This article is authored by Rishabh Nahar, partner and fund manager, Qode Advisors LLP

Markets Don’t Move in Straight Lines

Markets expand, contract, pause, and at times quietly distribute risk before the next move. Treat them as one dimensional, and portfolios will get blindsided. Our task is not to promise outperformance only in bull markets but to build an approach that adapts with the market’s changing character.

Understanding Market Structures

We broadly classify market regimes into four phases: Expansion, Contraction, Consolidation, and Distribution. Expansion gets the most attention as earnings improve and liquidity supports risk-taking. Contraction arrives when liquidity tightens and rallies fail to sustain. Consolidation reflects a sideways grind with rapid rotations beneath the surface. Distribution is the quiet rollover when indices still look healthy, but participation narrows.

Recognizing these phases is crucial because each leaves its own footprint on performance and guides how we position portfolios.

Why Leadership Always Rotates

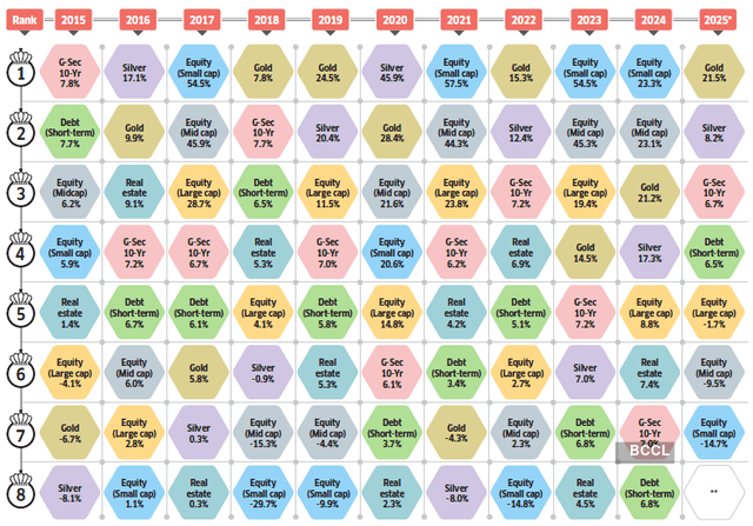

History shows there is no permanent leader. If we look at the asset-class quilt from the past decade, gold and equities have repeatedly swapped top rankings.

Source: ETwealth- April 21,2025 edition

One year it is small caps, the next sovereign debt or real estate. Leadership rotates, and portfolios must rotate with it. A static style shines in one phase but struggles in the next. This is why a dynamic process, grounded in principles rather than prediction, is essential.

The Principles Behind Qode Advisors’s Framework

At the core of the approach are a few timeless truths. Earnings power drives value, but valuations—absolute and relative—determine whether that growth is worth paying for. Modern markets are noisy, so we harness scale computing to cut through narrative, scanning liquidity, volatility, trend, and breadth data together. The idea is not to guess, but to see clearly.

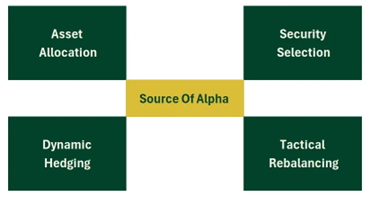

The Four Sources of Alpha

From these principles, we channel decisions through four levers. Asset allocation determines the overall risk balance between equities, debt, commodities, and cash. Security selection identifies the businesses with improving earnings and clean balance sheets. Tactical rebalancing allows us to respond without overreacting, letting trends run but harvesting mean reversion in choppy phases. And hedging keeps compounding safe, softening the blow of deep drawdowns.

Together, these tools ensure we can express views across regimes while keeping risk tightly controlled.

From Principles to Practice

Investing then becomes a matter of translating regimes into action. In risk-on phases we hold higher equity beta and lean into cyclicals. When contraction sets in, we tilt to quality, keep cash buffers, and let gold or duration protect capital. In consolidations, relative value and rebalancing dominate. And in distribution, we quietly trim crowded trades and prepare for volatility.

The Role of Quant Discipline

Quantitative models simply codify these principles. They are not black boxes, but rules applied consistently, updated in real time, and fully auditable. They provide discipline, speed, and clarity—helping us adapt without emotion.

Staying Invested Through the Cycle

The goal is never perfection. It is to stay in the game long enough for compounding to work. A dynamic approach means participating meaningfully in uptrends, cutting the tail of deep drawdowns, and keeping investors anchored through inevitable rotations in leadership. Markets will keep shifting, and our process is designed to shift with them—quietly, systematically, and with focus on what truly matters: long-term compounding.

