December 2025 was a month where market returns stayed close to flat, with the Nifty 50 TRI at -0.28% and the BSE 500 TRI at -0.24%.

Against that backdrop, PMS Bazaar performance snapshot tracked 484 strategies, including 440 equity strategies and 26 multi-asset strategies, to see how portfolios navigated the month. Dispersion still showed up: 106 equity PMS strategies delivered positive returns (24.1%), while 133 equity strategies (30.3%) finished ahead of the Nifty 50 TRI and 129 (29.3%) ahead of the BSE 500 TRI. In multi-asset, 17 of 26 strategies (65.3%) delivered a positive month, underlining how diversification can influence outcomes when headline indices are near zero.

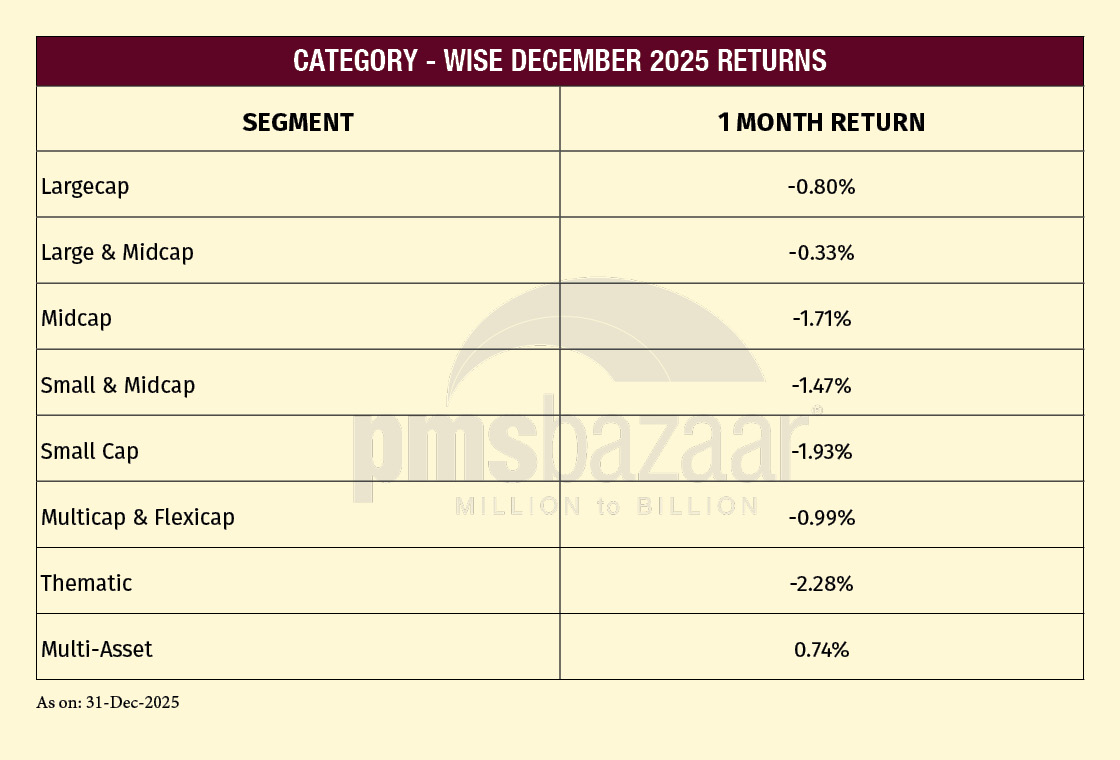

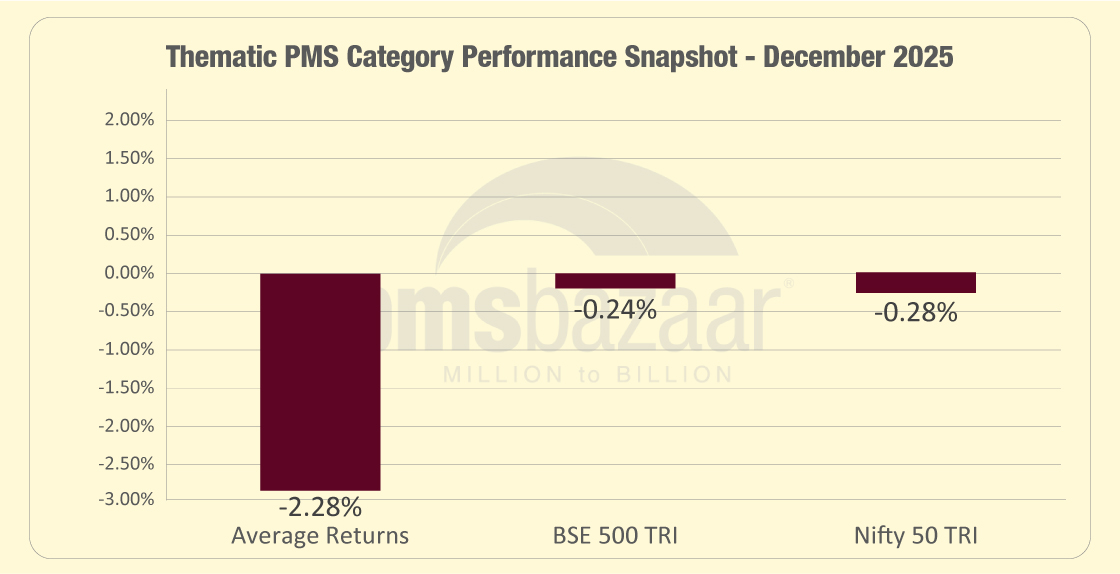

Category trends also mattered. Multi-asset was the only segment to post an average gain (+0.74%), while equity category averages ranged from modest declines in Large & Midcap (-0.33%) to softer numbers across styles such as Small Cap (-1.93%) and Thematic (-2.28%).

