Over 100 equity PMSes managed to out-perform Nifty50 TRI while 153 strategies outshined S&P BSE 500 TRI

August 2025 turned out to be the second consecutive month when equity markets slipped. After a 1.4% decline in July, the Nifty50 TRI ended 1.2% lower MoM in August. The wider index S&P BSE 500 TRI fell 1.75%, as extreme volatility was witnessed in smallcaps and midcaps. In such a backdrop, Portfolio Management Services grappled with gravity and only 33 strategies in total ending the month in positive out of the 423 equity PMSes tracked by PMS Bazaar. Importantly, over 100 equity PMSes managed to out-perform Nifty50 TRI while 153 strategies outshined S&P BSE 500 TRI.

Amongst all the notable performers for Aug-2025, select Small & Mid Cap, Thematic, Multi Cap & Flexi Cap, Small Cap and Large Cap strategies came out on top. The down draft in equity markets was so strong that none of the individual equity PMS categories clocked positive return, as negative returns became the de-facto standard.

Among the sectors, Utilities (-5%), Real Estate (-5%), Telecom (-4%), Healthcare (-4%), and Oil & Gas (-4%) were the top laggards. However, Automobiles (+6%) and Consumer (+1%) provided some succour and were the only gainers. It must be noted that in such a difficult time period, Multi Asset PMSes emerged as the least unscathed. Debt PMSes, by design, appeared as a safe haven amid the equity market downturn.

Here is a deeper look at August-2025 PMS returns.

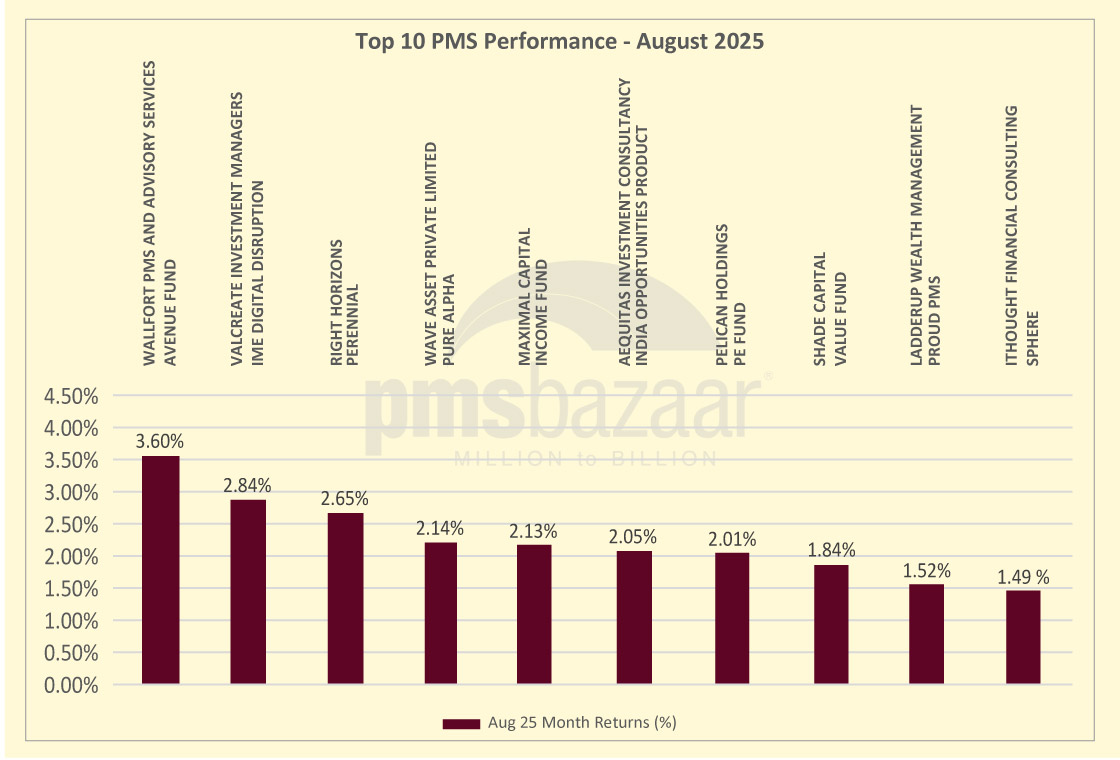

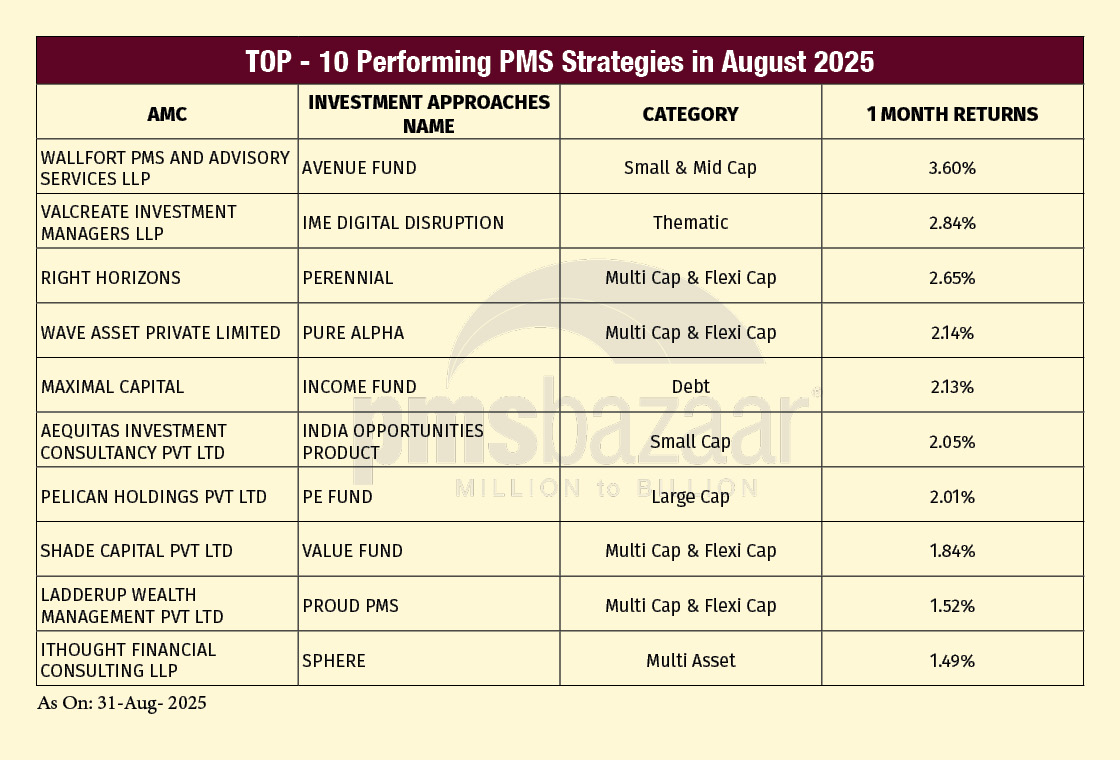

Top-10 performers in focus

In August 2025, small and mid-cap strategies stole the spotlight. Wallfort PMS’s Avenue Fund led the overall performance chart with a 3.6 percent gain, the best among peers. Its focus on emerging opportunities in smaller companies helped it outpace broader benchmarks. Close behind, Valcreate Investment Managers’ IME Digital Disruption fund delivered 2.84 percent. The thematic strategy, tilted toward technology-driven trends, stood out in a volatile month.

