While January’s numbers were largely in the red, investors should focus on long-term performance and diversification strategies to ride out volatility

January 2025 proved to be a tough first month of the calendar year for Portfolio Management Services (PMS) strategies, reflecting broader market volatility. Out of 401 PMS strategies analysed, only 12 managed to outperform the Nifty 50 TRI (-0.45%), while 57 surpassed the S&P BSE 500 TRI (-3.43%). In fact, only half a dozen PMS strategies clocked positive returns. The best-performing PMS strategy delivered a modest 1.10% return, while the worst saw a steep -20.33% drop.

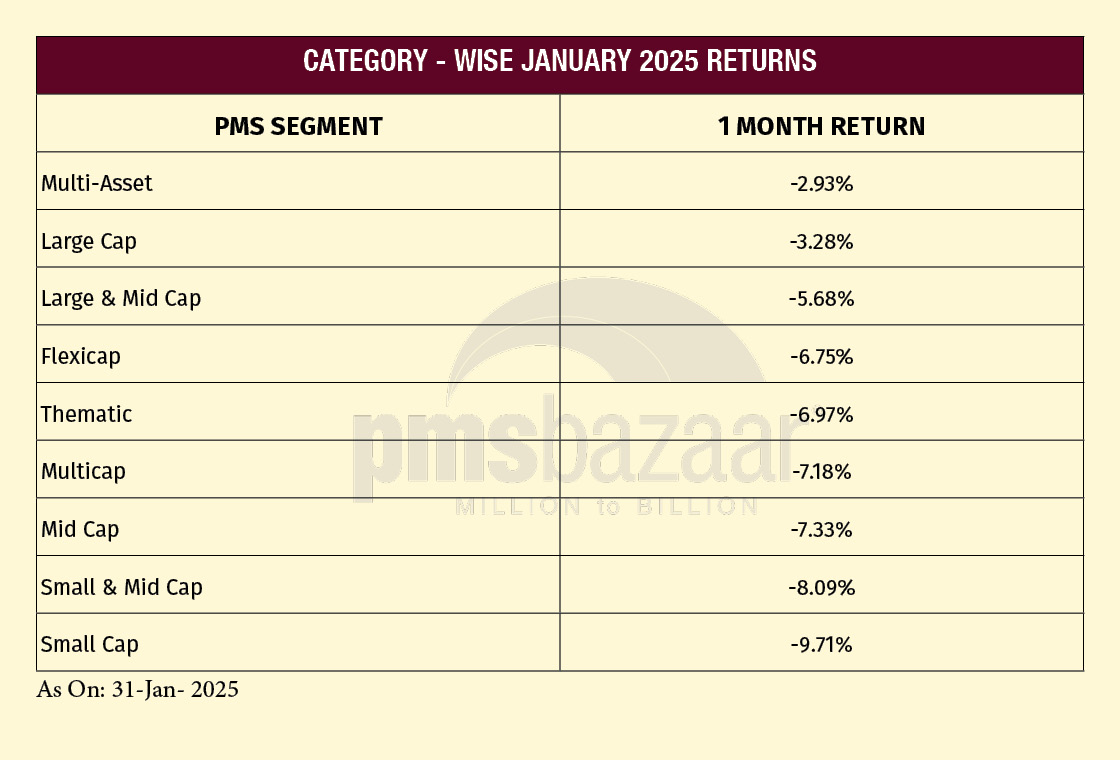

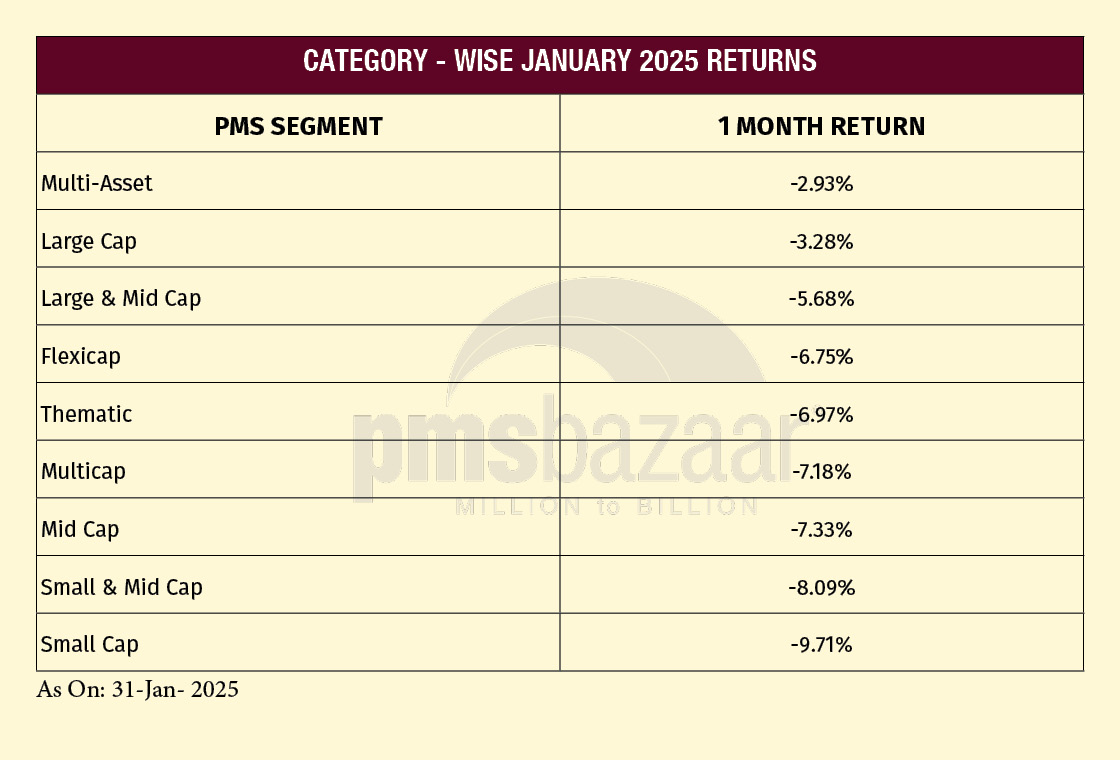

Despite the market downturn, select strategies demonstrated resilience, particularly in the multi-asset and large-cap categories. The multi-asset segment, with an average return of -2.93%, fared better than the broader market (BSE 500), with 13 schemes beating the index, according to PMS Bazaar data. The small-cap category faced the sharpest correction (-9.71%), highlighting the challenges in riskier segments.

This article explores the top-performing PMS strategies, category-wise returns, and how leading asset management companies (AMCs) navigated the challenging landscape. While January’s numbers were largely in the red, investors should focus on long-term performance and diversification strategies to ride out volatility. Do note the below numbers are absolute 1-month returns are as on 31 January 2025. Returns are calculated using the Time Weighted Rate of Return (TWRR) method and as provided by the respective AMCs.

