The latest wave of global tariff hikes has rattled many markets, but India stands on firmer ground this time. With limited exposure to US trade routes and robust domestic demand, the direct impact appears contained. What’s more, sliding global crude and metal prices may actually play to India’s advantage by easing input costs for companies.

Despite the volatility, March 2025 marked a clear rebound. The Nifty50 TRI rallied 6.31%, while the S&P BSE 500 TRI surged 7.32%, a sharp reversal after months of selling pressure. Riding on this market momentum, PMS strategies delivered impressive performance across the board. Large Cap, Multicap & Flexicap, and Large & Mid Cap categories led the charge.

Out of 401 strategies tracked by PMS Bazaar, 396 ended the month in green, with many top performers generating 10–15% returns. Investor portfolios saw a visible boost. More than 225 PMSes outperformed the Nifty, and over 123 beaten the BSE 500—highlighting the alpha potential in well-managed strategies. Here is a low-down.

Top performers in focus

At No. 1 was ASK Investment Managers’

Lighthouse Portfolio with a whopping 15.03% gain in March-2025. It is a satellite PMS strategy that invests in 3–4 high-conviction themes undergoing structural transformation. It blends top-down and bottom-up approaches to identify youthful, high-growth opportunities with long-term durability. The portfolio adapts themes over time, maintaining a strong margin of safety and a focused stock range of 15–30 companies. With sector flexibility and deep research, it aims to tap into large, evolving opportunities while staying true to ASK’s investment philosophy.

Close at the 2nd rank was Moat Financial Services’

UpperCrust Wealth Fund with a robust 14.89% jump this month. This is a multi-cap core and satellite themed PMS strategy that focuses on quality businesses led by outstanding capital allocators. The core portfolio (80%) targets companies with sustainable moats, while the satellite portion (20%) includes stocks, ETFs, liquid plans, and commodities for tactical balance. With a cap of 10% per stock and 25% per sector, the fund maintains a concentrated portfolio of around 15 names, backed by strong risk management and portfolio discipline.

At No. 3 was

Tulsian PMS with 13.8% return thanks to its large-cap focused strategy built on a core-satellite model. It invests in 10–15 fundamentally strong stocks through a bottom-up approach, targeting long-term compounding. The core portfolio anchors returns, while the satellite portion identifies undervalued opportunities using macro trends, qualitative filters, and a proprietary algorithm. The scheme aims to deliver consistent growth and alpha through selective buying and a disciplined 3–5 year investment horizon.

Here is a table of the 10 best-performing PMS strategies for March 2025.

Category Spotlight: March 2025

PMS strategies across segments posted solid returns in March 2025, riding the sharp rebound in Indian equities. Large Cap strategies led the pack with a 1-month return of 6.83%, benefitting from the Nifty’s strong 6.3% rise. Large and Mid Cap strategies followed with 6.21%, while Multi Cap & Flexicap and Thematic portfolios returned an even 6%. Small and Midcap strategies also held up well at 5.92%, while Midcap-only portfolios delivered 5.66%. Smallcap strategies lagged slightly but still closed the month with a respectable 5% gain. The overall performance shows that the recovery was broad-based, though relatively safer categories like Large Cap and diversified approaches outperformed. This reflects a risk-aware shift among PMS managers after a volatile start to 2025.

Here is how different PMS categories performed in March 2025.

Large Cap: The Large Cap segment delivered a strong average return of 6.83% in March 2025, outperforming the Nifty 50 TRI’s 6.31% rise. However, the S&P BSE 500 TRI fared slightly better at 7.32%. Out of the 26 PMS strategies tracked in this category, 15 outperformed the Nifty 50, while 8 surpassed the broader BSE 500 benchmark. This shows that while Large Cap strategies broadly captured the market rebound, only a subset managed to beat both key indices. The performance reflects solid stock selection and sector positioning by top-performing managers within this relatively stable but competitive segment.

Tulsian PMS topped the Large Cap segment in March 2025 with a stellar 13.80% return. Tulsian PMS delivers superior performance through a core-satellite approach, emphasizing asset allocation for long-term results. Core holdings drive stable beta returns, while alpha is generated by identifying undervalued stocks with high re-rating potential.

Other notable performers included ICICI Prudential’s

Large Cap strategy which followed at 9.50%, while Standard Chartered’s

Long Term Value Compounder posted 8.52%. The data reflects strong alpha generation by select large cap strategies in a month of market recovery.

Here is a table of the 5 best-performing Large Cap PMS strategies for March 2025.

Multi Cap & Flexi Cap: The Multi Cap & Flexi Cap category saw an average return of 6% in March 2025 across 238 PMS strategies. While this was slightly below the Nifty 50 TRI’s 6.31% and trailed the broader S&P BSE 500 TRI’s 7.32%, performance dispersion was notable. Out of the 238 strategies, 135 outperformed the Nifty 50, and 78 beaten the BSE 500, signalling effective stock picking by many portfolio managers. This category, with its flexible allocation across market caps, continued to serve as a balanced vehicle for capturing market upside while managing the volatility of early 2025.

