Of 427 equity PMSes, only 61 gained; Debt offerings showed positive returns. July 2025 proved to be a testing month for Portfolio Management Services (PMS) investors, with broad-based declines across most asset classes.

A PMS Bazaar analysis of 471 PMS schemes, including 17 debt, 27 multi-asset and 427 equity, shows debt strategies were the only major segment to end higher on average, returning 0.62% versus 0.53% for the Crisil Composite Bond Fund Index. Multi-asset PMSes fell 1.09%, while equity schemes dropped 1.91%, still faring better than the BSE 500 TRI’s 2.71% slide.

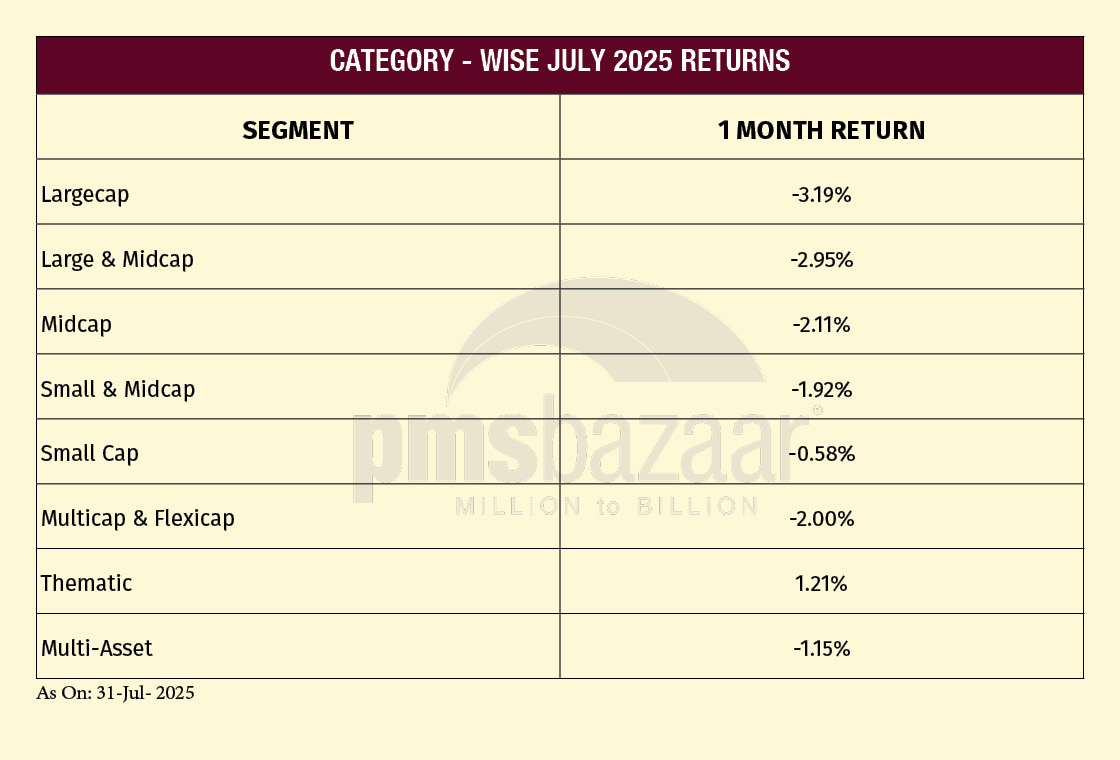

Weakness spanned the equity spectrum, as large, mid, small and microcaps all ended in the red. Only healthcare and FMCG indices eked out gains, with financials, IT and energy posting the steepest losses. Just 61 equity PMSes managed a positive return, though 265 still beat the broader market. Thematic PMSes led with a 1.21% gain, while largecap (-3.19%) and large & midcap (-2.95%) strategies were the hardest hit.

Here is a deeper look at July-2025 PMS returns.