Top-10 Performing PMS Strategies in January 2025

Amid the downturn, a handful of PMS strategies delivered relatively strong performance, demonstrating resilience.

Rajnish Garg-founded Invasset’s Growth Pro Max, a multi-cap strategy, was the top performer with a 1.10% return. Invasset leverages its proprietary AAID (Advanced Algorithms for Investment Decisions) to identify high-potential companies and sectors, aiming for consistent alpha generation through data-driven insights and strategic investment decisions.

Siddhartha Bhaiya-founded Aequitas Investment’s India Opportunities Product followed with 0.98%, outperforming other small-cap strategies. The strategy aims for capital appreciation by investing in high-quality Indian equities with strong governance. Using a bottom-up approach, it selects high-conviction ideas across market caps. The portfolio, comprising 15-20 stocks, balances diversification and meaningful exposure, focusing on companies with superior return ratios and attractive valuations.

Large-cap strategies such as Pelican Holdings’ PE Fund (0.73%) and Marcellus Investment Managers’ Kings of Capital (0.39%) also showed stability.

Despite a weak market, these strategies managed to contain downside risks better than peers. Large-cap strategies benefited from their exposure to more stable blue-chip stocks, while multi-cap and small-cap winners capitalised on selective stock picking. Notably, multi-asset strategies also held up better, highlighting the benefits of diversification.