Multi Cap and Flexi Cap PMS strategies posted strong returns in March 2025, with 5 top performers clocking over 10% gains.

ASK Lighthouse Portfolio led the chart with 15.03%,

ASK Lighthouse Portfolio targets deep opportunities across 3–4 key sectors, focusing on structural transformations. It blends top-down and bottom-up approaches to identify impactful themes while staying true to its core philosophy. This adaptive yet disciplined strategy enables sustained alpha generation.

Here is a table of the 5 best-performing Multi Cap & Flexi Cap PMS strategies for March 2025.

Large & Mid Cap: The Large & Mid Cap segment delivered a modest average return of 6.21% in March 2025, just shy of the Nifty 50 TRI’s 6.31% and underperforming the S&P BSE 500 TRI’s 7.32%. Among 22 strategies in this category, 11 outperformed the Nifty, while only 4 beaten the BSE 500. Despite lagging broader benchmarks, nearly half the strategies managed to edge past the large-cap index. This performance reflects mixed results in a month where market leadership was skewed towards larger names, making alpha generation more selective for portfolios spanning both large and mid-sized businesses.

Within the

Large & Mid Cap space, Care Portfolio Managers led with a 10% return in March 2025 ,Care PMS developed a model portfolio approach, investing in 18–20 companies from the top 250 by market cap. They were able to generate alpha with investing in consistent growers and sectors benefiting from industry tailwinds, macro trends, and policy shifts. Other notable performers include Samvitti Capital’s

Long Term Growth strategy at 9.57%.

which was followed by Concept Investwell’s Marvel portfolio which gave a return of 7.73%. The category saw solid participation across varied approaches, highlighting selective alpha generation amid a broader market rebound.

Here is a table of the 5 best-performing Large & Mid Cap PMS strategies for March 2025.

Small & Mid Cap: The Small & Mid Cap segment recorded an average return of 5.92% in March 2025 across 47 PMS strategies, trailing both the Nifty 50 TRI (6.31%) and the S&P BSE 500 TRI (7.32%). Despite the underperformance at the category level, 23 strategies managed to beat the Nifty 50, and 15 outperformed the BSE 500. The results reflect a selective recovery in the broader market, where larger names outpaced mid and small caps. Managers with concentrated, well-researched portfolios were better positioned to capture alpha in a segment still facing valuation pressures and rotational flows.

ASK’s Emerging Opportunities Portfolio led the Small & Mid Cap segment in March 2025 with a standout 12.91% return. They follow a concentrated strategy, investing across market caps in carefully selected high-quality, high-growth businesses. The focused portfolio targets long-term wealth creation through outstanding compounding potential.

The data highlights a broad-based recovery in well-managed small and mid-cap portfolios last month.

Here is a table of the 5 best-performing Small & Mid Cap PMS strategies for March 2025.

