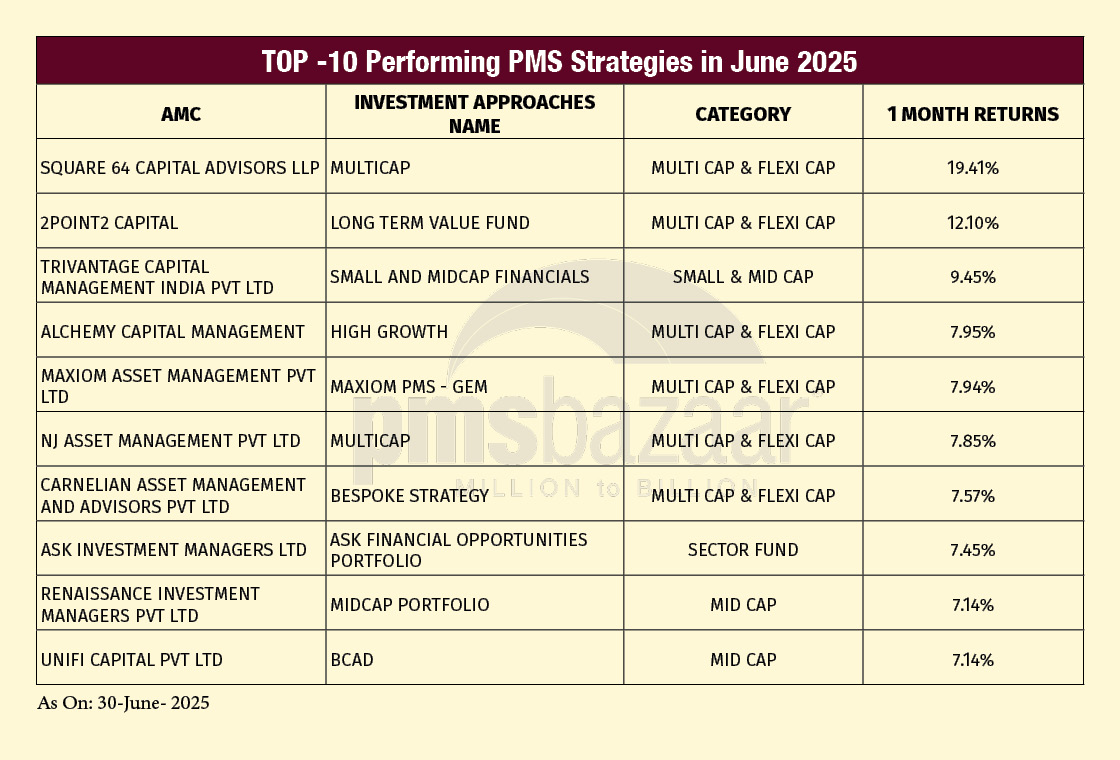

Top 10 performers in focus

June 2025’s top equity PMS performers showcased solid high-single to double-digit gains, with the leader delivering a standout 19.41%.

At the top was Square 64 Capital Advisors’ Multicap strategy, which surged 19.41%, far ahead of benchmarks, thanks to its broader market participation and agile allocation.

In second place was 2Point2 Capital’s Long Term Value Fund, clocking 12.10%, buoyed by conviction-led multicap and flexicap bets.

Trivantage Capital’s Small and Midcap Financials took the third spot with a 9.45% return, likely benefitting from June’s strength in financials and midcap resilience.

Alchemy Capital’s High Growth strategy (7.95%) and Maxiom Asset’s GEM PMS (7.94%) followed closely, indicating robust alpha delivery in the multi-cap & flexi-cap space.

Multicap approach from NJ Asset (7.85%) and Carnelian’s Bespoke Strategy (7.57%) maintained momentum with diversified exposure.

Among sector and midcap players, ASK’s Financial Opportunities Portfolio (7.45%) reflected focussed gains in financials, while Renaissance Midcap Portfolio and Unifi’s BCAD (Business Consolidation After Disruptions) strategy—both at 7.14%—rounded out the top 10, capturing the tailwind in broader markets.

The list reflects how multicap & flexicap and midcap-heavy strategies continued to reward managers with tactical positioning and broad-based equity exposure.

Here is a table of the top-10 performers of June-2025.

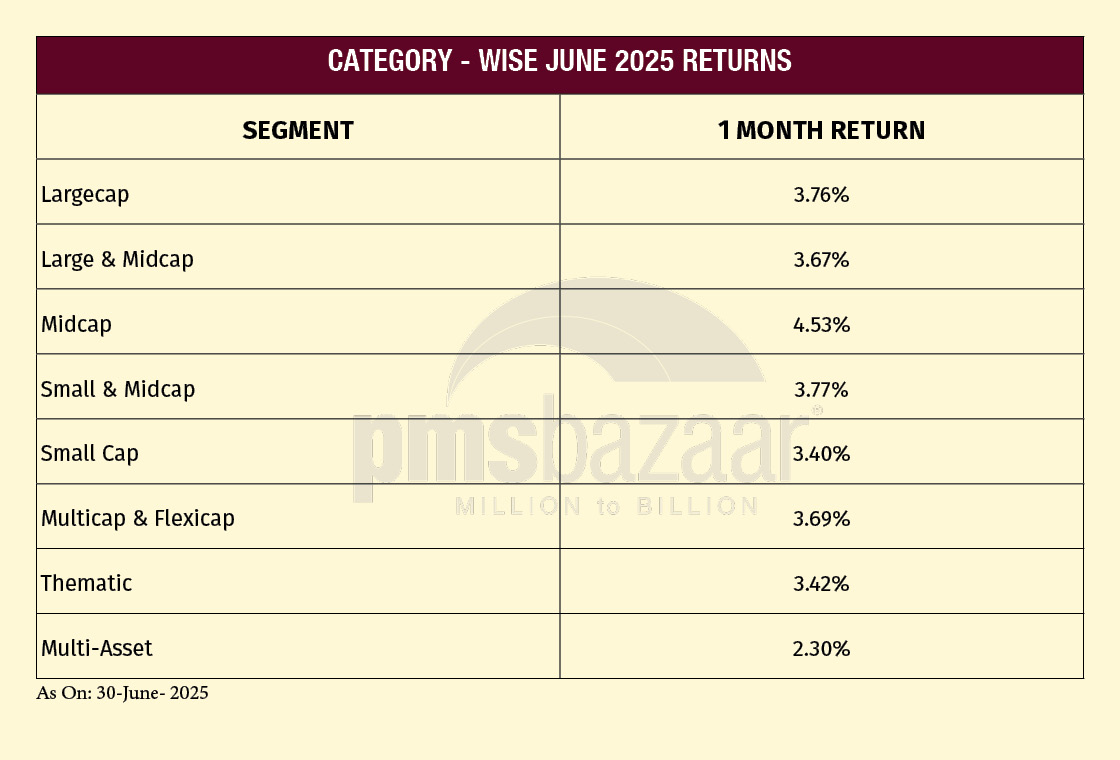

Category focus: Midcap shines, but broad-based gains across PMS segments

June saw midcap strategies at the forefront, delivering an average 4.53% return. This was driven by broad-based participation across infrastructure, real estate, and financial mid-sized names.