Right Horizons’ Perennial strategy followed with 2.65 percent, showing steady traction in the multi-cap and flexi-cap segment. Wave Asset’s Pure Alpha strategy was not far behind, adding 2.14 percent. Interestingly, Maximal Capital’s Income Fund featured in the top-five, posting 2.13 percent despite operating in the debt space, where returns are usually muted compared to equities.

Aequitas’s India Opportunities Product clocked 2.05 percent in the small-cap bucket, while Pelican Holdings’ PE Fund added 2.01 percent among large-cap equities. Shade Capital’s Value Fund returned 1.84 percent, showing resilience in the multi-cap category.

Rounding off the top-10 were Ladderup’s Proud PMS with 1.52 per cent and iThought’s SPHERE multi-asset fund at 1.49 per cent.

Overall, the month highlighted diverse winners across equity, debt, and multi-asset categories, with smaller company exposure clearly dominating.

Here is a table on top-10 PMS performers.

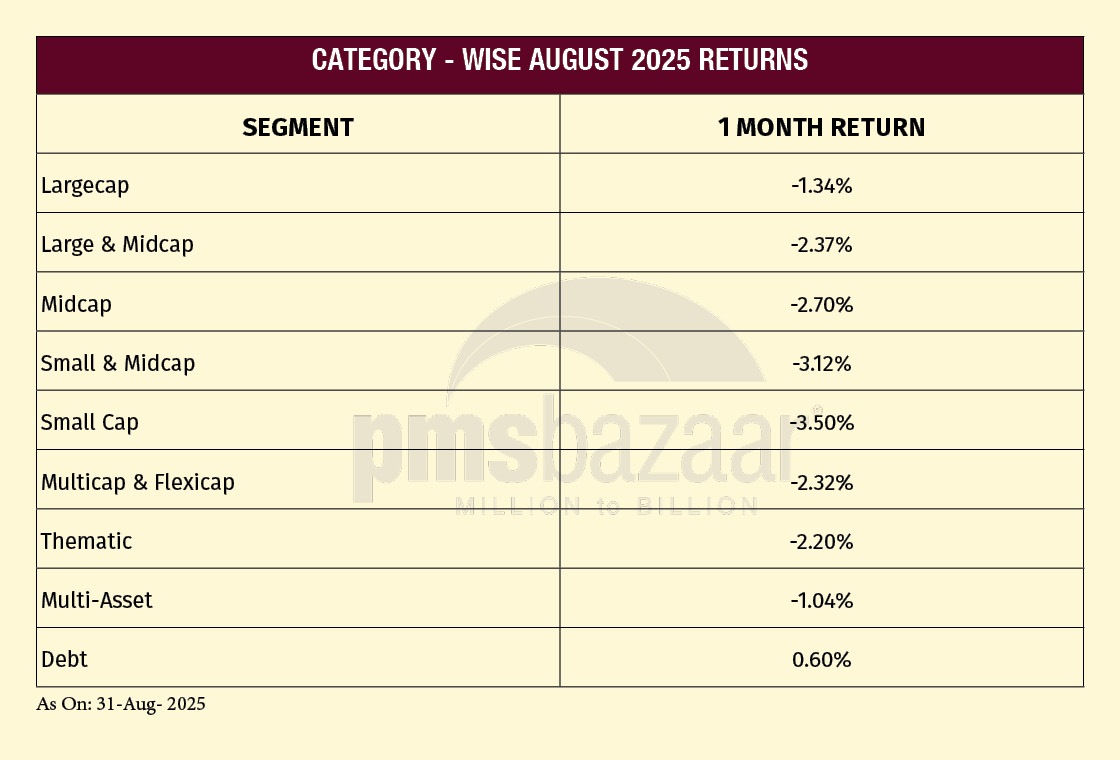

Category snapshot: Market segments weaken across the board as investors find relative safety in debt and diversified funds

August 2025 turned out to be a weak month across all categories, with most of the segments posting negative returns. Debt PMS strategies clocked up the highest overall return with 0.60% average rise.

Among others, multi-asset strategies held up best, losing only 1.04 per cent, reflecting relative stability from diversification. Large-cap funds slipped 1.34 per cent, faring better than most equity segments but still in the red.

Thematic funds saw sharper pressure with a 2.20 per cent fall, while multi-cap and flexi-cap portfolios dropped 2.32 per cent. Large & mid-cap strategies were close behind at -2.37 per cent, highlighting broad-based weakness across market tiers.

Mid-cap funds shed 2.70 per cent, extending the slide. Smaller companies bore the brunt of the downturn. Small & mid-cap funds declined 3.12 per cent, and small-cap strategies fell the most at 3.50 per cent.

The pattern shows investors seeking safety in diversified and large-cap allocations, while riskier small-cap pockets suffered the steepest pullback.

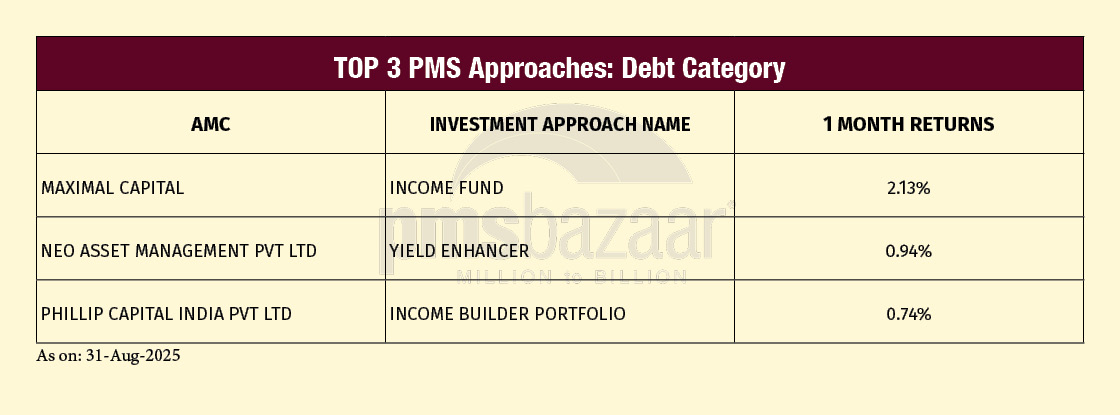

Debt funds hold firm in August with long-duration strategies outperforming peers

Debt PMS strategies delivered a mixed but largely positive performance in August 2025, with most products posting modest gains. Maximal Capital’s Income Fund led the pack with a strong 2.13 per cent return, well ahead of its peers, benefiting from the longer-duration Nifty Medium to Long Duration Debt Index. Neo Asset Management’s Yield Enhancer followed with 0.94 per cent, also backed by the same benchmark.

Among those tied to the Crisil Composite Bond Fund Index, Phillip Capital’s Income Builder Portfolio returned 0.74 per cent.

Here are the Top-3 performers.

