Long-only AIFs averaged -8.70% for the month, while long-short AIFs demonstrated relative resilience, arresting their average category loss at -3.09%

February 2025 proved to be another difficult month for Indian equities, with Category III Alternative Investment Funds (AIFs) continuing to mirror broader market pressures. Long-only AIFs were hit the hardest, averaging -8.70% for the month. Long-short AIFs demonstrated relative resilience, arresting their average category loss at -3.09%.

The BSE 500 TRI declined 7.74% and Nifty 50 TRI dropped 5.79% month-over-month (MoM), marking its fifth straight monthly decline and the sharpest since March 2020, barring pandemic-era volatility.

Investor sentiment remained fragile, weighed down by slowing corporate earnings, deepening global trade frictions, and persistent FII outflows. Yet, green shoots are visible, with expectations of a recovery in corporate earnings over the next few quarters, supported by upcoming fiscal and rural tailwinds.

This report, compiled using data from PMS Bazaar, reviews the monthly performance of 113 Category III AIFs, comprising 80 long-only and 33 long-short strategies. It highlights the key outperformers and shares perspectives on how alternative investment funds are traversing this volatile environment.

Uninspiring February show

Category III long-only AIFs in India focus on public equity investments with the objective of long-term capital appreciation. These funds offer greater flexibility in stock picking and portfolio concentration.

Unlike long-short AIFs, long-only funds stay fully invested in equities without using hedging strategies. They remain a preferred choice for sophisticated investors looking for higher alpha compared to conventional investment avenues. As per SEBI guidelines, the minimum investment required in an AIF is ₹1 crore, making these funds accessible primarily to high-net-worth and institutional investors.

In February 2025, long-only AIFs faced another difficult month, echoing January’s trend. The average category return stood at -8.70%, underperforming both the BSE 500 TRI (-7.74%) and the Nifty 50 TRI (-5.79%). Out of 80 schemes tracked, only 25 managed to outperform the BSE 500 TRI, while 15 schemes surpassed the Nifty 50 TRI.

The higher beta exposure of long-only AIFs resulted in sharper drawdowns versus market benchmarks, consistent with their directional equity bias. While some funds succeeded in limiting losses, the majority struggled to weather the volatility.

In terms of performance, the top spot for February goes to I Wealth Management LLP’s I Wealth Fund, with a return of -0.88%, significantly arresting losses and outperforming the broader market. Its core philosophy is built on four core pillars: process-oriented investing, data-driven decision-making, proactive risk management, and flexibility. Robust risk frameworks enables the AIF to manage portfolios through volatile markets, focusing on superior risk-adjusted returns.

At number 2 is Aequitas Investment Consultancy’s Equity Scheme I, which posted a -1.07% return and delivered more than 600 bps alpha. Managed by Siddhartha Bhaiya, this long-only Category III AIF follows a concentrated investment strategy focussed on fundamentally strong Indian equities with high growth potential, prioritising valuations and risk management. It had outperformed in Jan-2025 too amid weak equity markets.

Third on the list is Prajana Advisors’ Athena Enhanced Equity Fund, returning -3.07% in February when benchmark indices fell by over 5% each. Its core portfolio usually comprises high pedigree secular growth businesses, with more than 70 percent of the portfolio invested in large-caps for most periods of time. The satellite portfolio plays with option strategies to enhance the yield on the existing portfolio/cash investments and to tactically increase/decrease allocation to portfolio companies.

In fourth place is Nippon Life India AIF Management’s NIEO 2 - Financial Services, which delivered a return of -3.20% amid extremely weak markets. The multi-cap scheme focusses on financial sector opportunities and leverages Nippon’s extensive research capabilities to selectively invest in companies poised for structural growth within banking, NBFCs, and insurance sectors etc. It runs a benchmarking agnostic concentrated portfolio (20-30 stocks) with a 3-5 year buy-and-hold view.

Rounding out the top 5 is Senora Asset Management’s Stag Series 1, which returned -3.51% despite the challenging environment. This long-only AIF had secured 2nd spot in Jan-2025 and thus continued its wealth protection streak. Managed by Mridul Jain, this concentrated, India-centric, long-only large-cap investment strategy managed risk effectively and weathered near-term volatility.

Here are the top-10 long-only AIF performers of this month.

Note : *** Post Exp & Tax , ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax ,^^ Post Exp & Tax and Pre Perf.Fees , # Below 1 Year returns are Simple Annualized. All Performance above are as on 28 February 2025

Category III long-short AIFs in India combine hedging and directional strategies to generate returns while mitigating downside risks. Their defensive design proved valuable yet again in February 2025, as markets remained volatile due to FII Selling for the fifth straight month where they sold Indian listed equities to the tune of INR 58,988 Crores.