Small & Midcap strategies clocked 3.77%, supported by stock-specific gains in financials and industrials, with managers may have benefitted from active bottom-up selection in a liquid mid-market environment.

Largecap strategies delivered a healthy 3.76%, showing stability and participation in June’s benchmark-led rally. This was particularly true for sectors like telecom, metals, and frontline tech.

Multicap & Flexicap approaches posted 3.69%, reflecting the benefits of balanced exposure across market capitalisations. Note manager agility in rotating between mid-sized outperformers and largecap anchors also played a role.

Large & Midcap strategies came in at 3.67%, powered by balanced participation in core sectors and a blend of defensive largecaps and midcap cyclicals.

Thematic strategies returned 3.42%, led by strength in sector-focussed themes like digital, infrastructure, and financials, as investors rewarded coherent narratives and performance-linked stories.

Smallcap strategies posted 3.40%, reflecting select strength in microcaps, though allocations remain concentrated in stable, relatively liquid opportunities with visible earnings momentum.

Beyond pure equity approaches, Multi-asset PMS strategies averaged 2.30%, as equity allocations helped boost returns, while other asset classes likely played a muted role during a risk-on market phase.

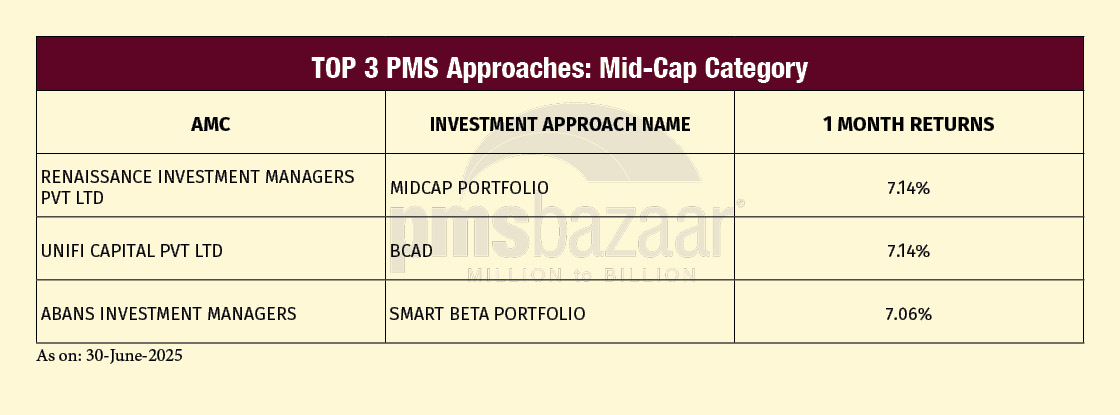

Midcap PMSes: Leadership through consistency and stock selection strength

Midcap PMS strategies maintained their leadership position in June 2025, delivering an average return of 4.53%. This was the highest among all equity PMS segments. Out of 20 strategies tracked, 14 outperformed the BSE 500 TRI’s 3.68% return, while 15 beat the Nifty 50 TRI’s 3.37%, underscoring the depth and consistency of alpha across mid-sized portfolios.

Top performers showcased differentiated styles. Renaissance Investment Managers' Midcap Portfolio and Unifi Capital’s BCAD strategy shared the top spot with a 7.14% gain, despite being benchmarked to different indices—Nifty 50 TRI and BSE 500 TRI, respectively.

Close behind was Abans Investment Managers’ Smart Beta Portfolio (7.06%), reflecting a likely quantitative tilt that benefitted from rotational leadership in June.

This dispersion of style, from traditional to quant and breakout, highlights the diversity of thought within the midcap PMS universe, and how active stock picking continues to reward disciplined managers.

Below is a table of the top-3 Midcap PMS strategies for June 2025.

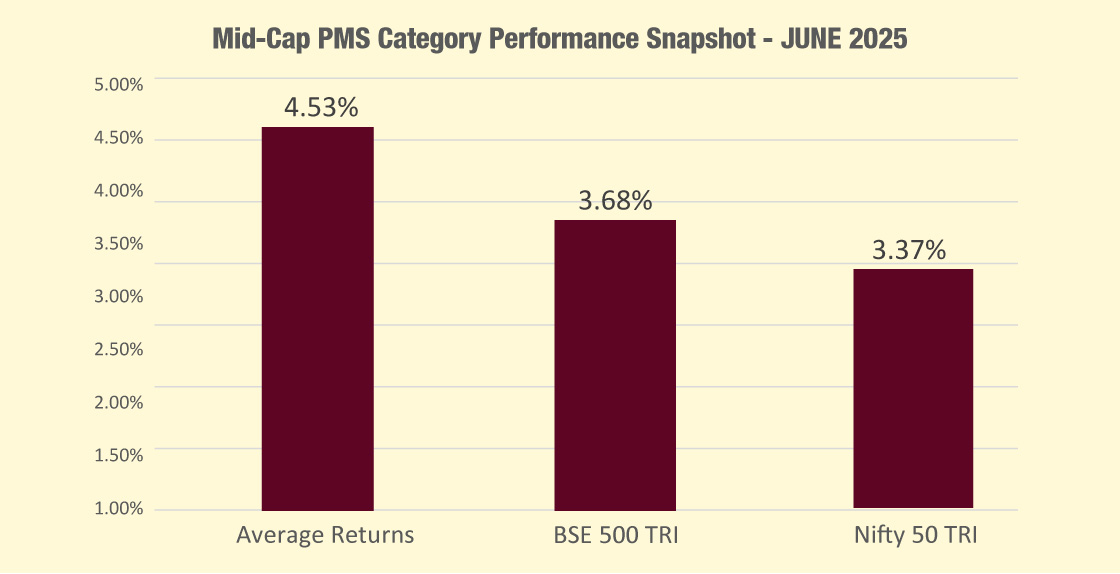

Midcap PMS Category Performance Snapshot:

Midcap PMS delivered an impressive 4.53% return in June 2025, outperforming both the BSE 500 TRI (3.68%) and Nifty 50 TRI (3.37%). This strong performance highlights the resilience and growth potential of midcap strategies.

