133 PMS Strategies reported 205 unique stocks in their disclosed portfolios, with single-stock weight as high as 29.75% in a strategy. In this monthly insight piece, we take a detailed look at the most-owned stocks, unique picks, sectoral preferences and stock allocation weights for June 2020.

It is often said no price is too low for a bear and no price is too high for a bull. But when you are a portfolio manager of a PMS, one cannot let personal preferences take centre-stage. As the steward of investors' money, all decisions have to be taken with keeping in mind the mandate of strategy and in sync with stakeholder expectations. India's equity market has well and truly recovered from the harrowing days in March and is now firmly positioned. How have PMS managers positioned themselves? What is popular, and what is not? Which sector holds more sway than others. At PMSBazaar, we track 133 PMS strategies that have reported granular data on top stocks.

Universe of equity

According to data available of 133 PMS Strategies, portfolios have 665 securities that can be counted as top holdings. Do note that these 665 securities are not unique; the same stock can be present in multiple portfolios. In fact, there are 205 unique securities. Remember we are here taking a look at the top-5 holdings of each portfolio, not the entire list of securities.

At the end of June 2020, as many as 57 (27.8%) of them stocks fall in the Large Cap segment. The Mid Cap segment has 58 unique stocks (28.29%) and the Small Cap club has 86 unique stocks (41.95%). About 4 fall in the ETF/MF category.

Stocks most-owned

PMS managers' criteria for stock selection is determined by risk profile and assessment of high-quality businesses. Usually, a strategy may outperform in some years and underperform in others, but PMS managers rarely compromise when it comes to quality and growth over the long term in the Indian markets.

In May 2020, the 10 most-owned stocks were a heady mix of LargeCaps and Midcaps. The LargeCap shift is all too evident in June 2020. The most-owned stock is HDFC Bank (present in 52 portfolios), followed by Reliance Industries (36), ICICI Bank (34), Bharti Airtel (20), Bajaj Finance (17), Infosys (17), Hindustan Unilever (16), Kotak Mahindra Bank (15), Divis Laboratories (14) and Avenue Supermarts (11), according to the PMSBazaar study. Looking from a sectoral prism, most-owned stocks are from Pharma, Chemicals, IT, FMCG, NBFC, Retail and Banks.

All the 3 Midcaps in May 2020 snapshot viz. Aarti Industries, P I Industries and Sanofi India have slipped in terms of the number of portfolios where they were part of top-holdings. Not just buying or selling, changes in market capitalization can also make stocks move up or down in top holdings.

Sector, stock insights

Given that a majority of PMS managers have a bottom-up investing approach, sector preferences may seem an outcome of a process. However, it is interesting to see how PMS money finds its way into various sectors.

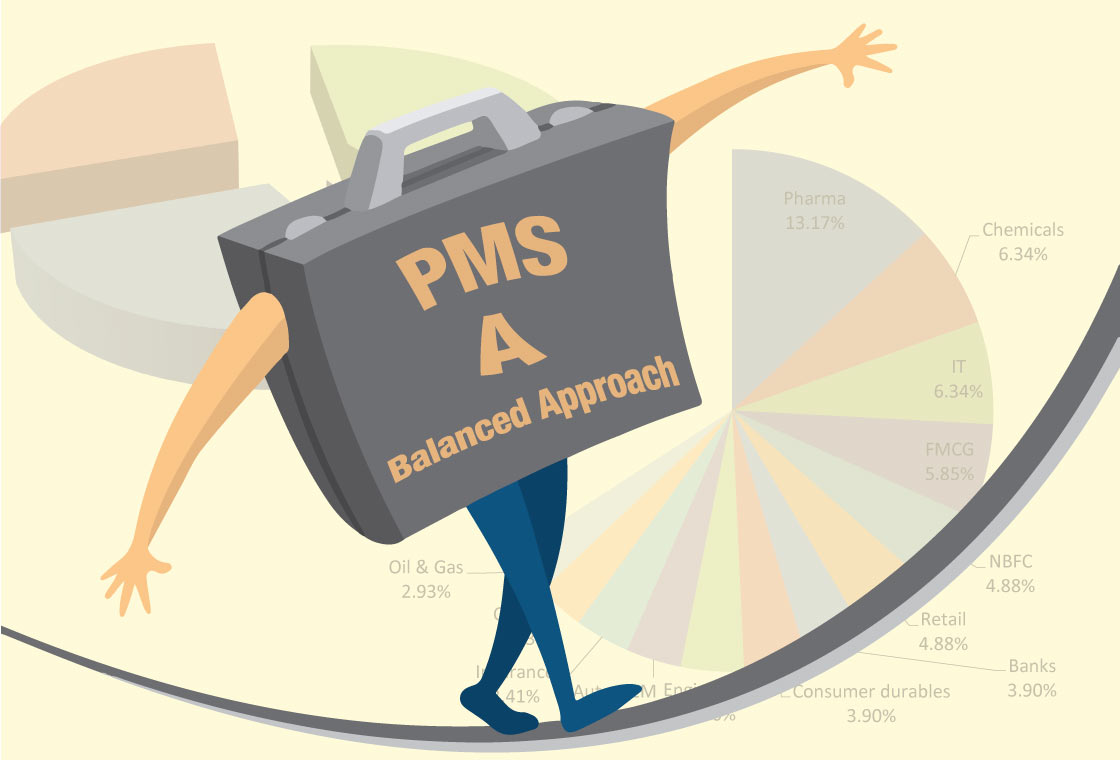

According to PMSBazaar study, which relied on stock count, the top most-owned sectors are Pharma (13.17%), Chemicals (6.34%), IT (6.34%), FMCG (5.85%), NBFC (4.88%), Retail (4.88%), Banks (3.90%), Consumer durables (3.90%), Engineering (3.90%), Auto OEM (3.41%), Insurance (3.41%), Cement (2.93%), Oil & Gas (2.93%) and Others (34.15%).

