PMSBazaar presents an industry-first analysis of the full portfolios of about 60% of India's multi-billion dollar PMS industry

In an unparalleled study, PMSBazaar - India's 1st and most-trusted data source for alternative investments - today revealed key insights of the portfolios of the fast-growing PMS industry of the country. Covering 124 strategies that have cumulatively invested in hundreds of stocks, the analysis covers about 60% of the PMS Industry. Here's a lowdown into how smart PMS fund managers are playing stocks, themes, sectors and much more. Keep reading.

Starting off

The PMSBazaar portfolio deep scan study covers a total of 3063 stocks from 124 PMS strategies; an average of 25 stocks in a portfolio. The number of unique stocks across the portfolios was 627

Do note that PMS funds allow investors to take concentrated and personalized stocks bets, an approach which is not available in conventional investment vehicles such as mutual funds that pool funds from many investors.

A popular misconception about PMS is the funds are midcap and smallcap focussed. The PMSBazaar study challenges this myth. Our analysis revealed that on a market capitalization category wise allocation, 46.37% of PMS assets fall under largecap, midcap allocation is 24.09% and smallcap weight accounts for 22.11%.

These numbers will be different for each scheme given their mandates, but on an overall basis the PMS stock universe appears to have tilted towards largecaps while maintaining growth engines with good allocations to mid and smallcaps.

Cash cache

About 7% PMS assets are in cash right now, perhaps waiting to be deployed.Interestingly, Pelican - PE fund with 49.70% cash is the strategy with the highest cash allocated. It is followed by Compound Everyday - Long Term Focused Value (33.00%), Alchemy - High Growth (30.30%), Alchemy - Leaders (29.28%), Alchemy - High Growth Select Stock (29.07%), MOAT Financial Services - Sattvik Portfolio (22.23%), Globe Capital Market - Value (19.91%), Prabhudas Lilladher - Fortune Strategy (19.90%), Invesco - Rise (17.47%) and Ace Pro - Large Cap (17.17%).

Please note that value-conscious investment frameworks tend to move more into cash during phases when markets, in their opinion, run ahead of fundamentals. But sitting on high levels of cash for too long can bring down returns. Investors should also note that these numbers capture a single moment in the portfolio, and cash percentages could change the very next day upon deployment or distribution.

Sector span

It is well-known how the country's benchmark indices have close to 30% weight in financial stocks. Does the PMS industry show similar trends in their portfolios? The sector wise allocation data showed some interesting trends.

Financials are cumulatively the top weight across the 124 PMS strategies studied, with 23.87% exposure. Financials are the only sector that have not participated wholeheartedly and as inclusively in the rally since March 2020 due to various concerns. With a fair exposure to financials, PMS strategies could in the days to come out-perform when the current concerns prove to be over-blown.

Interestingly, Healthcare is the second most influential with 11.69% weight. Through and post the pandemic situation, healthcare has seen renewed focus and vigour from governments and people.

FMCG, given its slowdown-proof nature and typically strong balance sheet businesses, is the third biggest weight at 8.48%. They are followed by Chemicals (8.45%), Technology (7.42%), Cash (7.04%), Services (5.80%), Construction (4.93%), Engineering (4.79%), Automobile (4.52%), Energy (3.91%), Consumer Durable (3.13%), Metals (1.86%), Communication (1.69%), Textiles (1.23%) and Others (1.19%).

Mr. Popular

In terms of popular stocks across the 124 PMS portfolios, there are some fascinating takeaways for stakeholders.

India's largest bank by market value i.e. HDFC Bank Ltd. is the most popular PMS stock by virtue of its presence in as many as 62 portfolios. ICICI Bank Ltd. is a close second with presence in 61 portfolios. Reliance Industries Ltd comes third (46), Bajaj Finance Limited is fourth (37), and Infosys Ltd is fifth (37).

Bharti Airtel Ltd. is the sixth most popular PMS stock (36), followed by HDFC Life Insurance Company Limited (33), Kotak Mahindra Bank Ltd. (32), Titan Company Limited (30) and Divi's Laboratories Ltd. (28).

Interestingly, the biggest company by mcap - TCS - is not in the top-10 list. Similarly, Hindustan Unilever (HUL), HDFC, and ITC are conspicuous by their absence. They are ranked lower in the popular chart across PMS funds.