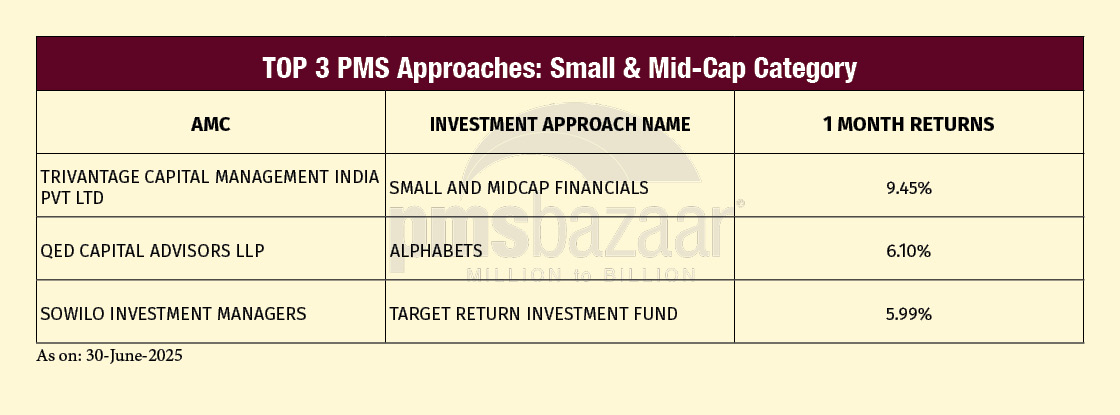

Small & Midcap PMSes: Financials and focussed themes drive standout gains

With an average return of 3.77% in June 2025, Small & Midcap PMS strategies performed solidly, slightly ahead of the BSE 500 TRI and comfortably above the Nifty 50 TRI. Out of 54 schemes tracked, 30 beat the BSE 500 TRI and 32 outperformed the Nifty 50 TRI, showcasing broad strength in this blended segment.

The top performer was Trivantage Capital’s Small and Midcap Financials, which surged 9.45%, more than double the category average. It was likely aided by strength in mid-sized lenders and NBFCs. QED Capital’s Alphabets strategy followed with a 6.10% return, demonstrating the value of a differentiated stock-coding approach anchored in active curation.

Sowilo Investment’s Target Return Fund delivered 5.99%, highlighting steady sector positioning with tactical flexibility.

The segment reflects how sharp thematic filters and sector-specific insights can add significant alpha, even in a market phase where broader participation may overshadow individual allocation decisions.

Below is a table of the top-3 Small & Midcap PMS strategies for June 2025.

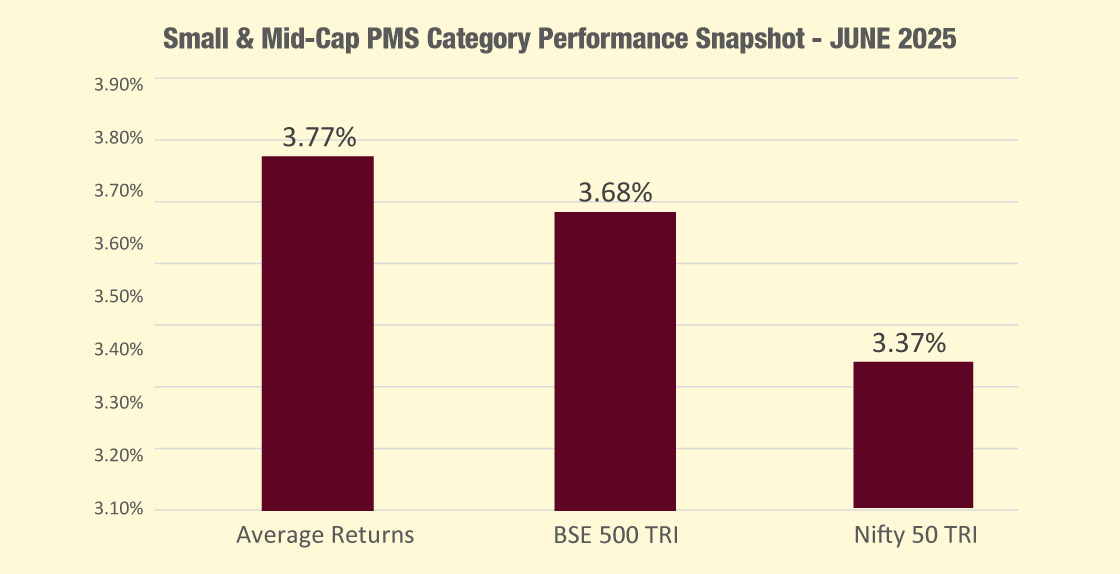

Small & Midcap PMS Category Performance Snapshot:

Small & Midcap PMS delivered a 3.77% return in June 2025, surpassing both the BSE 500 TRI (3.68%) and Nifty 50 TRI (3.37%). This outperformance reflects continued investor confidence in smaller, growth-oriented companies.

