Only 44 of 137 AIFs ended positive; long-only funds averaged –1.15%, while long-short peers limited losses to –0.29%

Alternative Investment Funds (AIFs), which are favourite hunting ground for wealthy investors, navigated a challenging July 2025, with only 44 out of 137 strategies tracked by PMS Bazaar ending the month in positive territory. The broader market saw the S&P BSE 500 TRI decline 2.71 per cent and the Nifty 50 TRI slip 2.77 per cent, setting a difficult backdrop across categories.

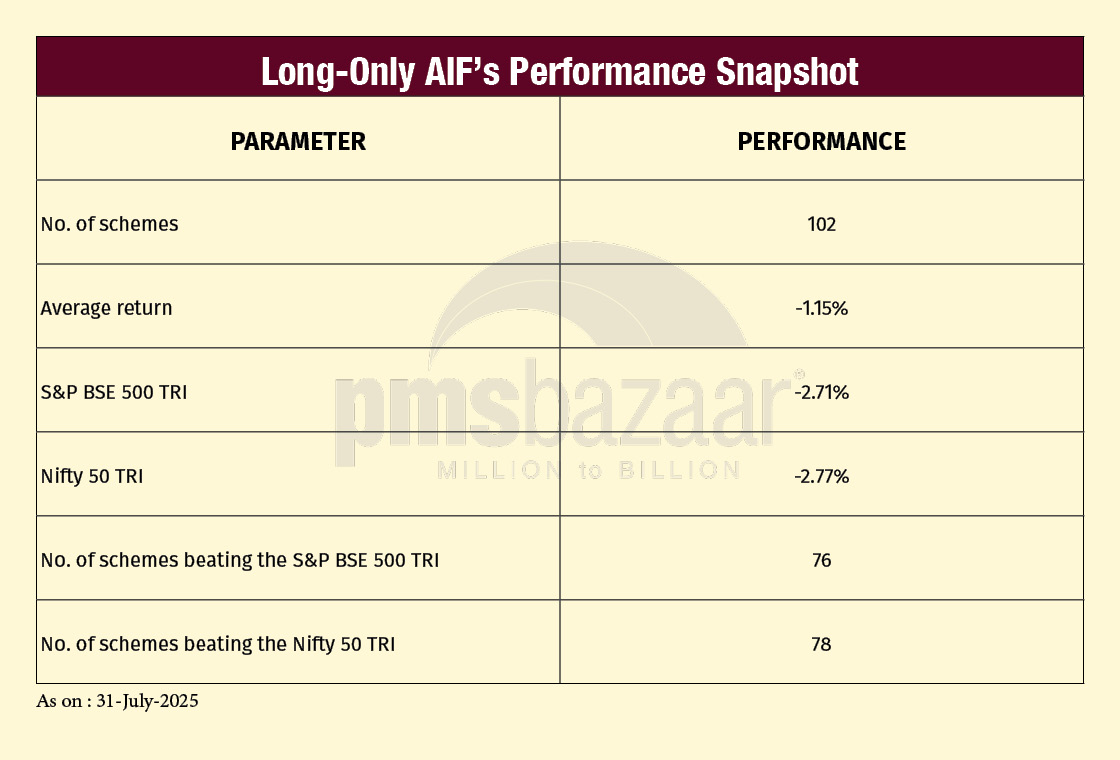

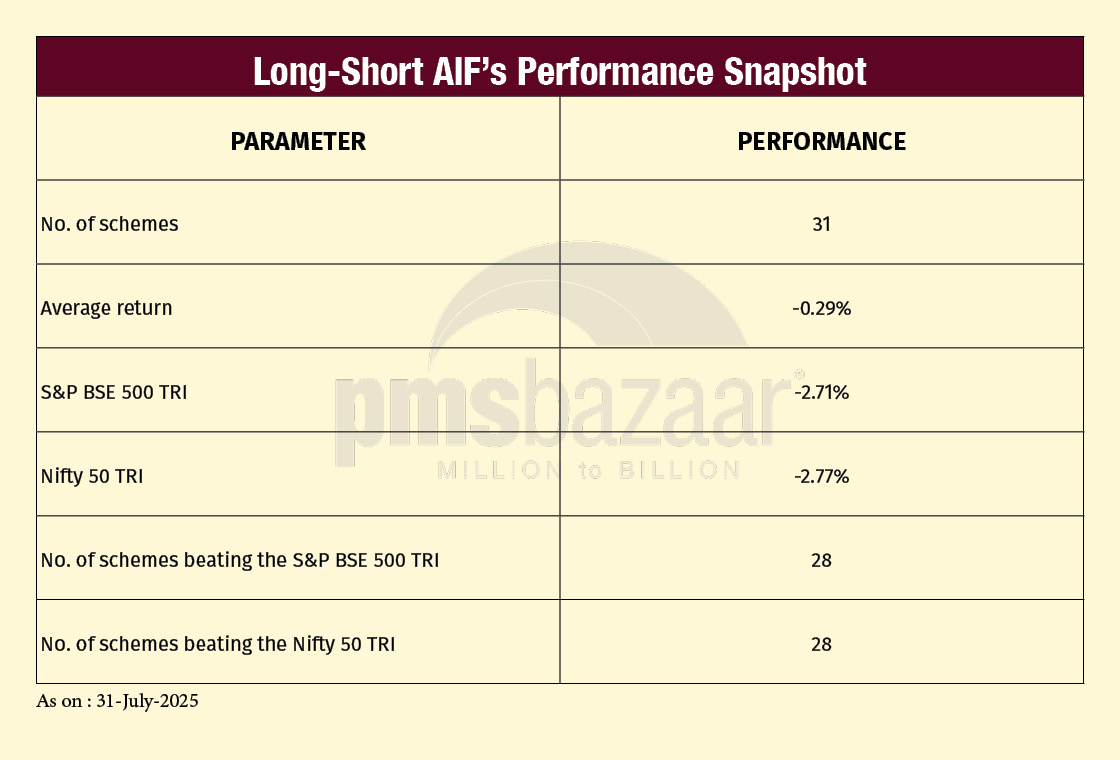

Long-only Category III AIFs showed relative resilience, posting an average return of –1.15 per cent. This was well ahead of both the BSE 500 and Nifty benchmarks, with 76 strategies beating the former and 78 outperforming the latter out of total 102 offerings. In contrast, long-short AIFs, while also delivering negative average returns at –0.29 per cent, fared even better in relative terms, with 28 of the 31 funds tracked surpassing both key indices.

The month underscored the defensive strength of hedged and flexible mandates in a weak market. At the same time, it highlighted that select long-only managers could still deliver meaningful outperformance despite index-level drawdowns.

Let us look at the July 2025 AIF performance in detail.

Long-only AIFs: Resilience amid market weakness

A long-only AIF (Alternative Investment Fund) under Category III invests primarily in listed equities without using short positions or hedging. These funds aim to generate absolute returns through high-conviction, buy-and-hold strategies focussed on capital appreciation. Unlike long-short funds, they remain fully or largely exposed to market movements. Suitable for investors with a high-risk appetite and long-term horizon, long-only AIFs offer access to concentrated portfolios managed by seasoned fund managers with thematic or sectoral expertise.

In July 2025, long-only Category III AIFs posted an average return of –1.15 percent, outperforming both the S&P BSE 500 TRI (–2.71 percent) and the Nifty 50 TRI (–2.77 percent). Of the 102 strategies tracked, 76 beat the BSE 500 and 78 outperformed the Nifty, reflecting the category’s ability to cushion losses despite the broader market downturn. Importantly, 24 out of 102 posted positive returns in the long-only AIF segment, which translates to 23.5 percent success rate.