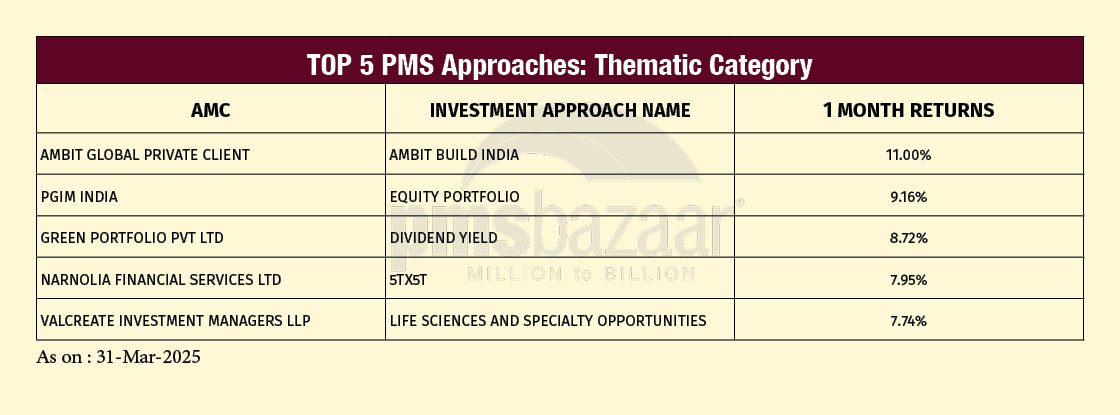

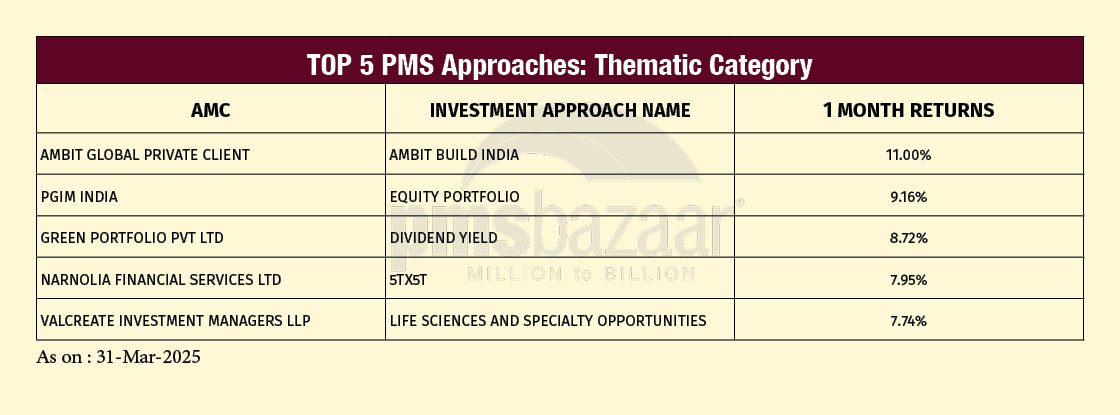

Thematic: Thematic PMS strategies delivered an average return of 6% in March 2025, narrowly trailing the Nifty 50 TRI at 6.31% and falling short of the S&P BSE 500 TRI’s 7.32%. Out of 18 strategies in this category, 9 outperformed the Nifty and 5 exceeded the broader BSE 500 benchmark. The results highlight selective outperformance within focused themes, suggesting that while some thematic bets paid off during the month’s rally, broader diversification and stock selection played a crucial role in return dispersion across strategies.

Ambit’s Build India strategy led thematic PMS performers in March 2025 with an 11% return. This strategy generated alpha by tapping into India's manufacturing and capex revival. With a market cap agnostic approach, it identified opportunities across the spectrum ,large to emerging players benefiting from rising investments in infrastructure and production. This focus on cyclical upturns in capital-intensive sectors led to higher volatility, but also allowed for significant upside capture during favorable phases, resulting in strong alpha generation over time.

They were followed by PGIM’s

Equity Portfolio (9.16%) and Green Portfolio’s

Dividend Yield strategy (8.72%). The range of themes reflects varied approaches to capitalise on sector-specific opportunities during the market rebound.

Here is a table of the 5 best-performing Thematic PMS strategies for March 2025.

Mid Cap: The Mid Cap PMS segment recorded an average return of 5.66% in March 2025, lagging behind both the Nifty 50 TRI (6.31%) and the broader S&P BSE 500 TRI (7.32%). Of the 22 strategies in this category, 10 managed to outperform the Nifty 50, while only 4 have beaten the BSE 500. This underperformance highlights the relatively subdued momentum in midcap stocks during the month’s rally. While market gains were led by larger names, select midcap strategies still managed to deliver alpha, thanks to focused stock selection and tactical allocation within the space.

Renaissance Investment Manager's

Mid Cap Portfolio led the mid cap pack in March 2025 with a strong 9.52% return, it generates alpha by identifying high-growth mid and small-cap companies with the potential to become future large and mid-caps. With a focused portfolio of 20–25 stocks, it emphasizes a low-mortality approach by backing quality businesses with strong fundamentals and scalable models.

They were followed by Purnartha’s

Dynamic Midcap Strategy at 9% and Emkay Investment’s

Gems portfolio at 7.58%. Despite modest category averages, a few managers captured notable upside through smart midcap allocations.

Here is a table of the 5 best-performing Mid Cap PMS strategies for March 2025.

Small Cap: Small Cap PMS strategies delivered an average return of 5% in March 2025, lagging behind the Nifty 50 TRI at 6.31% and the S&P BSE 500 TRI at 7.32%. Of the 25 strategies tracked, 10 outperformed the Nifty 50, while only 5 managed to beat the BSE 500. The underperformance highlights the cautious sentiment around small caps, though selective managers still found opportunities to generate alpha through focused stock picking in this volatile space.

Small Cap PMS strategies showed varied performance in March 2025. Qode Advisors’

Future Horizons topped the chart with a 10.30% return, which blends growth-oriented and defensive assets allowing for consistent performance across various market conditions.

The second best performing portfolio of the category is PRPEdge’s

Alphaa Focused Small-Cap Portfolio at 10.09% and Alchemy Capital’s

Alpha Small Cap (8.71%) were a close third. These results reflect selective outperformance within the small cap space amid a broader cautious market tone.

Here is a table of the 5 best-performing Small Cap PMS strategies for March 2025.

Outlook for April-2025

While global trade tensions and high starting valuations hint at turbulence ahead, PMS investors should not lose heart. The broader equity market may face a period of mean reversion, but that doesn’t imply a collapse. In fact, India's corporate sector is entering this phase with historically clean balance sheets and reduced leverage—an unusual and encouraging backdrop for long-term investors. Earnings may moderate, yet large caps remain resilient, supported by steady fundamentals.

- Small and midcaps are undergoing valuation compression, and though painful, this is also when future leaders will quietly emerge

- Thematic shifts, like the repositioning of private banks, also offer selective entry points with reasonable valuations.

- For PMS investors, this is a phase for discipline—not despair.

Those who stay invested with high quality portfolio managers, focused on valuation comfort and bottom-up stock picking, may benefit meaningfully once the dust settles. Every slowdown resets the board—and creates tomorrow’s opportunities.