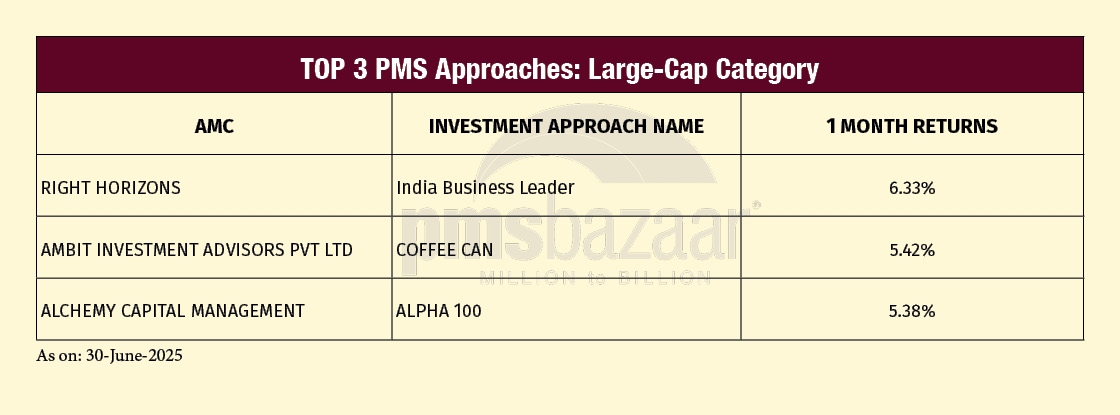

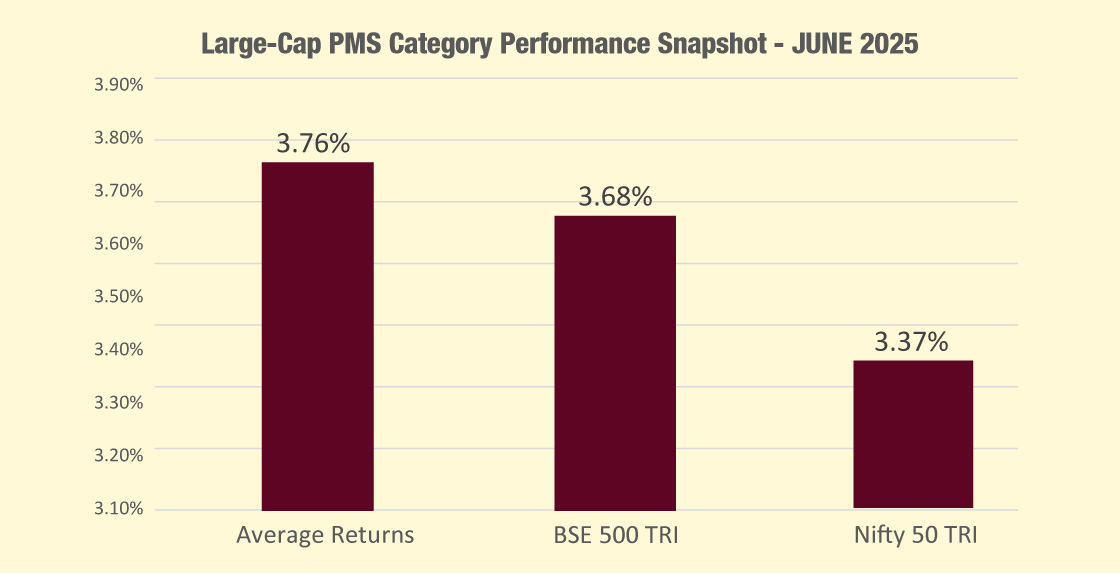

Largecap PMSes: Quality compounders and focused plays stand out

Large Cap PMS strategies delivered an average return of 3.76% in June 2025, slightly above the BSE 500 TRI and well ahead of the Nifty 50 TRI. Of the 25 strategies tracked, 11 outperformed the BSE 500 TRI and 12 beat the Nifty 50 TRI. This highlights selective alpha generation even in a broadly trending market.

Leading the segment was the Right Horizons India Business Leader strategy, which posted a strong 6.33%, indicating a tilt toward consistent compounders in high-return ratio sectors. Ambit Coffee Can followed with 5.42%, staying true to its philosophy of long-term quality holdings with low churn.

The Alchemy Alpha 100 strategy returned 5.38%, suggesting active conviction within the largecap universe.

Despite narrower room for discovery in largecaps, managers with disciplined frameworks and selective bias toward high-visibility businesses continued to deliver above-benchmark performance.

Below is a table of the top-3 Largecap PMS strategies for June 2025.

Largecap PMS Category Performance Snapshot:

Large Cap PMS delivered a 3.76% return in June 2025, edging past the BSE 500 TRI (3.68%) and comfortably outperforming the Nifty 50 TRI (3.37%). This indicates strong performance among actively managed large-cap strategies.

