126 of 129 AIFs ended in the green; long-only funds averaged 3.75%, while long-short peers delivered a modest 2.18%

Alternative Investment Funds (AIFs) extended their positive streak into June 2025, with 126 out of 129 strategies tracked by PMS Bazaar ending the month in the green. Cutting across categories, the top AIF strategies gave 7-10% return this month.

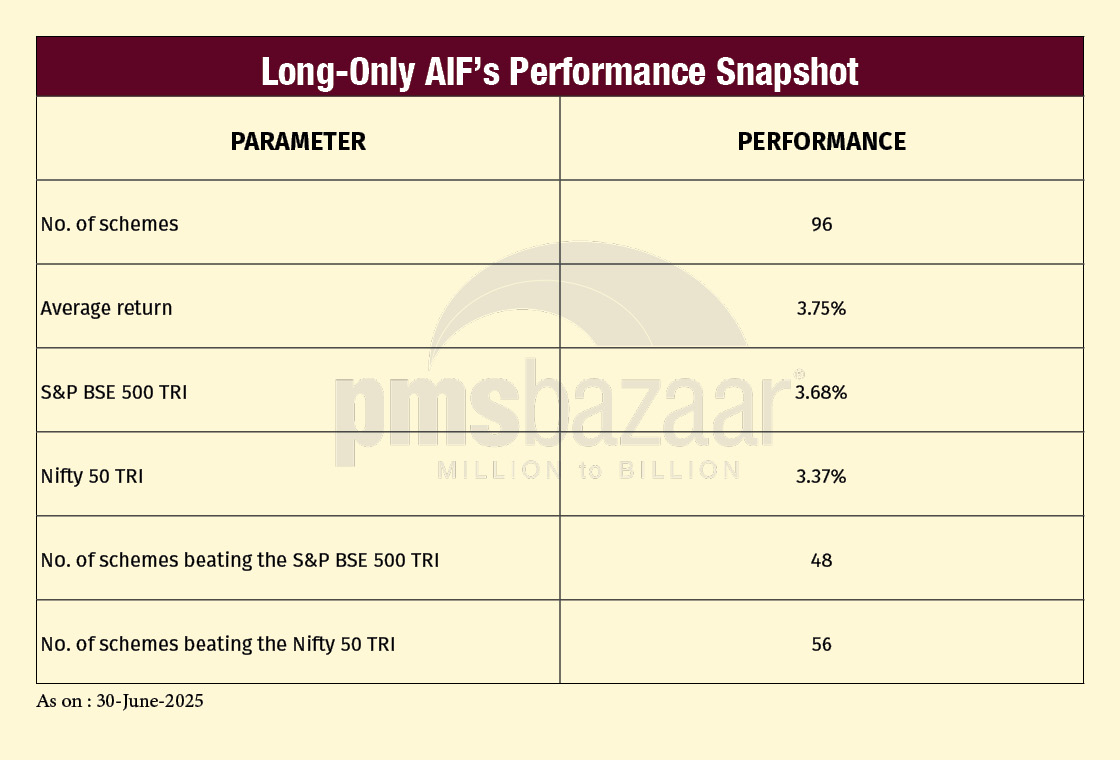

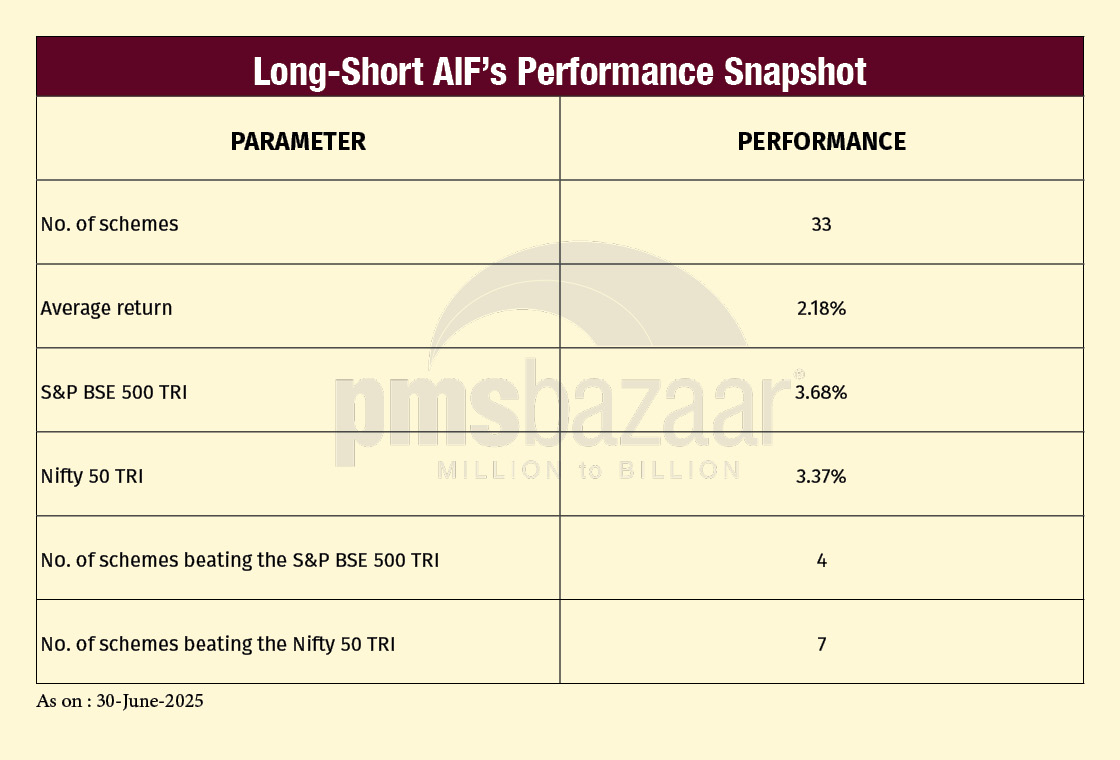

While both long-only and long-short Category III AIFs delivered positive returns, the performance gap between the two narrowed compared to May. Long-only strategies posted an average return of 3.75%, marginally ahead of the BSE 500 TRI (3.68%) and comfortably above the Nifty 50 TRI (3.37%). In contrast, long-short AIFs averaged 2.18%, reflecting a more cautious, hedged stance in a market that broadly trended higher.

Out of the 96 long-only strategies, 48 beat the BSE 500 TRI and 56 outperformed the Nifty 50 TRI—still a strong showing, though with lower dispersion than in May.

For long-short strategies, only 4 beat the BSE 500 TRI and 7 surpassed the Nifty 50 TRI, underlining the challenge of generating alpha in a directional market.

Overall, the month demonstrated the resilience of long-only mandates and the selective outperformance of dynamic hedge-based strategies.

Let us look at the June-2025 AIF performance in detail.

Long-Only AIFs: Steady month with broad participation

A long-only AIF (Alternative Investment Fund) under Category III invests primarily in listed equities without using short positions or hedging. These funds aim to generate absolute returns through high-conviction, buy-and-hold strategies focused on capital appreciation. Unlike long-short funds, they remain fully or largely exposed to market movements. Suitable for investors with a high-risk appetite and long-term horizon, long-only AIFs offer access to concentrated portfolios managed by seasoned fund managers with thematic or sectoral expertise.

Long-only Category III AIFs posted a solid performance in June 2025, with an average return of 3.75%—comfortably ahead of the Nifty 50 TRI (3.37%) and marginally better than the BSE 500 TRI (3.68%). Of the 96 long-only strategies tracked, 56 outperformed the Nifty 50 TRI and 48 beat the BSE 500 TRI, reflecting a broader yet more balanced return spread compared to May.

The momentum remained strong across mid and small-cap names, and many long-only funds benefited from high-conviction positions in manufacturing, financials, and new-age sectors. That said, the share of funds outperforming the broader index dipped a bit versus May’s unusually sharp dispersion, suggesting a more measured rally where index-heavy strategies held their own.