Lessons from Global Quant Adoption and Their Relevance for India

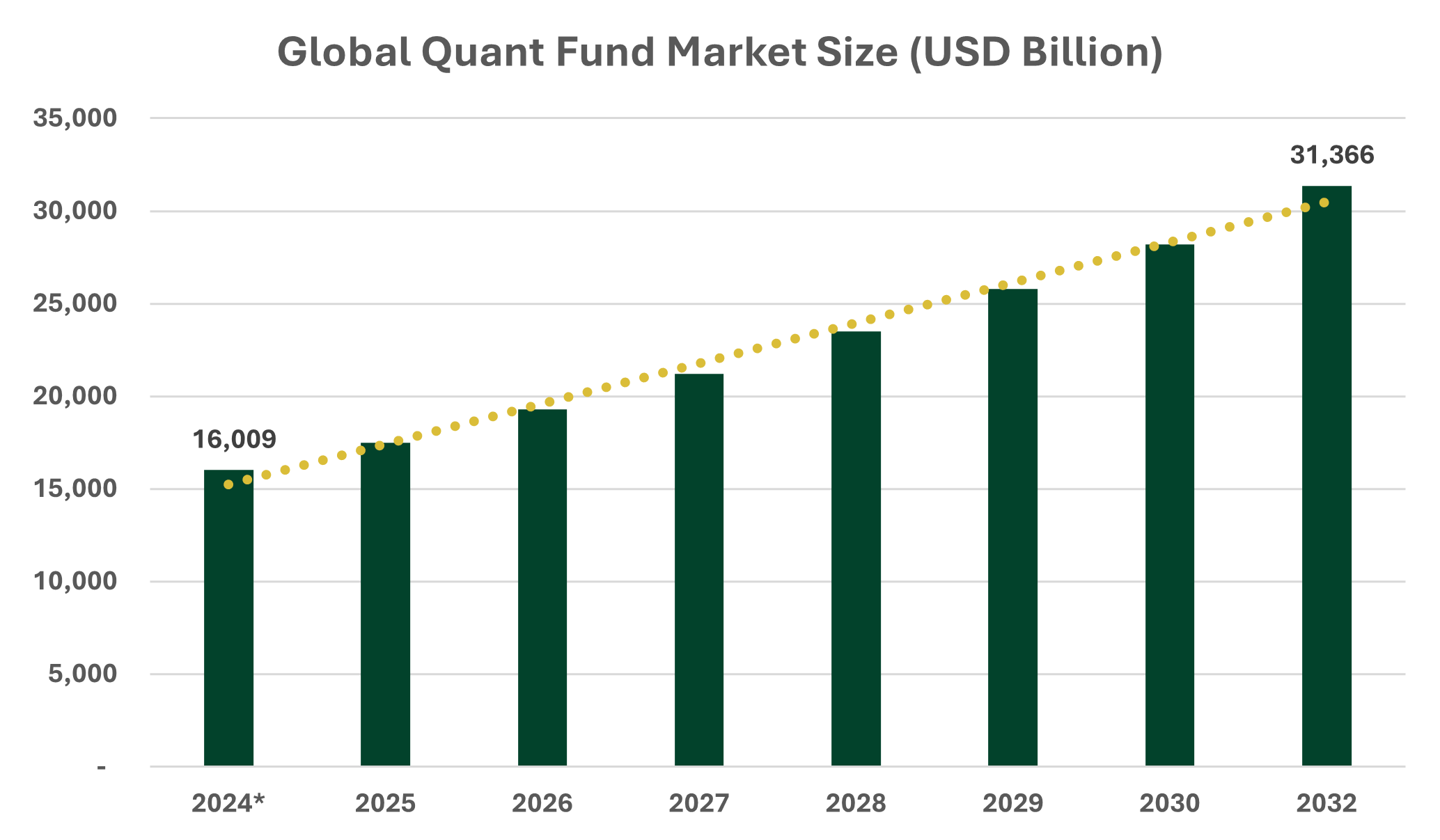

Quant investing is no longer an experiment in the West. In the US and Europe, systematic funds have become one of the largest segments of institutional capital. Decades of research on style premia such as momentum, value, carry, and quality, combined with advances in computing and data, have helped quant managers scale at a pace that traditional approaches could not. Today, quant-driven strategies account for trillions in assets globally.