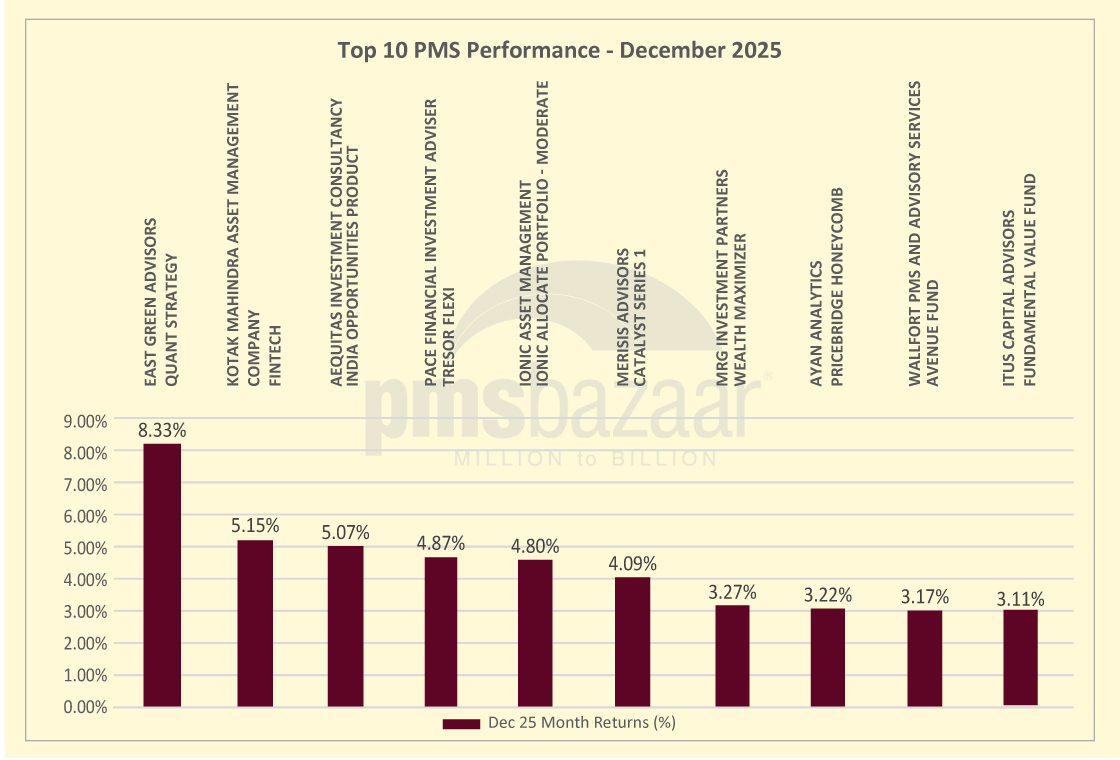

East Green Advisors’ Quant Strategy led the month with an 8.33% gain, topping the Dec-2025 table among the strategies tracked. It was followed by Kotak Mahindra AMC’s Fintech strategy at 5.15% and Aequitas’ India Opportunities Product at 5.07%. Multi-asset also featured among the leaders, with Pace Financial’s Tresor Flexi returning 4.87% and Ionic Asset Management’s Allocate Portfolio (Moderate) at 4.80%. The rest of the top 10 clustered in the 3–4% range, including Merisis’ Catalyst Series 1 (4.09%), MRG’s Wealth Maximizer (3.27%), Ayan Analytics’ PriceBridge Honeycomb (3.22%), Wallfort’s Avenue Fund (3.17%) and ITUS Capital’s Fundamental Value Fund (3.11%).

In the bigger picture, CY25 still closed as another positive year for Indian equities, marking the tenth consecutive year of gains, even as December ended the Nifty’s three-month winning streak.

Top-10 Performers

December’s top-10 PMS performers underline how outcomes can diverge even when headline indices are close to flat. East Green Advisors LLP’s Quant Strategy led the table with an 8.33% one-month gain, setting the pace for the month. The next two positions were closely matched: Kotak Mahindra Asset Management Company Ltd’s Fintech strategy returned 5.15%, while Aequitas Investment Consultancy Pvt Ltd’s India Opportunities Product delivered 5.07%, a slim 0.08 percentage-point gap.

A second cluster sat just below 5%. Pace Financial Investment Adviser Pvt Ltd’s Tresor Flexi posted 4.87%, and Ionic Asset Management’s Ionic Allocate Portfolio - Moderate followed at 4.80%. Merisis Advisors Private Limited’s Catalyst Series 1 extended the run of positive numbers with a 4.09% return. After that, the remaining four strategies formed a compact band between 3.11% and 3.27%: MRG Investment Partners Pvt Ltd’s Wealth Maximizer (3.27%), Ayan Analytics Pvt Ltd’s PriceBridge Honeycomb (3.22%), Wallfort PMS and Advisory Services LLP’s Avenue Fund (3.17%) and ITUS Capital Advisors Pvt Ltd’s Fundamental Value Fund (3.11%).

Two data-led observations stand out. First, leadership was broad: each of the top 10 entries comes from a different AMC, indicating that multiple investment approaches found traction in the same month. Second, the internal spread within this leader set is meaningful: 5.22 percentage points separate the first and tenth ranks, while several positions are decided by small differences.

For readers tracking PMS performance, that mix of standout leaders and close clustering is a cue to look beyond rank alone and track outcomes across months for context.

Here is a table of the top-10 performers.

Category Scan

December 2025’s category-wise PMS returns show a clear split between diversified allocations and most pure equity segments.

Multi-Asset was the only category with a positive average return, at 0.74%, standing out in a month when the broader market indices were marginally negative. Among equity categories, Large & Midcap was the most resilient at -0.33%, suggesting that this blend held up relatively better versus other style buckets.

Largecap strategies averaged -0.80% for the month, while Multicap & Flexicap came in at -0.99%, both reflecting a mild-to-moderate decline, but still meaningfully better than the deeper drawdowns seen lower down the market-cap spectrum.

As the segment tilts smaller, the monthly numbers weakened: Small & Midcap averaged -1.47% and Midcap -1.71%, indicating that mid-sized exposures faced greater pressure during the period. Small Cap was softer at -1.93%, and Thematic strategies recorded the weakest average outcome at -2.28%.

The ranking matters as much as the absolute figures: December’s pattern is one where returns deteriorate as portfolios move away from broader, diversified mixes and toward narrower exposures.

Here is a table on how the PMS categories performed.

