AIFs struggle as market Volatility weighs on returns; only 13 out of 141 strategies clock positive returns

Alternative Investment Funds (AIFs) saw mixed fortunes in August 2025, as equity markets ended the month in the red. Both the S&P BSE 500 TRI and the Nifty 50 TRI posted losses of 1.75 per cent and 1.21 per cent respectively. Against this backdrop, long-only AIFs struggled to keep pace, while long-short strategies managed to deliver some downside protection.

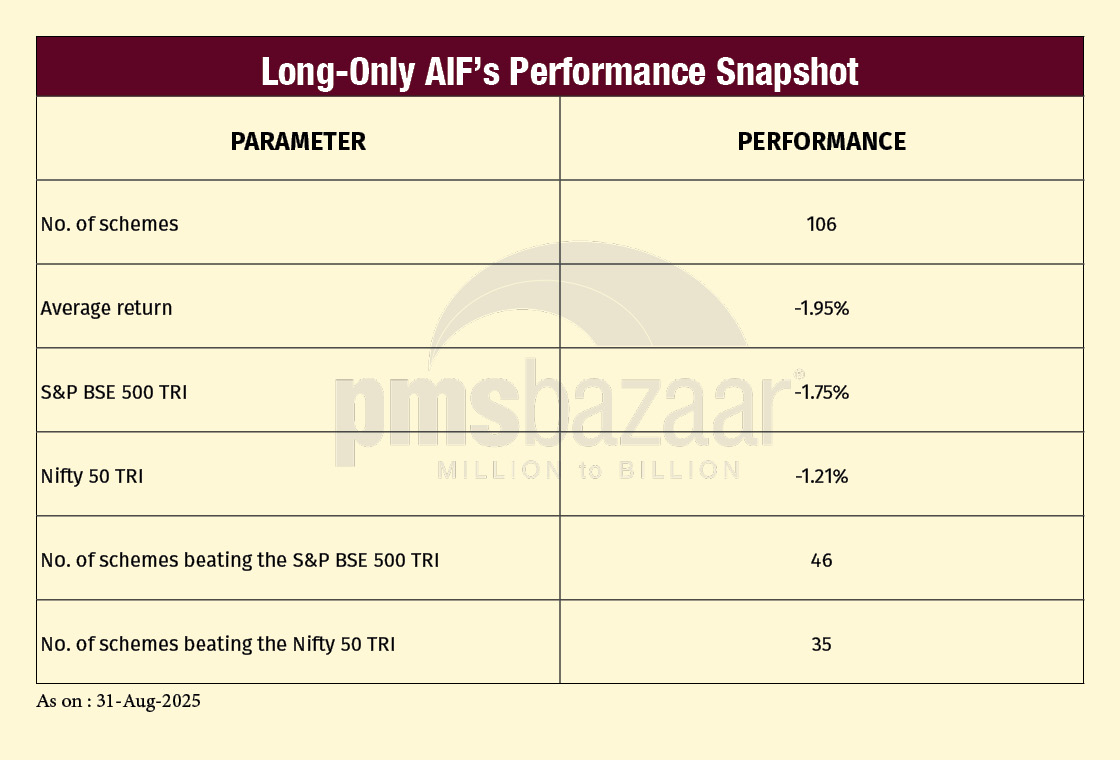

Data from 106 long-only AIFs shows that the segment recorded an average return of –1.95 per cent for the month. This performance lagged both the broad-based S&P BSE 500 TRI and the large-cap focused Nifty 50 TRI. Only 46 funds managed to outperform the S&P BSE 500 TRI, and just 35 stayed ahead of the Nifty 50 TRI. The breadth of underperformance suggests that long-only managers found it difficult to navigate the market’s decline, with stock-picking gains insufficient to offset broader equity weakness.