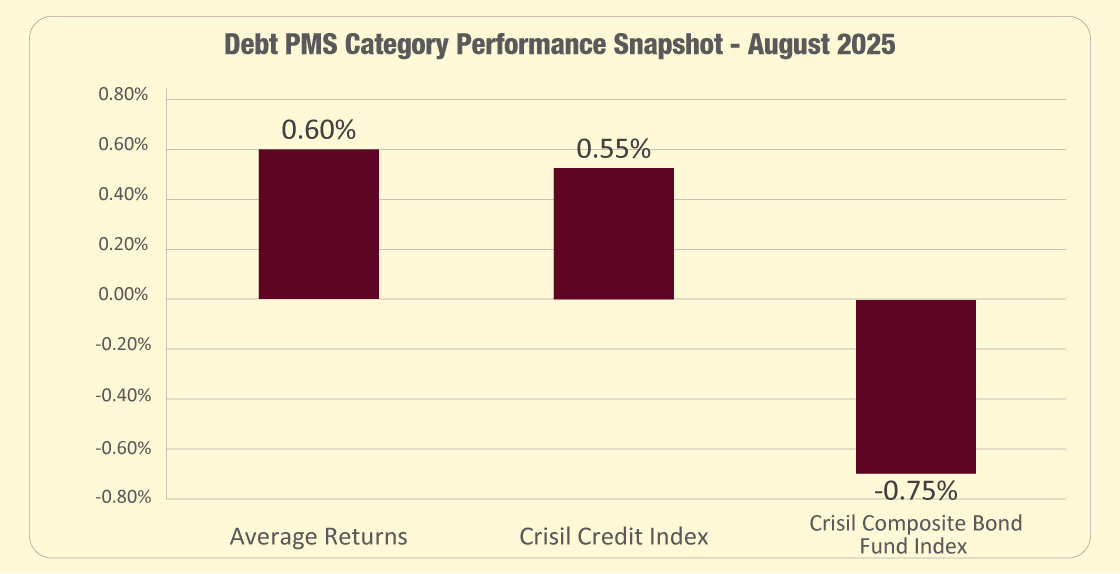

Debt PMS Category Performance Snapshot:

Debt PMS outperformed both benchmarks in August 2025, delivering an average return of 0.60%, ahead of the CRISIL Credit Index (0.55%) and significantly above the CRISIL Composite Bond Fund Index (-0.75%).

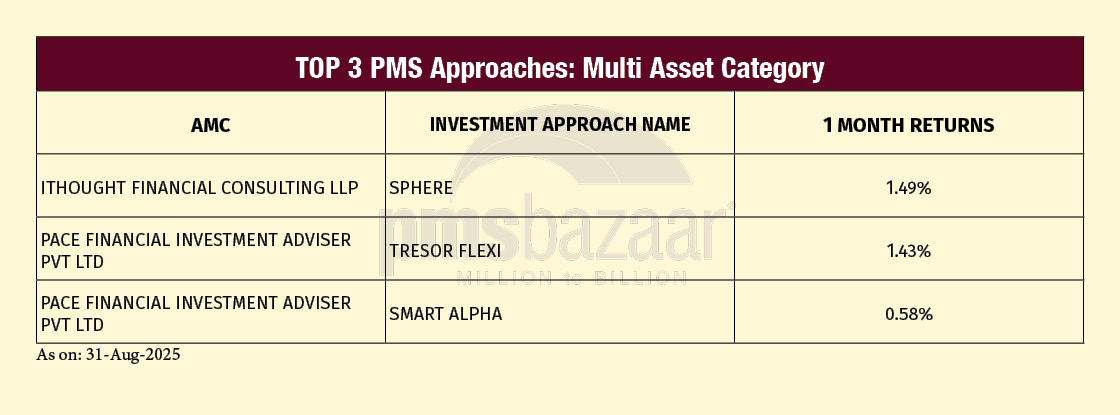

Multi-asset funds face broad weakness though a handful post positive returns

Though relatively speaking, multi-asset PMS category performed decently in an overall weak market situation, they faced a difficult August 2025. Average returns slipped 1.04 per cent. Both benchmark indices, NSE Multi Asset Index 1 and 2, also closed in the red at -0.50 per cent and -0.66 per cent respectively. Out of the 26 schemes in this category, only seven managed to outperform Index 1, and nine beat Index 2, reflecting selective resilience in a challenging month.

Despite the overall weakness, a few strategies stood out. ithought Financial Consulting’s SPHERE led with a robust 1.49 per cent gain, followed closely by Pace Financial’s Tresor Flexi at 1.43 per cent. Pace also delivered through Smart Alpha, which added 0.58 per cent.

The divergence underscores how select managers were able to generate positive alpha even in a tough backdrop.

Here are the top-3 performers.

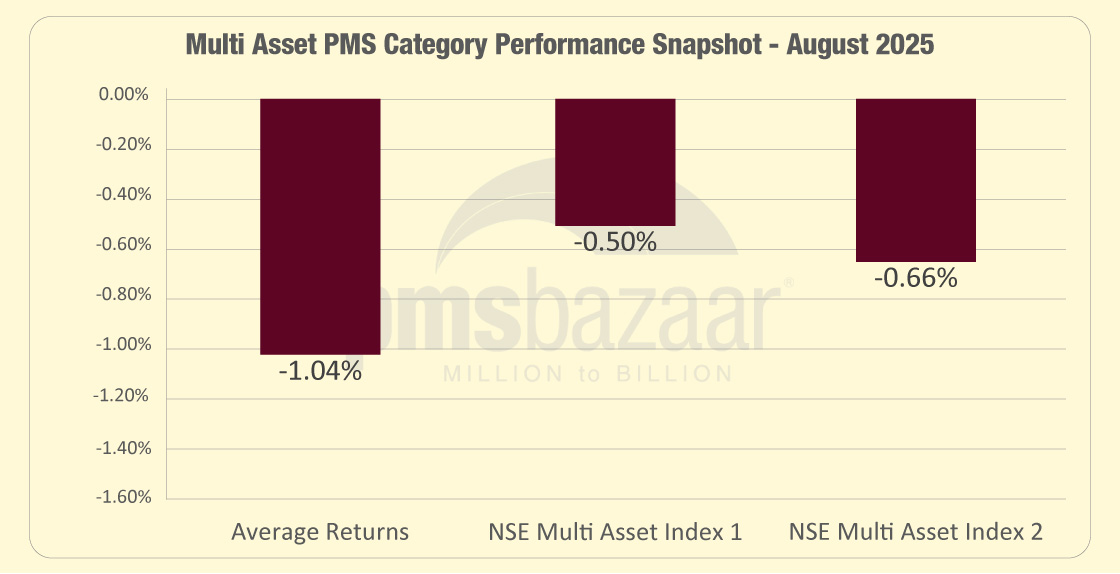

Multi-Asset PMS Category Performance Snapshot:

Multi Asset PMS strategies delivered -1.04% in August 2025, underperforming both the NSE Multi Asset Index 1 (-0.50%) and Index 2 (-0.66%). This reflects weaker relative performance despite the diversified nature of multi-asset portfolios.