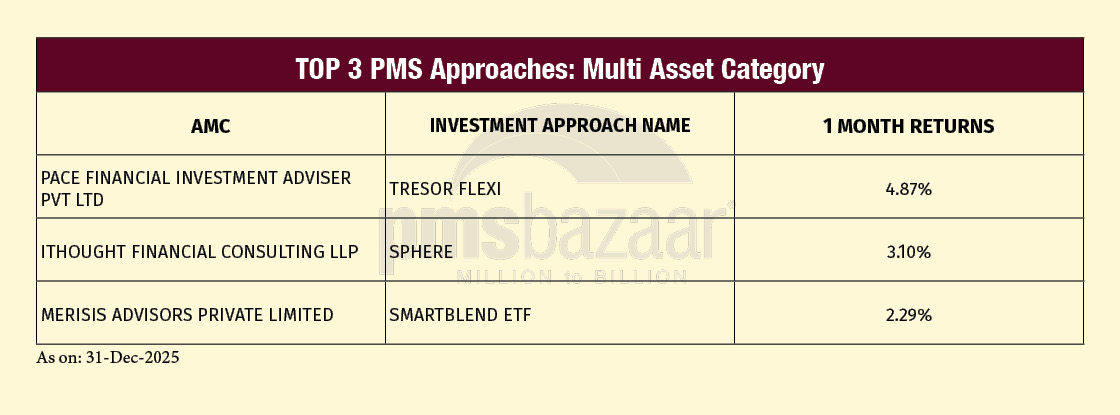

Multi-Asset Strategies

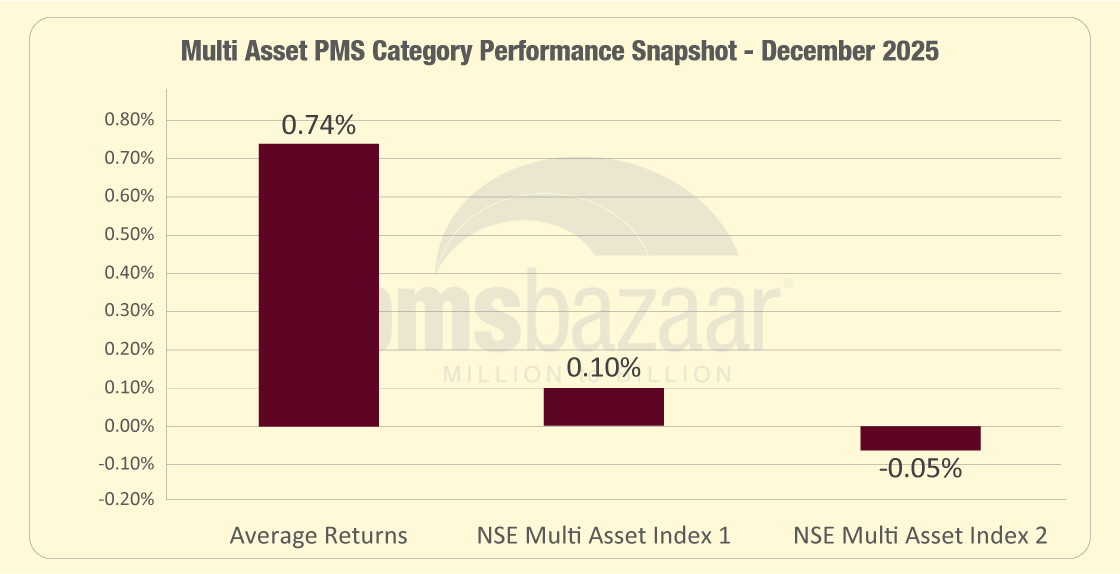

Multi-asset PMS strategies stood out in December 2025 as the one category that, on average, delivered a positive month. Across 26 schemes tracked, the category posted an average return of 0.74%. That compares with modest moves in the reference indices: NSE Multi Asset Index 1 returned 0.10% and NSE Multi Asset Index 2 was marginally lower at -0.05%. On an outperformance count, 17 of the 26 schemes finished ahead of Index 1, and the same 17 beat Index 2, highlighting that a majority of strategies in this bucket stayed on the right side of their yardsticks for the month.

Within the category, the better performers pulled ahead by a meaningful margin. Pace Financial Investment Adviser Pvt Ltd’s Tresor Flexi led this set with a 4.87% one-month gain. ithought Financial Consulting LLP had two entries in the higher-return group, with SPHERE at 3.10%. Merisis Advisors Private Limited’s Smartblend ETF was at 2.29%.

Here is a table on the top performers in this category.

Finally, December reinforced how multi-asset allocations can keep return paths smoother when equity categories are under pressure.