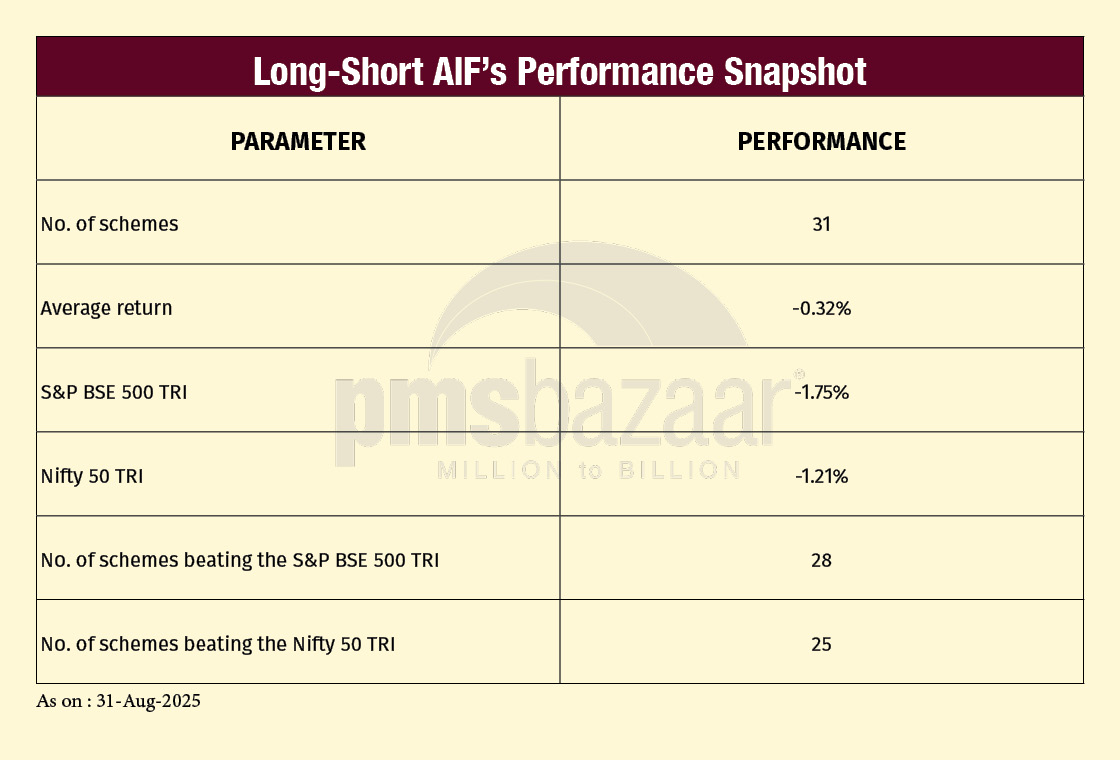

In contrast, the 31 long-short AIFs delivered relatively better outcomes. The category posted a smaller average decline of 0.32 per cent, comfortably ahead of both equity benchmarks. A large majority of managers in this space outperformed, with 28 funds surpassing the S&P BSE 500 TRI and 25 beating the Nifty 50 TRI. The data indicates that hedging strategies and tactical short positions offered effective buffers during a challenging month for equities.

The contrast highlights the role of strategy design in shaping investor outcomes. Long-only portfolios, tethered to equity market direction, bore the brunt of August’s volatility. Long-short funds, with the flexibility to balance exposures, succeeded in preserving capital more effectively. With the markets remaining sensitive to global and domestic triggers, the divergence between the two AIF categories underscores the importance of approach and execution in delivering risk-adjusted returns.