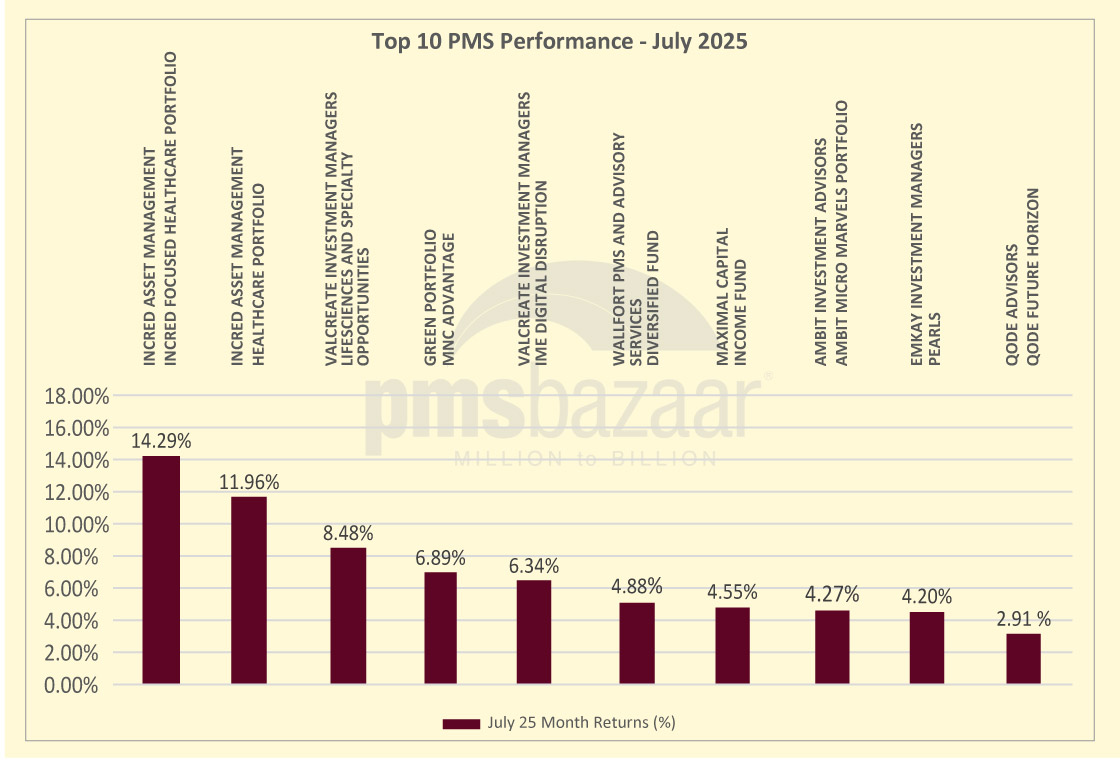

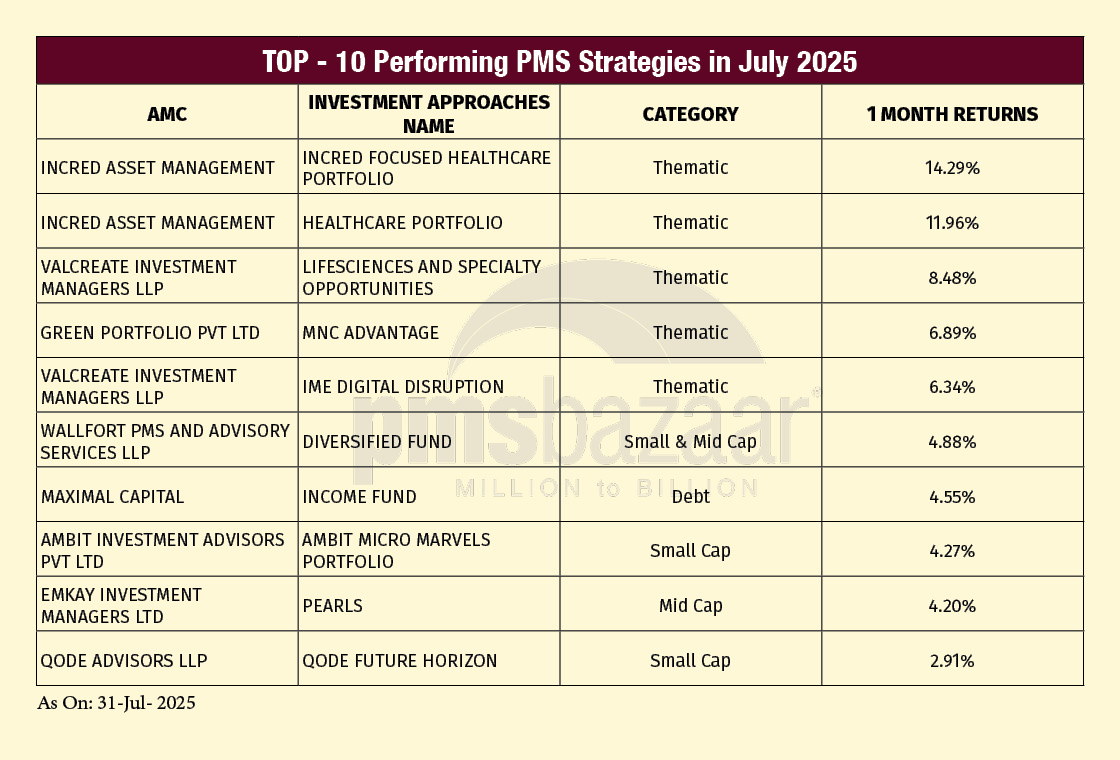

Top 10 performers in focus

July 2025’s PMS leaderboard was dominated by thematic strategies, particularly those riding the resilience of healthcare and innovation-focused sectors.

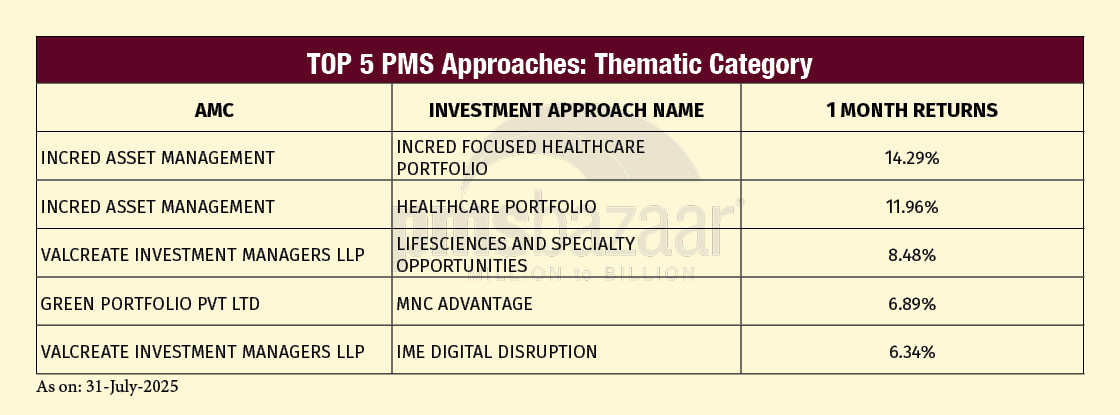

InCred Asset Management claimed the top two spots, with its Incred Focused Healthcare Portfolio delivering a stellar 14.29% return and the Healthcare Portfolio close behind at 11.96%. Both benefitted from sectoral tailwinds as healthcare stocks defied the broader market’s weakness.

Valcreate Investment Managers’ Lifesciences and Specialty Opportunities came third with an 8.48% gain, while Green Portfolio’s MNC Advantage (6.89%) and Valcreate’s IME Digital Disruption (6.34%) rounded out the thematic-heavy top five.

Outside the thematic pack, Wallfort PMS’s Diversified Fund led the Small & Midcap space with a 4.88% return. Maximal Capital’s Income Fund was the best-performing debt PMS at 4.55%, offering stability amid equity volatility.

Ambit Micro Marvels Portfolio (4.27%) and Emkay’s Pearls (4.20%) showcased selective alpha in smallcap and midcap categories, respectively. Qode Advisors’ Qode Future Horizon closed the top 10 with a 2.91% gain in the smallcap segment.

The month’s winners underscored that sector-specific bets and niche strategies, especially in healthcare and innovation, were key to generating meaningful positive returns in an otherwise weak market backdrop.

Category focus: Thematic defies the downtrend as equities slip across the board

July 2025 saw a stark reversal from the broad gains of previous months, with most PMS categories ending in the red.

Thematic strategies were the clear outlier, averaging a 1.21% gain. Tailwinds from healthcare and select innovation-led themes shielded them from the market-wide selling, with top performers delivering double-digit returns.

Smallcap PMS strategies limited losses to 0.58%, reflecting resilience in niche and microcap plays where selective stock picking helped offset broader weakness.

Multi-asset PMSes, down 1.15%, cushioned equity losses with exposure to debt and other non-equity assets, though not enough to post gains.

Small & Midcap PMSes fell 1.92%, pressured by declines in financials and industrial cyclicals.

Multicap & Flexicap strategies dropped 2.00%, with diversified portfolios unable to escape the downturn in large and mid-tier names.

Midcap PMSes, which had led gains in June, slipped 2.11% as selling hit infrastructure, real estate, and mid-sized financial stocks.

Large & Midcap PMSes lost 2.95%, weighed down by weakness in benchmark heavyweights.

Largecap PMSes were the worst hit, down 3.19%, as financials, IT, and energy dragged frontline indices lower.