Large & Mid-cap Strategies

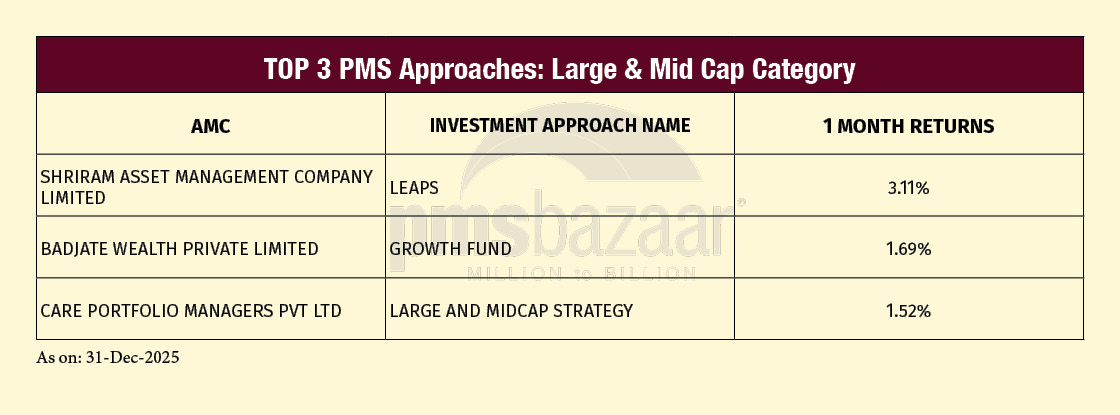

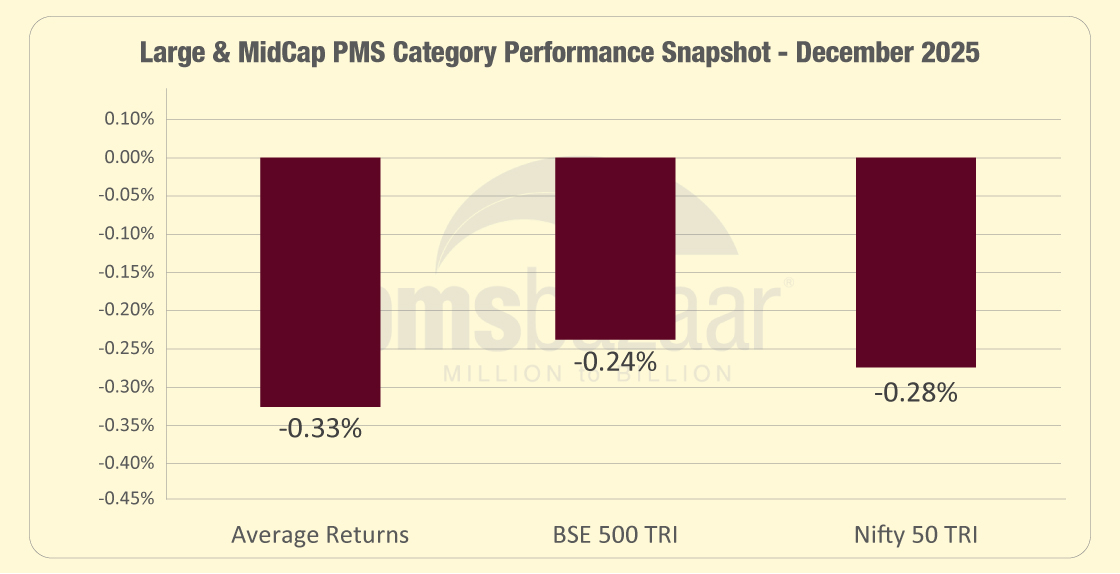

Large & Mid Cap PMS strategies had a steadier December 2025 than most equity categories, even though the segment’s average return was marginally negative. Across 22 schemes tracked, the category returned -0.33% for the month, close to the broader benchmarks: S&P BSE 500 TRI at -0.24% and Nifty 50 TRI at -0.28%. The outperformance split was evenly balanced: 11 schemes beat the BSE 500 TRI and 11 beat the Nifty 50 TRI, showing a clean “half the field ahead, half behind” pattern in a month where index moves were small.

Within the category, a handful of strategies delivered clear positive numbers. Shriram Asset Management Company Limited’s LEAPS topped the list at 3.11% (benchmark: Nifty 50 TRI). Badjate Wealth Private Limited’s Growth Fund followed with 1.69%, and Care Portfolio Managers Pvt Ltd’s Large and Midcap Strategy returned 1.52% (both benchmarked to S&P BSE 500 TRI).

Here is a table on the top performers in this category.

In conclusion, the data suggests a category where small differences in positioning can decide month-to-month rank, but the range of outcomes is still wide enough for active strategies to meaningfully separate.

Large-Cap Strategies

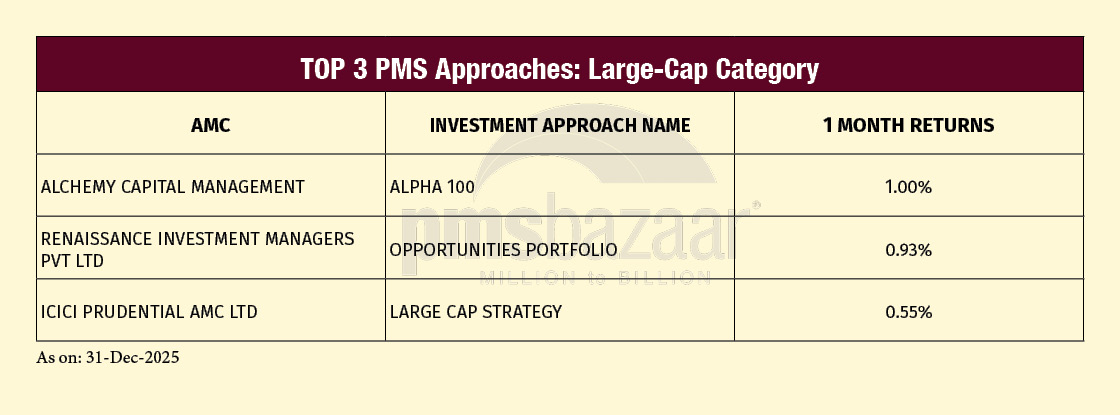

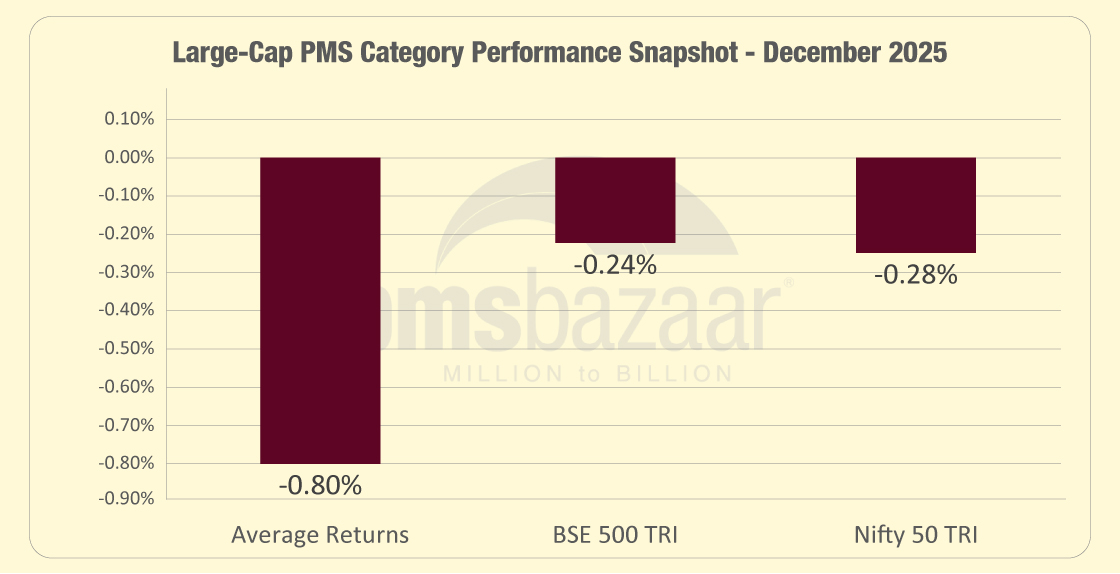

Large-cap PMS strategies saw a softer month in December 2025 relative to the headline indices. Across 30 schemes tracked, the category average return was -0.80%, compared with -0.24% for the S&P BSE 500 TRI and -0.28% for the Nifty 50 TRI. On an outperformance basis, 10 schemes beat the Nifty 50 TRI and 9 beat the BSE 500 TRI, indicating that leadership existed but was not broad-based within the segment.