The chart below shows the projected growth of the global quant fund market, which is expected to almost double from about 16 trillion dollars in 2024 to more than 31 trillion dollars by 2032. This trajectory reflects how investors across the world are allocating to rule-based, evidence-led frameworks that combine diversification with discipline.

Source: Verified Market Research

Source: Verified Market Research

India presents a very different picture. Despite a vibrant asset management industry, fully quant-driven active funds remain rare. Most PMS and mutual fund managers still rely primarily on discretionary judgment, with quant models occasionally used as overlays. But the first signs of adoption are already visible. One mutual fund house scaled from only 500 crores to over 1 lakh crore in assets in just six years, built entirely on a quant-based, rules-driven approach. What enabled such growth was not clever marketing, but consistent and superior risk-adjusted performance that investors came to trust.

Perhaps the best way to understand the quiet adoption of quant in India is to note that the largest quant fund in the country today is an index fund. Passive investing is in many ways the simplest form of quant discipline. It is rules-based, repeatable, unbiased, and transparent. The success of index funds and ETFs shows that investors already understand the value of removing human emotion from decision-making.

Yet, when it comes to active quant funds in India, the numbers are still very small. Only a handful of dedicated, fully systematic PMS or mutual funds exist today. That is likely to change. As investors see the benefits of data-driven risk management, evidence-led stock selection, and the ability to run multiple strategies that adapt to shifting market regimes, institutions and HNIs will become more comfortable allocating meaningful capital.