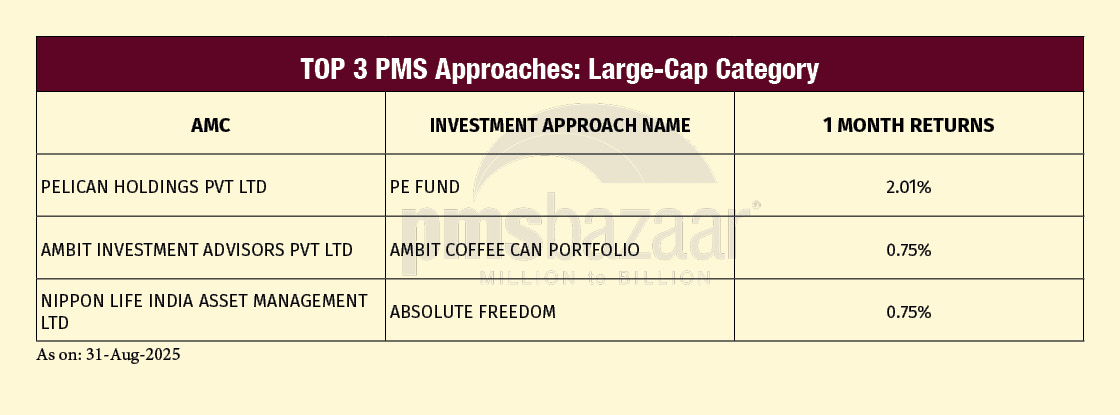

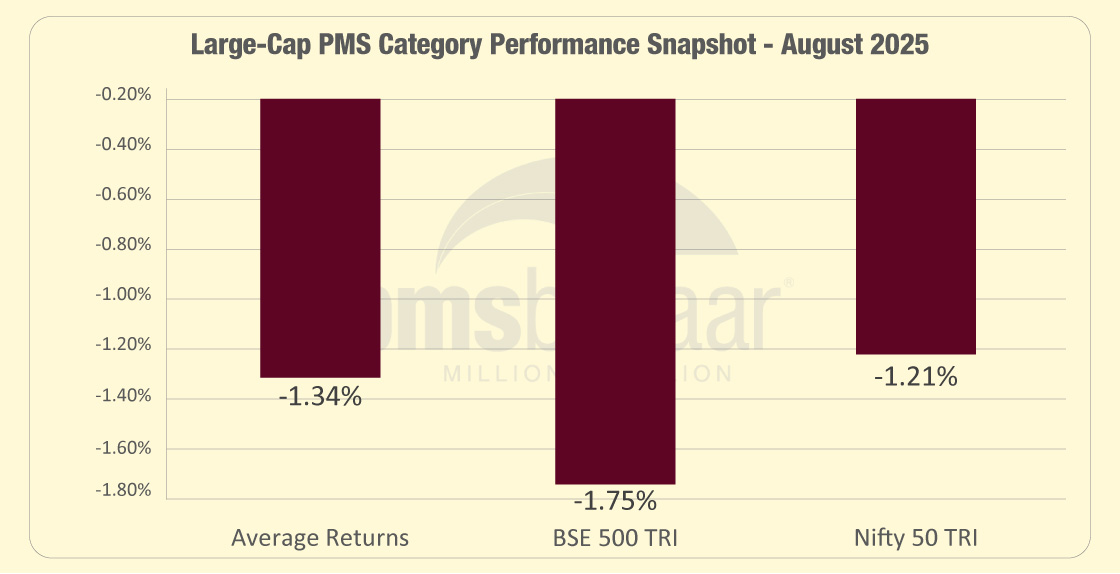

Large-cap PMS strategies show resilience with select funds delivering positive returns

Large-cap PMS strategies faced a soft August 2025, with the category average slipping 1.34 per cent. This was a shade better than the broader BSE 500 TRI, which declined 1.75 per cent, but slightly worse than the Nifty 50 TRI’s 1.21 per cent fall. Out of 27 schemes, 15 managed to beat the BSE 500 TRI, while 12 outperformed the Nifty 50 TRI, showing that nearly half the pack held up better than benchmarks.

The top performer was Pelican Holdings’ PE Fund, which delivered a healthy 2.01 per cent return, bucking the overall weakness. Ambit’s Coffee Can Portfolio and Nippon Life’s Absolute Freedom strategy also ended in positive territory, both gaining 0.75 per cent.

Overall, large-cap managers showcased resilience, with select funds managing to generate meaningful positive returns despite a challenging backdrop.

Here are the Top-3 performers.

Largecap PMS Category Performance Snapshot:

Largecap PMS strategies delivered an average return of -1.34%, slightly underperforming the Nifty 50 TRI (-1.21%) but outperforming the BSE 500 TRI (-1.75%). This suggests that largecap managers managed to limit downside better than the broader market.