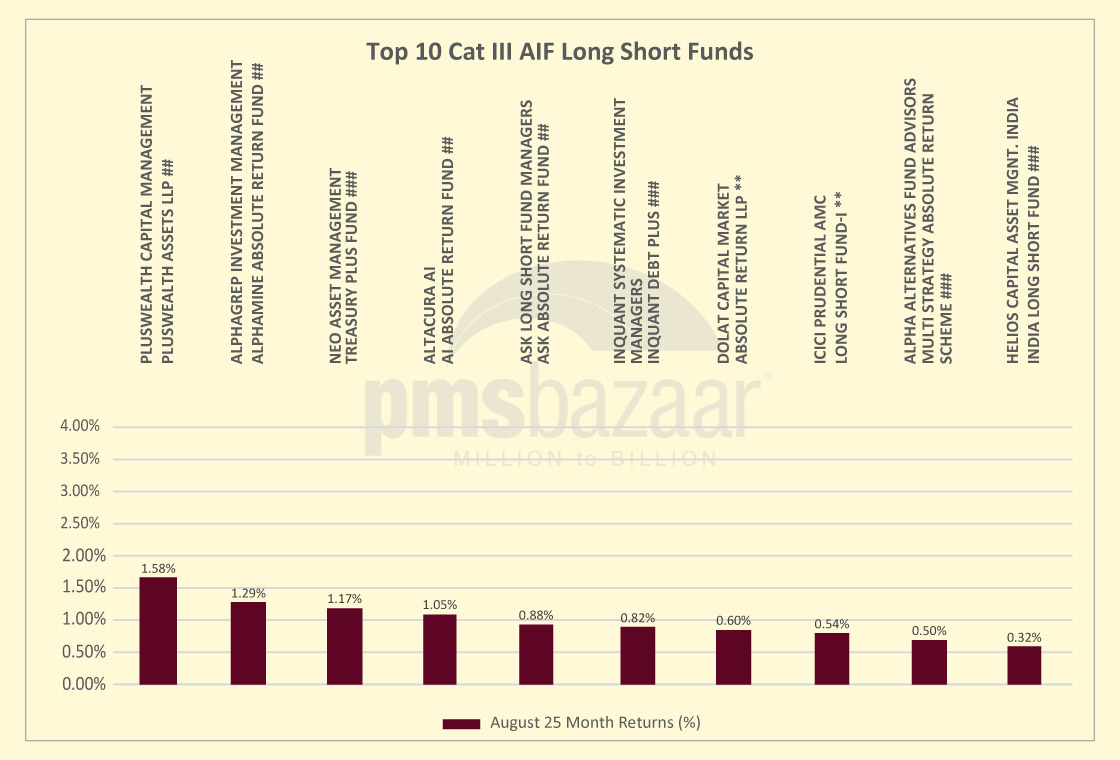

Hedging Pays Off as Long-Short AIFs Outperform in August

Long-short strategies delivered relative resilience in August 2025, limiting losses in a difficult equity market. The 31 funds in this category posted an average decline of just 0.32 per cent, substantially softer than the S&P BSE 500 TRI’s –1.75 per cent and the Nifty 50 TRI’s –1.21 per cent.

The data reveals that 28 funds outperformed the broad-based S&P BSE 500 TRI, while 25 stayed ahead of the Nifty 50 TRI. This strong hit rate demonstrates the value of flexible positioning when benchmarks are under pressure.

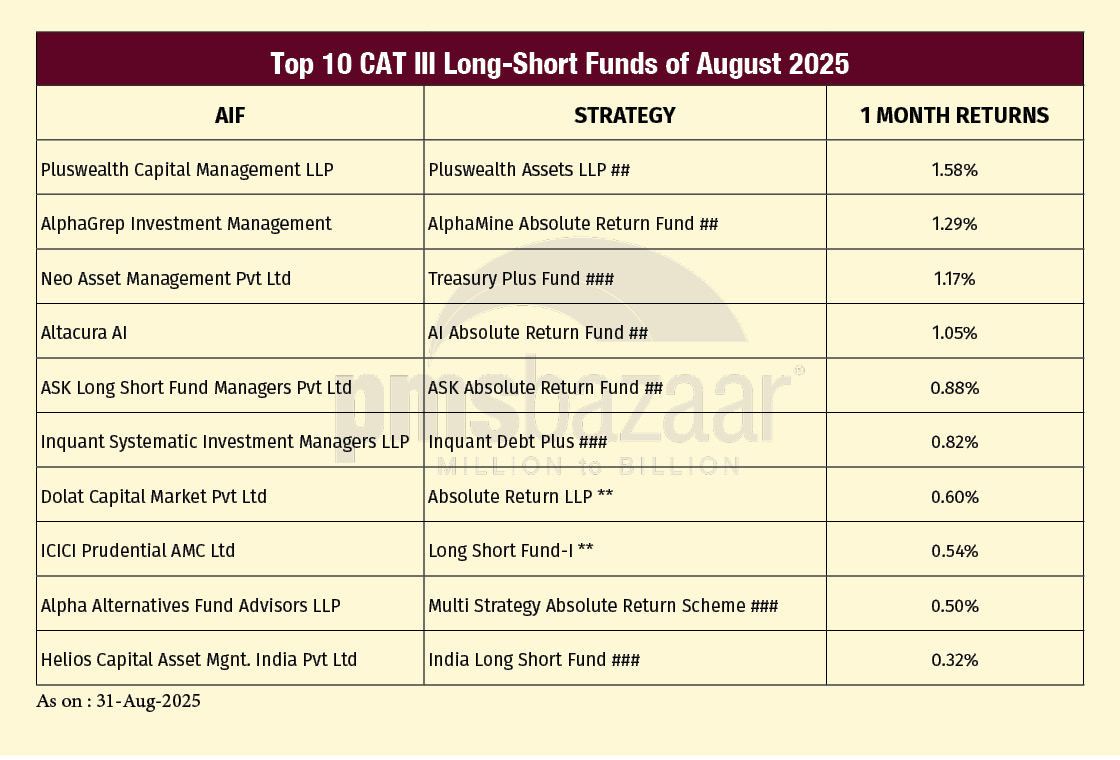

A closer look at the leaders shows several funds generating positive returns despite the challenging backdrop. Pluswealth Capital Management’s Pluswealth Assets LLP topped the list, delivering a 1.58 per cent gain. AlphaGrep Investment’s AlphaMine Absolute Return Fund followed with 1.29 per cent, while Neo Asset Management’s Treasury Plus Fund added 1.17 per cent. These funds demonstrated effective hedging and tactical exposure adjustments that allowed them to generate alpha even as broader indices slipped.

