Covid-19 induced selling had given a once-in-decade opportunity for patient investors

Remember those terrible days in March 2020? Within a few sessions, the Sensex had slipped to low of 25,981.24 and the sentiment on the street was bearish. Despite the fact that coronavirus cases in India had just started emerging, those days were marked by extreme panic. While markets slightly recovered by the end of March, investors were shell-shocked by the ferocity of the downturn.

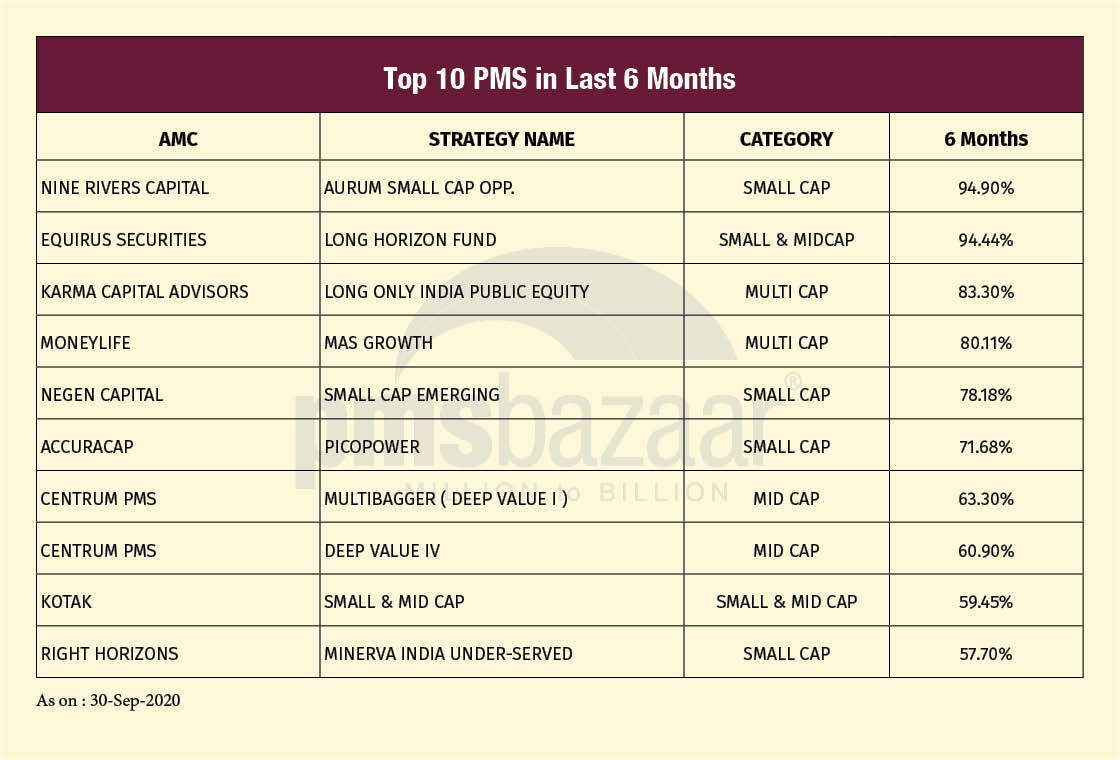

And, then it happened. Seeds of recovery were sown. Fast forward six months, and the results are for all to see. PMS products have proved to be a good capturing tool of the upside. As PMSes rebounded from March lows, investors in top performing strategies are sitting on a cool 80-95% gain. The 'panic' in March has become 'profit' by September, and those who lapped up the once-in-a-decade opportunity have gained out-sized rewards for their conviction and patience. Read on to know more.

Study details

In this article, we are taking a look at 6 PMS categories tracked by PMS Bazaar. In total there are 150 strategies across Largecap, Large & Midcap, Midcap, Multicap, Smallcap, and Thematic segments.

One reason to take these 6 PMS categories is because we can also compare how the same 6 mutual fund categories (272 actively managed schemes including open and closed-ended) have done. Do note that PMS average as well as strategy specific returns contain half a dozen schemes with return reported pre-fees.

Before we start, readers must know that Nifty 50 in the six months ended September 30, 2020 delivered 30.8% gain. Nifty Midcap 100 index bounced back with 45% gain. BSE Smallcap index was the best, with 54.7% return. These numbers can serve as benchmarks.

PMS Bazaar does not encourage or entertain performance analysis or investing with extremely short horizons such as 6 months. PMS as a product requires at least 5 years of patience. The goal of the article is to show that investors who are patient and ignore noise usually remain in good stead despite one-off market turbulences.