Top-10 Performers

Segment-wise Top performers

January 2025 was a challenging month across all PMS strategy categories, with negative returns across the board. While large-cap strategies provided relative stability, small-cap and midcap strategies faced sharp declines. The multi-asset category (-2.93%) was the best-performing segment, while small-cap PMS (-9.71%) bore the brunt of the downturn.

The extent of underperformance across segments indicates the broad-based market correction, with midcap and small-cap stocks facing severe pressure. Even within the best-performing category (multi-asset), only 4 out of 20 strategies delivered positive returns, while in high-risk segments like flexicap, thematic, and small & midcap PMS strategies, none of the funds posted gains.

Despite the weak performance, select strategies within each category managed to cushion the downside. Below is a detailed breakdown of category-wise performance for January 2025.

Category-Wise January 2025 returns

Each segment faced unique challenges. Large-cap strategies weathered the correction better due to their exposure to fundamentally strong blue-chip stocks. On the other hand, small-cap and midcap PMS strategies struggled, with heightened volatility eroding gains.

Multi-asset strategies, which include equity, debt, and commodities, stood out with better relative performance, reflecting the importance of diversification in weak market conditions.

The next sections will provide a detailed breakdown of each category, including top-performing strategies.

Multiasset PMSes

The multi-asset PMS category delivered an average return of -2.93% in January 2025, making it the most resilient PMS segment during a difficult month for equity markets.

While the category still posted negative returns, it performed better than broader equity benchmarks, particularly the S&P BSE 500 TRI (-3.43%), reinforcing the benefits of asset diversification.

Compared to multi-asset indices, however, PMS strategies struggled, as the NSE Multi Asset Index 1 fell by -1.08%, while the NSE Multi Asset Index 2 declined by -1.11%.

Out of 20 multi-asset PMS strategies, only four managed to deliver positive returns. Despite the challenges, 13 strategies outperformed the BSE 500 TRI, while five managed to do better than the Nifty 50 TRI (-0.45%). This suggests that while equity-heavy PMS strategies suffered sharp corrections, multi-asset approaches provided some cushion due to exposure to fixed income and alternative asset classes.

Among the top-performing multi-asset PMS strategies, ithought Financial Consulting’s

SPHERE strategy delivered a 1.42% return, making it the strongest performer in this category. The firm’s

NIO strategy also posted a 0.67% return, securing its position as the second-best performer. Eklavya Capital Advisors’

Long-Term Value strategy rounded off the top three, returning 0.42% for the month. These strategies benefitted from a combination of equity selection and alternative asset allocation, helping them navigate market volatility more effectively than their peers.

While multi-asset PMS strategies did not escape the broader downturn, they proved less vulnerable compared to equity-only approaches. Their ability to mitigate losses highlights the value of diversification, particularly during market stress. As uncertainty persists, multi-asset strategies may continue to offer investors better downside protection than purely equity-focussed funds.

Top-5 Performers

Largecap PMSes

The largecap PMS category recorded an average return of -3.28% in January 2025, reflecting the market downturn but faring better than several other PMS categories. The Nifty 50 TRI (-0.45%) provided a more stable benchmark, while the S&P BSE 500 TRI declined by -3.43%, against which 11 out of 27 largecap PMS strategies managed to outperform. Only three strategies posted positive returns, highlighting the difficulty of navigating market volatility within the large-cap space.

Among the best-performing strategies, Pelican Holdings’

PE Fund led with a 0.73% return, significantly outperforming both benchmark indices. Marcellus Investment Managers’

Kings of Capital strategy followed with a 0.39% gain, demonstrating its focus on fundamentally strong financial sector stocks. ithought Financial Consulting’s

TRUBLU strategy, delivering 0.22%, rounded out the top three performers in this category. These strategies benefited from selective stock-picking in defensive sectors, helping them withstand the market decline better than their peers.

Despite the negative category-wide performance, four PMS strategies still outperformed the Nifty 50 TRI, proving that large-cap PMS managers with disciplined portfolio positioning could limit downside risks. With market uncertainty continuing, large-cap PMS strategies remain a preferred choice for investors seeking relatively lower volatility and stable returns compared to mid and small-cap counterparts.