Other notable names included Altacura AI’s AI Absolute Return Fund at 1.05 per cent and ASK’s Absolute Return Fund at 0.88 per cent. Inquant’s Debt Plus Fund also contributed with 0.82 per cent, underscoring how systematic approaches can cushion portfolios. Dolat Capital Market’s Absolute Return LLP (0.60 per cent) and ICICI Prudential’s Long Short Fund-I (0.54 per cent) further illustrated steady performance within a conservative mandate. Rounding off the top ten were Alpha Alternatives’ Multi Strategy Absolute Return Scheme (0.50 per cent) and Helios Capital’s India Long Short Fund, which managed a 0.32 per cent gain in its aggressive stance.

Here are the top-10 long short AIF performers.

Note: *** Post Exp & Tax, ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax, ^^ Post Exp & Tax and Pre Perf.Fees, # Below 1 Year returns are Simple Annualized. All Performance above are as on 31st August 2025.

The breadth of outperformance across diverse managers highlights the strength of active long-short frameworks. In an environment where long-only strategies struggled to preserve value, these funds demonstrated how disciplined hedging and tactical calls can help investors ride through volatility with reduced drawdowns.

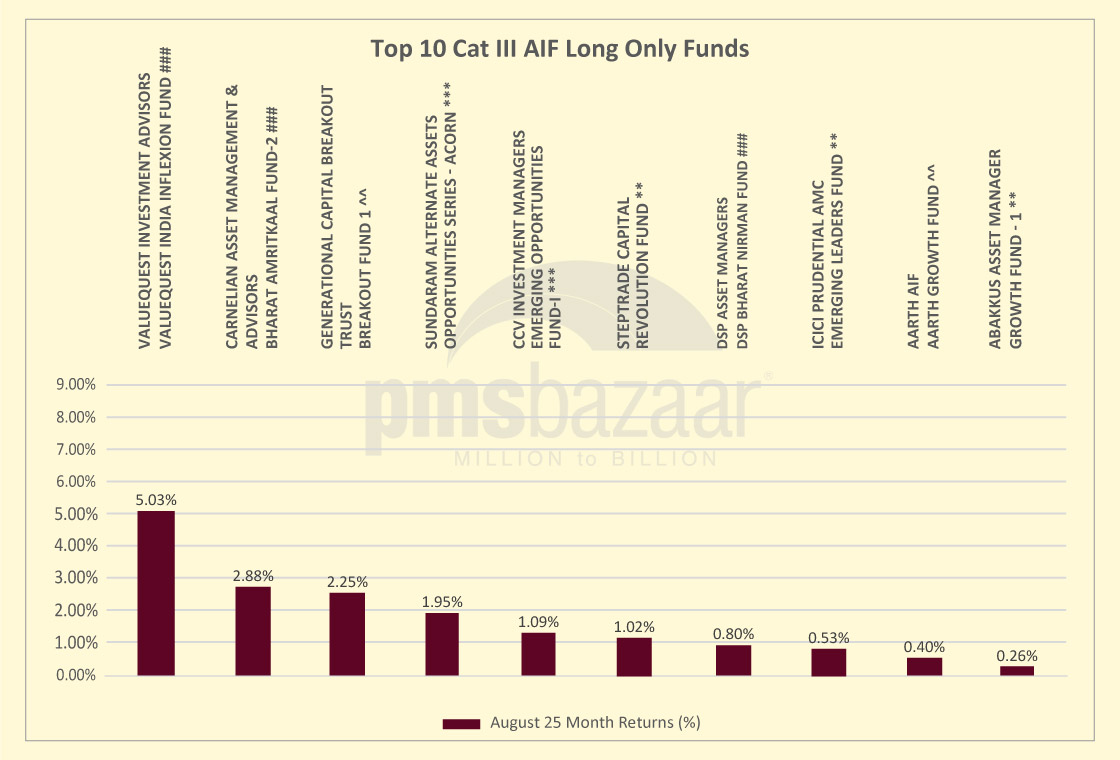

Equity Weakness Drags Long-Only AIFs, Outliers Stand Tall

The long-only segment of Alternative Investment Funds faced headwinds in August 2025, posting broad underperformance against equity benchmarks. Data from 106 funds shows the category delivered an average return of –1.95 per cent, trailing both the S&P BSE 500 TRI (–1.75 per cent) and the Nifty 50 TRI (–1.21 per cent).