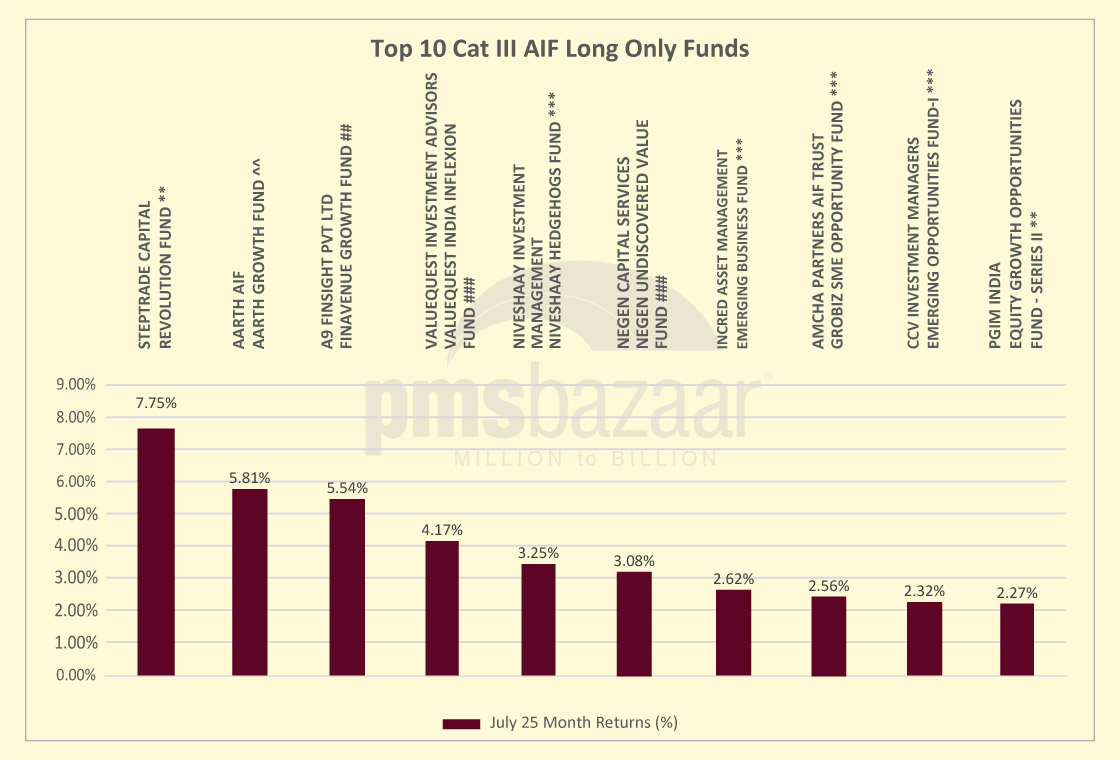

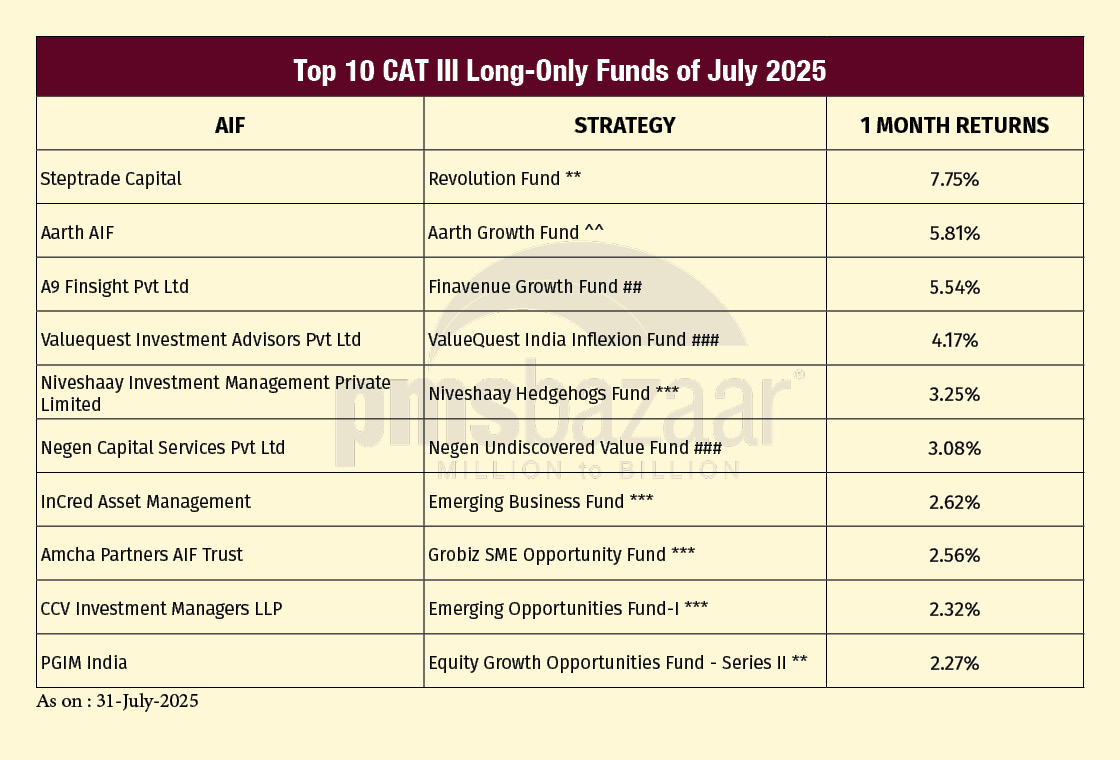

Performance dispersion was wide, with a handful of funds delivering strong positive returns even in a weak month. Steptrade Capital’s Revolution Fund led with a robust 7.75 percent gain. Steptrade Revolution Fund offers exclusive access to high-growth opportunities in the SME and Microcap sectors. Its fund managers focus on anchor investments in IPOs and listed companies with market caps up to INR 1,000 crore to deliver promising returns. It targets companies with strong growth potential, competitive advantages, and efficient governance.