At the top of the list, Alchemy Capital Management’s Alpha 100 delivered a 1.00% one-month return, followed closely by Renaissance Investment Managers Pvt Ltd’s Opportunities Portfolio at 0.93%. ICICI Prudential AMC Ltd’s Large Cap Strategy posted 0.55%.

Here is a table on the top performers in this category.

Overall, December’s large-cap picture was one where a few strategies stayed positive, but the segment average was pulled down by broader weakness across the category.

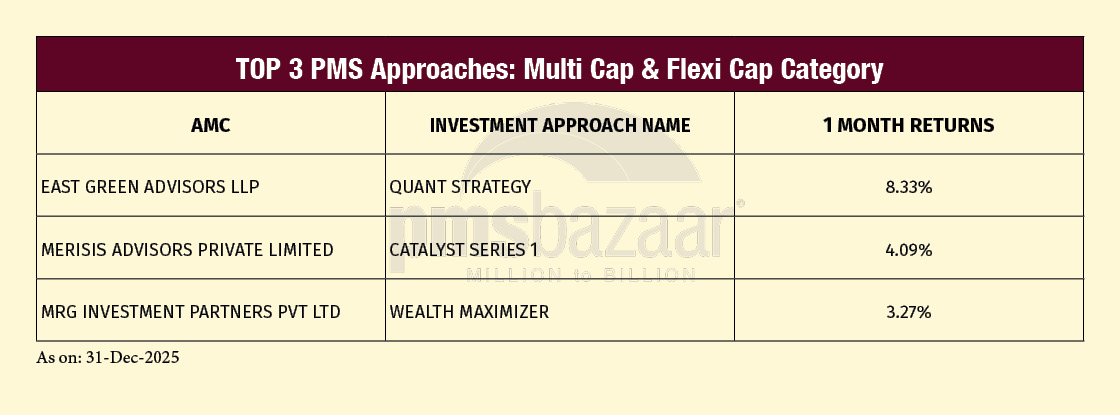

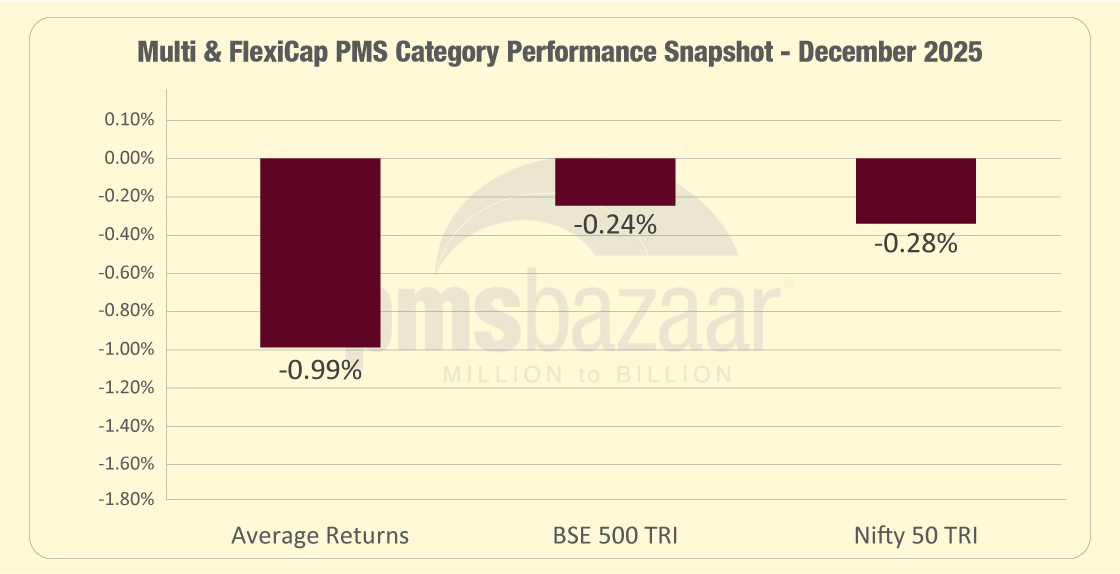

Multi-Cap & Flexi-Cap Strategies

Multi-cap & flexicap PMS strategies are the largest bucket, with 260 schemes tracked, and the category showed a meaningful spread between the average outcome and the best performers. The category average return was -0.99% for the month, compared with -0.24% for the S&P BSE 500 TRI and -0.28% for the Nifty 50 TRI. On an outperformance count, 77 schemes beat the BSE 500 TRI and 78 beat the Nifty 50 TRI, indicating that a sizable minority managed to stay ahead of the benchmarks despite the category’s weaker average.

At the top end, East Green Advisors LLP’s Quant Strategy stood out sharply with an 8.33% one-month gain. The next set of leaders were well ahead of the indices but far below the top spot: Merisis Advisors Private Limited’s Catalyst Series 1 returned 4.09%, MRG Investment Partners Pvt Ltd’s Wealth Maximizer 3.27%.

Here is a table on the top performers in this category.

The December’s data suggests that even when the average is negative, this broad category can still throw up pockets of strong positive performance.

