After an extraordinary FY24, PMS strategies across segments saw a reset in FY2025, with returns normalising amid market volatility, mid & smallcap corrections, and selective sector resilience.

After a blockbuster FY2024, PMS strategies in India faced a far tougher landscape in FY2025. The broader market, represented by the Nifty 50 TRI and BSE 500 TRI, delivered muted gains of 6.65% and 5.96% respectively, a sharp contrast to the double-digit returns of the previous year. Against this backdrop, equity PMS strategies averaged 6.81% in FY2025, marking a major reset from the 46.28% average return seen in FY2024. Mid & small-cap volatility, sectoral churn, and global headwinds made alpha generation significantly more challenging. This article explores how different PMS categories managed the year and what the FY2025 experience teaches investors about setting realistic expectations in dynamic market conditions.

Portfolio Management Services

Portfolio Management Services (PMS) offer investors professionally managed equity portfolios with higher concentration and customisation than traditional investment choices such as mutual funds. With a minimum investment of ₹50 lakh, PMS strategies cater to high-net-worth individuals seeking differentiated exposure across largecap, midcap, multicap, small-cap, thematic, and sector-focused strategies. Unlike pooled funds, PMS investments are held in the investor’s name, allowing for greater transparency and control. Returns can vary widely depending on market conditions and the manager’s approach. This means strategy selection and time horizon are critical to long-term outcomes.

Category-Wise Summary of PMS Performance in FY2025

PMS strategies in FY2025 reflected the market's shift from exuberance to caution. The average equity PMS return for the year stood at 6.81%, a steep drop from 46.28% in FY2024. Most categories underperformed their previous year’s highs, with wide gaps seen particularly in midcap and smallcap strategies. Here’s a breakdown of how various PMS categories fared. We tracked over 370 strategies for this financial year exercise.

Large & Midcap PMSes strategies averaged 4.66%, far lower than FY2024’s 45.83%.

Largecap PMSes delivered 5.52%, compared to 37.43% in the previous year.

Midcap PMSes, once a stronghold of alpha, returned only 4.19% versus 42.02% earlier.

Multicap & Flexicap PMSes stood at 6.07% — down sharply from 47.43%.

Sector-focused PMSes returned 7.35%, also trailing FY2024’s 36.74%.

Small & Midcap PMSes held up relatively better at 11.07%, but still fell from 50.57%.

Smallcap PMSes averaged 8.12% versus 49.41% in FY2024.

Thematic PMS strategies stood out with 12.11%, down from 43.08% but still leading all segments in FY2025.

This convergence across categories underscores how sharp trend reversals and lack of broad-based market leadership made consistent alpha generation difficult.

Here is a snapshot of different PMS categories and their FY25 vs FY24 performance:

Top-10 PMS Strategy Performers of FY2025

A handful of PMS strategies stood out in an otherwise subdued year for equity portfolios. Leading the charts was InCred Asset Management’s Incred Focused Healthcare Portfolio, a thematic strategy that delivered a stellar 53.64% return in FY2025. Close behind was Equitree Capital Advisors’ Emerging Opportunities, a small-cap focussed strategy that posted 38.26%. InCred’s Healthcare Portfolio also featured in the top three with a 36.88% return.

Among diversified strategies, Wallfort PMS’ Diversified Fund returned 35.62%, while Stallion Asset’s Core Fund, under the multicap & flexicap category, delivered 30.57%. Wallfort’s Ameya Fund, SVAN Investment’s Velocity, and Green Lantern’s Growth Fund — all in the small & midcap space — delivered between 24% and 26%. Composite Investments’ Emerging Star Fund and Counter Cyclical Investments’ Diversified Long Term Value strategy rounded out the top ten with returns of 24.00% and 23.06%, respectively.

Here is a snapshot of the top-10 performers.

Interestingly, many of the top PMS performers from FY2024 saw muted outcomes in FY2025. Invasset’s Growth Pro Max, which led last year with a 128.47% return, managed only 6.13%. Green Lantern’s Growth Fund held up better, delivering 24.62%. Other high-fliers like Asit C Mehta’s multicap and midcap strategies and Samvitti’s Active Alpha saw returns trickle down to single digits. Equitree Capital’s Emerging Opportunities bucked the trend, remaining reasonably strong with a 38.26% return in FY2025. The sharp reset in returns shows that past outperformance is no guarantee of future success, especially in volatile and shifting market environments. Hence, one year performance should not be a major pillar in strategy selection.

Large & Midcap PMSes

Large & Midcap PMS strategies struggled in FY2025, delivering an average return of 4.66%, significantly lower than the sharp 45.83% seen in FY2024. This sharp reset reflected the broader cooling off in large and midcap stocks after the strong rally of the previous year.

While a few strategies managed to post double-digit returns led by SageOne’s Large and Midcap Portfolio at 14.90% and Concept Investwell’s Marvel at 14.13% most strategies ended up in low single digits. Several even posted negative returns.

The wide spread in performance shows that active stock picking made a meaningful difference, but overall, the category found it difficult to generate strong alpha against a volatile large and midcap backdrop during FY2025.