Thematic PMS beats market in July, led by healthcare and innovation themes

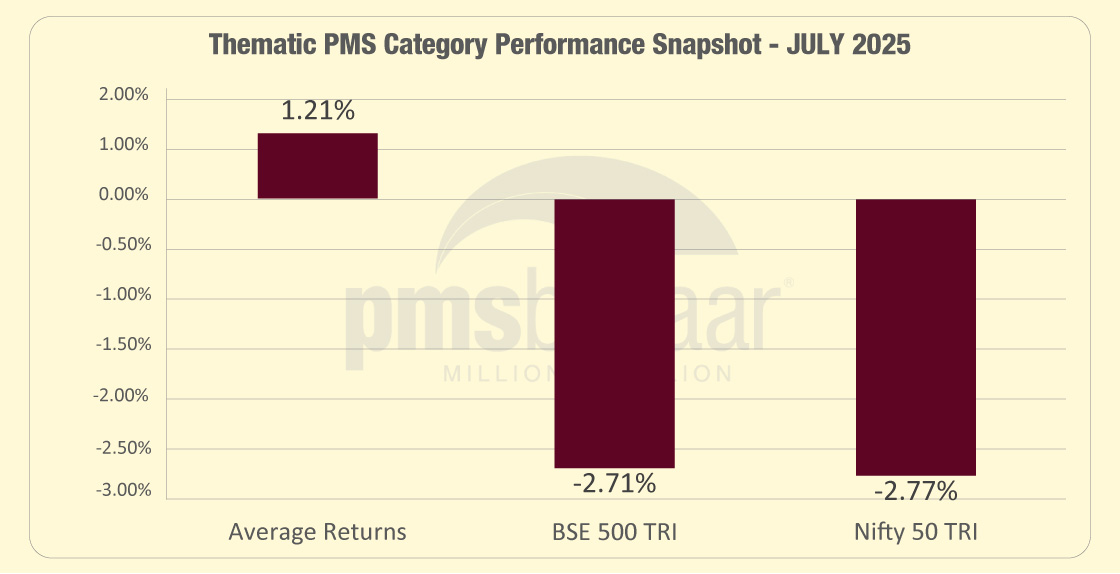

Thematic PMS strategies stood out in July 2025, defying the broad market weakness with an average return of 1.21%. This performance was significantly ahead of the BSE 500 TRI’s 2.71% drop and the Nifty 50 TRI’s 2.77% decline. Out of 18 thematic schemes tracked, 14 outperformed the BSE 500 TRI and 15 beat the Nifty 50 TRI, highlighting the category’s defensive strength and targeted sector positioning.

Healthcare-oriented portfolios led the pack, benefiting from sector resilience and investor rotation into defensive growth themes. InCred Asset Management secured the top two positions — its Incred Focused Healthcare Portfolio surged 14.29%, while the Healthcare Portfolio returned 11.96%. Valcreate Investment Managers’ Lifesciences and Specialty Opportunities followed with 8.48%, further underscoring healthcare’s dominance.

Outside healthcare, Green Portfolio’s MNC Advantage gained 6.89%, driven by global-linked Indian franchises, and Valcreate’s IME Digital Disruption returned 6.34%, reflecting strength in innovation-led businesses.

In a month where most equity categories posted losses, thematic PMS managers with concentrated exposure to resilient sectors and secular growth stories were able to generate meaningful alpha, proving the merit of focused investment strategies in volatile conditions.

Below is a table of the top-5 Thematic PMS strategies for July 2025.

Thematic PMS Category Performance Snapshot:

In July 2025, Thematic PMS delivered a 1.21% gain, significantly outperforming the BSE 500 TRI and Nifty 50 TRI, which fell by over 2.7%.

Smallcap PMS outperforms broader market despite July weakness

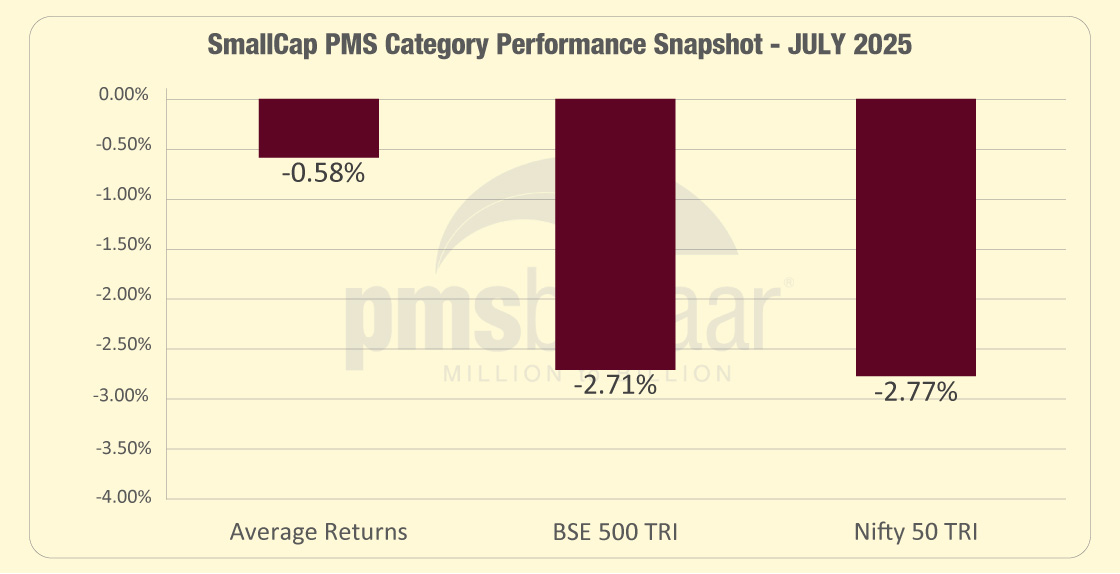

Smallcap PMS strategies posted an average return of -0.58% in July 2025, significantly outperforming the BSE 500 TRI’s -2.71% and the Nifty 50 TRI’s -2.77%. Out of 26 schemes tracked, 23 managed to beat both benchmarks, reflecting strong relative performance in a month when most equity categories were deep in the red.

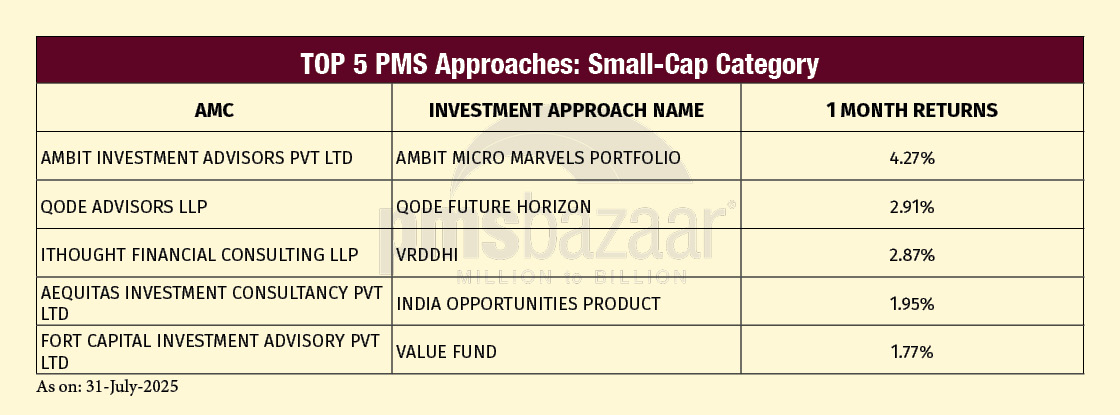

Ambit Investment Advisors’ Ambit Micro Marvels Portfolio led the pack with a 4.27% gain, driven by targeted exposure to high-growth smallcap names with robust earnings visibility. Qode Advisors’ Qode Future Horizon followed with a 2.91% return, while ithought Financial Consulting’s VRDDHI delivered 2.87%, both benefitting from selective positioning in resilient smallcap segments.