Only 46 funds managed to outperform the broader S&P BSE 500 TRI, while 35 beat the Nifty 50 TRI, underscoring the challenges faced by managers with fully invested equity portfolios.

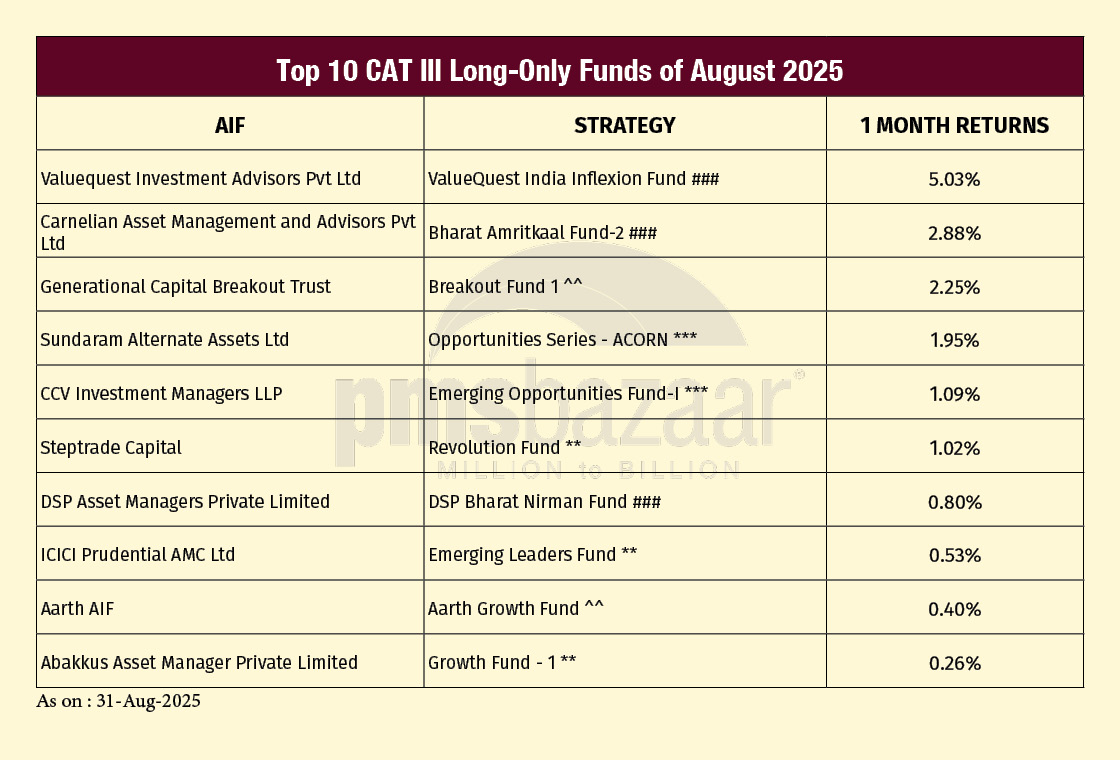

Despite the weak average, several funds stood out with strong positive returns, highlighting the value of differentiated strategies. ValueQuest India Inflexion Fund led the performance chart with a robust 5.03 per cent gain, sharply ahead of indices and peers. Carnelian Asset Management’s Bharat Amritkaal Fund-2 also impressed with a 2.88 per cent rise, while Generational Capital’s Breakout Fund 1 delivered 2.25 per cent. These returns underline the impact of concentrated bets and thematic plays that worked even in a declining market.

Other notable gainers included Sundaram Alternates’ Opportunities Series – ACORN at 1.95 per cent and CCV Investment’s Emerging Opportunities Fund-I, which returned 1.09 per cent. Steptrade Capital’s Revolution Fund (1.02 per cent) and DSP’s Bharat Nirman Fund (0.80 per cent) also found a place in the top ten. Large institutional names like ICICI Prudential’s Emerging Leaders Fund (0.53 per cent) and Abakkus Asset Manager’s Growth Fund – 1 (0.26 per cent) rounded off the list along with Aarth AIF’s Growth Fund (0.40 per cent).