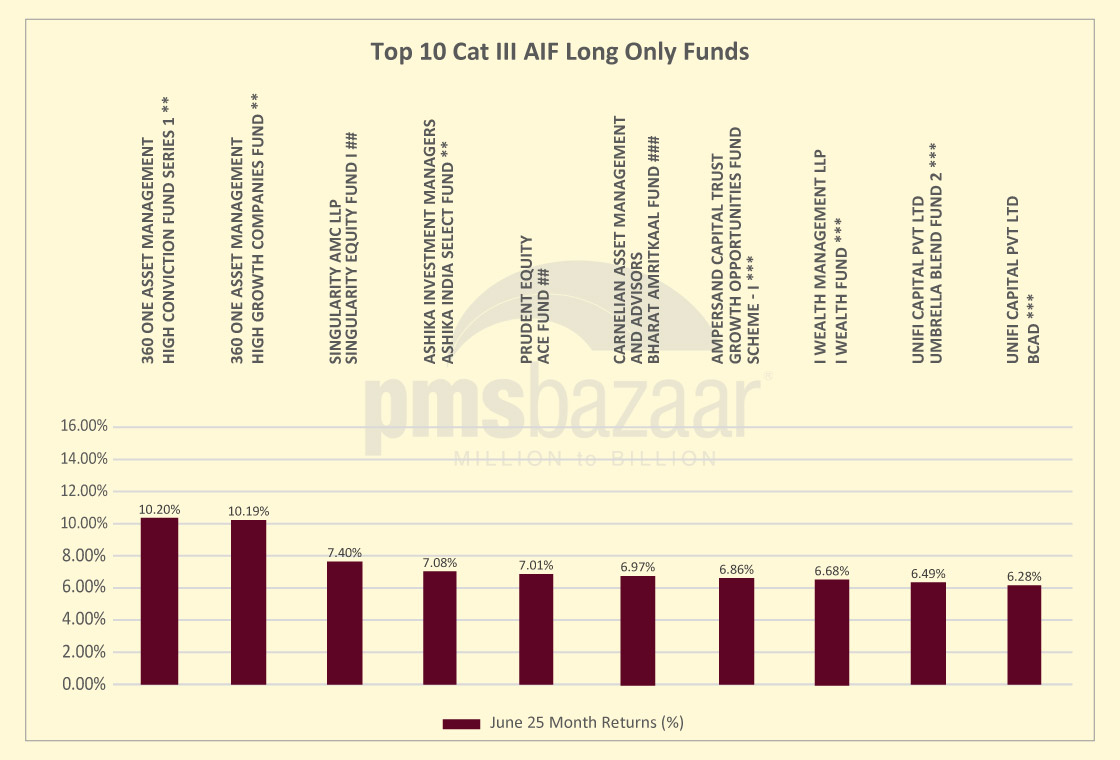

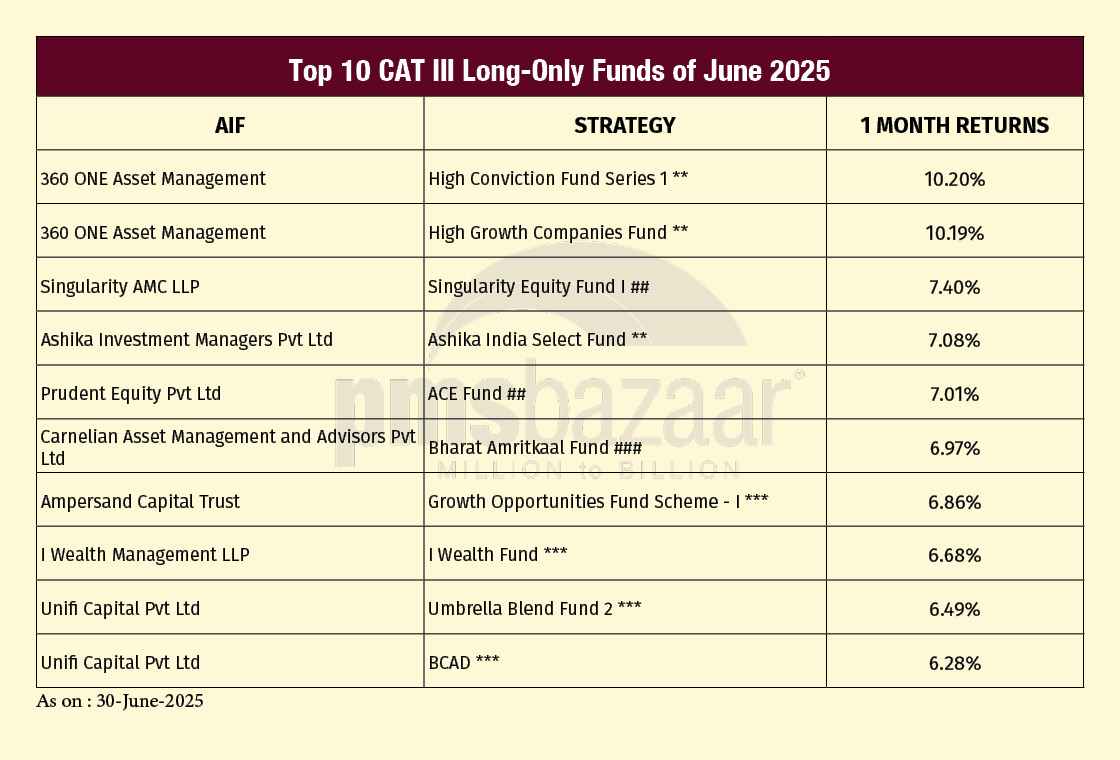

Topping the chart this month was 360 ONE Asset Management, whose High Conviction Fund Series 1 delivered 10.20%, closely followed by its High Growth Companies Fund at 10.19%. These results highlight the fund house’s consistent focus on scalable, earnings-resilient businesses.

Other standout performers included Singularity AMC’s Equity Fund I (7.40%), Ashika India Select Fund (7.08%), and Prudent Equity’s ACE Fund (7.01%).

Also notable were Carnelian’s Bharat Amritkaal Fund (6.97%) and Ampersand’s Growth Opportunities Fund Scheme I (6.86%), showcasing how others with concentrated thematic plays held up well. These funds typically favour high-growth companies with strong cash flows and clear sectoral tailwinds.

Overall, June reinforced the appeal of unhedged long-only strategies in a directional market. While fewer funds beat the benchmark compared to May, alpha generation remained respectable, especially among managers with focused portfolios and long-term conviction.

Here is a look at the top-10 long-only AIFs for June 2025.

*** Post Exp & Tax, ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax,^^ Post Exp & Tax and Pre Perf.Fees, # Below 1 Year returns are Simple Annualized. All Performance above are as on 30 June 2025 *

Long-Short AIFs: Cautious stance limits upside

Long-short AIFs are Category III Alternative Investment Funds that use both long (buy) and short (sell) positions to generate returns across market cycles. By actively managing net exposure, these funds aim to capture upside while limiting downside risk. They often employ hedging, arbitrage, or sector rotation strategies. Ideal for high-net-worth investors seeking lower volatility and risk-adjusted returns, long-short AIFs offer flexibility to ride uncertain markets with disciplined positioning and tactical allocation.