Aequitas Investment Consultancy’s India Opportunities Product, benchmarked to the Nifty 50 TRI, gained 1.95%, showcasing effective diversification. Fort Capital Investment Advisory’s Value Fund rounded out the top five with a 1.77% return.

The results highlight that, even in a volatile and declining market, nimble stock selection and conviction-driven portfolios can generate positive outcomes in the smallcap PMS space, offering investors valuable downside protection relative to the broader indices.

Below is a table of the top-5 Smallcap PMS strategies for July 2025.

Smallcap PMS Category Performance Snapshot:

In July 2025, Small Cap PMS posted a marginal decline of 0.58%, yet outperformed both the BSE 500 TRI and Nifty 50 TRI, which fell by over 2.7%.

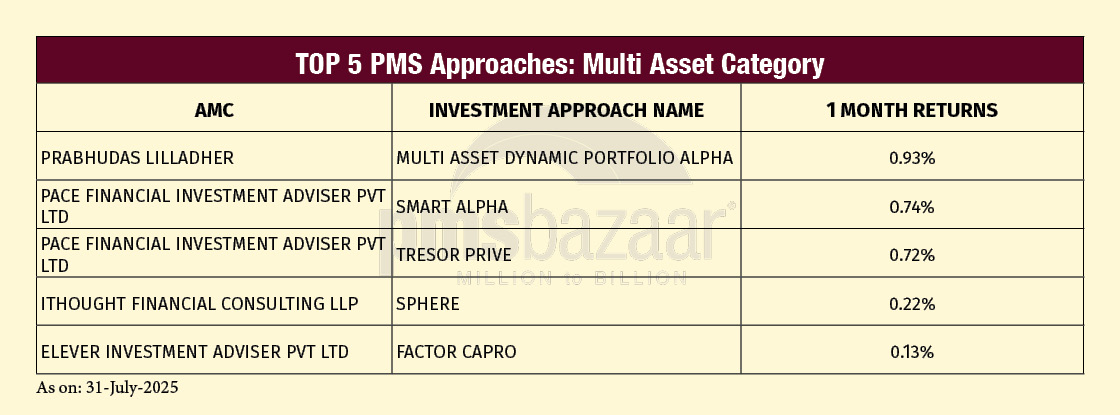

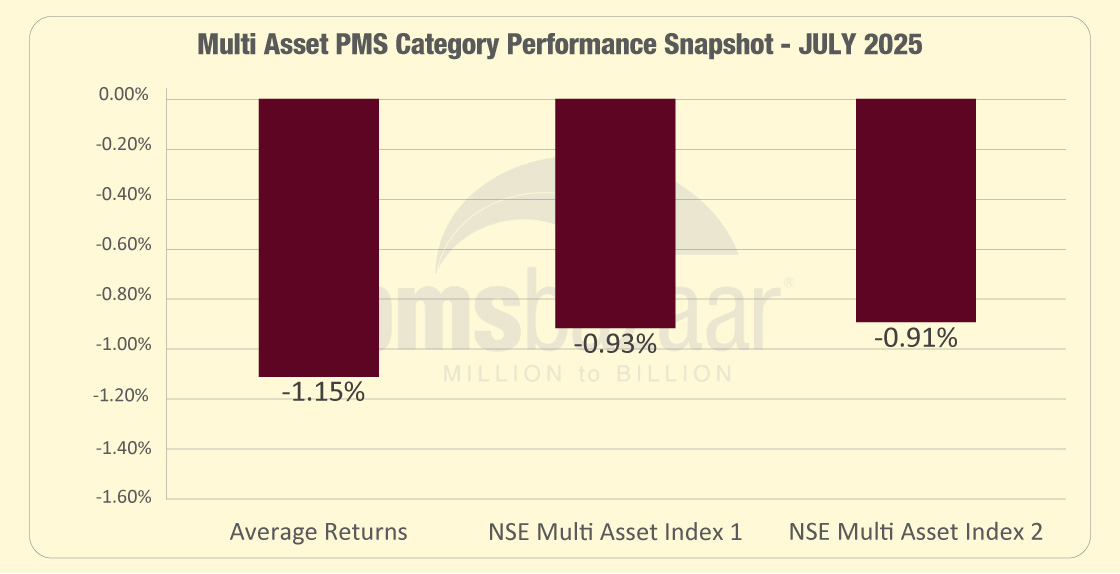

Multi-Asset PMS sees modest losses; top funds manage small gains

Multi-Asset PMS strategies ended July 2025 with an average return of -1.15%, underperforming both NSE Multi Asset Index 1 (-0.93%) and Index 2 (-0.91%). Out of the 28 schemes tracked, 15 managed to beat each benchmark, underscoring mixed outcomes for the category during a month marked by broad equity weakness and muted performance from other asset classes.

Prabhudas Lilladher’s Multi Asset Dynamic Portfolio Alpha led the segment with a 0.93% gain, reflecting effective allocation shifts and tactical positioning across asset classes. Pace Financial Investment Adviser featured twice in the top performers list — Smart Alpha returned 0.74% and Tresor Prive delivered 0.72%, both benefitting from balanced strategies with selective equity exposure.

ithought Financial Consulting’s SPHERE strategy posted a 0.22% return, while Elever Investment Adviser’s Factor Capro, benchmarked to NSE Multi Asset Index 2, gained 0.13%.

While equity-heavy allocations weighed on overall category returns, these top performers showed that nimble asset allocation and diversification can help cushion portfolios and even deliver gains, even in months where market breadth is weak and risk assets broadly struggle.

Below is a table of the top-5 Multiasset PMS strategies for July 2025.

Multi-Asset PMS Category Performance Snapshot:

In July 2025, Multi Asset PMS recorded a decline of 1.15%, underperforming the NSE Multi Asset Index 1 and Index 2, which fell by 0.93% and 0.91% respectively.