Here is a snapshot of the top 5 performers :

Large cap PMSes

Largecap PMS strategies delivered an average return of 5.52% in FY2025, reflecting a subdued outcome compared to the 37.43% average achieved in FY2024. The overall performance aligned closely with the Nifty 50 TRI's return of 6.65%, making it a year of modest relative returns for most large-cap managers.

Despite the headwinds, some strategies stood out. Marcellus’ Kings of Capital led the pack with 20.02%, followed by Standard Chartered’s Long Term Value Compounder at 16.80% and Narnolia’s Large Cap at 13.98%. A broad group of strategies posted mid-single-digit returns, including offerings from JM Financial, ICICI Prudential, Ambit, and Capitalmind.

However, dispersion within the category was notable, with several strategies posting negative returns.

In essence, while a few large-cap managers captured selective alpha, the category overall reflected the market’s narrower breadth and limited upside during FY2025.

Here is a snapshot of the top 5 performers:

Midcap PMSes

Midcap PMS strategies faced a sharp deceleration in FY2025, averaging just 4.19% compared to a robust 42.02% in FY2024. Although several managers managed to stay in positive territory, the overall returns reflect the high volatility and drawdowns that hit the midcap segment during the second half of the year.

The top-performing strategy was Marcellus’ Rising Giants Portfolio, which returned 14.92%, followed by Right Horizons’ Super Value at 12.10% and Ambit’s Good and Clean at 10.75%. A few more strategies hovered around the 7–10% range, but most others delivered low single-digit returns. Notably, a cluster of midcap strategies ended the year in red.

The wide dispersion highlights that FY2025 was a stock-pickers’ market within midcaps, with outcomes hinging heavily on positioning through the correction months.

Here is a snapshot of the top 5 performers:

Small-cap PMSes

Small-cap PMS strategies delivered an average return of 8.12% in FY2025, a notable moderation from the 49.41% posted in FY2024. The year was marked by sharp corrections in the small-cap space, particularly in the second half, although some recovery was seen in March 2025.

Equitree Capital’s Emerging Opportunities led the category with a strong 38.26%, followed by Counter Cyclical’s Diversified Long Term Value at 23.06%, and Accuracap’s Dynamo at 21.67%. Aequitas, Right Horizons, and Alchemy also posted double-digit gains, highlighting resilience among a handful of managers.

On the other end, several strategies struggled. Nearly a quarter of listed small-cap PMS strategies posted returns below 1%.

Overall, FY2025 proved to be a test of conviction and timing for small-cap fund managers, with outcomes swinging sharply depending on entry points and exposure management.

Here is a snapshot of the top 5 performers:

Small & Midcap PMSes

Small & Midcap PMS strategies recorded an average return of 11.07% in FY2025, sharply lower than the exceptional 50.57% posted in FY2024. Yet within this broad category, some managers continued to deliver impressive outcomes despite the volatility that hit mid and smallcap segments post-September 2024.

Wallfort’s Diversified Fund topped the charts with a solid 35.62%, followed by its Ameya Fund at 26.13% and SVAN’s Velocity at 25.73%. Several other strategies from Green Lantern, Composite Investments, and Magadh Capital delivered returns in the 19–24% range.

The performance dispersion was wide. On one end, more than a dozen strategies delivered double-digit gains, while others ended in the red. Returns below 3% were not uncommon, even among portfolios managed by well-established firms.

FY2025 reminded investors that timing and exposure levels matter significantly in a category that inherently carries high risk and high reward.

Here is a snapshot of the top 5 performers:

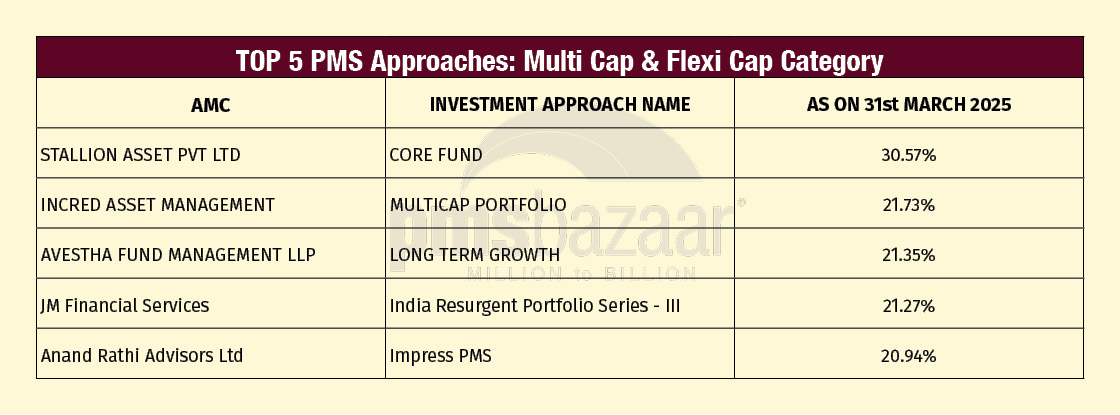

Multicap & Flexicap PMSes

With 220 strategies tracked, multicap and flexicap PMS offerings delivered an average return of 6.07% in FY2025. This was broadly in line with the Nifty50 TRI (6.65%) and BSE500 TRI (5.96%). However, this was a steep fall from FY2024’s average return of 47.43%, highlighting the impact of a high base, lower breadth, and muted midcap participation in the latter half of the year.