It was followed by Aarth AIF’s Aarth Growth Fund at 5.81 percent and A9 Finsight’s Finavenue Growth Fund at 5.54 percent. These gains underscored the value of focussed stock selection and nimble positioning.

Here is a look at the top-10 long-only AIFs for July 2025.

Note: *** Post Exp & Tax, ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax,^^ Post Exp & Tax and Pre Perf.Fees, # Below 1 Year returns are Simple Annualized. All Performance above is as on 31 July 2025.

Other notable performers included ValueQuest India Inflexion Fund (4.17 percent), Niveshaay Hedgehogs Fund (3.25 percent), and Negen Undiscovered Value Fund (3.08 percent). Funds such as InCred’s Emerging Business Fund, Grobiz SME Opportunity Fund, and PGIM India’s Equity Growth Opportunities Fund – Series II also finished in the green, signalling resilience in niche and thematic strategies.

Overall, July reaffirmed that even in risk-off markets, select long-only managers with concentrated conviction can protect capital and deliver relative alpha.

Long-short AIFs: Hedged approaches outperform in market downturn

Long-short AIFs are Category III Alternative Investment Funds that take both long (buy) and short (sell) positions to generate returns across market cycles. By actively managing net exposure, these funds aim to capture upside while limiting downside risk. They often use hedging, arbitrage, or sector rotation strategies. Designed for high-net-worth investors seeking lower volatility and improved risk-adjusted returns, long-short AIFs offer flexibility to adapt to shifting market conditions with disciplined allocation.

In July 2025, the segment proved its defensive value. Long-short Category III AIFs posted an average return of –0.29 percent, significantly outperforming the S&P BSE 500 TRI (–2.71 percent) and Nifty 50 TRI (–2.77 percent). Of the 31 strategies tracked, 28 beat both indices, underscoring the category’s strength in cushioning capital during a broad market decline. Importantly, 16 out of 31 long-short AIFs posted positive returns, which translates to 51.6 percent success rate.