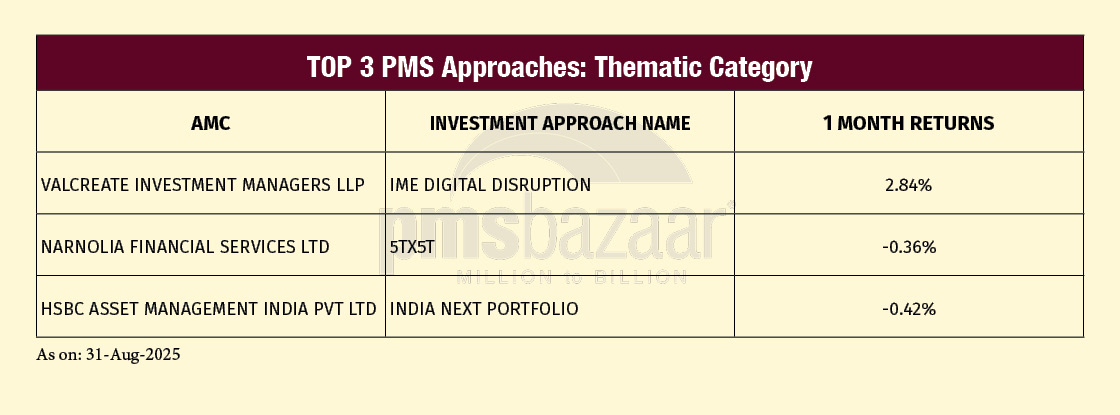

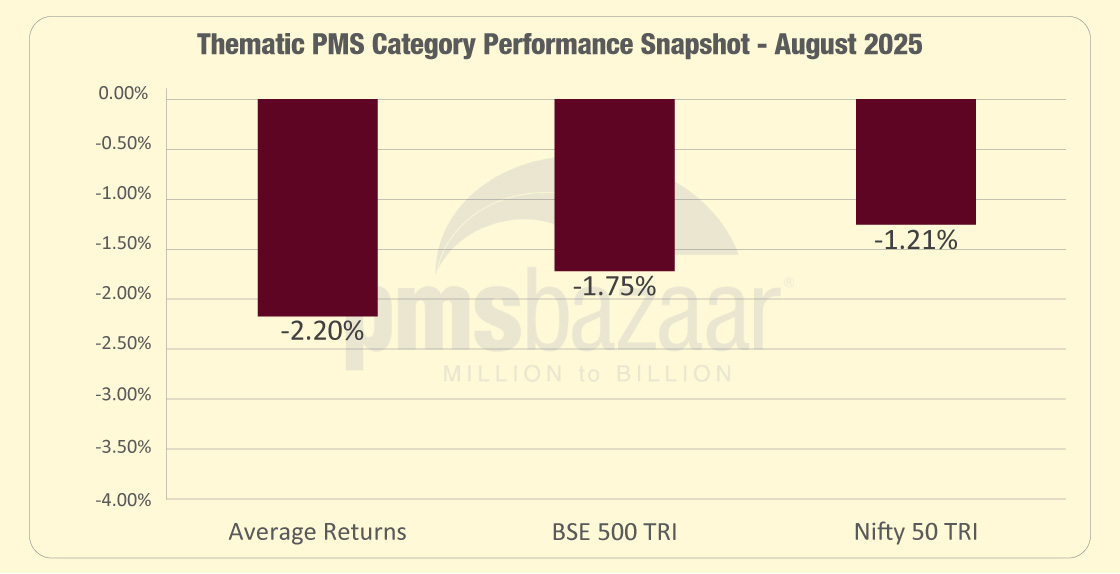

Thematic PMS strategies struggle in August, but a few outperform

Thematic PMS funds had a weak run in August 2025, with the category average slipping 2.20 per cent. Both benchmarks also ended lower, though the BSE 500 TRI fell 1.75 per cent and the Nifty 50 TRI declined 1.21 per cent, indicating relatively lesser pain. Out of 18 schemes, only seven managed to outperform the BSE 500 TRI, while just five beat the Nifty 50 TRI. The data reflects the segment’s vulnerability during volatile market phases, as concentrated thematic bets came under pressure.

Yet, performance across individual funds was not entirely one-sided. Valcreate Investment Managers’ IME Digital Disruption strategy stood out, clocking a robust 2.84 per cent gain and topping the chart. Narnolia’s 5TX5T strategy limited its loss to 0.36 per cent, while HSBC’s India Next Portfolio was close behind at -0.42 per cent.

Here are the Top-3 performers.

Thematic PMS Category Performance Snapshot:

Thematic PMS strategies underperformed in August 2025, with average returns at -2.20%, weaker than both the BSE 500 TRI (-1.75%) and Nifty 50 TRI (-1.21%). This indicates a sharper drawdown for thematic mandates compared to the broader market.

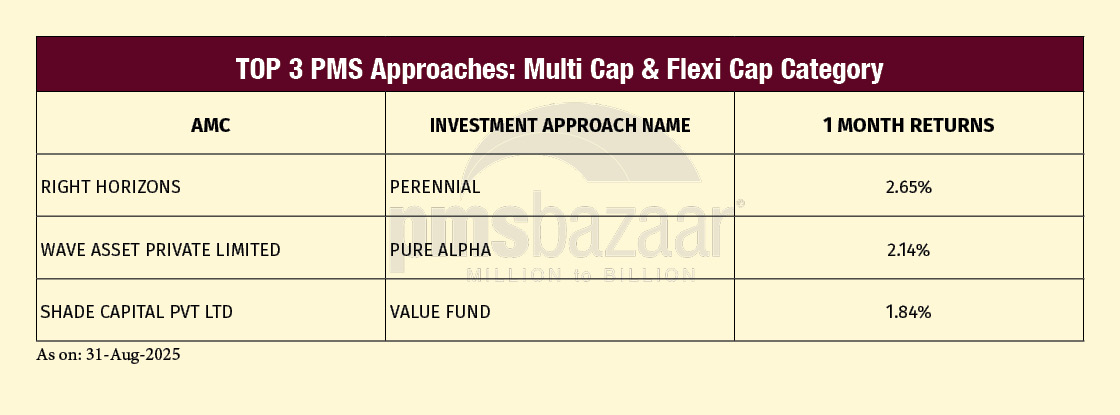

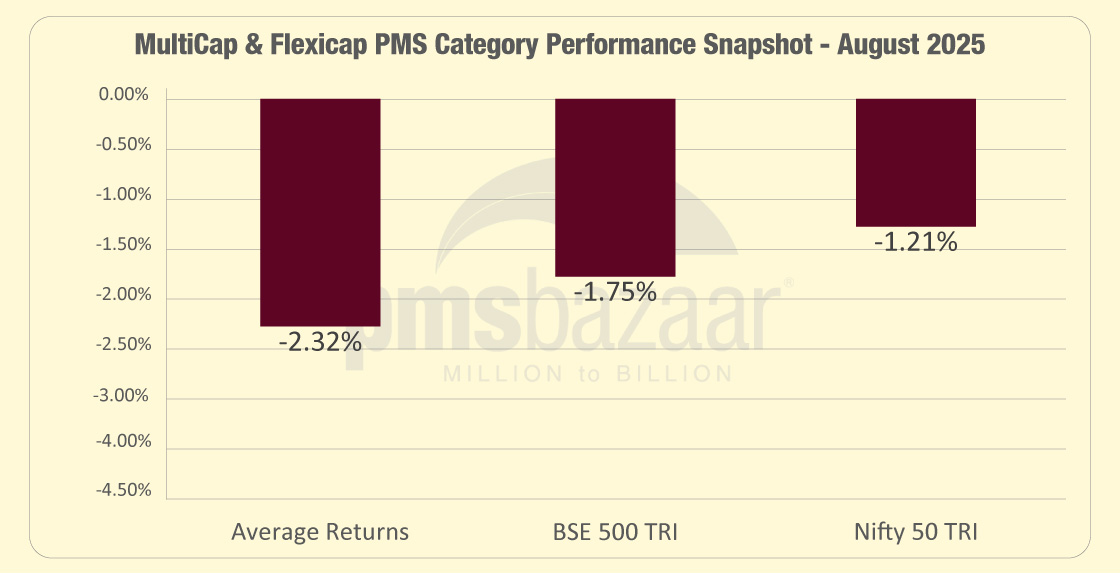

Multicap and Flexicap PMS funds deliver mixed returns with few standouts

The multicap and flexicap PMS category had a challenging August 2025, with average returns slipping 2.32 per cent. This was worse than both benchmarks, as the BSE 500 TRI lost 1.75 per cent and the Nifty 50 TRI fell 1.21 per cent. Out of 249 schemes, 99 outperformed the BSE 500 TRI, while 65 beat the Nifty 50 TRI. The large base of funds meant that competition was intense, and only a handful managed to post meaningful gains.

Right Horizons’ Perennial strategy led the table, returning 2.65 per cent. Wave Asset’s Pure Alpha was close behind at 2.14 per cent, while Shade Capital’s Value Fund delivered 1.84 per cent.

The segment’s breadth shows that despite a weak category average, select managers generated alpha.

Here are the Top-3 performers.

Multicap & Flexicap PMS Category Performance Snapshot:

Multicap & Flexicap PMS strategies fell -2.32% in August 2025, underperforming the BSE 500 TRI (-1.75%) and Nifty 50 TRI (-1.21%). This shows broader equity weakness hit flexible mandate portfolios harder than benchmarks.