The top-performing fund for the financial year was Stallion Asset’s Core Fund, delivering an impressive return of 30.57%. It was followed by InCred Asset Management’s Multicap Portfolio with a return of 21.73%, closely trailed by Avestha Fund Management’s Long Term Growth Portfolio, which returned 21.35%.

Performance dispersion remained wide, from +30.57% at the top to below -11% at the bottom. Several strategies still managed double-digit gains by sticking to focused allocation themes or maintaining quality-biased portfolios. On the other hand, PMSes riding on valuation rerating or lower-quality beta gave back meaningful alpha.

FY2025 was a reminder that multicap PMSes thrive not merely on broad market rallies but on selective conviction. For investors, deeper scrutiny of process and portfolio health mattered more than chasing past-year winners.

Here is a snapshot of the top 5 performers:

Sector and Thematic PMSes

Sector-focussed PMS strategies delivered mixed results in FY2025. The ASK Financial Opportunities Portfolio led the category with a 15.59% return versus category return of 7.35%.

Here is a snapshot of the top 3 performers which are sector focused :

Thematic PMS strategies offered a broader spectrum. InCred’s Healthcare-focussed PMS topped the entire equity PMS universe with a 53.64% return. Several other strategies, such as dividend yield, digital disruption, and infra-linked themes like Build India, posted double-digit gains. At the other end, themes tied to ESG, early-stage innovation, and fintech struggled.

The dispersion in performance underlines the importance of timely theme selection and consistent execution. For investors, thematic and sector PMSes remain high-conviction plays i.e. they can outperform strongly but carry meaningful risk if the underlying narrative falters.

Here is a snapshot of the top 5 performers which are thematic focused :

Lessons from FY2025 for PMS Investors

FY2025 served as a timely reminder that PMS investing isn’t about chasing last year’s chart-toppers. The dramatic reset in returns across categories shows how market cycles can humble even the best-performing strategies.

For investors, the key lies in evaluating the process, not just past numbers. Consistency, conviction, and clarity in the fund manager’s approach matter far more than one-off highs. PMS is designed for high-net-worth investors with a long-term view: it’s not a shortcut to alpha but a vehicle for thoughtful, differentiated equity exposure.

The wide dispersion in FY2025 outcomes reinforces the need for patience, portfolio review, and an understanding that volatility is part of the journey. In short, a good PMS strategy is not one that always wins in every market, but one that stays true to its philosophy through the cycle.

Recent Blogs

MICRO CAPS: The Dark Horses of the Indian Equity Market

PMS Bazaar recently organized a webinar titled “MICRO CAPS: The Dark Horses of the Indian Equity Market,” which featured Mr. Rishi Agarwal and Mr. Adheesh Kabra, both Co-Founders and Fund Managers, Aarth AIF. This blog covers the important points shared in this insightful webinar.

Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy

PMS Bazaar recently organized a webinar titled “Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy,” which featured Mr.Anunaya Kumar, President – Sales and Distribution ASK Investment Managers Limited. This blog covers the important points shared in this insightful webinar.

.jpg)

Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS

PMS Bazaar recently organized a webinar titled “Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS,” which featured Mr. Karan Bhatia, Co-Founder and Co-Fund Manager , Pricebridge Honeycomb ETF PMs. This blog covers the important points shared in this insightful webinar.

Spot the Trouble: Red Flags in Equity Investment Analysis

PMS Bazaar recently organized a webinar titled “Spot the Trouble: Red Flags in Equity Investment Analysis,” which featured Mr. Arpit Shah, Co-Founder & Director, Care Portfolio Managers. This blog covers the important points shared in this insightful webinar.

Long-Only AIFs Rebound Sharply in October; Long-Short Strategies Lag Despite Lower Volatility

106 long-only AIFs averaged 3.68% vs 32 long-short AIFs at 2.7%; only 24–31% of funds beat key indices

Markets log strongest monthly gains in 7 months; PMS performance turns near-uniform in October

Nifty 50 TRI gained 4.62%, BSE 500 TRI rose 4.27%; 415 of 427 equity PMSes ended positive

How SMEs are Shaping India’s Investment Landscape?

PMS Bazaar recently organized a webinar titled “How SMEs are Shaping India’s Investment Landscape?” which featured Mr. Shrikant Goyal, Fund Manager, GetFive Opportunity Fund.

Stable Income from Indian REITs and InvITs

PMS Bazaar recently organized a webinar titled “Stable Income from Indian REITs and InvITs,” which featured Mr. Rahul Jain, Head of Public Markets, Alt.