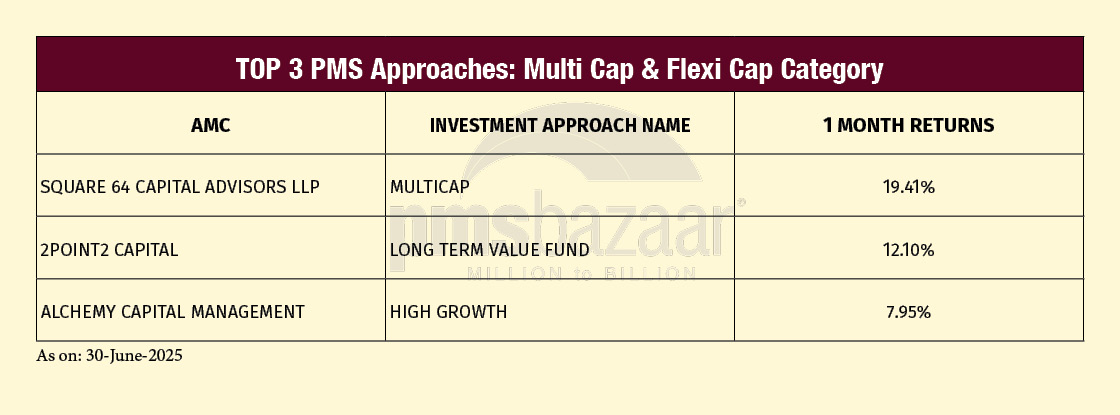

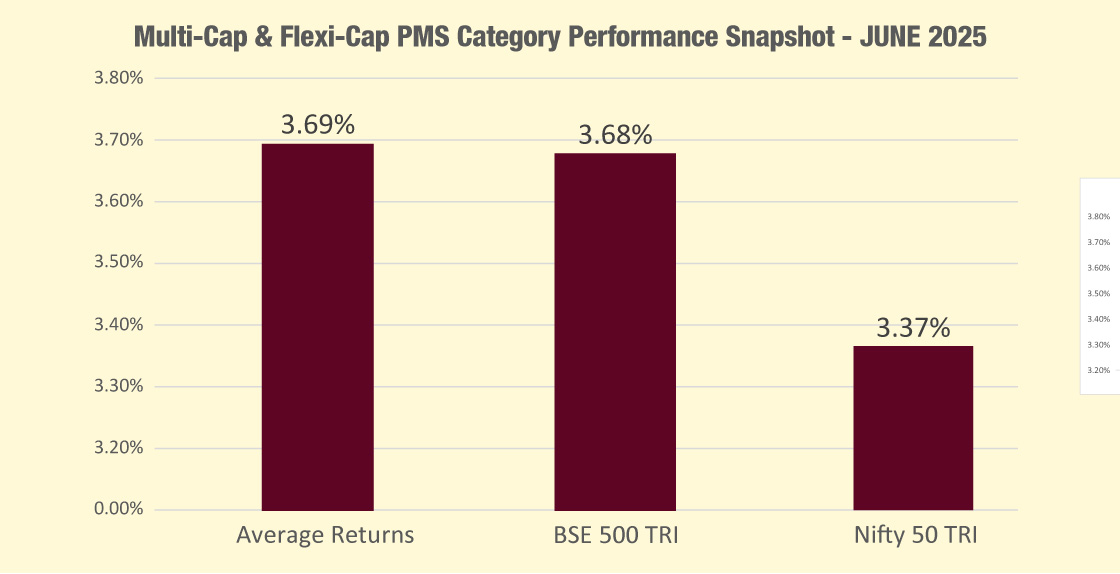

Multicap & Flexicap PMSes: Wide dispersion, but top performers deliver exceptional alpha

Multicap & Flexicap PMS strategies delivered an average return of 3.69% in June 2025, almost in line with the BSE 500 TRI and comfortably ahead of the Nifty 50 TRI.

Out of 253 strategies tracked, 129 outperformed the BSE 500 TRI and 147 beat the Nifty 50 TRI, showcasing the flexibility and adaptability of this dominant category.

Topping the performance chart across all segments was Square 64 Capital’s Multicap strategy, which posted a staggering 19.41% return. This performance may be indicative of timely bets across the market-cap spectrum.

Close behind was 2Point2 Capital’s Long Term Value Fund, returning 12.10%, reaffirming the strength of high-conviction, value-driven portfolios.

Alchemy Capital’s High Growth (7.95%) followed, reflecting robust stock selection in quality growth themes.

Despite the sheer size of this segment (250+ schemes), June’s returns underline that flexibility, when combined with sharp positioning, can still create wide performance dispersion. And, the best managers continue to deliver outsized alpha when it matters!

Below is a table of the top-3 Multicap & Flexicap PMS strategies for June 2025.

Multicap & Flexicap PMS Category Performance Snapshot:

Multicap & Flexicap PMS delivered a 3.69% return in June 2025, slightly outperforming the BSE 500 TRI (3.68%) and well ahead of the Nifty 50 TRI (3.37%). This reflects the effectiveness of diversified strategies across market caps.

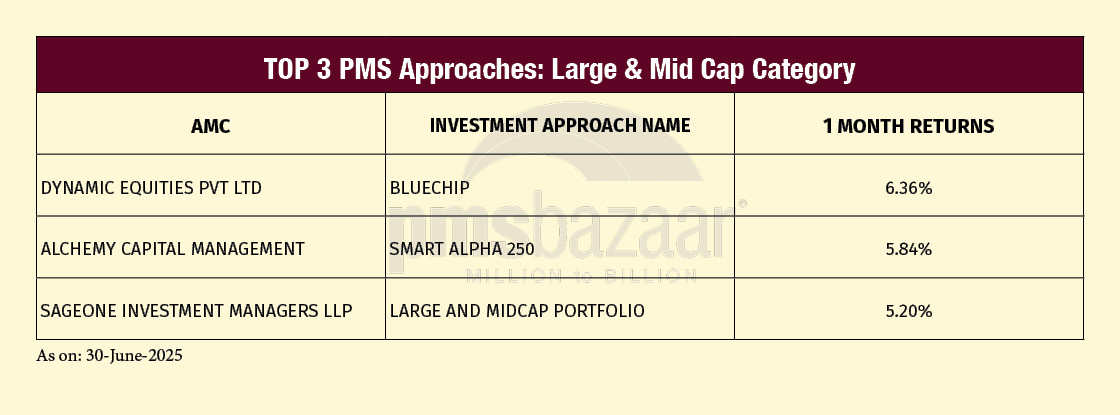

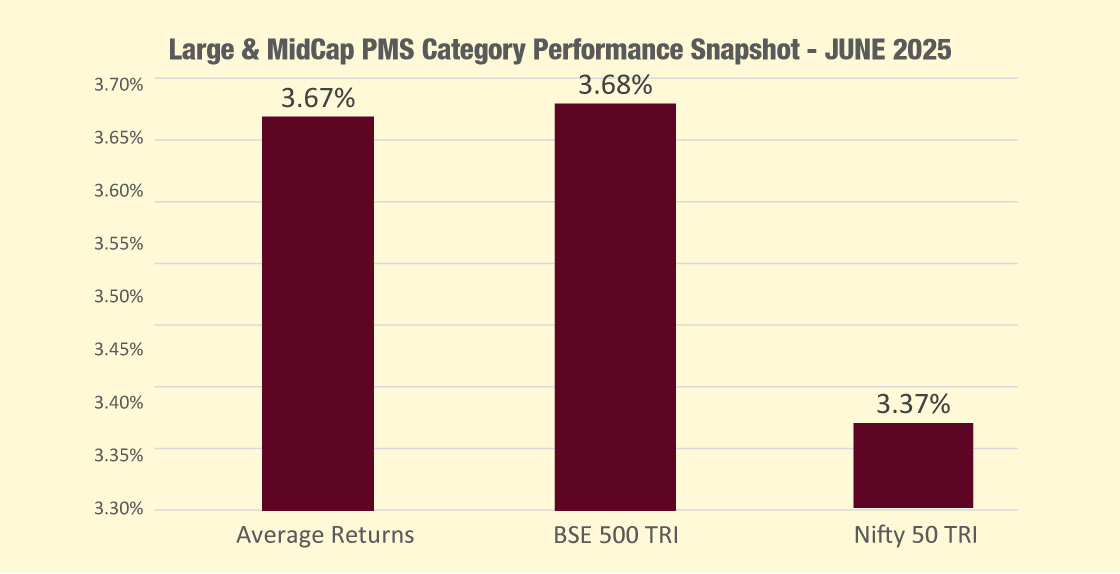

Large & Midcap PMSes: Quant, core and consistent ideas deliver solid outcomes

Large & Midcap PMS strategies recorded an average return of 3.67% in June 2025, almost matching the BSE 500 TRI and comfortably ahead of the Nifty 50 TRI.