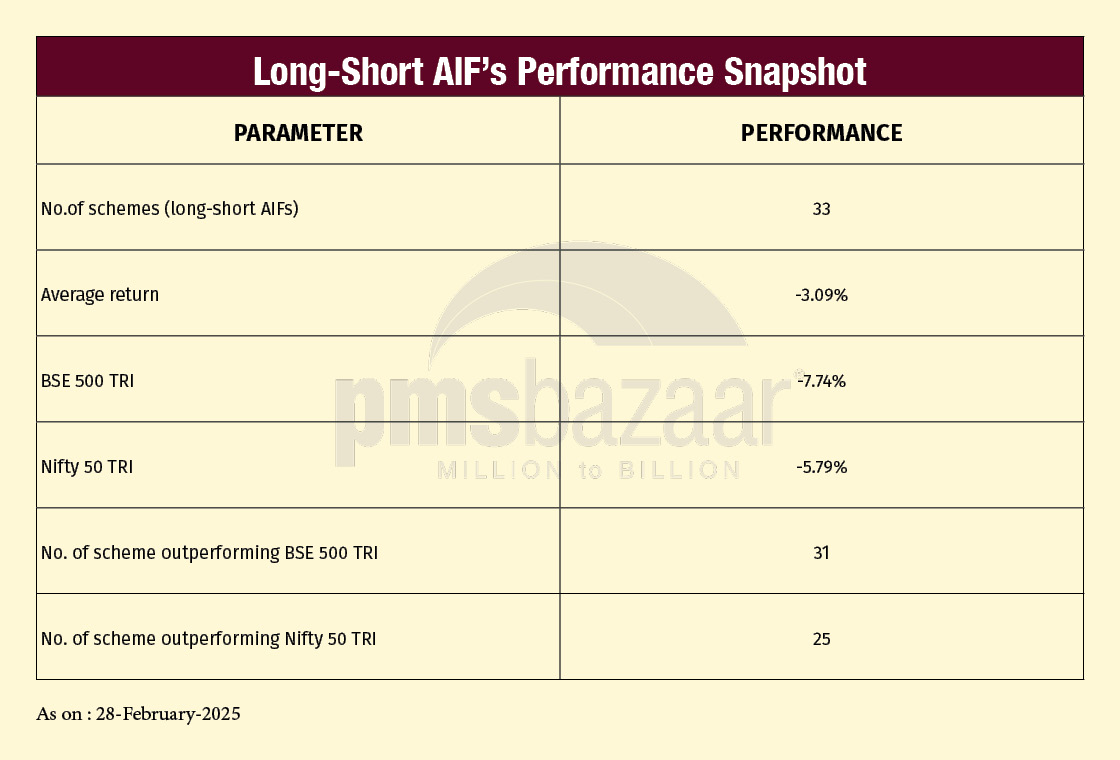

Despite the sharp market correction, long-short AIFs outperformed broader indices, delivering an average return of -3.09% compared to the BSE 500 TRI’s -7.74% and the Nifty 50 TRI’s -5.79%. Out of the 33 tracked schemes, 31 outperformed the BSE 500 TRI and 25 outperformed the Nifty 50 TRI. This was a great show of strength by Long-short strategies given the current environment.

The flexibility of long-short strategies helped cushion funds from steeper market drawdowns, contrasting with the deeper declines witnessed in long-only AIFs. Notably, 10 long-short funds posted positive returns this month, once again underscoring their role as defensive vehicles during market stress.

Fund managers employed a range of hedging techniques and arbitrage strategies to contain downside risk and protect investor capital. While dispersion in performance persisted across fund managers, the majority of them demonstrated resilience amid continued global and domestic headwinds.

As macroeconomic uncertainty lingers, long-short AIFs remain appealing to investors seeking lower volatility and enhanced downside protection.

Leading the pack this month is Altacura AI Absolute Return Fund, delivering a 1.03% positive return. The AIF is an Artificial Intelligence-backed multi-strategy hedge fund that aims to deliver strong absolute returns with very low drawdowns on a monthly basis. The long-short fund uses multiple strategies such as low-risk volatility dispersion trade, long-short portfolio, and option strategies linked to market outlook to generate superior risk-adjusted returns.

Second place goes to Mayank Bhagat-managed Neo Asset Management Treasury Plus Fund, clocking a return of 0.81%. Focussed on arbitrage and low-risk market-neutral strategies, the fund emphasises capital preservation while delivering steady absolute returns.