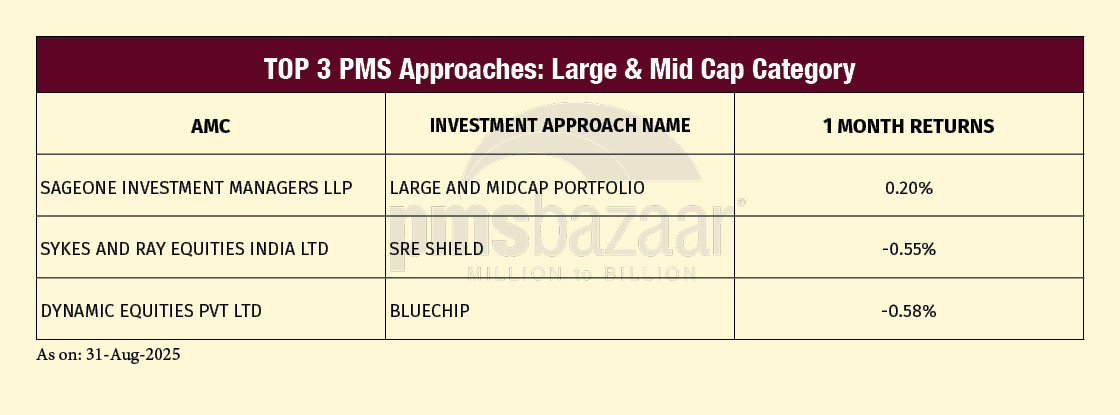

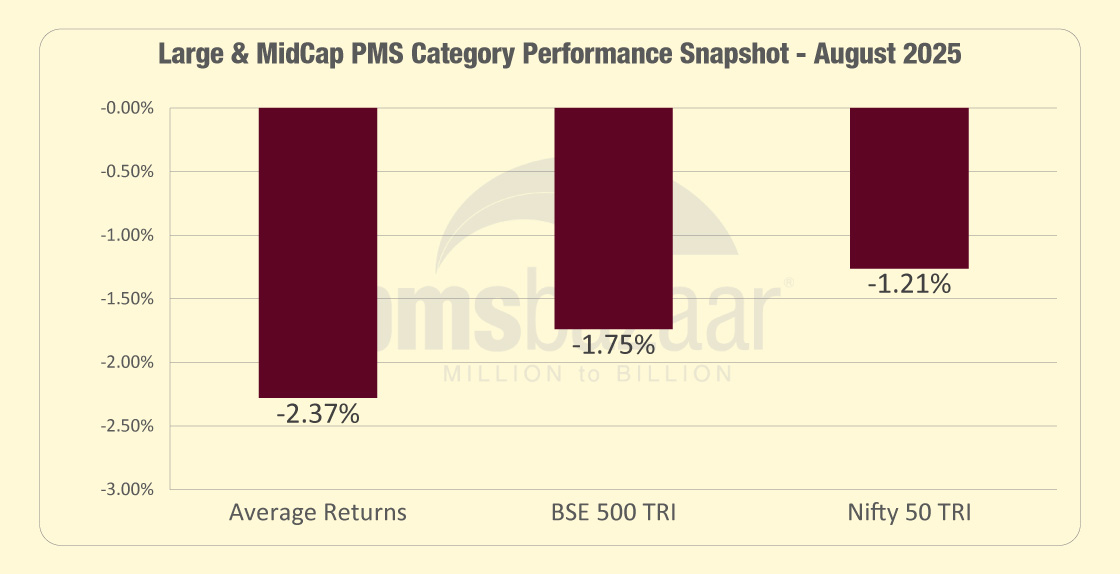

Large and Midcap PMS funds face steep declines with few bright spots

Large and midcap PMS strategies recorded another weak month in August 2025, with the category average down 2.37 per cent. Both benchmarks fared relatively better, as the BSE 500 TRI fell 1.75 per cent and the Nifty 50 TRI declined 1.21 per cent. Of the 22 schemes tracked, only eight outperformed the BSE 500 TRI and just five managed to beat the Nifty 50 TRI. The data highlights how managers in this segment struggled to contain downside amid broad-based market weakness.

Within the top 10 performers, SageOne Investment Managers’ Large and Midcap Portfolio was the only fund to deliver positive returns, gaining 0.20 per cent. Others were in negative territory, though some limited losses. Sykes and Ray’s SRE Shield and Dynamic Equities’ Bluechip fell 0.55 and 0.58 per cent respectively.

Here are the Top-3 performers.

Large & Midcap PMS Category Performance Snapshot:

Large & Midcap PMS strategies delivered an average return of -2.37%, underperforming both the BSE 500 TRI (-1.75%) and Nifty 50 TRI (-1.21%). This reflects a challenging month for portfolio managers in this category, lagging broader market benchmarks.

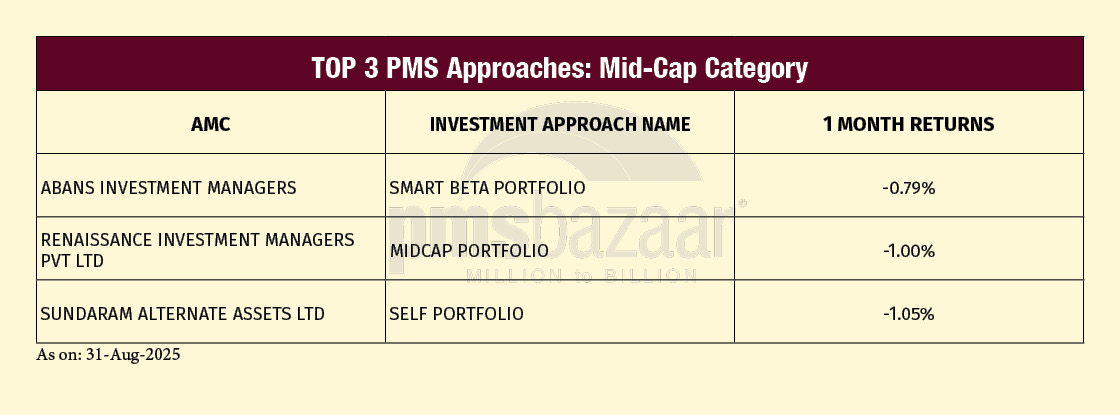

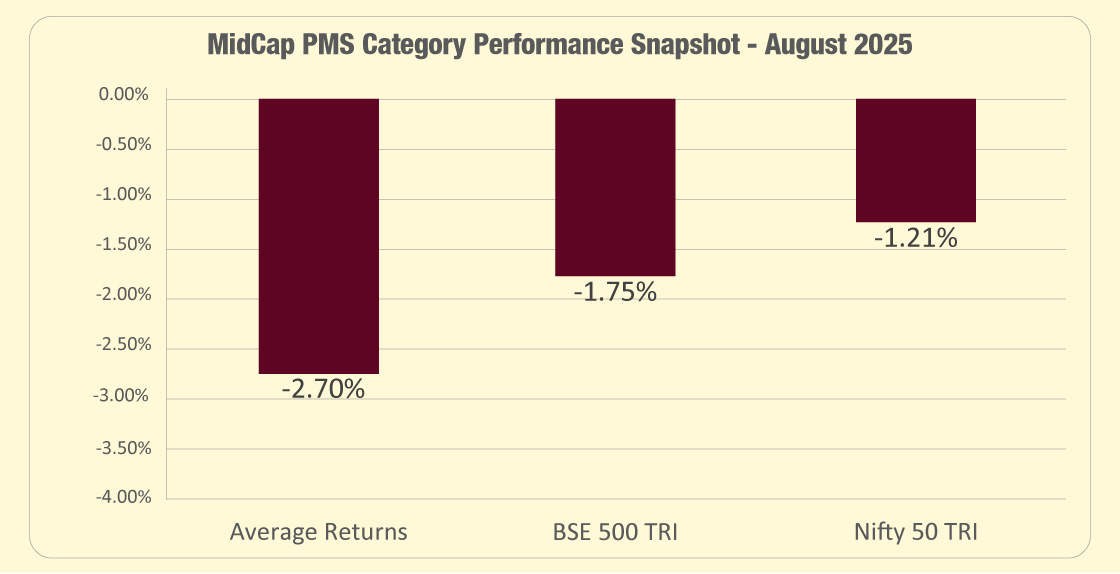

Midcap PMS funds underperform with sharp declines across strategies

Midcap PMS strategies struggled in August 2025, recording an average decline of 2.70 per cent. This was weaker than both benchmarks, as the BSE 500 TRI fell 1.75 per cent and the Nifty 50 TRI slipped 1.21 per cent. Out of 21 schemes, only five managed to outperform the BSE 500 TRI, and just three beat the Nifty 50 TRI. The data shows how concentrated midcap exposure magnified losses during the volatile month.