Out of 23 schemes tracked, 10 outperformed the BSE 500 and 12 beat the Nifty 50, reflecting moderate alpha generation within this blended allocation space.

Dynamic Equities’ Bluechip strategy led the segment with a 6.36% return, benefitting from targeted exposure to benchmark leaders and stable compounders. Alchemy Smart Alpha 250 (5.84%) followed, suggesting disciplined stock selection within a diversified mid-to-large universe.

SageOne’s Large and Midcap Portfolio delivered 5.20%, reflecting an approach rooted in scalable business models with earnings visibility.

This segment continues to offer an appealing middle ground for investors seeking quality exposure to both growth-rich midcaps and stability-oriented largecaps.

Below is a table of the top-3 Large & Midcap PMS strategies for June 2025.

Large & Midcap PMS Category Performance Snapshot:

Large & Midcap PMS delivered a 3.67% return in June 2025, closely aligning with the BSE 500 TRI (3.68%) and outperforming the Nifty 50 TRI (3.37%). This indicates stable performance with balanced exposure across large and midcap segments.

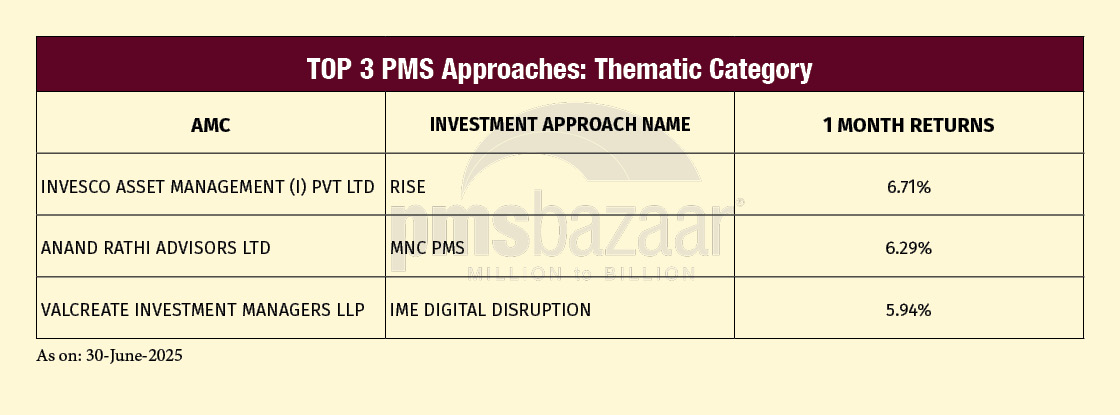

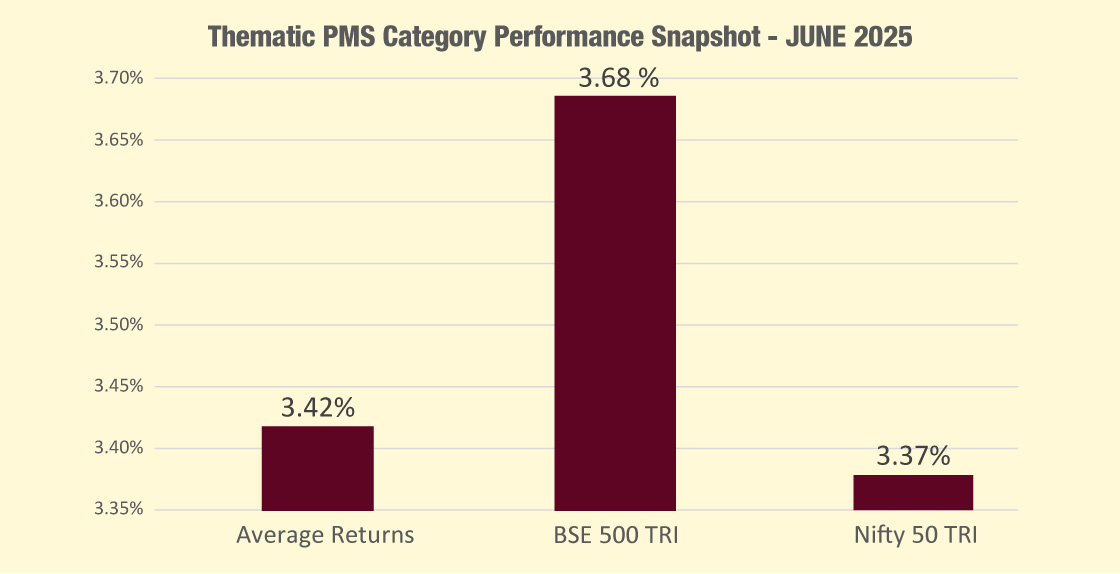

Thematic PMSes: Select strategies outshine on ideas with sectoral conviction

Thematic PMS strategies delivered an average return of 3.42% in June 2025, modestly trailing the BSE 500 TRI but outperforming the Nifty 50 TRI.

Of the 18 strategies tracked, 7 managed to beat the broader BSE 500 TRI and 9 outperformed the Nifty 50 TRI. Performance dispersion remained wide, reflecting the varying maturity and momentum of underlying themes.

Invesco’s RISE strategy led the pack with a strong 6.71% return, indicating sustained interest in consumption and emerging sectoral shifts.

Anand Rathi’s MNC PMS followed with 6.29%, benefitting from global-linked Indian franchises and strong balance sheets.

Valcreate Investment Managers IME Digital Disruption (5.94%) showing how focussed exposure to innovation and niche growth segments continues to find favour.

Despite being a niche segment, thematic PMS offerings showed that when backed by clear sectoral tailwinds, conviction-based ideas can deliver sharp bursts of alpha in select cycles.

Below is a table of the top-3 Thematic PMS strategies for June 2025.

Thematic PMS Category Performance Snapshot:

Thematic PMS delivered a 3.42% return in June 2025, slightly above the Nifty 50 TRI (3.37%) but trailing the BSE 500 TRI (3.68%). This indicates a mixed month for thematic strategies amid broader market gains.