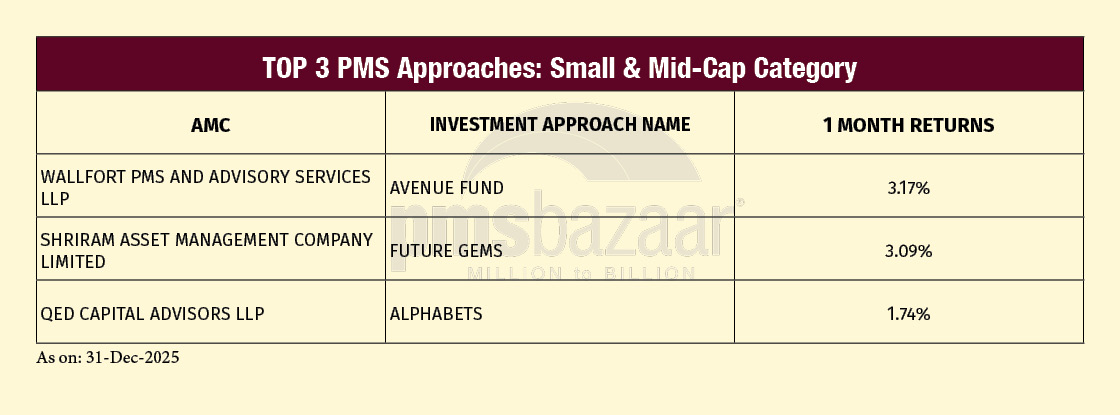

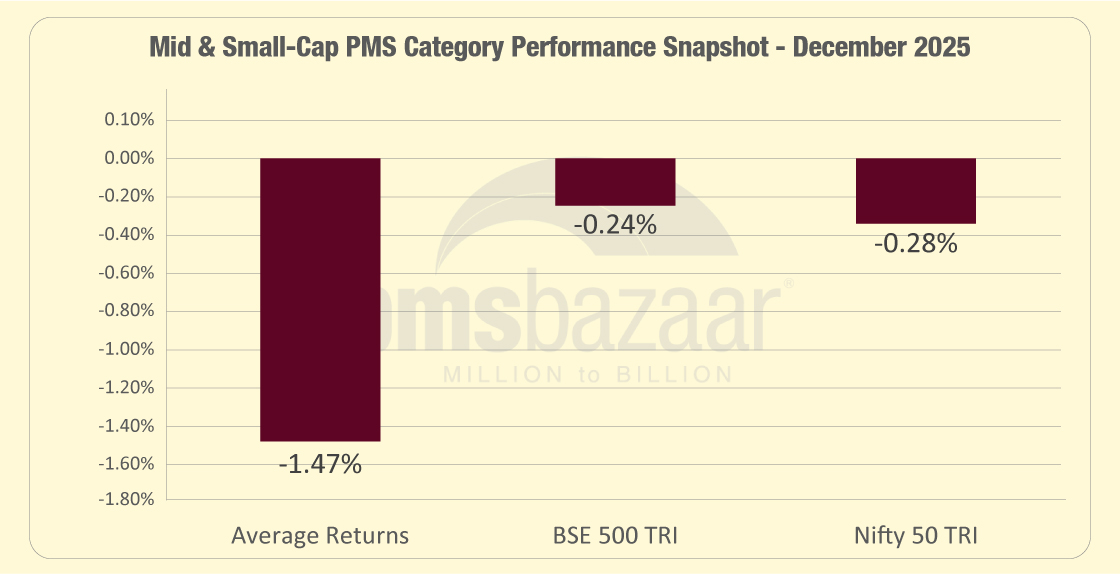

Small & Mid-Cap Strategies

Small & mid-cap PMS strategies faced a more demanding December 2025, with the category average return at -1.47% across 54 schemes tracked. In comparison, the broader market yardsticks were only mildly negative for the month (S&P BSE 500 TRI at -0.24% and Nifty 50 TRI at -0.28%). Even so, a meaningful subset still finished ahead of these benchmarks: 17 schemes outperformed the BSE 500 TRI and 19 outperformed the Nifty 50 TRI, underlining that selection mattered even within a weaker category tape.

Among the stronger names in this set, Wallfort PMS and Advisory Services LLP’s Avenue Fund led this snapshot with a 3.17% one-month return, closely followed by Shriram Asset Management Company Limited’s Future GEMS at 3.09%. QED Capital Advisors LLP’s Alphabets returned 1.74%.

Here is a table on the top performers in this category.

December’s small & mid-cap data shows a wider gap between the category average and the leaders, highlighting how outcomes within the segment can vary sharply month to month.