Top-5 Performers

Large & Midcap PMSes

The large and mid-cap PMS category struggled in January 2025, posting an average return of -5.68%. None of the 18 tracked strategies delivered a positive return, underscoring the difficulties faced by PMS managers in navigating the volatility of midcap stocks. While the Nifty 50 TRI declined by -0.45% and the S&P BSE 500 TRI fell by -3.43%, only five large and mid-cap PMS strategies managed to outperform the BSE 500 TRI, and none outperformed the Nifty 50 TRI.

The best-performing PMS strategy in this category was Jama Wealth Asset Management’s

Maxiom PMS – JEWEL, which limited losses to -1.86%, outperforming its peers. Care Portfolio Managers’

Large and Midcap Strategy, with a -1.88% return, followed closely behind, benefitting from a selective approach in high-quality midcap names. Ayan Analytics’

Price Bridge Upswing strategy, which declined by -2.50%, rounded out the top three, demonstrating better risk management in a challenging environment.

The steep correction in this segment reflects the broader weakness in midcap stocks, which tend to experience sharper drawdowns during market downturns. The category’s exposure to both large and midcap stocks was insufficient to cushion the fall, as midcaps faced higher volatility. While some strategies showed relative strength, the overall sentiment in this space remains cautious.

Top-5 Performers

Flexicap PMSes

The flexicap PMS category had a difficult January 2025, recording an average return of -6.75%. Out of the 62 strategies tracked, none delivered positive returns, highlighting the broad-based correction across market capitalisations.

While the Nifty 50 TRI declined by -0.45% and the S&P BSE 500 TRI fell by -3.43%, only 12 flexicap PMS strategies managed to outperform the BSE 500 TRI, and just one strategy was able to do better than the Nifty 50 TRI.

Among the top-performing PMS strategies in this category, PRPEdge Wealth’s

Alphaa MPT Plus Fund delivered the best performance at -0.01%, managing to hold steady despite market turbulence. Unique Asset Management’s

Focused Fund, which declined by -0.65%, followed closely, benefitting from a concentrated approach in selective stocks. Eklavya Capital Advisors’

Equity Strategy, down -1.13%, rounded out the top three performers.

The steep drawdown in flexicap PMS strategies reflects the broad-based decline across large, mid, and small-cap stocks, which the category typically invests in. With no capitalisation restrictions, flexicap strategies faced challenges in both high-beta midcap stocks and weak sentiment in larger names.

Top 5 Performers

Thematic PMSes

The thematic PMS category posted an average return of -6.97% in January 2025. With 19 strategies tracked, none managed to post a positive return, reflecting the broad-based correction across specific investment themes.

While the Nifty 50 TRI declined by -0.45% and the S&P BSE 500 TRI fell by -3.43%, only two thematic PMS strategies outperformed the BSE 500 TRI, and just one strategy beat the Nifty 50 TRI, highlighting the difficulty in generating alpha through sector or theme-based allocations.

The best-performing strategy in this segment was InCred Asset Management’s

InCred Focused Healthcare Portfolio, which limited losses to -0.26%. The healthcare theme demonstrated some resilience in a weak market, benefitting from the sector’s defensive characteristics. Green Portfolio’s

Dividend Yield strategy, which declined by -2.46%, was the second-best performer, with a focus on high-yielding stocks helping to cushion losses. Invesco Asset Management’s

RISE strategy, down -3.47%, rounded out the top three in this category.

The sharp underperformance of thematic PMS strategies suggests that concentrated bets on specific sectors struggled to hold up amid broader market weakness. Strategies focused on high-growth themes faced the worst drawdowns as investors moved towards defensive plays. Given the ongoing market volatility, the ability of thematic strategies to recover will depend on sectoral tailwinds and macroeconomic stability.