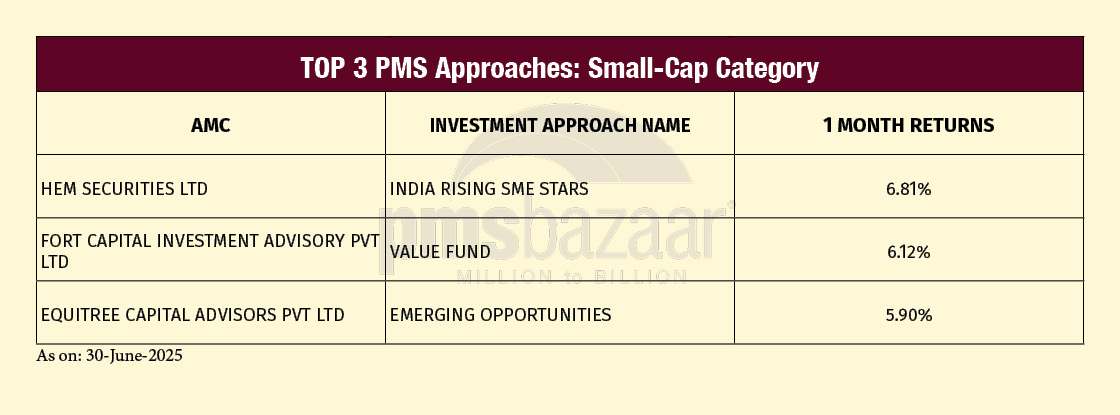

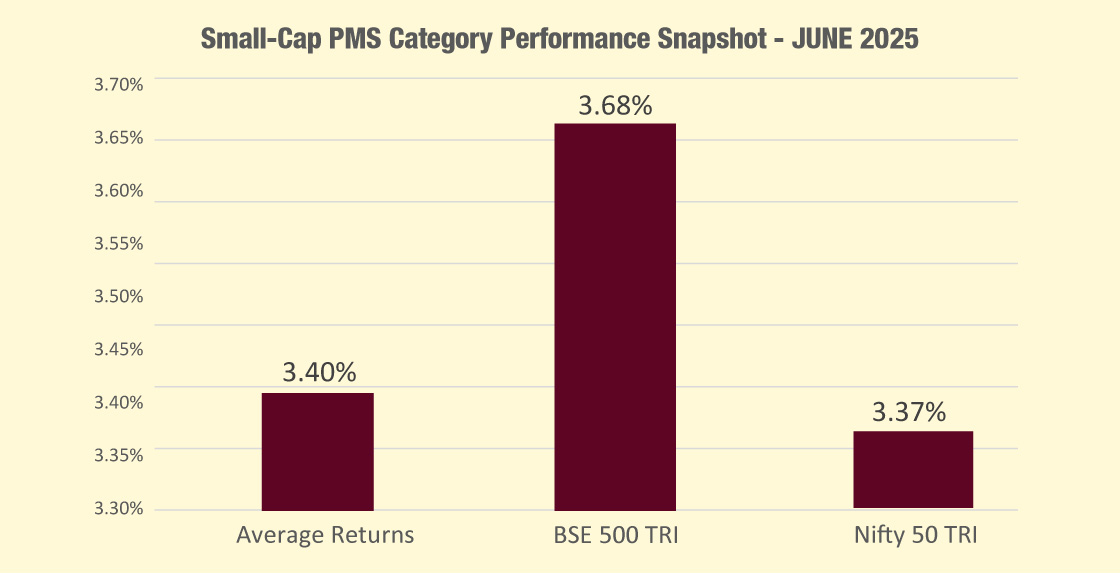

Smallcap PMSes: Outperformance hinges on selectivity and conviction bets

Smallcap PMS strategies recorded an average return of 3.40% in June 2025, narrowly lagging the BSE 500 TRI but ahead of the Nifty 50 TRI.

Among the 25 schemes tracked, 11 outperformed the BSE 500 TRI, while 13 beat the Nifty 50 TRI. The data underscores that success in this category remains highly stock-specific and driven by deep conviction calls.

Hem Securities’ India Rising SME Stars led the segment with a 6.81% return, highlighting the alpha potential in under-researched SME and micro-cap names when backed by strong earnings visibility.

Fort Capital’s Value Fund followed with a 6.12% gain, indicating renewed interest in attractively priced small-cap cyclicals.

Equitree’s Emerging Opportunities clocked 5.90%, showcasing disciplined discovery in scalable businesses.

Overall, while broad returns were moderate, top strategies reaffirmed that careful stock picking remains the most potent differentiator in the small-cap PMS universe.

Below is a table of the top-3 Smallcap PMS strategies for June 2025.

Smallcap PMS Category Performance Snapshot:

Small Cap PMS delivered a 3.40% return in June 2025, marginally outperforming the Nifty 50 TRI (3.37%) but lagging behind the BSE 500 TRI (3.68%). This suggests a relatively cautious month for small-cap strategies amidst broader market movements.