Mid-Cap Strategies

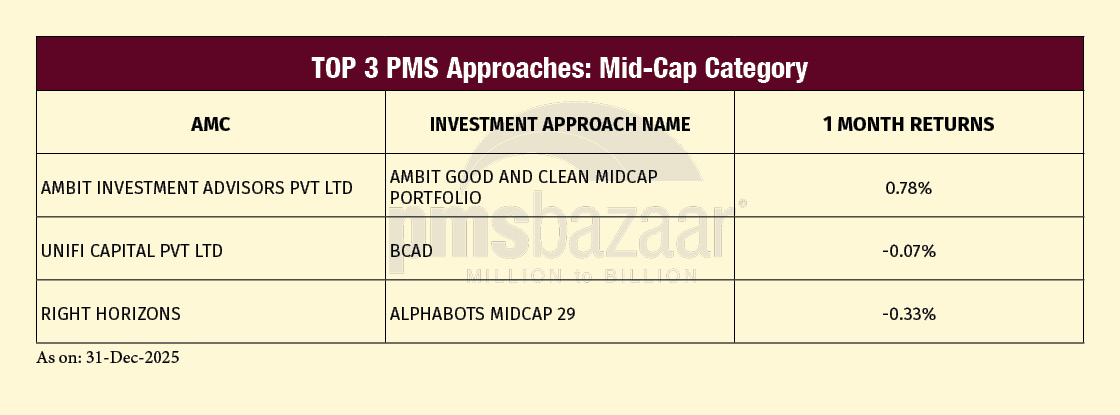

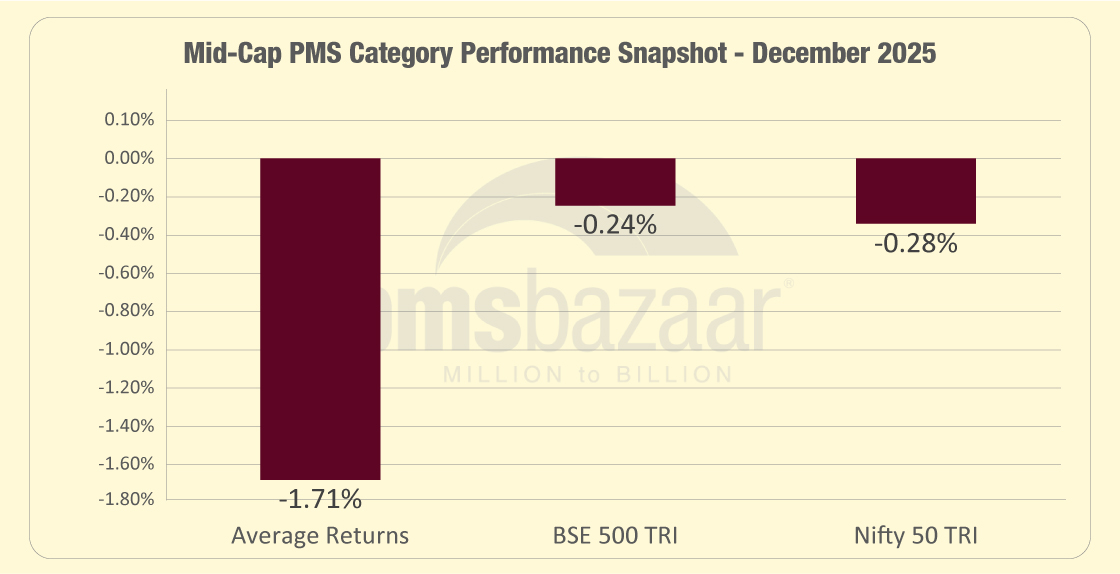

Mid-cap PMS strategies had a tougher December 2025. Across 21 schemes, the category average return was -1.71% for the month, a sharper decline than the broader indices, which were only mildly negative (S&P BSE 500 TRI at -0.24% and Nifty 50 TRI at -0.28%). What stands out is how narrow outperformance was in this bucket: only 2 schemes outperformed the BSE 500 TRI and only 2 outperformed the Nifty 50 TRI, suggesting that, for most strategies in this segment, the month was more about limiting drawdowns than generating positive returns.

In the list of mid-cap strategies shown, Ambit Investment Advisors Pvt Ltd Ambit Good and Clean Midcap Portfolio was the only entry with a clearly positive one-month return, at 0.78%. The rest of the sample clustered around small declines to deeper negatives. Unifi Capital Pvt Ltd BCAD was near-flat at -0.07%, followed by Right Horizons’ Alphabots Midcap 29 at -0.33%.

Here is a table on the top performers in this category.

Hence, the month’s mid-cap snapshot shows limited upside participation and a wide spread even within a generally weak category.

Small-Cap Strategies

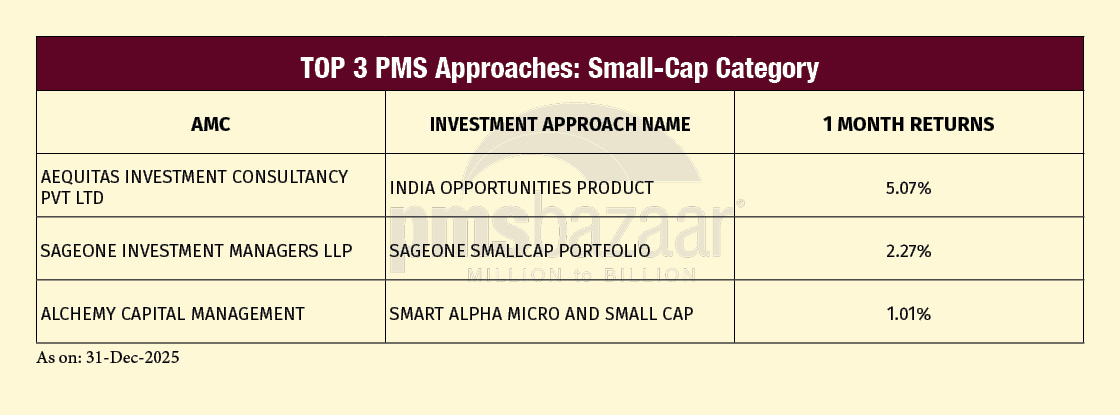

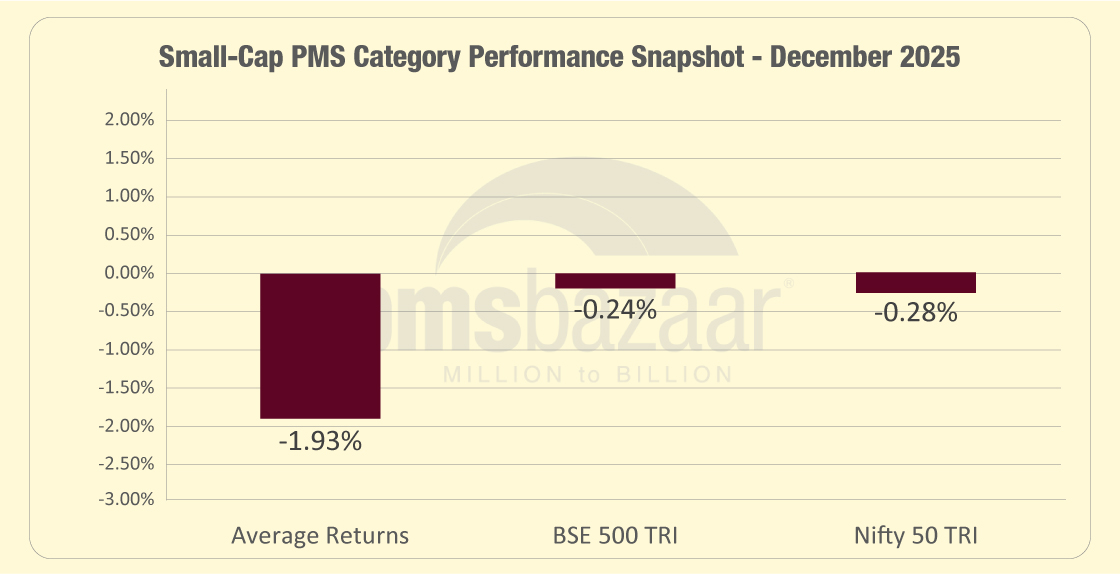

Small-cap PMS strategies saw a weaker December 2025 on average, with returns showing a wider gap between the category mean and the best outcomes. Across 28 schemes tracked, the category average return was -1.93% for the month, versus modest declines in the broader indices (S&P BSE 500 TRI at -0.24% and Nifty 50 TRI at -0.28%). Outperformance was relatively narrow in this segment: only 5 schemes beat the BSE 500 TRI and the same 5 beat the Nifty 50 TRI, pointing to a month where a small set of strategies held up well while most were below the benchmark line.