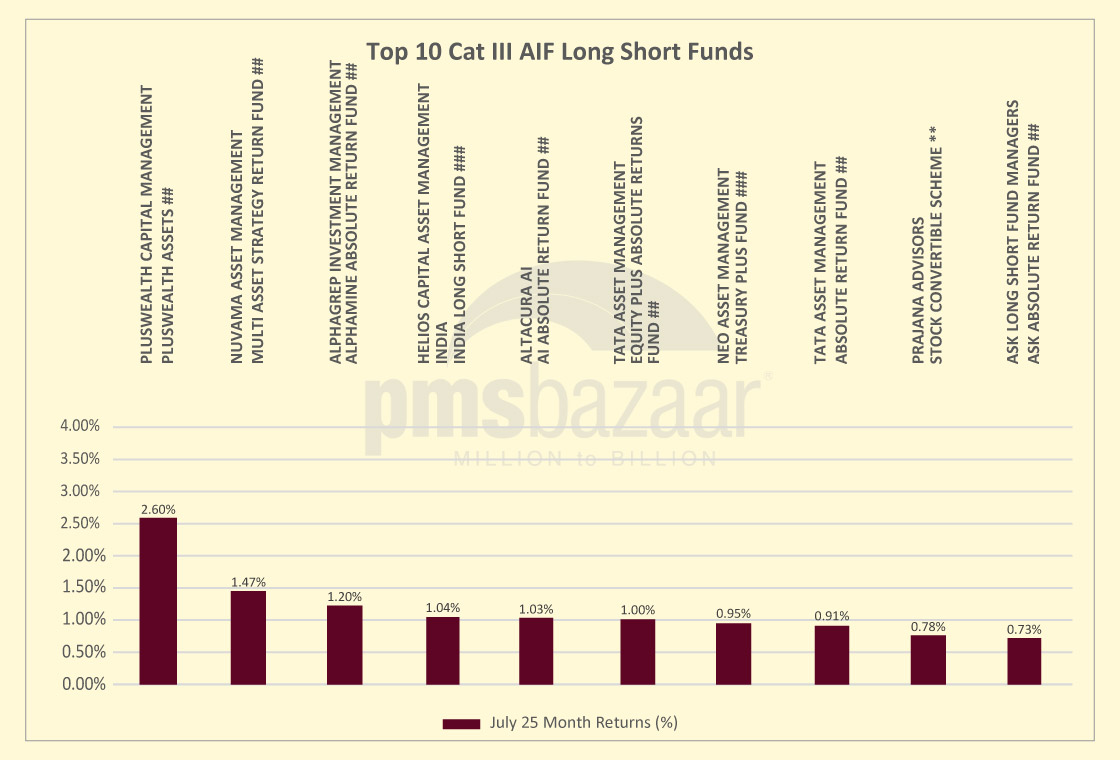

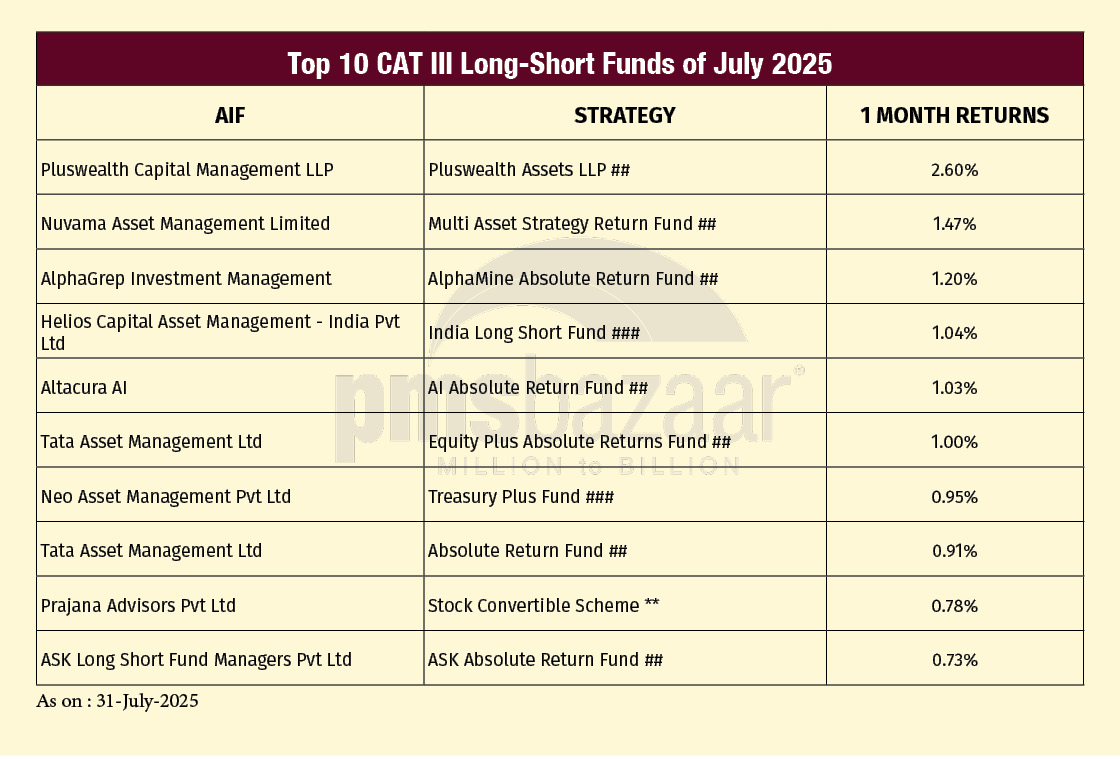

The month’s leader was Pluswealth Capital Management’s Pluswealth Assets LLP Fund, gaining 2.60 percent through a conservative mandate. This fund focusses on employing a quantitative, technology-driven approach to generate returns by identifying and capitalizing on mispriced assets in the market. They utilize a long-short strategy with a conservative approach, primarily trading in equities and derivatives.

Nuvama Asset Management’s Multi Asset Strategy Return Fund (1.47 percent) and AlphaGrep’s AlphaMine Absolute Return Fund (1.20 percent) also delivered steady gains, showing that market-neutral and diversified strategies could thrive even in weak equity markets.

Other notable performers included Helios India Long Short Fund (1.04 percent), Altacura AI Absolute Return Fund (1.03 percent), and Tata Asset Management’s Equity Plus Absolute Returns Fund (1.00 percent). Funds such as Neo Asset’s Treasury Plus Fund and ASK Long Short Fund Managers’ Absolute Return Fund rounded off the top 10, all managing to stay positive while benchmarks slipped over 2.7 percent.