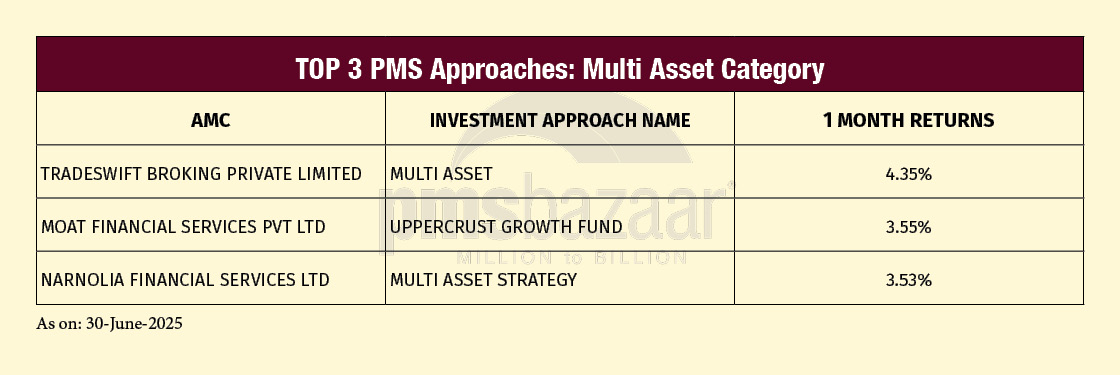

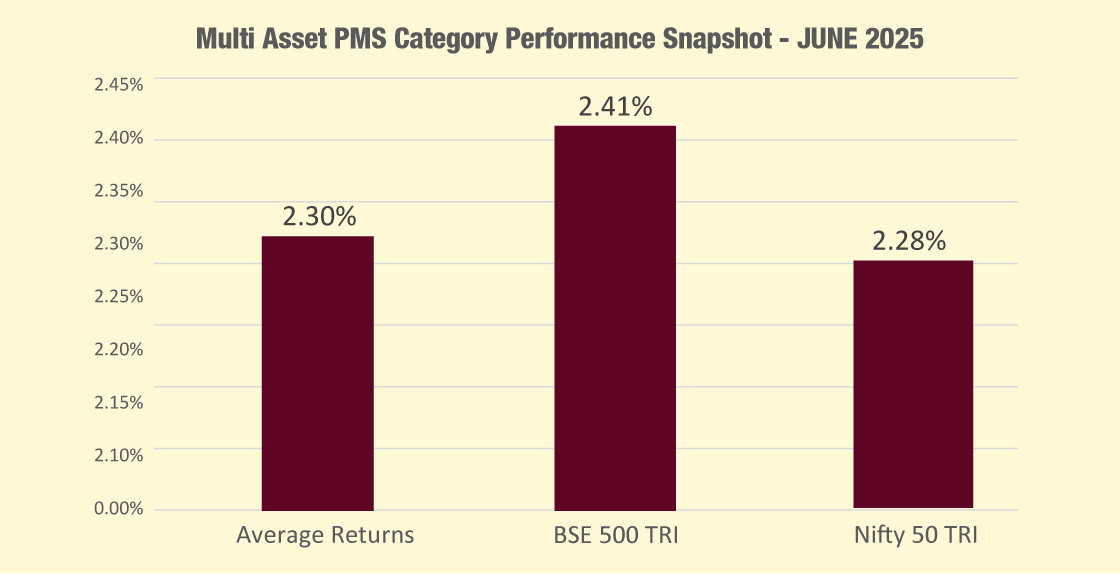

Multi Asset PMSes: Equity tilt lifts returns in a risk-on month

Multi Asset PMS strategies delivered an average return of 2.30% in June 2025, tracking slightly below NSE Multi Asset Index 1 (2.41%) and marginally above Index 2 (2.28%).

Of the 21 strategies tracked, 9 beat Index 1 and 10 outperformed Index 2. The results reflect how equity-heavy allocations benefited in a month marked by strong equity market momentum, even as debt and gold played more passive roles.

Tradeswift Broking’s Multi Asset strategy topped the category with a 4.35% return, signalling an aggressive tilt toward risk assets or tactical sector positioning.

Moat Financial’s UpperCrust Growth Fund followed with 3.55%, indicating balanced but equity-leaning exposure to growth segments.

Narnolia Financial’s Multi Asset Strategy came in at 3.53%, benchmarked to Nifty 50 TRI, showing that flexible benchmarks can still produce competitive results when aligned with market trends.

Multi Asset PMS continues to appeal to investors seeking smoother return profiles, especially when led by managers able to actively calibrate allocations across market cycles.

Below is a table of the top-3 Multi Asset PMS strategies for June 2025.

Multi-Asset PMS Category Performance Snapshot:

Multi Asset PMS delivered a 2.30% return in June 2025, outperforming the NSE Multi Asset Index 2 (2.28%) but trailing the NSE Multi Asset Index 1 (2.41%). The performance reflects a balanced outcome amid diversified asset allocations.

Outlook for July

Following a broad-based rally in June, sentiment heading into July remains constructive but selectively cautious.

With markets now consolidating recent gains, investor focus is likely to shift toward stock-level fundamentals and earnings commentary.

Macro stability and sector rotation trends may influence flows, especially within select strategies.

While temporary volatility can’t be ruled out, the underlying market breadth suggests continued participation across styles.

For PMS investors, this phase calls for patience and conviction.

Staying aligned with managers who prioritise bottom-up research, capital efficiency, and scalable opportunities will remain key to generating alpha.

Recent Blogs

PMS performance hit by broad market slump in July; Thematic strategies buck the trend

Of 427 equity PMSes, only 61 gained; Debt offerings showed positive returns. July 2025 proved to be a testing month for Portfolio Management Services (PMS) investors, with broad-based declines across most asset classes.

July tests AIF resilience; Long-short strategies lead relative gains game

Only 44 of 137 AIFs ended positive; long-only funds averaged –1.15%, while long-short peers limited losses to –0.29%

The Lollapalooza Effect in Investing Through Pricing Power

PMS Bazaar recently organized a webinar titled “The Lollapalooza Effect in Investing Through Pricing Power” which featured Mr. Siddharth Bothra, Executive Director and Fund Manager, Ambit Asset Management. This blog covers the important points shared in this insightful webinar.

The Secret Sauce of Quant PMS

PMS Bazaar recently organized a webinar titled “The Secret Sauce of Quant PMS,” which featured Mr. Vivek Sharma, VP & Investment Head, Estee Advisors Private Limited.

Bridging Performing Credit and Emerging Equity for Balanced Wealth Creation

PMS Bazaar recently organized a webinar titled “Bridging Performing Credit and Emerging Equity for Balanced Wealth Creation,” which featured Mr. Phanisekhar Ponangi, Co-Founder and CIO, MavenArk Asset Managers Pvt Limited. This blog covers the important points shared in this insightful webinar.

June Brings Steady Gains for AIFs; Long-Only Strategies Maintain Lead

126 of 129 AIFs ended in the green; long-only funds averaged 3.75%, while long-short peers delivered a modest 2.18%

Alpha from Simplicity: The Power of Vanilla Investing

PMS Bazaar recently organized a webinar titled “Alpha from Simplicity: The Power of Vanilla Investing,” which featured Mr. Sheetal Malpani, Chief Investment Officer and Head of Equity, Tamohara Investment Managers. This blog covers the important points shared in this insightful webinar.

Sectors to watch and Sectors to Dodge – Alternates Universe Webinar Series

PMS Bazaar recently organized a webinar titled “Sectors to watch and Sectors to Dodge” which featured Mr. Darshan Engineer, Fund Manager at Sundaram Alternate Assets and Mr. Sandeep Tulsiyan, also a Fund Manager at Sundaram Alternate Assets, who had a discussion with Mrs. Reshmi Chakraborthy from Sundaram Alternate Assets. This blog covers the important points shared in this insightful webinar.