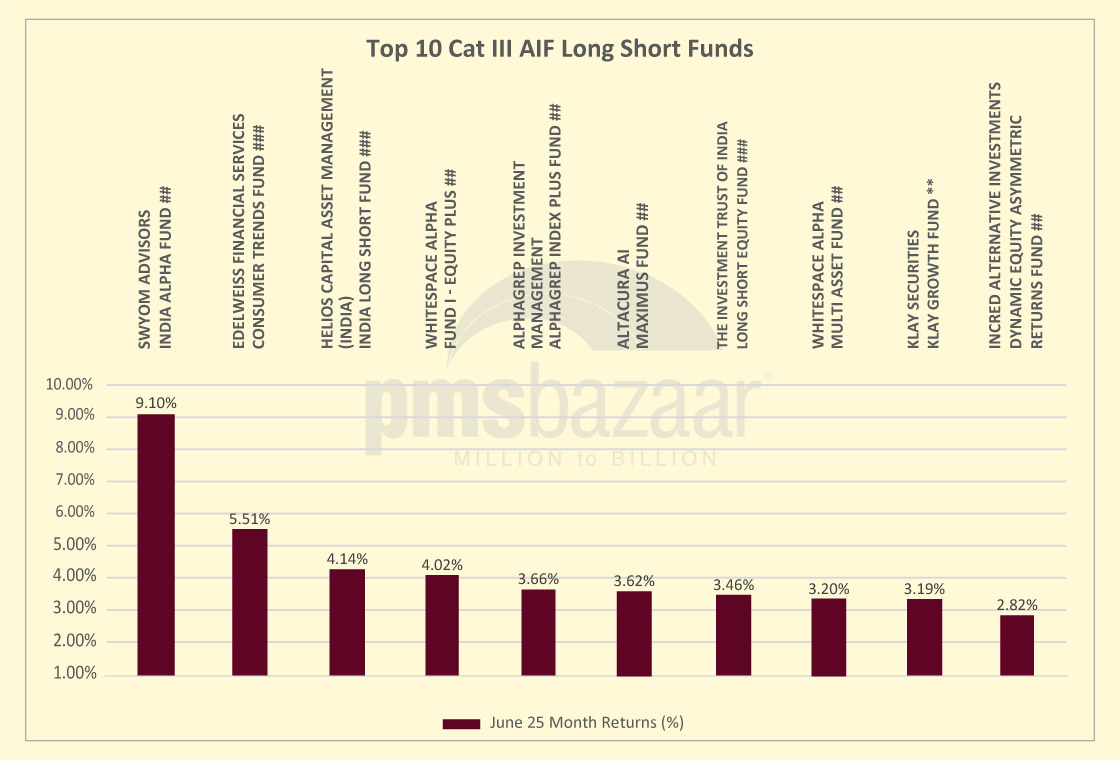

Long-short Category III AIFs posted an average return of 2.18% in June 2025, lagging both the BSE 500 TRI (3.68%) and Nifty 50 TRI (3.37%). Of the 33 strategies tracked, only 4 beat the BSE 500 TRI and 7 outperformed the Nifty 50 TRI. While the broader market showed strength, hedged strategies saw limited upside due to their lower net equity exposure and focus on downside protection.

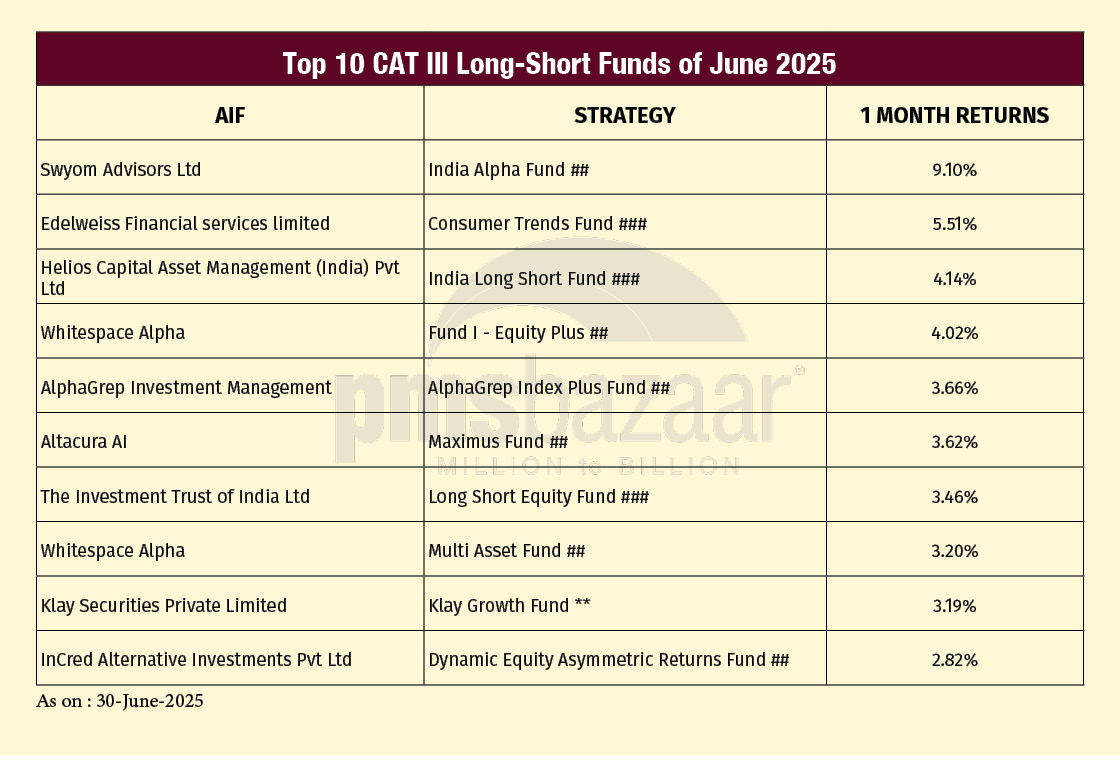

That said, the top performers demonstrated the value of tactical agility. Swyom Advisors’ India Alpha Fund once again led the category with a standout 9.10% return, signalling its ability to extract alpha through directional calls even in a cautiously positioned portfolio. This fund also topped the long-short charts in May, reinforcing its consistency in a volatile environment.