Among the top 10, Abans Investment Managers’ Smart Beta Portfolio contained the downside best, limiting losses to 0.79 per cent. Renaissance Investment Managers’ Midcap Portfolio fell 1.00 per cent, while Sundaram Alternate Assets’ SELF Portfolio dropped 1.05 per cent.

Overall, midcap PMS managers faced one of the toughest months among equity categories.

Here are the Top-3 performers.

Midcap PMS Category Performance Snapshot:

In August 2025, the average Midcap PMS returns fell by -2.70%, underperforming both the BSE 500 TRI (-1.75%) and Nifty 50 TRI (-1.21%). This indicates a notably weaker performance by midcap PMS managers compared to broader market indices.

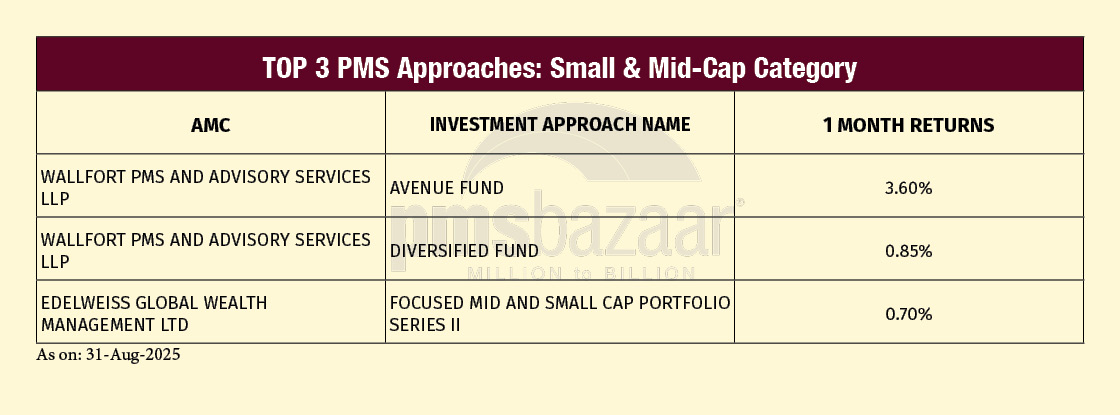

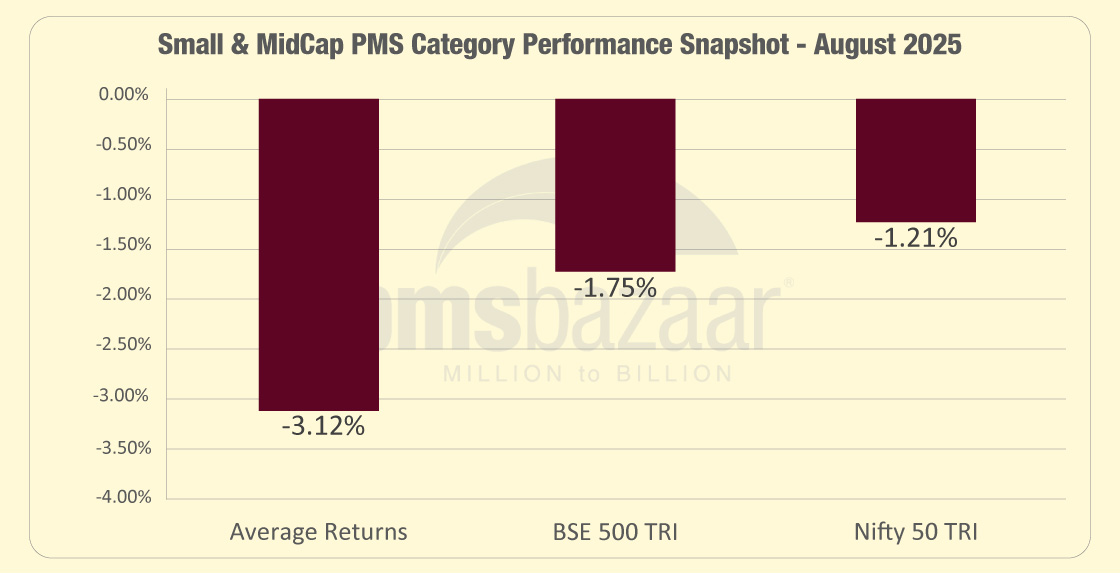

Small and midcap PMS funds hit one of the hardest, but a few buck the trend

The small and midcap PMS category bore the sharpest losses in August 2025, with average returns plunging 3.12 per cent. This was far worse than both the BSE 500 TRI’s 1.75 per cent fall and the Nifty 50 TRI’s 1.21 per cent decline. Out of 54 schemes, only 13 managed to outperform the BSE 500 TRI, while just eight beat the Nifty 50 TRI. The data highlights how smaller companies came under heavy pressure during the month, dragging down portfolios with concentrated allocations.

Yet, a handful of strategies delivered positive results. Wallfort PMS’s Avenue Fund stood out with a strong 3.60 per cent gain, the best across the entire category. Its Diversified Fund followed with 0.85 per cent, while Edelweiss’s Focused Mid and Small Cap Portfolio Series II added 0.70 per cent.

Here are the Top-3 performers.

Small & Midcap PMS Category Performance Snapshot:

Small & Midcap PMS strategies saw sharp declines in August 2025, with average returns at -3.12%, well below the BSE 500 TRI (-1.75%) and Nifty 50 TRI (-1.21%). This underscores the heightened volatility and deeper corrections in smaller market segments.