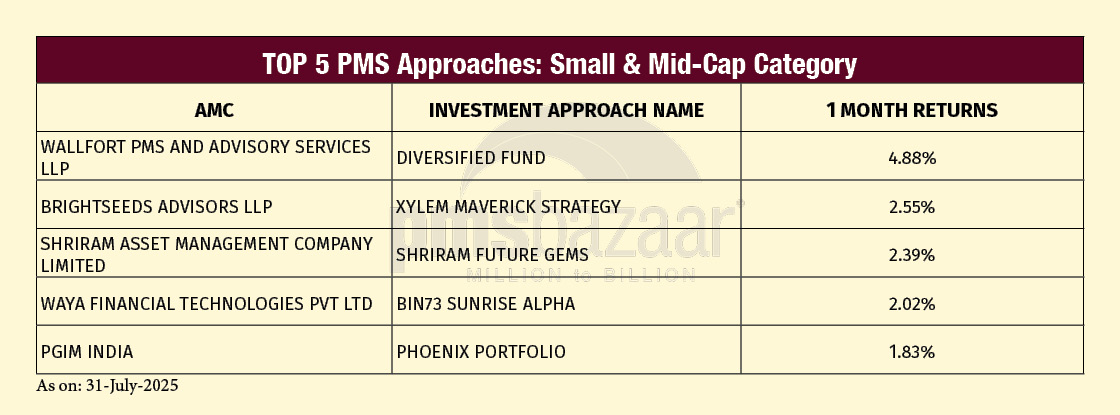

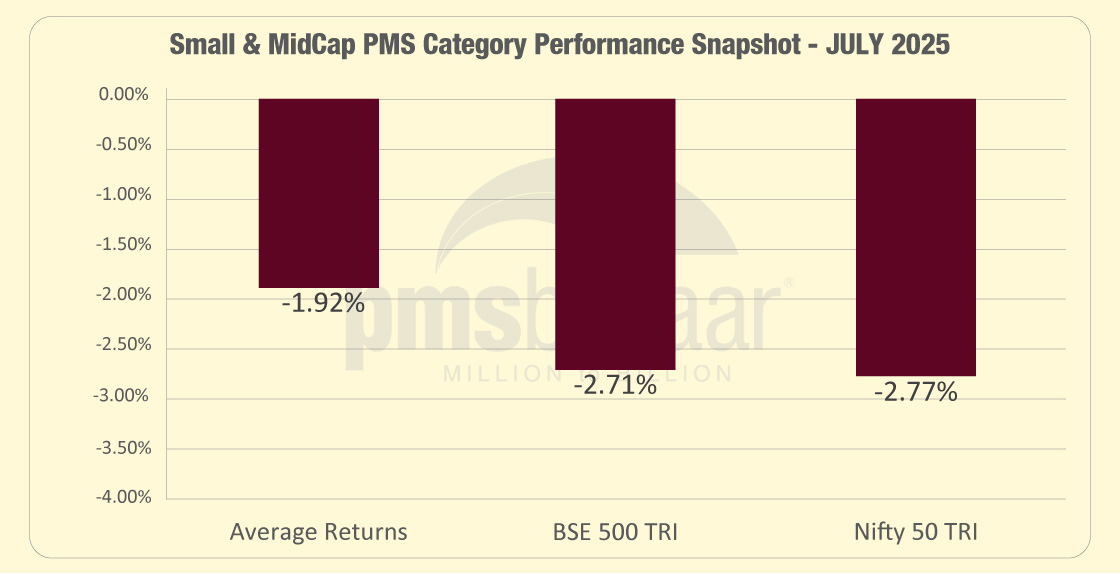

Small & Midcap PMS limits losses in July; select funds deliver gains

Small & Midcap PMS strategies recorded an average return of -1.92% in July 2025, outperforming both the BSE 500 TRI (-2.71%) and the Nifty 50 TRI (-2.77%). Of the 54 schemes tracked, 35 outperformed the BSE 500 TRI and 37 beat the Nifty 50 TRI, underscoring relative resilience in this blended category despite a challenging month for equities.

The segment’s top performer was Wallfort PMS and Advisory Services’ Diversified Fund, which gained 4.88%, benefiting from well-timed sector allocation and select stock-specific strength. Brightseeds Advisors’ Xylem Maverick Strategy followed with a 2.55% gain, reflecting disciplined positioning in mid-market opportunities. Shriram Asset Management’s Shriram Future GEMS, benchmarked to the Nifty 50 TRI, delivered 2.39%, while Waya Financial Technologies’ Bin73 Sunrise Alpha posted a 2.02% return. PGIM India’s Phoenix Portfolio rounded out the top five with a 1.83% gain.

While the broader small and midcap indices saw selling pressure, the ability of certain managers to stay in positive territory highlights the role of targeted sector exposure and active stock selection in cushioning portfolios during volatile phases.

Below is a table of the top-5 Small & Midcap PMS strategies for July 2025.

Small & Midcap PMS Category Performance Snapshot:

In July 2025, Small & Midcap PMS declined by 1.92%, yet managed to outperform the BSE 500 TRI and Nifty 50 TRI, which fell by 2.71% and 2.77% respectively.