Top-5 Performers

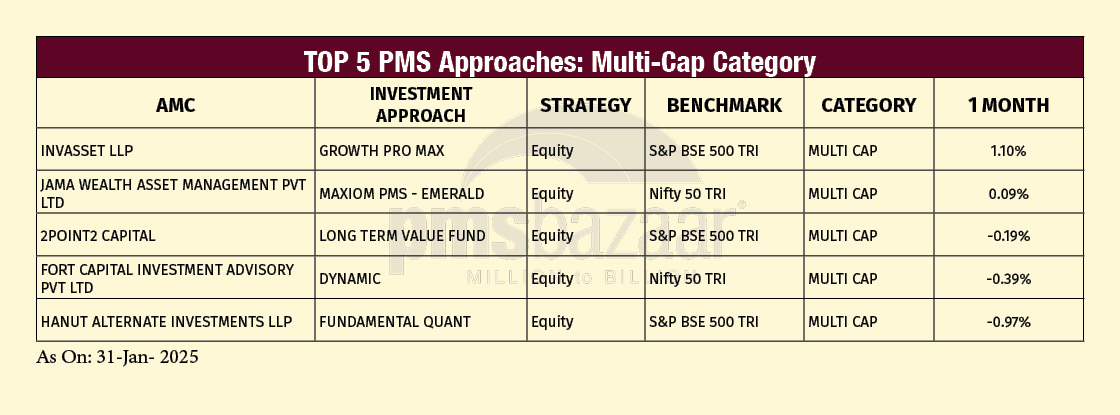

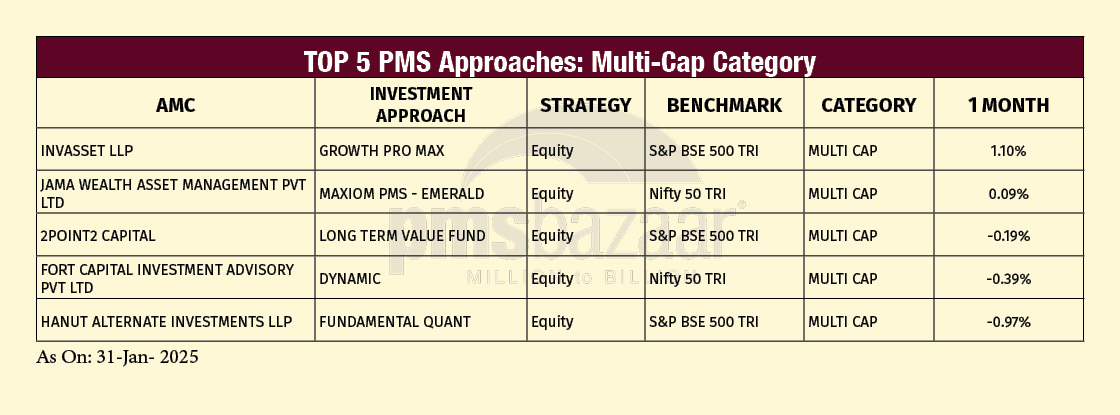

Multicap PMSes

The multicap PMS category recorded an average return of -7.18%, reflecting the sharp correction across the broader market. With 176 strategies tracked, it was one of the largest PMS segments, yet only two strategies managed to post positive returns.

While the Nifty 50 TRI declined by -0.45% and the S&P BSE 500 TRI fell by -3.43%, 19 multicap PMS strategies outperformed the BSE 500 TRI, and just four strategies beat the Nifty 50 TRI.

The top-performing PMS strategy in this category was Invasset’s

Growth Pro Max, delivering a 1.10% return, making it the only multicap strategy with a meaningful gain. Jama Wealth’s

Maxiom PMS – EMERALD, which posted a 0.09% return, was the only other strategy that managed to stay in positive territory. 2Point2 Capital’s

Long-Term Value Fund, down -0.19%, was the third-best performer, containing losses better than most.

The significant underperformance of the multicap category suggests that its exposure to mid and small-cap stocks led to steeper drawdowns. Many strategies struggled to protect capital, given the broad-based sell-off across market capitalizations. While a handful of strategies managed to outperform the benchmarks, the majority suffered deeper losses, indicating the difficulty of navigating volatility with a diversified approach in a down market.

Top-5 Performers

Midcap PMSes

The midcap PMS category delivered an average return of -7.33%, making it one of the worst-performing segments in January 2025. With 23 strategies tracked, none posted a positive return, reflecting the sharp correction in midcap stocks.

While the Nifty 50 TRI fell by -0.45% and the S&P BSE 500 TRI declined by -3.43%, only one midcap PMS strategy managed to outperform the BSE 500 TRI, and none outperformed the Nifty 50 TRI.