Lower cost of production is a theme that runs for both pharmaceuticals and Chemicals sectors, who have shot to fame in the Covid-19 world. Additionally, pharma stocks offer good balance sheets, all-weather-proof businesses and dependable cash flows. Chemical companies listed in India enjoy both the raw material supply story and the potential of cornering market-share globally after the tirade against China.

IT/Technology is a well-known defensive bet in a market that has surprised everybody with its pole-vault worthy performance. FMCG provides a serious play on domestic consumption, and given the perception that rural India is managing better than urban Bharat, FMCG stocks find favour even though valuations in many cases may seem stretched. While banks do not throw any surprise in terms of sector bias given the status-quo leader of the rally, PMS managers seem to be backing certain proven high-quality NBFC stocks since the market appears to be pricing in the worst for all.

We have discussed the most-owned Large Cap stocks above. So, here we will talk about the most-owned Mid Cap stocks and Small Cap stocks.

Most-owned Mid Caps are Sanofi India, Aarti Industries, Abbott India, Coromandel International, Ipca Laboratories, P I Industries, Dr Lal Pathlabs, Jubilant Foodworks, Max Financial Services and Trent. Pharma and healthcare stocks are the dominant theme again.

Most-owned Small Caps are Alkyl Amines Chemicals, Granules India, Dixon Technologies India, Quess Corp, Vaibhav Global, Astrazeneca Pharma, APL Apollo Tubes, GMM Pfaudler, Indian Energy Exchange and JB Chemicals & Pharmaceuticals. The list is dominated by specialty chemical/chemical-linked company and pharma stocks, like in May 2020.

Stock weight trends

PMS offerings are often marketed as vehicles for high stock allocations. It is interesting to see which stocks enjoy the high stock weights in portfolios, since this opens the PMS manager up to critical evaluation in the eyes of investors.

Single-stock allocation weight is as high as 29.75% for Aarti Industries. The next in this list are

Sterling & Wilson Solar (24.26%), Alkyl Amines Chemicals (19.84%), ICICI Bank (19.80%), Fortis Healthcare (19.53%), Kotak Mahindra Bank (18.17%), GMM Pfaudler (16.50%), Sun Pharmaceutical Industries (16.50%), Reliance ETF Gold Bees (15.80%) and Bajaj Finance (15.78%).

Others are Avenue Supermarts (14.90%), Schaeffler India (14.72%), HDFC Standard Life Insurance Co (14.43%), Reliance Industries (13.98%), ICICI Bank (13.93%), Nestle India (13.76%), Axis Bank (13.74%) and Divis Laboratories (13.54%).

Overall, there are 43 unique stocks with at least 10% stock allocation in an individual portfolio. Out of these, 7 stocks have been allocated more than 10% by 2 or more strategies. Topping the favorite list are HDFC Bank and Reliance with 8 PMS Strategies allocating more than 10%, followed by ICICI Bank with 4 PMS strategies.

PMS Strategies with ETF Holdings

There are two Strategies with ETF Holdings. Single ETF allocation weight is 50% for Reliance ETF Junior Bees, the next is Nippon India Junior Bees with 40% allocation.

Recent Blogs

Long-Short AIFs Outperform Again Even as Markets Rebound in September

104 long-only funds shows an average monthly gain of just 0.37 per cent, while long-short AIF category averaged 0.94 per cent

Resilience returns as markets rebound in September; Multi-asset PMSes lead pack

Over 63% of equity PMSes ended September in green; nearly two-thirds outperformed key benchmarks.

Stories Fade, Numbers Last: Trends vs Fundamentals

This article is authored by CA Rishi Agarwal, Co-founder & Fund Manager, Aarth Growth Fund

Auto-Adaptive Strategies for a Rapidly Changing Market

PMS Bazaar recently organized a webinar titled “Auto-Adaptive Strategies for a Rapidly Changing Market,” which featured Mr. Alok Agarwal, Head - Quant and Fund Manager, Alchemy Capital Management.

How to overcome FOMO (Fear of Missing out) in Investing and Why Timing Matters?

PMS Bazaar recently organized a webinar titled “How to overcome FOMO (Fear of Missing out) in Investing and Why Timing Matters?” which featured Mr. Mahesh Gowande, Director and CIO, PriceBridge (Ayan Analytics Pvt. Ltd).

Reigniting India’s Consumption Engine

This article is authored by Ashish Chaturmohta, Managing Director, APEX PMS, JM Financial Ltd.

Navigating the Dichotomies in MSME Investing - Challenges and Opportunities

PMS Bazaar recently organized a webinar titled “Navigating the Dichotomies in MSME Investing - Challenges and Opportunities,” which featured Mr. Rishi Agarwal, Co-Founder and Fund Manager, Aarth AIF.

Outperforming During Market Drawdowns

PMS Bazaar recently organized a webinar titled “Outperforming During Market Drawdowns” which featured Mr. Rishab Nahar, Partner and Fund Manager, Qode Advisors LLP. This blog covers the important points shared in this insightful webinar.