At the top of the list, Aequitas Investment Consultancy Pvt Ltd’s India Opportunities Product delivered a standout 5.07% one-month return. SageOne Investment Managers LLP’s SageOne Smallcap Portfolio followed at 2.27%, and Alchemy Capital Management’s Smart Alpha Micro and Small Cap returned 1.01%.

Here is a table on the top performers in this category.

Thus, December was a more selective month for small-cap PMS strategies, with leadership concentrated in a handful of portfolios.

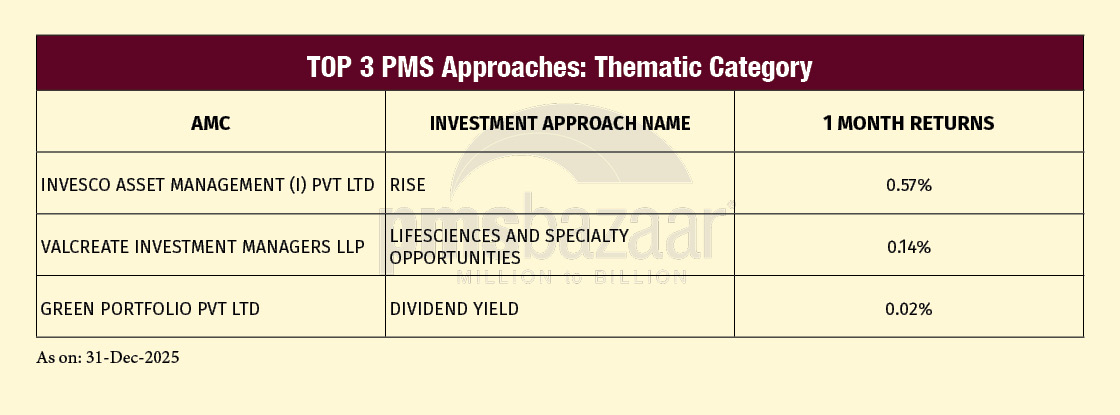

Thematic Strategies

Thematic PMS strategies had the most challenging December 2025 among all the categories tracked. Across 17 schemes, the category average return was -2.28% for the month, while the broader indices were only mildly negative (S&P BSE 500 TRI at -0.24% and Nifty 50 TRI at -0.28%). Outperformance was narrow: just 3 schemes beat the BSE 500 TRI and the same 3 beat the Nifty 50 TRI, highlighting how concentrated thematic exposure can translate into sharper month-to-month swings in outcomes.

Within this set, a small pocket still stayed in the green. Invesco Asset Management (I) Pvt Ltd’s RISE delivered a 0.57% one-month return, the highest in the list provided. Valcreate Investment Managers LLP’s Lifesciences and Specialty Opportunities was next at 0.14%, and Green Portfolio Pvt Ltd’s Dividend Yield was marginally positive at 0.02%.

Here is a table on the top performers in this category.

December’s thematic data reinforces a simple point from the numbers: when the market is near-flat, thematic positioning can still produce very different outcomes across strategies, and the dispersion can work both ways over time.

Outlook

We remain constructive on Indian equities and believe the market is well placed to recover the relative underperformance seen in CY25. The setup looks healthier on three counts. First, earnings visibility appears better as companies cycle into a cleaner base and management commentary stays focused on growth, efficiency and balance-sheet strength. Second, domestic macro conditions remain supportive: India’s growth drivers are largely internal, liquidity conditions are manageable, and the policy environment continues to encourage capex and formalisation. Third, an easing of geopolitical noise can help risk appetite normalise, which typically benefits equities after a period of caution.

For PMS investors, this is a reminder that month-to-month leaderboards can change quickly, but the long-term opportunity is anchored in the market’s ability to compound through cycles. A disciplined PMS approach can be well suited to participate in a potential up-move while still managing volatility.

Happy Investing in 2026!

Recent Blogs

January Rout, Extreme Dispersion: PMS Returns Swing From Losses to Gains

Benchmark falls deepened losses, but multi-asset and debt cushioned portfolios meaningfully

Investment Frameworks : A Practitioner’s Guide

PMS Bazaar recently organized a webinar titled “Investment Frameworks: A Practitioner’s Guide,” which featured Mr. Sumit Agrawal, Senior Vice President, Nuvama Asset Management Limited. This blog covers the important points shared in this insightful webinar.

Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability

PMS Bazaar recently organized a webinar titled “Aurum Multiplier Portfolio - Where Small and Mid-Cap Alpha Meets Large-Cap Stability,” which featured Mr. Sandeep Daga, MD& CIO, Nine Rivers Capital and Mr. Kunal Sabnis, Portfolio Manager, Nine Rivers Capital. This blog covers the important points shared in this insightful webinar.

Equity Markets 2026: Outlook, Risks and Strategy

PMS Bazaar recently organized a webinar titled “Equity Markets 2026: Outlook, Risks and Strategy,” which featured Mr. Ashish Chaturmohta, MD & Fund Manager – APEX PMS, JM Financial Limited. This blog covers the important points shared in this insightful webinar.

MICRO CAPS: The Dark Horses of the Indian Equity Market

PMS Bazaar recently organized a webinar titled “MICRO CAPS: The Dark Horses of the Indian Equity Market,” which featured Mr. Rishi Agarwal and Mr. Adheesh Kabra, both Co-Founders and Fund Managers, Aarth AIF. This blog covers the important points shared in this insightful webinar.

Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy

PMS Bazaar recently organized a webinar titled “Finding Clarity in Volatile Markets: A Large-Cap Led ASK CORE Strategy,” which featured Mr.Anunaya Kumar, President – Sales and Distribution ASK Investment Managers Limited. This blog covers the important points shared in this insightful webinar.

.jpg)

Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS

PMS Bazaar recently organized a webinar titled “Passively Active Investing — A Modern Investor’s Lens on ETF-Based PMS,” which featured Mr. Karan Bhatia, Co-Founder and Co-Fund Manager , Pricebridge Honeycomb ETF PMs. This blog covers the important points shared in this insightful webinar.

Spot the Trouble: Red Flags in Equity Investment Analysis

PMS Bazaar recently organized a webinar titled “Spot the Trouble: Red Flags in Equity Investment Analysis,” which featured Mr. Arpit Shah, Co-Founder & Director, Care Portfolio Managers. This blog covers the important points shared in this insightful webinar.