Third is Dolat Capital Market Absolute Return LLP, with a 0.48% gain. Managed by Mr. Purvag Shah the fund employs a combination of proprietary derivative strategies to diversify the portfolio and aims to generate absolute, uncorrelated returns across market cycles. By targeting low beta and maintaining a low standard deviation relative to the Nifty 50 Index, the strategy is designed to reduce volatility. A strong focus on capital protection ensures that downside risks are limited through the use of derivatives.

At number 4 is YES Securities Alpha Plus Fund, which returned 0.41%. The AIF actively deploys a range of trading strategies in the derivatives market, aiming to profit from both rising and falling price trends in underlying securities. It focusses on generating alpha by consistently delivering superior risk-adjusted returns over extended periods. The fund invests in equity-related derivative instruments, applying strategies built on proven, data-driven statistical and quantitative research.

Rounding out the top 5 is ASK Long Short Fund Managers’ Absolute Return Fund, posting a return of 0.34%. With no fixed tenure, the fund positions itself as a core portfolio holding, serving as a debt-plus alternative for clients' fixed-income portfolios. The fund aims to deliver superior risk-adjusted returns over any liquid fixed-income alternatives invested in *a 12–15-month investment horizon perspective, with a focus on low volatility and minimal drawdowns.

Here are the top-10 long-short AIF performers of this month.

Note : *** Post Exp & Tax , ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax ,^^ Post Exp & Tax and Pre Perf.Fees , # Below 1 Year returns are Simple Annualized. All Performance above are as on 28 February 2025

India’s corporate earnings may bottom out over the next one to two quarters. While macroeconomic fundamentals remain strong for India, growth has faced a cyclical slowdown driven by lower government capex during 9MFY25 (+2% YoY) and inflation weighing on domestic consumption.

The Union Budget has provided relief to the middle class in terms of Taxation to boost spending and created space for potential RBI rate cuts to stimulate growth. Capex is expected to accelerate from Q4 onwards and could be frontloaded in FY26 due to the upcoming elections. A healthy Rabi season should also support rural recovery, setting the stage for earnings rebound.

Key factors to monitor include central banks’ rate moves, US policies under the new administration, oil price trends, geopolitical risks, and signs of consumption revival.

Valuations remain reasonable, with the Nifty 50 Index trading at a P/E Ratio ~18.5x FY26E and ~16.2x FY27E, in line with historical averages. Earnings are projected to recover in CY25 and CY26.

AIF investors should stay focussed on long-term Investment objectives rather than reacting to short-term market noise. Alternative investments remain a strategic allocation for those seeking consistent, risk-adjusted returns across market cycles.

Recent Blogs

Long-Only AIFs Rebound Sharply in October; Long-Short Strategies Lag Despite Lower Volatility

106 long-only AIFs averaged 3.68% vs 32 long-short AIFs at 2.7%; only 24–31% of funds beat key indices

Markets log strongest monthly gains in 7 months; PMS performance turns near-uniform in October

Nifty 50 TRI gained 4.62%, BSE 500 TRI rose 4.27%; 415 of 427 equity PMSes ended positive

How SMEs are Shaping India’s Investment Landscape?

PMS Bazaar recently organized a webinar titled “How SMEs are Shaping India’s Investment Landscape?” which featured Mr. Shrikant Goyal, Fund Manager, GetFive Opportunity Fund.

Stable Income from Indian REITs and InvITs

PMS Bazaar recently organized a webinar titled “Stable Income from Indian REITs and InvITs,” which featured Mr. Rahul Jain, Head of Public Markets, Alt.

5 Key Considerations Before Investing in AIFs in India

Alternative Investment Funds (AIFs) have emerged as a compelling option for sophisticated investors seeking diversification and potentially superior returns. But venturing into AIFs requires a clear understanding of their unique characteristics that go beyond simply knowing what they are and their categories.

How AIF can help in diversification?

Traditionally, Indian investors have relied on a mix of stocks and bonds to build their wealth. While this approach offers diversification, it can still leave your portfolio vulnerable to market fluctuations. Enter Alternative Investment Funds (AIFs), a dynamic asset class gaining traction for its ability to unlock diversification beyond the realm of conventional options.

Long-Short AIFs Outperform Again Even as Markets Rebound in September

104 long-only funds shows an average monthly gain of just 0.37 per cent, while long-short AIF category averaged 0.94 per cent

Resilience returns as markets rebound in September; Multi-asset PMSes lead pack

Over 63% of equity PMSes ended September in green; nearly two-thirds outperformed key benchmarks.