Here are the top-10 long only AIF performers.

Note: *** Post Exp & Tax, ** Post Exp, Pre Tax. ## Gross returns, ### Post Exp & Pre Perf.Fees & Tax, ^^ Post Exp & Tax and Pre Perf.Fees, # Below 1 Year returns are Simple Annualized. All Performance above are as on 31st August 2025.

The wide dispersion of outcomes within the long-only category reflects the difficulty of generating alpha in a falling market. While the overall picture was one of decline, select managers demonstrated that stock-specific calls and conviction-led approaches could still deliver meaningful gains, offering a silver lining in an otherwise muted month.

September 2025 Outlook

As investors look ahead to September, the focus remains on how markets digest global cues, domestic flows, and policy signals.

For long-only AIF participants, the recent setbacks underline the need for patience. Equity-heavy strategies are inherently exposed to short-term volatility, but they also stand to benefit if sector rotations or earnings surprises trigger fresh momentum. A selective approach, backed by conviction in themes that can withstand uncertainty, may continue to differentiate winners from laggards.

For long-short investors, August reaffirmed the value of tactical flexibility. The ability to hedge and adjust exposures helped many funds soften the blow of market declines. Heading into September, such strategies may remain attractive in navigating uneven trends. Periods of heightened volatility can present opportunities to capture alpha through relative value plays and short exposures, while still participating in upside rallies.

Across both approaches, investor mindset will be tested by mixed signals: global growth concerns on one hand, and domestic resilience on the other.

For AIF investors, the outlook is not about timing every swing but staying committed to a diversified strategy. September could still bring pockets of opportunity, and those positioned with both long-only conviction and long-short adaptability may be best placed to ride the churn.

Disclaimer: This Blog is made for informational purposes only and does not constitute an offer, solicitation, or an invitation to the public in general to invest in any of the Funds mentioned. All the Returns mentioned in this blog are provided by the respective asset management companies and may vary based on their reporting structure (Pre-tax, Post-tax, Post-expenses, etc.). PMS Bazaar has taken due care and caution in the compilation of data and information. However, PMS Bazaar doesn’t guarantee the accuracy, adequacy, or completeness of any information. Investors must read the detailed Private Placement Memorandum (PPM), including the risk factors, and consult your Financial Advisor before making any investment decision/contribution to AIF. This Blog has been prepared for general guidance, and no person should act upon any information contained in the document. PMS Bazaar, its affiliates, and their office, directors, and employees shall not be responsible or liable for any investment action initiated. This Blog is intended only for the personal use to which it is addressed and not for distribution.

Recent Blogs

Reigniting India’s Consumption Engine

This article is authored by Ashish Chaturmohta, Managing Director, APEX PMS, JM Financial Ltd.

Navigating the Dichotomies in MSME Investing - Challenges and Opportunities

PMS Bazaar recently organized a webinar titled “Navigating the Dichotomies in MSME Investing - Challenges and Opportunities,” which featured Mr. Rishi Agarwal, Co-Founder and Fund Manager, Aarth AIF.

Outperforming During Market Drawdowns

PMS Bazaar recently organized a webinar titled “Outperforming During Market Drawdowns” which featured Mr. Rishab Nahar, Partner and Fund Manager, Qode Advisors LLP. This blog covers the important points shared in this insightful webinar.

Weakness persists as equity markets decline in August; Multi Asset and Debt PMSes emerge as safe havens

Over 100 equity PMSes managed to out-perform Nifty50 TRI while 153 strategies outshined S&P BSE 500 TRI

Smart Beta Strategies: What Investors Should Know Before Investing

This article is authored by Vivek Sharma, VP and Head of Investments at Estee Advisors

Dynamic Investing Approach in Different Markets

This article is authored by Rishabh Nahar, partner and fund manager, Qode Advisors LLP

The Accreditation Edge: Unlocking the Power of Accredited Investors to make Diversified Investments

PMS Bazaar recently organized a webinar titled “The Accreditation Edge: Unlocking the Power of Accredited Investors to make Diversified Investments,” which featured Mr. Archit Lohia, Founder and CEO of Career Topper Online Education Pvt. Ltd. This blog covers the important points shared in this insightful webinar.

PMS performance hit by broad market slump in July; Thematic strategies buck the trend

Of 427 equity PMSes, only 61 gained; Debt offerings showed positive returns. July 2025 proved to be a testing month for Portfolio Management Services (PMS) investors, with broad-based declines across most asset classes.