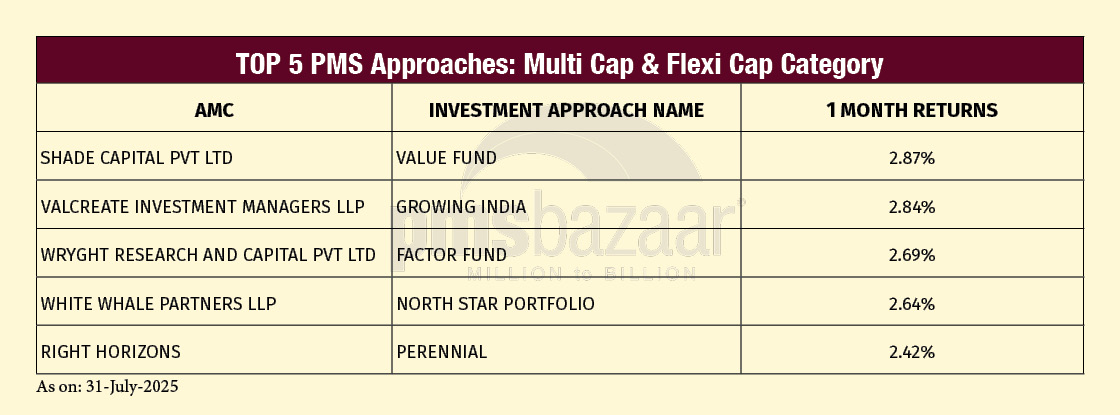

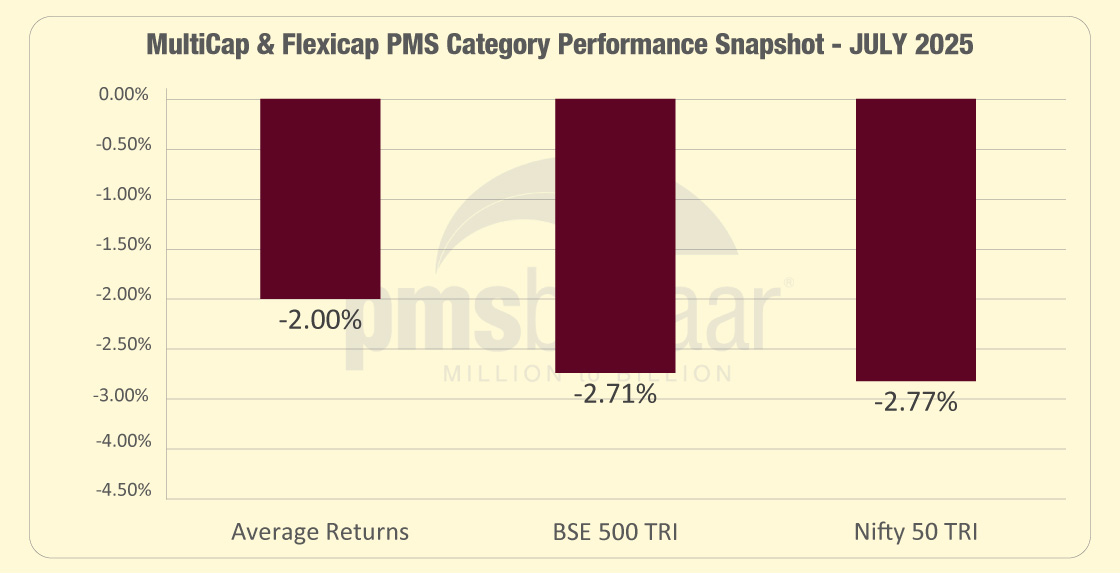

Multicap & Flexicap PMS limits downside, majority beat benchmarks

Multicap & Flexicap PMS strategies averaged a -2.00% return in July 2025, outperforming both the BSE 500 TRI (-2.71%) and the Nifty 50 TRI (-2.77%). Out of 252 schemes tracked, 161 beat the BSE 500 TRI, and 166 outperformed the Nifty 50 TRI. The segment’s relative resilience came from diversified positioning across market caps, which helped mitigate losses during a broad market decline.

Shade Capital’s Value Fund led the category with a 2.87% gain, reflecting effective stock selection and sector allocation. Valcreate Investment Managers’ Growing India followed closely at 2.84%, while Wryght Research and Capital’s Factor Fund delivered 2.69%, signalling that factor-based approaches found traction in July’s volatile environment.

White Whale Partners’ North Star Portfolio, benchmarked to the Nifty 50 TRI, posted a 2.64% return, and Right Horizons’ Perennial gained 2.42%, rounding out the top five.

Despite negative average returns, the high proportion of outperformers shows that active allocation flexibility remains a strength of multicap and flexicap PMS managers, enabling them to navigate market corrections better than the broader indices.

Below is a table of the top-5 Multicap & Flexicap PMS strategies for July 2025.

Multicap & Flexicap PMS Category Performance Snapshot:

In July 2025, Multicap & Flexicap PMS posted a 2.00% decline, still outperforming the BSE 500 TRI and Nifty 50 TRI, which dropped by 2.71% and 2.77% respectively.

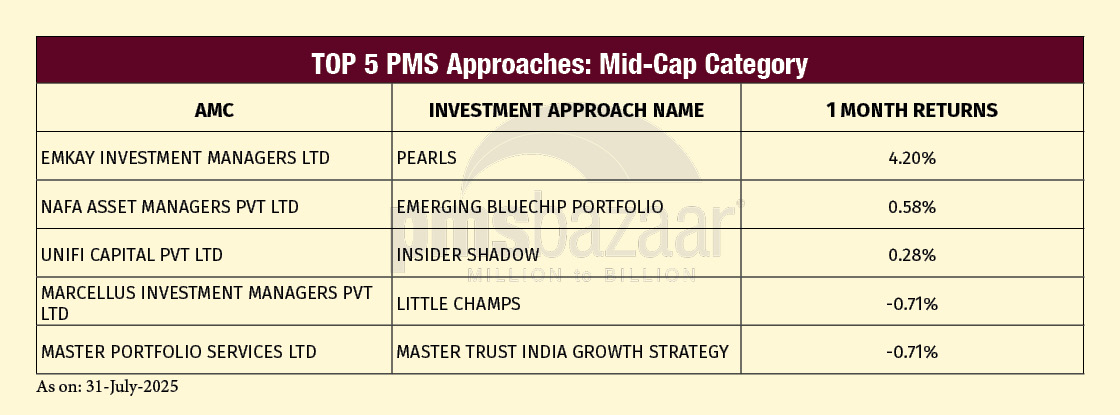

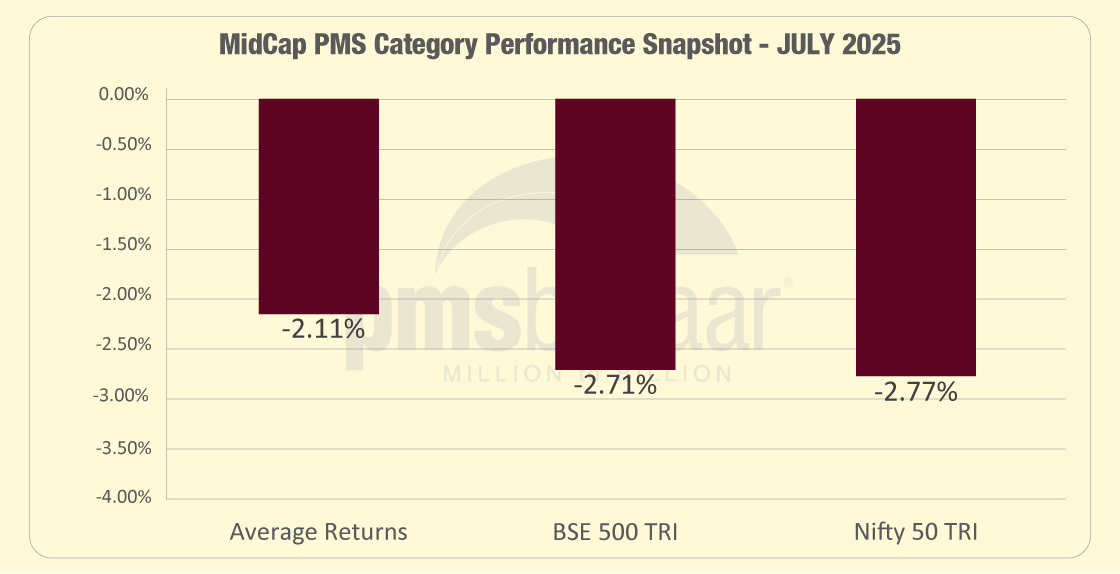

Midcap PMS underperforms in July, but top funds manage gains

Midcap PMS strategies posted an average return of -2.11% in July 2025, outperforming both the BSE 500 TRI (-2.71%) and the Nifty 50 TRI (-2.77%). Of the 21 schemes tracked, 12 outperformed the BSE 500 TRI and 13 beat the Nifty 50 TRI. While the category was weighed down by sectoral weakness in financials, real estate, and select industrials, a few strategies managed to stay in the green.

Emkay Investment Managers’ Pearls strategy led with a robust 4.20% gain, demonstrating effective stock selection and sector allocation. NAFA Asset Managers’ Emerging Bluechip Portfolio followed with 0.58%, and Unifi Capital’s Insider Shadow returned 0.28%, both showing resilience through concentrated, conviction-driven positions.