Other notable gainers, such as Edelweiss Financial Consumer Trends Fund, Helios India Long Short Fund, Whitespace Alpha Fund I - Equity Plus and AlphaGrep Index Plus Fund, included AIFs that skillfully blended market-neutral and opportunistic exposures.

While June didn’t favour heavy hedging, funds with flexible mandates and dynamic sector rotation fared better. The dispersion in performance highlights the importance of timing and active management in long-short AIFs.

By design, these strategies seek to cushion portfolios during sharp corrections and provide smoother return profiles. While they may trail in strong bull phases, they play a critical role in risk-adjusted allocation, especially for HNIs looking for lower beta and consistent alpha over cycles.

In a month where market sentiment was generally risk-on, the long-short segment showed that selective outperformance is still possible when managers combine conviction with cautious optimism. As volatility resurfaces, whether due to global macro or earnings resets, this category may regain favour among allocators seeking a hedge-led approach.

Here is a look at the top-10 long-short AIFs for June 2025.

*** Post Exp & Tax, ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax,^^ Post Exp & Tax and Pre Perf.Fees, # Below 1 Year returns are Simple Annualized. All Performance above are as on 30 June 2025 *

Outlook for July

After a steady June, the AIF landscape enters July with cautious optimism. With most strategies ending the previous month in the green, confidence remains intact across both long-only and long-short segments.

This is a phase where clarity in stock selection, risk management, and portfolio discipline will matter more than chasing momentum. For long-only funds, a focus on scalable, quality businesses continue to offer compounding potential. For long-short strategies, evolving market narratives may create new tactical windows to generate alpha.

Investors would do well to stay aligned with fund managers who blend conviction with adaptability. The strength of the AIF platform lies in its ability to pursue differentiated ideas across cycles, across capitalisations, and across volatility regimes.

As India's structural story continues to unfold, AIFs remain well-placed to deliver performance with precision, purpose, and patience.

Staying invested with a long-term lens remains the most powerful edge.

Recent Blogs

January Rout, Extreme Dispersion: PMS Returns Swing From Losses to Gains

Benchmark falls deepened losses, but multi-asset and debt cushioned portfolios meaningfully

Investment Frameworks : A Practitioner’s Guide

PMS Bazaar recently organized a webinar titled “Investment Frameworks: A Practitioner’s Guide,” which featured Mr. Sumit Agrawal, Senior Vice President, Nuvama Asset Management Limited. This blog covers the important points shared in this insightful webinar.

Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability

PMS Bazaar recently organized a webinar titled “Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability,” which featured Mr. Sandeep Daga, MD& CIO, Nine Rivers Capital and Mr. Kunal Sabnis, Portfolio Manager, Nine Rivers Capital. This blog covers the important points shared in this insightful webinar.

Flat Markets, Wide Outcomes: How 484 PMS Strategies Performed in Dec 2025

December 2025 was a month where market returns stayed close to flat, with the Nifty 50 TRI at -0.28% and the BSE 500 TRI at -0.24%.

Equity Markets 2026: Outlook, Risks and Strategy

PMS Bazaar recently organized a webinar titled “Equity Markets 2026: Outlook, Risks and Strategy,” which featured Mr. Ashish Chaturmohta, MD & Fund Manager – APEX PMS, JM Financial Limited. This blog covers the important points shared in this insightful webinar.

MICRO CAPS: The Dark Horses of the Indian Equity Market

PMS Bazaar recently organized a webinar titled “MICRO CAPS: The Dark Horses of the Indian Equity Market,” which featured Mr. Rishi Agarwal and Mr. Adheesh Kabra, both Co-Founders and Fund Managers, Aarth AIF. This blog covers the important points shared in this insightful webinar.

Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy

PMS Bazaar recently organized a webinar titled “Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy,” which featured Mr.Anunaya Kumar, President – Sales and Distribution ASK Investment Managers Limited. This blog covers the important points shared in this insightful webinar.

.jpg)

Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS

PMS Bazaar recently organized a webinar titled “Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS,” which featured Mr. Karan Bhatia, Co-Founder and Co-Fund Manager , Pricebridge Honeycomb ETF PMs. This blog covers the important points shared in this insightful webinar.