Rocking returns

Smallcap - The best performing PMS category was undoubtedly Smallcap. The 12 strategies gave the category an average gain of 52.5%. This is in comparison to 47.6% average gain notched up by 46 actively managed smallcap schemes. Leading from the PMS front are Nine Rivers Capital Aurum Small Cap Opp. (up 94.9%), Negen Capital Emerging (up 78.18%) and AccuraCap Picopower (up 71.68%). Do note that 4 of 12 Smallcap PMSes beat the BSE Smallcap index. In the Small & Midcap category, the 8 strategies average gain was 50.09%. Equirus Long Horizon Fund up 94.44%,Kotak Small & Midcap up 59.45% and Motilal Oswal IOP V2 up 57.03%

Midcap - In the last 6 months, the 3rd best performing PMS category was Midcap strategy with an average 44.25%, for 14 strategies. In comparison, Midcap mutual funds (actively managed schemes) have a category average of 37.58%. The top 3 PMS Midcap schemes all belonged to Centrum - Multibagger (Deep Value I) up 63.30%, Deep Value IV up 60.90% and Good To Great up 55.70%. Do note that 5 out of 14 Midcap PMSes beat the Nifty Midcap 100 index.

Multicap - The 98 PMS schemes that classify as Multicap gave a six-month return of 32.25%, which is again higher than the MF Multicap category average of 27.3% clocked by data from 94 schemes. Leading from the PMS front are Karma Capital Advisors Long Only India Public Equity up 83.30%, Moneylife MAS Growth up 80.11% and Asit C Mehta Investment Intermediates ACE up 53.80%. If BSE 500 index’s 33.8% gain in six-months is taken as a yardstick, then 35 out of 98 Multicap PMSes out-performed the benchmark.

Thematic - The thematic segment in PMS has only 4 schemes. The category average is 31.2% as far as 6-month data is concerned. The average gain of PMSes is a tad lower than the thematic MF category gain of 31.85% in the same time period. The two best performing thematic PMS strategies are both from Green Portfolio - Dividend Yield strategy up 44.16% and Green Portfolio MNC Advantage up 32.22%.

Large & Midcap - Like the Thematic segment in PMS, the Large & Midcap space is also quite small with just 3 schemes. Bonana Growth gave 6-month gain of 41.21%, Emkay Lead PMS gave 21.50% return and LIC MF Value Equity+ was up 15.68%. In comparison, the 28-scheme strong Large & Midcap MF basket clocked an average six-month gain of 31.49%.

Largecap - There are 19 Largecap PMS strategies tracked by PMS Bazaar. The six-month average gain of Largecap PMSes stood at 25.06%, which is a tad higher than the 24.78% gain notched up by 48-fund strong Largecap MFs. The 3 best performing Largecap PMS strategies are Asit C Mehta Investment Intermediaries ACE 50 (up 40.80%), ICICI Pru Largecap Portfolio (up 34.72%) and Varanium Capital Advisors Large Cap Focused Fund (up 34.20%). Do note that if Nifty’s 30.8% in the last 6 months is the benchmark, then only 3 of 19 Largecap PMSes delivered alpha.

Recent Blogs

MICRO CAPS: The Dark Horses of the Indian Equity Market

PMS Bazaar recently organized a webinar titled “MICRO CAPS: The Dark Horses of the Indian Equity Market,” which featured Mr. Rishi Agarwal and Mr. Adheesh Kabra, both Co-Founders and Fund Managers, Aarth AIF. This blog covers the important points shared in this insightful webinar.

Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy

PMS Bazaar recently organized a webinar titled “Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy,” which featured Mr.Anunaya Kumar, President – Sales and Distribution ASK Investment Managers Limited. This blog covers the important points shared in this insightful webinar.

.jpg)

Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS

PMS Bazaar recently organized a webinar titled “Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS,” which featured Mr. Karan Bhatia, Co-Founder and Co-Fund Manager , Pricebridge Honeycomb ETF PMs. This blog covers the important points shared in this insightful webinar.

Spot the Trouble: Red Flags in Equity Investment Analysis

PMS Bazaar recently organized a webinar titled “Spot the Trouble: Red Flags in Equity Investment Analysis,” which featured Mr. Arpit Shah, Co-Founder & Director, Care Portfolio Managers. This blog covers the important points shared in this insightful webinar.

Long-Only AIFs Rebound Sharply in October; Long-Short Strategies Lag Despite Lower Volatility

106 long-only AIFs averaged 3.68% vs 32 long-short AIFs at 2.7%; only 24–31% of funds beat key indices

Markets log strongest monthly gains in 7 months; PMS performance turns near-uniform in October

Nifty 50 TRI gained 4.62%, BSE 500 TRI rose 4.27%; 415 of 427 equity PMSes ended positive

How SMEs are Shaping India’s Investment Landscape?

PMS Bazaar recently organized a webinar titled “How SMEs are Shaping India’s Investment Landscape?” which featured Mr. Shrikant Goyal, Fund Manager, GetFive Opportunity Fund.

Stable Income from Indian REITs and InvITs

PMS Bazaar recently organized a webinar titled “Stable Income from Indian REITs and InvITs,” which featured Mr. Rahul Jain, Head of Public Markets, Alt.