On the other hand, Marcellus Investment Managers’ Little Champs and Master Portfolio Services’ Master Trust India Growth Strategy each declined 0.71%, still performing better than the broader midcap index.

The results underline that in challenging market phases, alpha generation in midcaps hinges on a combination of disciplined bottom-up selection and the ability to sidestep sectors under heavy selling pressure.

Below is a table of the top-5 Midcap PMS strategies for July 2025.

Midcap PMS Category Performance Snapshot:

In July 2025, Midcap PMS declined by 2.11%, yet outperformed the BSE 500 TRI and Nifty 50 TRI, which recorded sharper falls of 2.71% and 2.77% respectively.

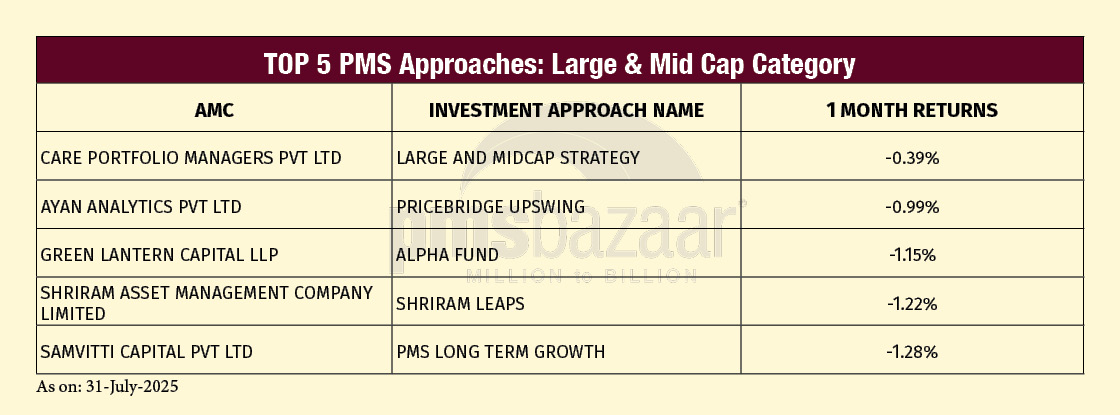

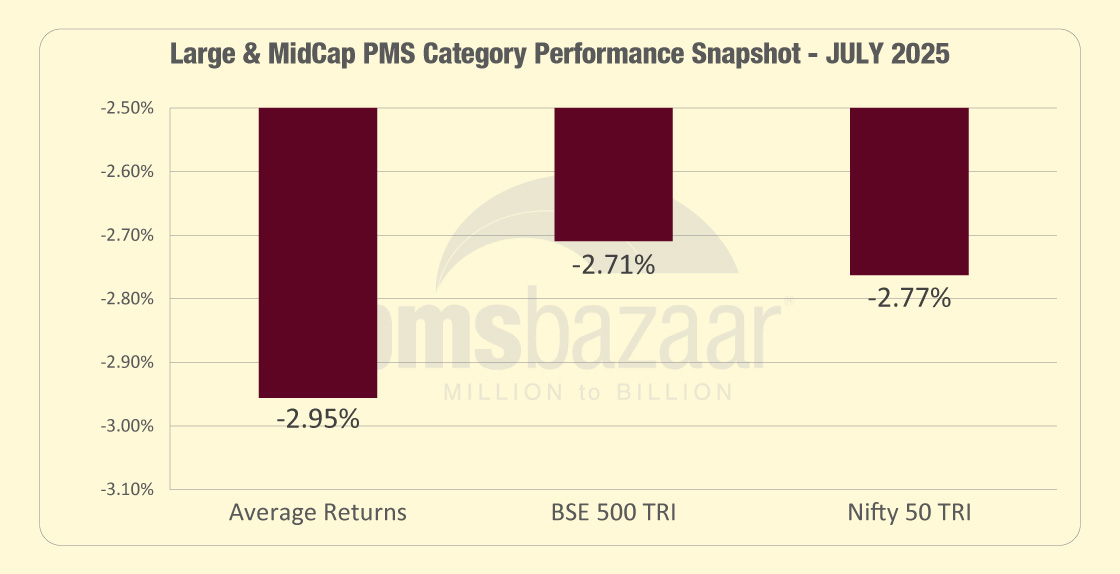

Large & Midcap PMS lags in July, most schemes in negative territory

Large & Midcap PMS strategies delivered an average return of -2.95% in July 2025, underperforming both the BSE 500 TRI (-2.71%) and the Nifty 50 TRI (-2.77%). Out of the 23 schemes tracked, only nine outperformed each benchmark, reflecting the segment’s broad struggle amid weakness in largecap and midcap indices.

Care Portfolio Managers’ Large and Midcap Strategy emerged as the best performer, limiting its loss to -0.39% through selective allocation and defensive positioning. Ayan Analytics’ PriceBridge Upswing followed, down 0.99%, benefitting from relative stability in certain index-heavy stocks.

Green Lantern Capital’s Alpha Fund ended July with a -1.15% return, while Shriram Asset Management’s Shriram LEAPS posted -1.22%. Samvitti Capital’s PMS Long Term Growth saw a -1.28% decline, rounding out the top five performers in the category.

The results highlight that even the best-managed portfolios in this segment struggled to avoid losses in a month marked by sharp declines in key sectors like financials, IT, and energy, underscoring the difficulty of generating alpha in a broad market correction.

Below is a table of the top-5 Large & Midcap PMS strategies for July 2025.

Large & Midcap PMS Category Performance Snapshot:

In July 2025, Large & Midcap PMS fell by 2.95%, underperforming both the BSE 500 TRI and Nifty 50 TRI, which declined by 2.71% and 2.77% respectively.