The best-performing midcap PMS strategy was Marcellus Investment Managers’

Rising Giants Portfolio, which limited losses to -2.16%, demonstrating resilience in a weak market. Concept Investwell’s

Marvel strategy, down -3.89%, followed as the second-best performer, benefiting from a selective approach in midcap stocks. Emkay Investment Managers'

Gems strategy, which posted a -4.00% return, rounded out the top three performers in the category.

The steep losses across midcap PMS strategies reflect the broader trend of heightened volatility in the midcap space. The lack of positive returns across the category highlights the difficulty fund managers faced in containing downside risks. With only one strategy outperforming the BSE 500 TRI, it is evident that midcap stocks faced significant selling pressure, making it challenging for PMS managers to protect capital.

Top-5 Performers

Small and midcap PMSes

The small and midcap PMS category faced one of the sharpest corrections in January 2025, with an average return of -8.09%. Out of 44 strategies tracked, none managed to deliver a positive return, reflecting the severe downturn in the broader small and midcap segments.

While the Nifty 50 TRI declined by -0.45% and the S&P BSE 500 TRI fell by -3.43%, only two small and midcap PMS strategies managed to outperform the BSE 500 TRI, and none outperformed the Nifty 50 TRI.

The best-performing strategy in this category was Fyers Asset Management’s

Fyers Genesis Fund, which limited losses to -0.65%, significantly outperforming most peers. Wallfort PMS & Advisory’s

Diversified Fund, with a -3.06% return, was the second-best performer, benefiting from a diversified approach that helped cushion losses. Green Lantern Capital’s

Growth Fund, which declined by -4.23%, was the third-best performer in this segment.

The steep drawdowns across small and midcap strategies highlight the risk associated with investing in this space, particularly in a volatile market. While some funds managed to contain losses better than others, the category’s widespread underperformance underscores the difficulty of navigating sharp corrections in lower market capitalisations.

Top-5 Performers

Smallcap PMSes

The smallcap PMS category faced a sharp correction in January 2025, posting an average return of -9.71%, making it the worst-performing PMS segment for the month. Out of 25 strategies tracked, only one PMS strategy managed a positive return, while the rest saw steep losses. Compared to the Nifty 50 TRI (-0.45%) and the S&P BSE 500 TRI (-3.43%), only one small-cap PMS strategy outperformed both benchmarks, highlighting the high volatility and drawdowns in this space.

The best-performing strategy was Aequitas Investment Consultancy’s India Opportunities Product, delivering a 0.98% return, making it the only smallcap PMS strategy to stay in the green. Sundaram Alternate Assets’ Rising Stars strategy, which declined by -3.72%, was the second-best performer, followed by Fort Capital Investment Advisory’s Value Fund, which posted a -4.49% return.

The steep losses in the small-cap PMS category reflect the broader sentiment shift towards risk aversion, as small-cap stocks typically face greater volatility and liquidity constraints during market downturns. Many of these strategies rely on high-growth, high-beta stocks, which tend to underperform in periods of market stress. A potential recovery in small-cap PMS performance will likely depend on improving risk appetite and a more favorable market environment.

Top-5 Performers

Outlook

India’s economic growth outlook remains strong, with Bloomberg consensus projecting 6.5% annual GDP growth, the highest among major economies. While the first half of FY25 saw a slowdown, NSO estimates and high-frequency indicators suggest a recovery in the second half. New orders, agricultural exports, rural wages, industrial production, steel output, auto sales, and tax collections have shown signs of improvement after a weak second quarter.

The Indian 10-year bond yield remains stable at 6.8%, supported by fiscal discipline. Tax reforms in Budget 2025, including revised slabs under the new tax regime, are set to boost disposable incomes for 30 million salaried households, increasing consumption in sectors like autos, durables, asset management, and travel.

The US 10-year yield has risen from 3.7% to 4.5%, while India’s remains steady, narrowing the yield gap and contributing to a 3%-rupee depreciation. After years of strong earnings growth, FY25 earnings are expected to moderate, weighing on valuations. However, India’s long-term fundamentals remain robust, and despite global uncertainties, PMS strategies continue to offer investment opportunities in a resilient domestic economy.

.jpg)

.jpg)