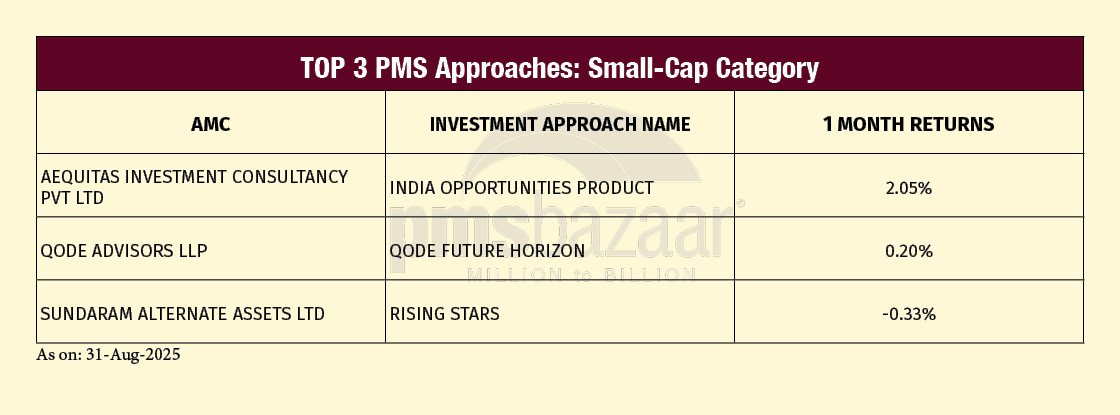

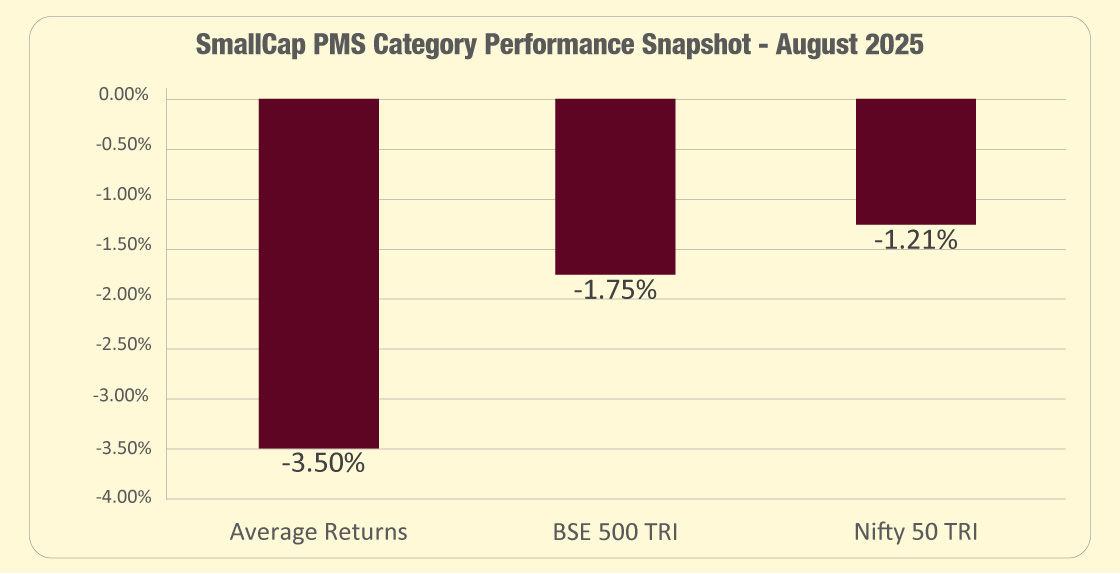

Small-cap PMSes face steepest losses but a few delivers gains

Small-cap PMS strategies endured the sharpest declines in August 2025, with the category average plunging 3.50 per cent. This underperformance was stark compared to the BSE 500 TRI’s 1.75 per cent fall and the Nifty 50 TRI’s 1.21 per cent decline. Out of 26 schemes, only four managed to outperform each benchmark, highlighting the stress across the small-cap space.

Amid this weakness, a few funds still posted gains. Aequitas Investment Consultancy’s India Opportunities Product stood out, delivering a strong 2.05 per cent return, the best in the segment. Qode Advisors’ Qode Future Horizon also stayed positive with a modest 0.20 per cent gain. Sundaram Alternate Assets’ Rising Stars limited its loss to 0.33 per cent.

The data underscores how difficult the environment was for small-cap managers, with only a handful bucking the trend.

Here are the Top-3 performers.

Smallcap PMS Category Performance Snapshot:

Small Cap PMS schemes faced steeper losses in August 2025, averaging -3.50%, far below the BSE 500 TRI (-1.75%) and Nifty 50 TRI (-1.21%). This highlights the sharper correction in the small-cap segment compared to the broader markets.

Outlook for September

The first quarter of FY26, often described as the “crossover quarter,” signalled a shift from the muted, low-single-digit earnings growth of FY25 to a more durable double-digit trajectory. Earnings breadth improved meaningfully. Indian equities have remained lacklustre, with Nifty down over 3.2% YoY, underperforming global peers due to earnings weakness and macro/geopolitical headwinds. That said, the domestic backdrop looks more encouraging. India’s GDP accelerated to 7.8% YoY in 1QFY26, the best in five quarters, supported by broad-based strength in manufacturing, agriculture, and services.

At this level of earnings, valuations remain close to long-period averages. PMS investors need to stay patient and anchored to their long-term goals, especially during phases of volatility. Market cycles often bring short-term discomfort, but disciplined investing helps capture the benefits of active management and compounding. Chasing momentum or reacting to near-term setbacks can dilute portfolio outcomes. A goal-based approach, combined with trust in the portfolio manager’s strategy, ensures that investors remain aligned with their wealth creation objectives despite temporary fluctuations.

Happy Investing!

Recent Blogs

January Rout, Extreme Dispersion: PMS Returns Swing From Losses to Gains

Benchmark falls deepened losses, but multi-asset and debt cushioned portfolios meaningfully

Investment Frameworks : A Practitioner’s Guide

PMS Bazaar recently organized a webinar titled “Investment Frameworks: A Practitioner’s Guide,” which featured Mr. Sumit Agrawal, Senior Vice President, Nuvama Asset Management Limited. This blog covers the important points shared in this insightful webinar.

Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability

PMS Bazaar recently organized a webinar titled “Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability,” which featured Mr. Sandeep Daga, MD& CIO, Nine Rivers Capital and Mr. Kunal Sabnis, Portfolio Manager, Nine Rivers Capital. This blog covers the important points shared in this insightful webinar.

Flat Markets, Wide Outcomes: How 484 PMS Strategies Performed in Dec 2025

December 2025 was a month where market returns stayed close to flat, with the Nifty 50 TRI at -0.28% and the BSE 500 TRI at -0.24%.

Equity Markets 2026: Outlook, Risks and Strategy

PMS Bazaar recently organized a webinar titled “Equity Markets 2026: Outlook, Risks and Strategy,” which featured Mr. Ashish Chaturmohta, MD & Fund Manager – APEX PMS, JM Financial Limited. This blog covers the important points shared in this insightful webinar.

MICRO CAPS: The Dark Horses of the Indian Equity Market

PMS Bazaar recently organized a webinar titled “MICRO CAPS: The Dark Horses of the Indian Equity Market,” which featured Mr. Rishi Agarwal and Mr. Adheesh Kabra, both Co-Founders and Fund Managers, Aarth AIF. This blog covers the important points shared in this insightful webinar.

Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy

PMS Bazaar recently organized a webinar titled “Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy,” which featured Mr.Anunaya Kumar, President – Sales and Distribution ASK Investment Managers Limited. This blog covers the important points shared in this insightful webinar.

.jpg)

Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS

PMS Bazaar recently organized a webinar titled “Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS,” which featured Mr. Karan Bhatia, Co-Founder and Co-Fund Manager , Pricebridge Honeycomb ETF PMs. This blog covers the important points shared in this insightful webinar.