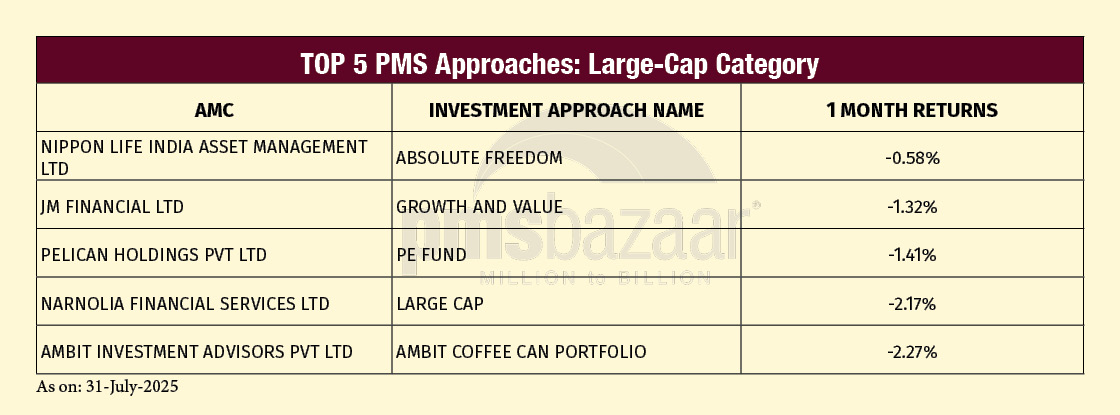

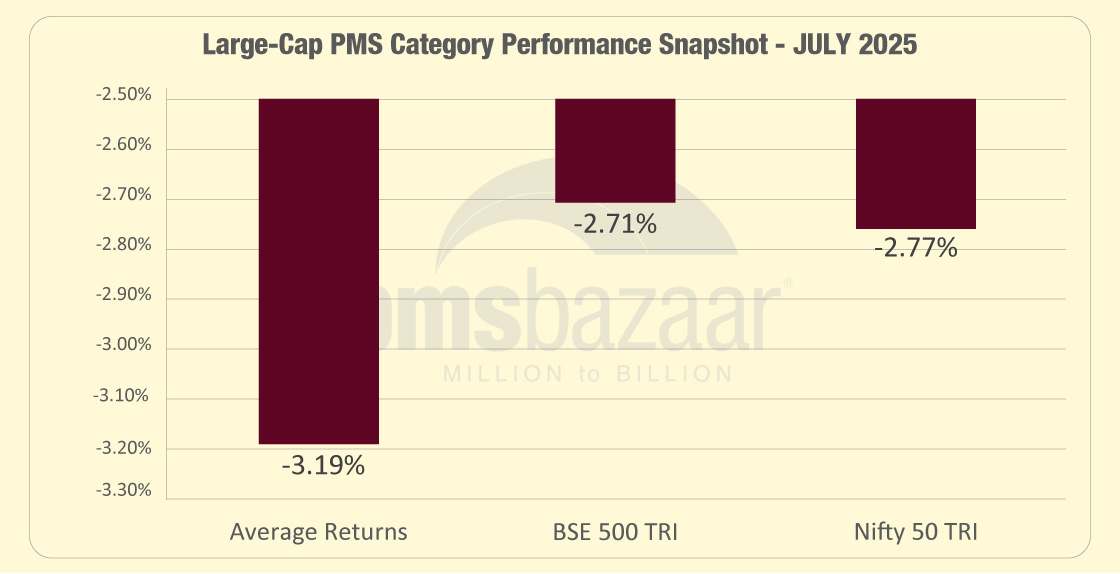

Largecap PMS underperforms in July as sectoral drags weigh

Largecap PMS strategies recorded an average return of -3.19% in July 2025, lagging both the BSE 500 TRI (-2.71%) and the Nifty 50 TRI (-2.77%). Of the 27 schemes tracked, only seven outperformed the BSE 500 TRI, while nine managed to beat the Nifty 50 TRI. The category was impacted by sharp declines in financials, IT, and energy, which dominate largecap allocations.

Nippon Life India Asset Management’s Absolute Freedom strategy emerged as the best performer, limiting its loss to -0.58% through selective allocation and defensive stock positioning. JM Financial’s Growth and Value followed with -1.32%, and Pelican Holdings’ PE Fund posted -1.41%, both faring relatively better than most peers.

Narnolia Financial Services’ Large Cap strategy declined -2.17%, while Ambit Investment Advisors’ Ambit Coffee Can Portfolio saw a -2.27% fall.

The data shows that even the best-managed largecap PMS portfolios faced headwinds in a month where benchmark-heavy sectors struggled, underscoring the difficulty of generating alpha when broad market sentiment turns negative.

Below is a table of the top-5 Largecap PMS strategies for July 2025.

Largecap PMS Category Performance Snapshot:

In July 2025, Largecap PMS registered a decline of 3.19%, underperforming the BSE 500 TRI and Nifty 50 TRI, which fell by 2.71% and 2.77% respectively.

Outlook for August-2025

As we step into August 2025, the mood in the PMS space is turning more constructive after July’s broad-based correction. Valuations in several pockets, especially mid and smallcaps, have moderated, opening up opportunities for managers with a strong bottom-up approach.

On the macro front, stable crude prices, continued moderation in inflation, and expectations of a supportive monetary stance are helping sentiment. FIIs have remained net buyers in recent weeks, and domestic flows through SIPs and HNIs continue to provide a cushion against global volatility. Sector rotation is also underway, with healthcare, FMCG, and select industrials attracting fresh interest after demonstrating relative strength in July.

While near-term volatility cannot be ruled out—especially around global cues and geopolitical developments—the broader market breadth is likely to improve.

For PMS investors, August could present a window to selectively add exposure to high-quality businesses with strong cash flows and earnings visibility. Managers who can balance defensive allocations with targeted participation in emerging growth themes may be best placed to capture alpha in the weeks ahead.

Happy Investing!

Recent Blogs

Investment Frameworks : A Practitioner’s Guide

PMS Bazaar recently organized a webinar titled “Investment Frameworks: A Practitioner’s Guide,” which featured Mr. Sumit Agrawal, Senior Vice President, Nuvama Asset Management Limited. This blog covers the important points shared in this insightful webinar.

Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability

PMS Bazaar recently organized a webinar titled “Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability,” which featured Mr. Sandeep Daga, MD& CIO, Nine Rivers Capital and Mr. Kunal Sabnis, Portfolio Manager, Nine Rivers Capital. This blog covers the important points shared in this insightful webinar.

Flat Markets, Wide Outcomes: How 484 PMS Strategies Performed in Dec 2025

December 2025 was a month where market returns stayed close to flat, with the Nifty 50 TRI at -0.28% and the BSE 500 TRI at -0.24%.

Equity Markets 2026: Outlook, Risks and Strategy

PMS Bazaar recently organized a webinar titled “Equity Markets 2026: Outlook, Risks and Strategy,” which featured Mr. Ashish Chaturmohta, MD & Fund Manager – APEX PMS, JM Financial Limited. This blog covers the important points shared in this insightful webinar.

MICRO CAPS: The Dark Horses of the Indian Equity Market

PMS Bazaar recently organized a webinar titled “MICRO CAPS: The Dark Horses of the Indian Equity Market,” which featured Mr. Rishi Agarwal and Mr. Adheesh Kabra, both Co-Founders and Fund Managers, Aarth AIF. This blog covers the important points shared in this insightful webinar.

Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy

PMS Bazaar recently organized a webinar titled “Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy,” which featured Mr.Anunaya Kumar, President – Sales and Distribution ASK Investment Managers Limited. This blog covers the important points shared in this insightful webinar.

.jpg)

Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS

PMS Bazaar recently organized a webinar titled “Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS,” which featured Mr. Karan Bhatia, Co-Founder and Co-Fund Manager , Pricebridge Honeycomb ETF PMs. This blog covers the important points shared in this insightful webinar.

Spot the Trouble: Red Flags in Equity Investment Analysis

PMS Bazaar recently organized a webinar titled “Spot the Trouble: Red Flags in Equity Investment Analysis,” which featured Mr. Arpit Shah, Co-Founder & Director, Care Portfolio Managers. This blog covers the important points shared in this insightful webinar.