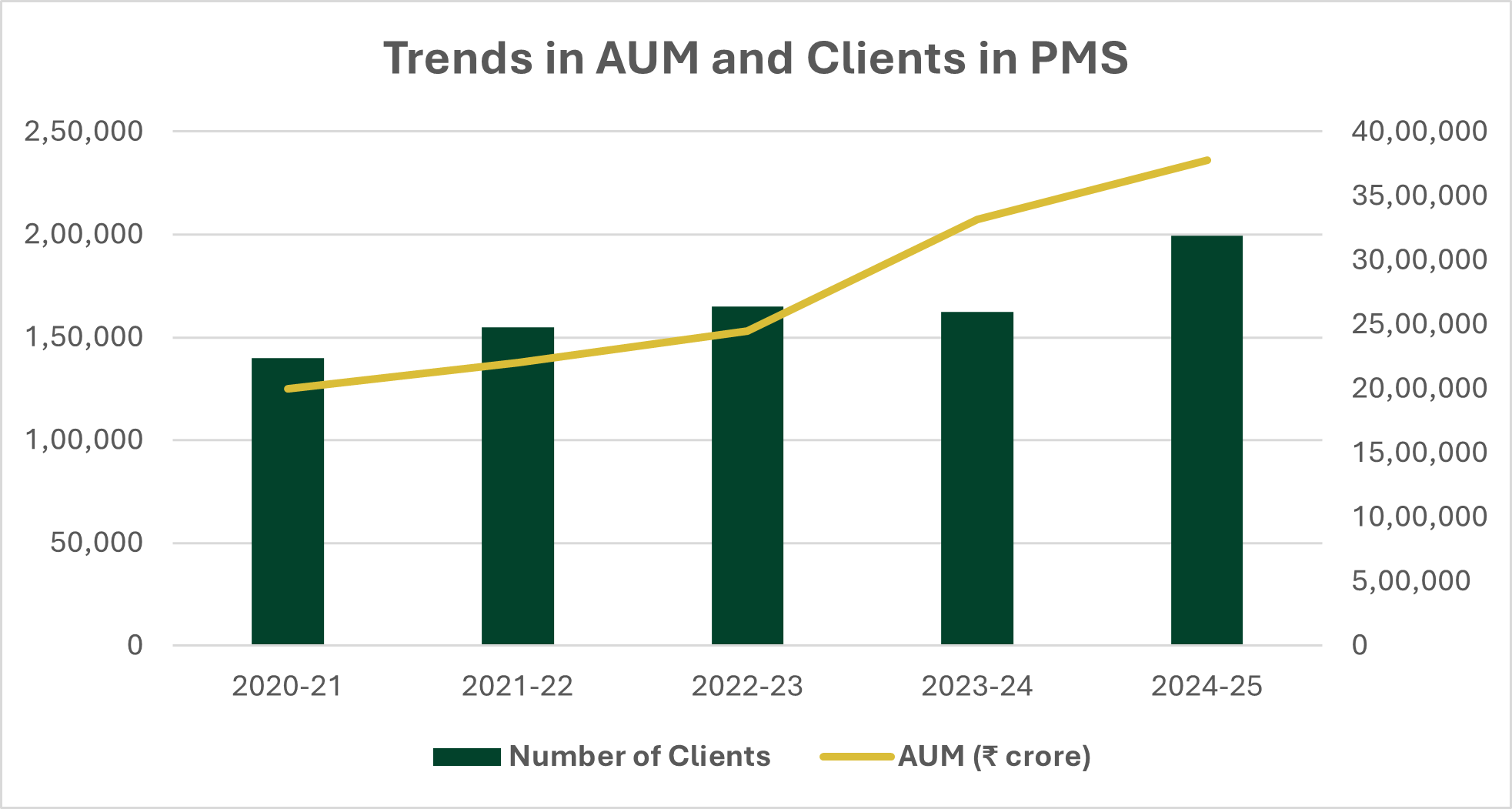

The growth of PMS AUM and clients in India already shows that the demand is building. As investors realise that quant is not a black box but simply discipline expressed through code, adoption will accelerate. The US experience tells us that this curve of acceptance can steepen very quickly once performance and transparency come together.

Source: SEBI

India’s quant journey will not replicate the US exactly, but the direction of travel is clear. Passive, rules-based products have already won investor trust. The next step is active quant PMS and funds that can bring together asset allocation, security selection, tactical rebalancing, and hedging in a systematic framework. The real edge here is not in predicting the future but in being consistent and resilient, able to adapt across expansions, contractions, consolidations, and distributions without losing sight of the long-term compounding journey.

For investors, the real question is no longer whether quant will matter in India. It is how quickly adoption will scale. If global evidence is any guide, it will happen faster than most expect.

Conclusion

Disclaimer: The views expressed are solely those of the author and do not represent PMS Bazaar’s views. This article is for information only and not investment advice. Investments are subject to market risks; investors should consult their advisors before investing.

Recent Blogs

Investment Frameworks : A Practitioner’s Guide

PMS Bazaar recently organized a webinar titled “Investment Frameworks: A Practitioner’s Guide,” which featured Mr. Sumit Agrawal, Senior Vice President, Nuvama Asset Management Limited. This blog covers the important points shared in this insightful webinar.

Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability

PMS Bazaar recently organized a webinar titled “Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability,” which featured Mr. Sandeep Daga, MD& CIO, Nine Rivers Capital and Mr. Kunal Sabnis, Portfolio Manager, Nine Rivers Capital. This blog covers the important points shared in this insightful webinar.

Flat Markets, Wide Outcomes: How 484 PMS Strategies Performed in Dec 2025

December 2025 was a month where market returns stayed close to flat, with the Nifty 50 TRI at -0.28% and the BSE 500 TRI at -0.24%.

Equity Markets 2026: Outlook, Risks and Strategy

PMS Bazaar recently organized a webinar titled “Equity Markets 2026: Outlook, Risks and Strategy,” which featured Mr. Ashish Chaturmohta, MD & Fund Manager – APEX PMS, JM Financial Limited. This blog covers the important points shared in this insightful webinar.

MICRO CAPS: The Dark Horses of the Indian Equity Market

PMS Bazaar recently organized a webinar titled “MICRO CAPS: The Dark Horses of the Indian Equity Market,” which featured Mr. Rishi Agarwal and Mr. Adheesh Kabra, both Co-Founders and Fund Managers, Aarth AIF. This blog covers the important points shared in this insightful webinar.

Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy

PMS Bazaar recently organized a webinar titled “Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy,” which featured Mr.Anunaya Kumar, President – Sales and Distribution ASK Investment Managers Limited. This blog covers the important points shared in this insightful webinar.

.jpg)

Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS

PMS Bazaar recently organized a webinar titled “Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS,” which featured Mr. Karan Bhatia, Co-Founder and Co-Fund Manager , Pricebridge Honeycomb ETF PMs. This blog covers the important points shared in this insightful webinar.

Spot the Trouble: Red Flags in Equity Investment Analysis

PMS Bazaar recently organized a webinar titled “Spot the Trouble: Red Flags in Equity Investment Analysis,” which featured Mr. Arpit Shah, Co-Founder & Director, Care Portfolio Managers. This blog covers the important points shared in this insightful webinar.