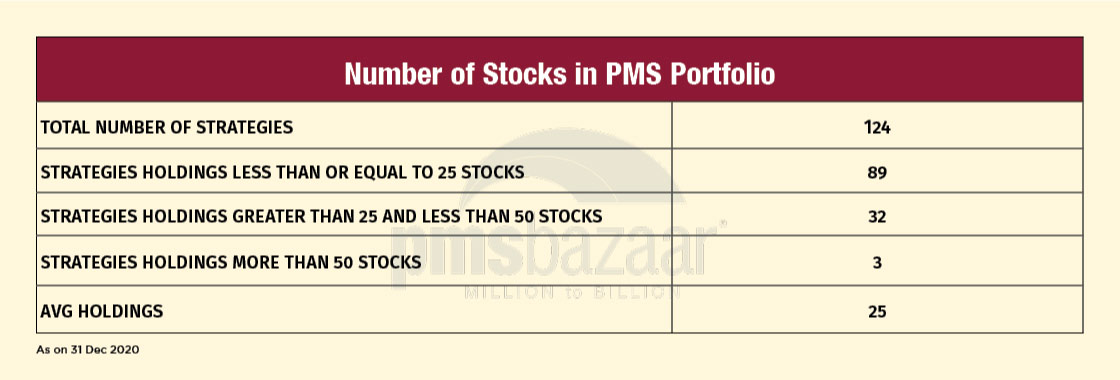

In terms of portfolio concentration, PMSBazaar study found 89 strategies holding less than or equal to 25 stocks. There were 32 strategies with holdings greater than 25 and less than 50 stocks. There are only 3 PMS strategies with holdings of more than 50 stocks.

The average number of holdings in PMSes is 25. Conventional portfolio management know-how also says that the number of stocks in a portfolio should ideally between 15 to 25, depending on the investment strategy.

In terms of highest allocation to a single stock in percentage terms, Aarti Industries Ltd takes the cake with one strategy having 23.26% allocation. It is followed by Bajaj Finance Limited (21.12%), Intellect Design Arena Ltd (20.72%), ICICI Bank Ltd. (19.70%), Sun Pharmaceutical Industries Ltd. (18.09%), HDFC Bank Ltd. (18.08%), Greenpanel Industries Limited (16.05%), SBI Life Insurance Company Limited (15.86%),Divis Laboratories (15.42%), ITC Limited (14.97%)

Do remember that thematic, sector and strategies running concentrated bets tend to have stocks with very high allocation.

Recent Blogs

Flat Markets, Wide Outcomes: How 484 PMS Strategies Performed in Dec 2025

December 2025 was a month where market returns stayed close to flat, with the Nifty 50 TRI at -0.28% and the BSE 500 TRI at -0.24%.

Equity Markets 2026: Outlook, Risks and Strategy

PMS Bazaar recently organized a webinar titled “Equity Markets 2026: Outlook, Risks and Strategy,” which featured Mr. Ashish Chaturmohta, MD & Fund Manager – APEX PMS, JM Financial Limited. This blog covers the important points shared in this insightful webinar.

MICRO CAPS: The Dark Horses of the Indian Equity Market

PMS Bazaar recently organized a webinar titled “MICRO CAPS: The Dark Horses of the Indian Equity Market,” which featured Mr. Rishi Agarwal and Mr. Adheesh Kabra, both Co-Founders and Fund Managers, Aarth AIF. This blog covers the important points shared in this insightful webinar.

Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy

PMS Bazaar recently organized a webinar titled “Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy,” which featured Mr.Anunaya Kumar, President – Sales and Distribution ASK Investment Managers Limited. This blog covers the important points shared in this insightful webinar.

.jpg)

Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS

PMS Bazaar recently organized a webinar titled “Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS,” which featured Mr. Karan Bhatia, Co-Founder and Co-Fund Manager , Pricebridge Honeycomb ETF PMs. This blog covers the important points shared in this insightful webinar.

Spot the Trouble: Red Flags in Equity Investment Analysis

PMS Bazaar recently organized a webinar titled “Spot the Trouble: Red Flags in Equity Investment Analysis,” which featured Mr. Arpit Shah, Co-Founder & Director, Care Portfolio Managers. This blog covers the important points shared in this insightful webinar.

Long-Only AIFs Rebound Sharply in October; Long-Short Strategies Lag Despite Lower Volatility

106 long-only AIFs averaged 3.68% vs 32 long-short AIFs at 2.7%; only 24–31% of funds beat key indices

Markets log strongest monthly gains in 7 months; PMS performance turns near-uniform in October

Nifty 50 TRI gained 4.62%, BSE 500 TRI rose 4.27%; 415 of 427 equity PMSes ended positive