July reinforced the role of hedged long-short mandates as a stabilising force in portfolios. While they may lag in strong rallies, their ability to preserve capital in adverse markets strengthens their case for investors seeking consistent, lower-beta returns.

Here is a look at the top-10 long-short AIFs for July 2025.

Note: *** Post Exp & Tax, ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax,^^ Post Exp & Tax and Pre Perf.Fees, # Below 1 Year returns are Simple Annualized. All Performance above is as on 31 July 2025.

Outlook for August 2025

After July’s uneven performance, the AIF landscape enters August with a cautiously constructive bias. The sharp market correction has eased valuations across sectors, particularly in mid and smallcaps, creating potential entry points for long-only managers with a strong fundamental framework.

Macro indicators are providing some support. Stable crude prices, a gradual moderation in inflation, and the likelihood of a steady monetary policy stance are bolstering confidence. Continued domestic inflows from HNIs and family offices, alongside selective FII buying, are helping offset global uncertainties. Sector leadership is also shifting, with healthcare, FMCG, and select manufacturing names showing relative resilience through July’s volatility.

For long-only AIFs, this could be a phase to selectively add to high-conviction positions in quality, scalable businesses with clear earnings visibility. Long-short strategies, meanwhile, may find new tactical opportunities as sector rotation and stock-specific dispersion create fertile ground for alpha generation through both directional and market-neutral exposures.

While short-term swings around global macro data and geopolitical events remain possible, the medium-term opportunity set for active, high-conviction AIF managers looks encouraging. Blending defensive allocations with targeted participation in emerging growth themes may prove a winning approach in the weeks ahead.

Disclaimer: This Blog is made for informational purposes only and does not constitute an offer, solicitation, or an invitation to the public in general to invest in any of the Funds mentioned. All the Returns mentioned in this blog are provided by the respective asset management companies and may vary based on their reporting structure (Pre-tax, Post-tax, Post-expenses, etc.). PMS Bazaar has taken due care and caution in the compilation of data and information. However, PMS Bazaar doesn’t guarantee the accuracy, adequacy, or completeness of any information. Investors must read the detailed Private Placement Memorandum (PPM), including the risk factors, and consult your Financial Advisor before making any investment decision/contribution to AIF. This Blog has been prepared for general guidance, and no person should act upon any information contained in the document. PMS Bazaar, its affiliates, and their office, directors, and employees shall not be responsible or liable for any investment action initiated. This Blog is intended only for the personal use to which it is addressed and not for distribution.

Recent Blogs

Outperforming During Market Drawdowns

PMS Bazaar recently organized a webinar titled “Outperforming During Market Drawdowns” which featured Mr. Rishab Nahar, Partner and Fund Manager, Qode Advisors LLP. This blog covers the important points shared in this insightful webinar.

Long-Short AIF Strategies Cushion Fall, But Long-Only Funds Trail Benchmarks in August

AIFs struggle as market Volatility weighs on returns; only 13 out of 141 strategies clock positive returns

Weakness persists as equity markets decline in August; Multi Asset and Debt PMSes emerge as safe havens

Over 100 equity PMSes managed to out-perform Nifty50 TRI while 153 strategies outshined S&P BSE 500 TRI

Smart Beta Strategies: What Investors Should Know Before Investing

This article is authored by Vivek Sharma, VP and Head of Investments at Estee Advisors

Dynamic Investing Approach in Different Markets

This article is authored by Rishabh Nahar, partner and fund manager, Qode Advisors LLP

The Accreditation Edge: Unlocking the Power of Accredited Investors to make Diversified Investments

PMS Bazaar recently organized a webinar titled “The Accreditation Edge: Unlocking the Power of Accredited Investors to make Diversified Investments,” which featured Mr. Archit Lohia, Founder and CEO of Career Topper Online Education Pvt. Ltd. This blog covers the important points shared in this insightful webinar.

PMS performance hit by broad market slump in July; Thematic strategies buck the trend

Of 427 equity PMSes, only 61 gained; Debt offerings showed positive returns. July 2025 proved to be a testing month for Portfolio Management Services (PMS) investors, with broad-based declines across most asset classes.

The Lollapalooza Effect in Investing Through Pricing Power

PMS Bazaar recently organized a webinar titled “The Lollapalooza Effect in Investing Through Pricing Power” which featured Mr. Siddharth Bothra, Executive Director and Fund Manager, Ambit Asset Management. This blog covers the important points shared in this insightful webinar.